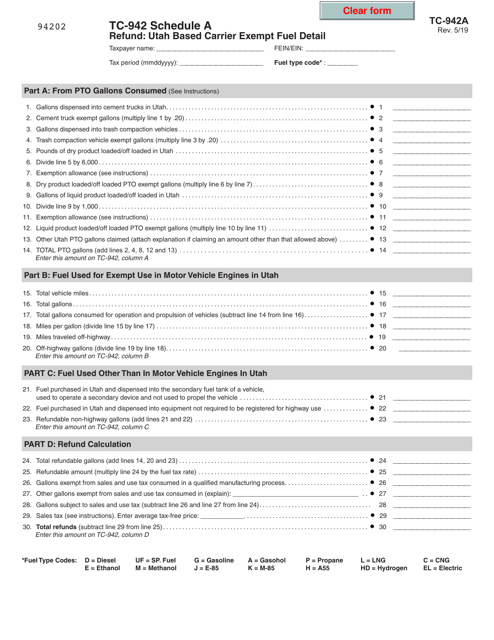

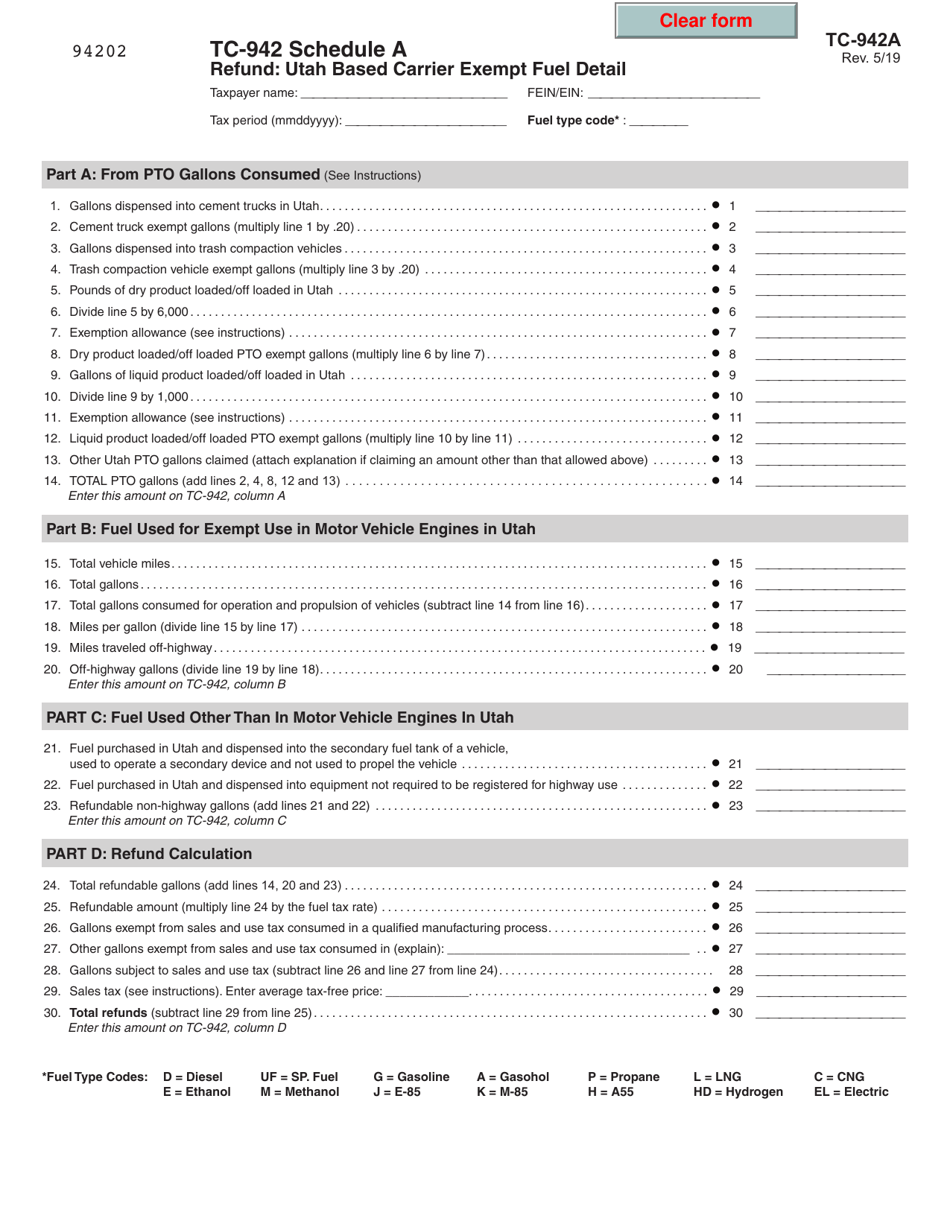

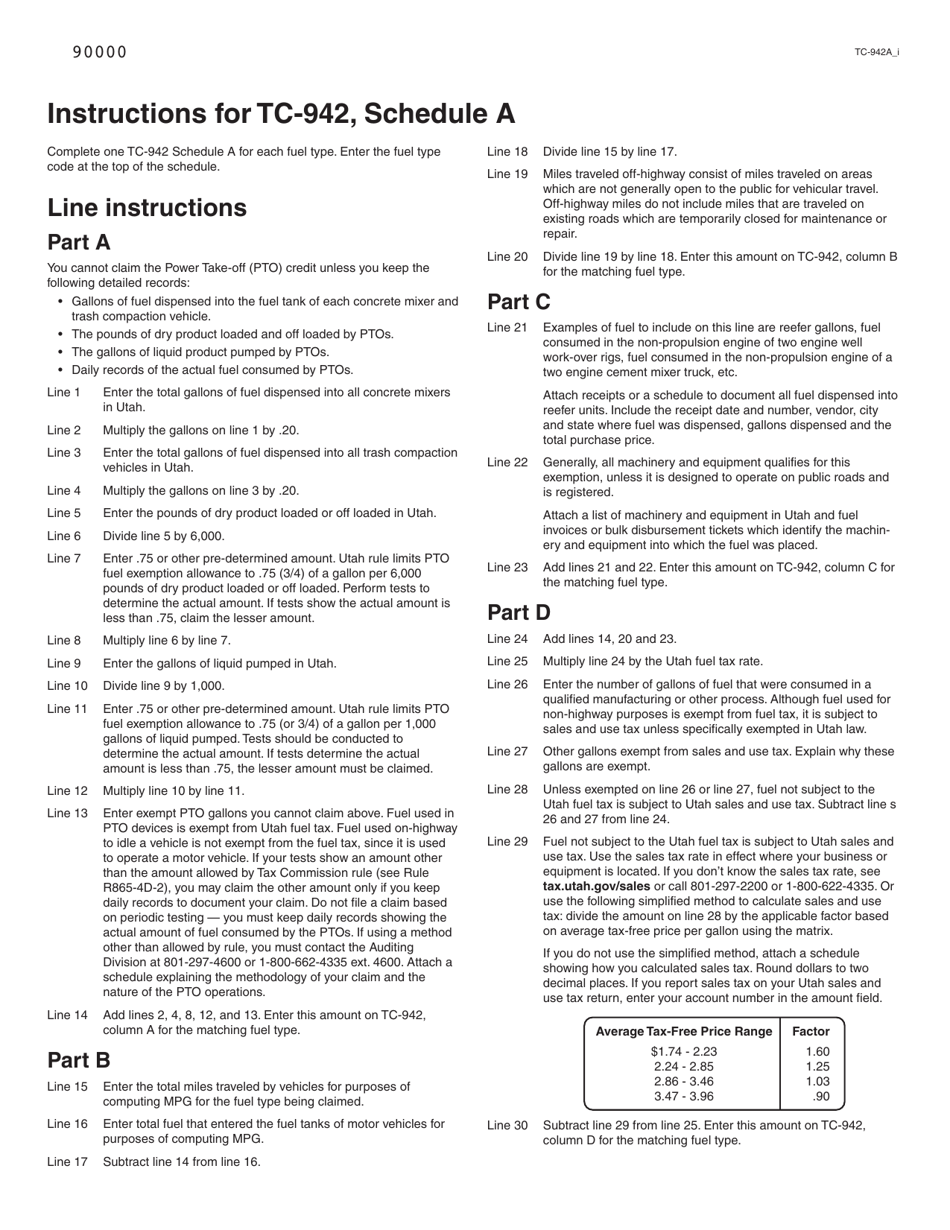

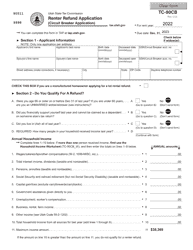

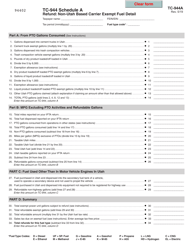

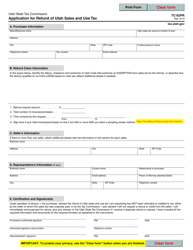

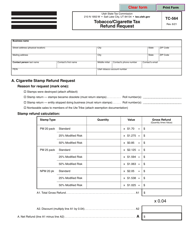

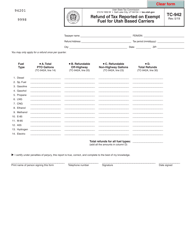

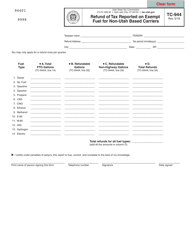

Form TC-942 Schedule A Refund: Utah Based Carrier Exempt Fuel Detail - Utah

What Is Form TC-942 Schedule A?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah.The document is a supplement to Form TC-942, Refund of Tax Reported on Exempt Fuel for Utah Based Carriers. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-942 Schedule A?

A: Form TC-942 Schedule A is a tax form used by Utah based carriers to claim a refund for exempt fuel.

Q: What is an exempt fuel?

A: Exempt fuel refers to fuel that is not subject to certain taxes, such as certain federal or state taxes.

Q: Who can use Form TC-942 Schedule A?

A: Form TC-942 Schedule A can be used by Utah based carriers who are eligible for a refund of taxes on exempt fuel.

Q: What is the purpose of Form TC-942 Schedule A?

A: The purpose of Form TC-942 Schedule A is to report and claim a refund for exempt fuel taxes paid by Utah based carriers.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

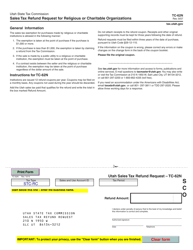

Download a fillable version of Form TC-942 Schedule A by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.