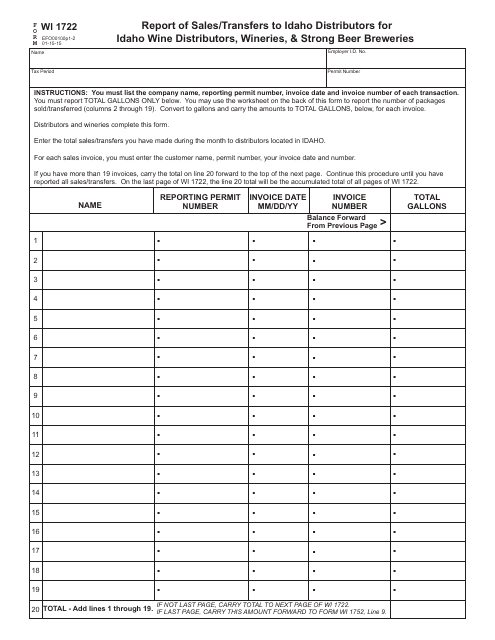

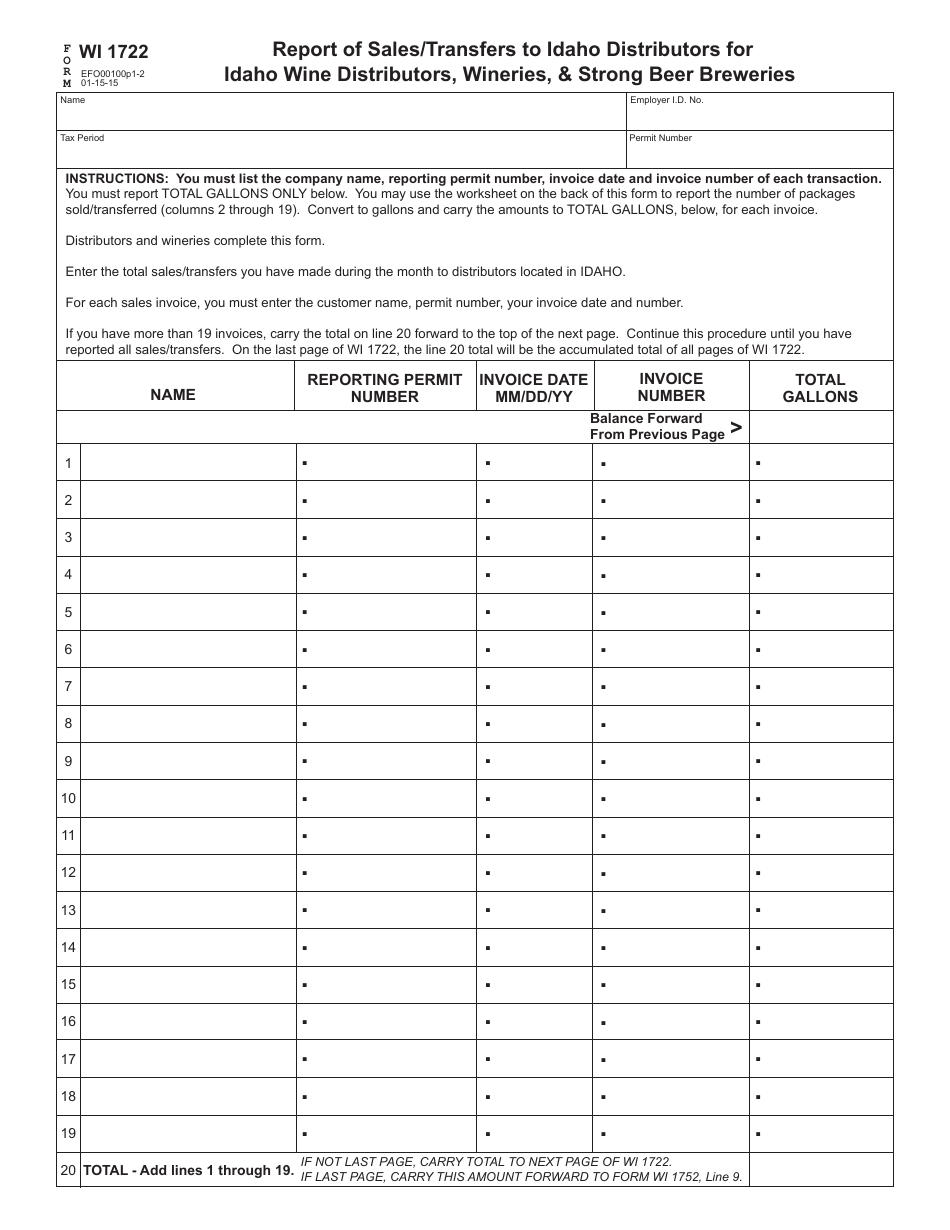

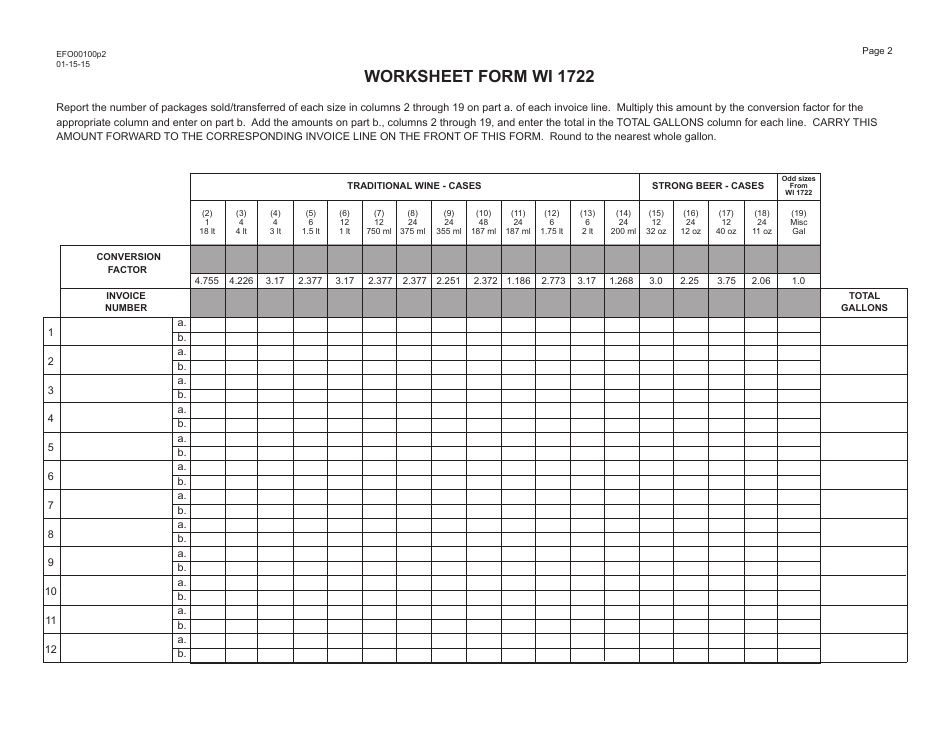

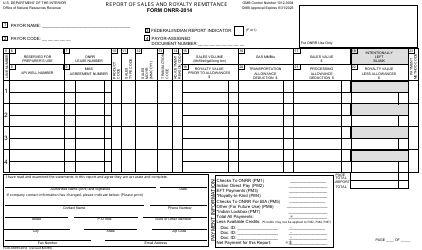

Form WI1722 Report of Sales / Transfers to Idaho Distributors for Idaho Wine Distributors, Wineries, & Strong Beer Breweries - Idaho

What Is Form WI1722?

This is a legal form that was released by the Idaho Department of Finance - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WI1722 Report?

A: The WI1722 Report is a document used by Idaho wine distributors, wineries, and strong beer breweries to report their sales and transfers to Idaho distributors.

Q: Who needs to file the WI1722 Report?

A: Idaho wine distributors, wineries, and strong beer breweries are required to file the WI1722 Report.

Q: What information is included in the WI1722 Report?

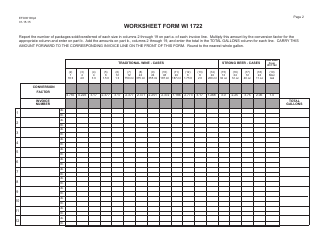

A: The WI1722 Report includes details of sales and transfers made by Idaho wine distributors, wineries, and strong beer breweries to Idaho distributors, including quantities, types of products, and other relevant information.

Q: How often does the WI1722 Report need to be filed?

A: The WI1722 Report needs to be filed monthly by Idaho wine distributors, wineries, and strong beer breweries.

Q: What are the penalties for not filing the WI1722 Report?

A: Failure to file the WI1722 Report or filing it late may result in penalties, including fines and interest charges.

Q: Are there any exemptions to filing the WI1722 Report?

A: There are no exemptions to filing the WI1722 Report. All Idaho wine distributors, wineries, and strong beer breweries must file this report.

Form Details:

- Released on January 15, 2015;

- The latest edition provided by the Idaho Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WI1722 by clicking the link below or browse more documents and templates provided by the Idaho Department of Finance.