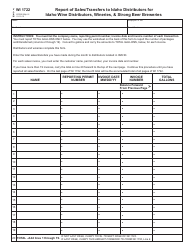

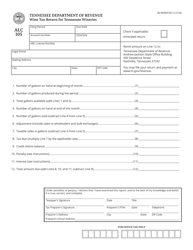

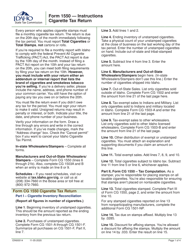

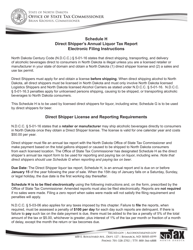

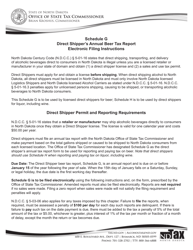

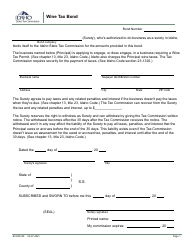

Instructions for Form 1752 Wine Tax Return for Distributors, Wineries, Direct Shippers, and Strong Beer Breweries - Idaho

This document contains official instructions for Form 1752 , Wine Tax Return for Distributors, Wineries, Direct Shippers, and Strong Beer Breweries - a form released and collected by the Idaho State Tax Commission.

FAQ

Q: Who needs to file Form 1752?

A: Distributors, wineries, direct shippers, and strong beer breweries in Idaho.

Q: What is the purpose of Form 1752?

A: To report and pay wine tax in Idaho.

Q: Are there any filing deadlines for Form 1752?

A: Yes, the deadlines vary based on the type of filer. Please refer to the instructions for specific deadlines.

Q: What information is required to complete Form 1752?

A: You will need to provide details about your business, quantities and types of wine sold, and calculations for tax liability.

Q: Are there any penalties for late or incorrect filing of Form 1752?

A: Yes, there may be penalties for late or incorrect filing. Please refer to the instructions or contact the Idaho State Tax Commission for more information.

Q: Is there any additional documentation required to be submitted with Form 1752?

A: Additional documentation may be required depending on your specific situation. Please refer to the instructions for a comprehensive list of required documents.

Q: Can I request an extension to file Form 1752?

A: Yes, extensions may be available. You can request an extension by contacting the Idaho State Tax Commission.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Idaho State Tax Commission.