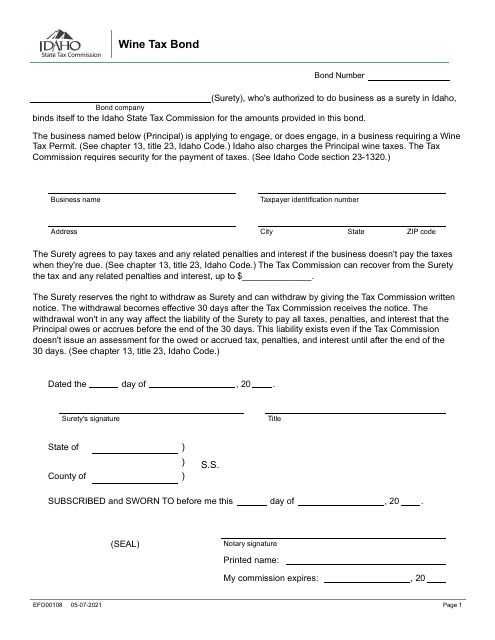

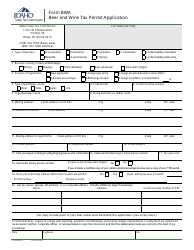

Form EFO00108 Wine Tax Bond - Idaho

What Is Form EFO00108?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EFO00108?

A: Form EFO00108 is the Wine Tax Bond for the state of Idaho.

Q: What is a Wine Tax Bond?

A: A Wine Tax Bond is a type of surety bond required by the state of Idaho for businesses involved in the production, distribution, or sale of wine.

Q: Who needs to file Form EFO00108?

A: Any business involved in the production, distribution, or sale of wine in the state of Idaho needs to file Form EFO00108.

Q: Why is a Wine Tax Bond required?

A: The Wine Tax Bond is required by the state of Idaho as a form of financial guarantee to ensure that businesses comply with tax and regulatory obligations related to wine production and sales.

Q: What is the purpose of Form EFO00108?

A: The purpose of Form EFO00108 is to provide detailed information about the business applying for the Wine Tax Bond, including their license number, business name, and contact information.

Q: Is there a fee for filing Form EFO00108?

A: Yes, there is a fee associated with filing Form EFO00108. The exact amount may vary, so it's best to check with the Idaho State Tax Commission for the current fee.

Form Details:

- Released on May 7, 2021;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form EFO00108 by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.