This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040-C

for the current year.

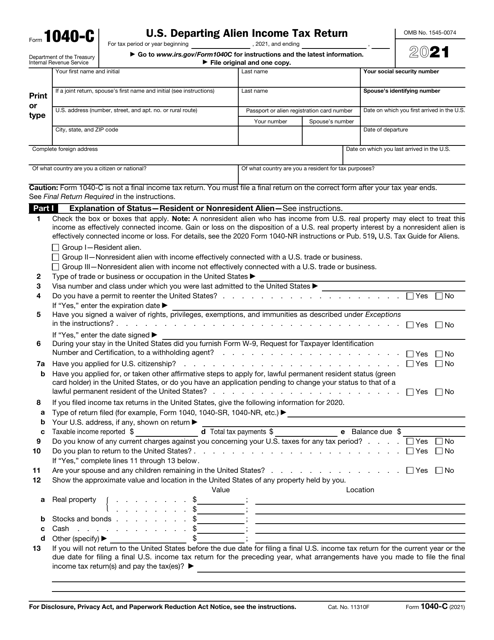

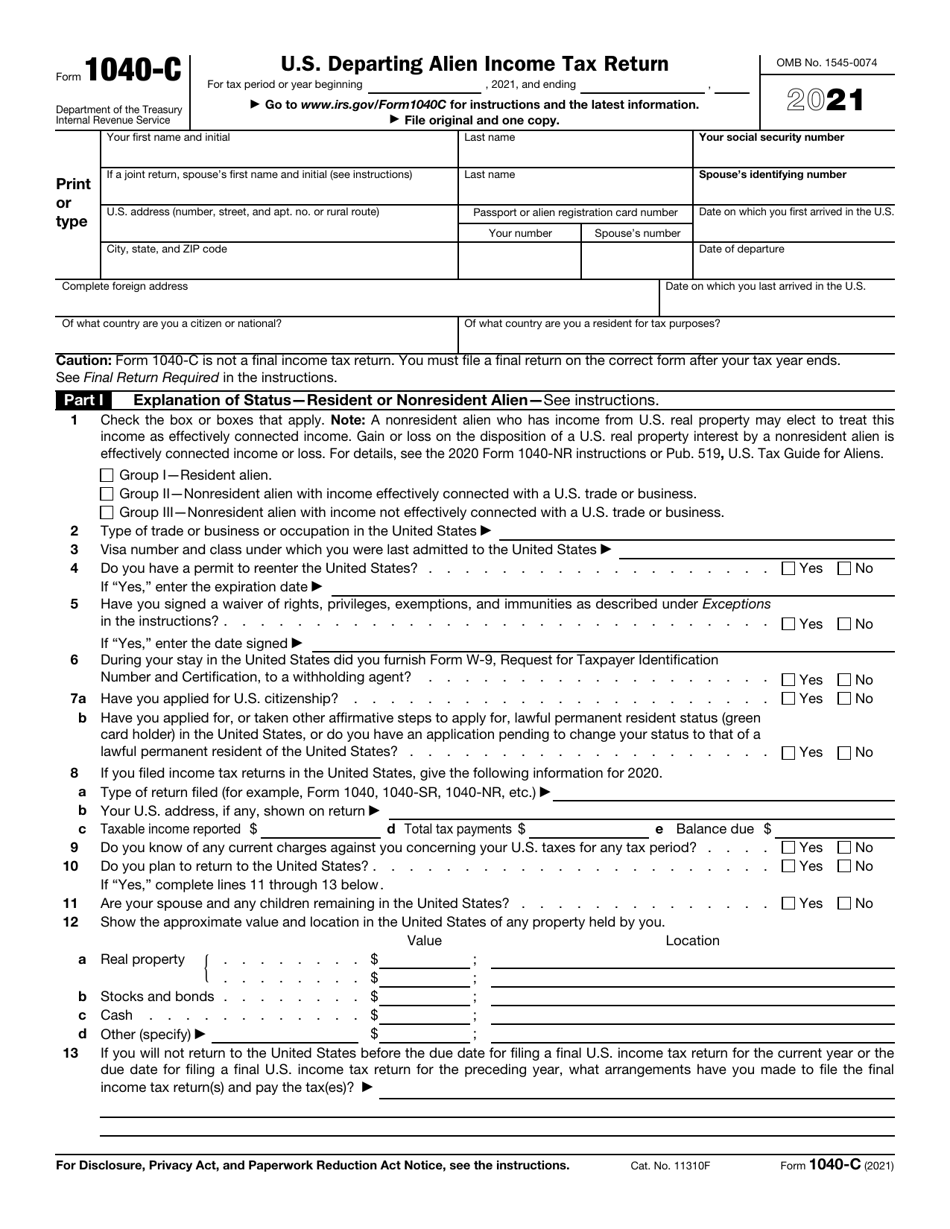

IRS Form 1040-C U.S. Departing Alien Income Tax Return

What Is IRS Form 1040-C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040-C?

A: IRS Form 1040-C is the U.S. Departing Alien Income Tax Return.

Q: Who needs to file Form 1040-C?

A: Form 1040-C is filed by nonresident aliens who are leaving the United States and are required to pay any remaining income tax.

Q: When is Form 1040-C due?

A: Form 1040-C is due on the date of departure from the United States.

Q: What income is reported on Form 1040-C?

A: Form 1040-C is used to report income from U.S. sources, such as wages, salaries, and business income.

Q: Can I e-file Form 1040-C?

A: No, Form 1040-C cannot be e-filed. It must be filed on paper.

Q: What if I have a refund on Form 1040-C?

A: If you are due a refund on Form 1040-C, you must file Form 1040-NR instead to claim the refund.

Form Details:

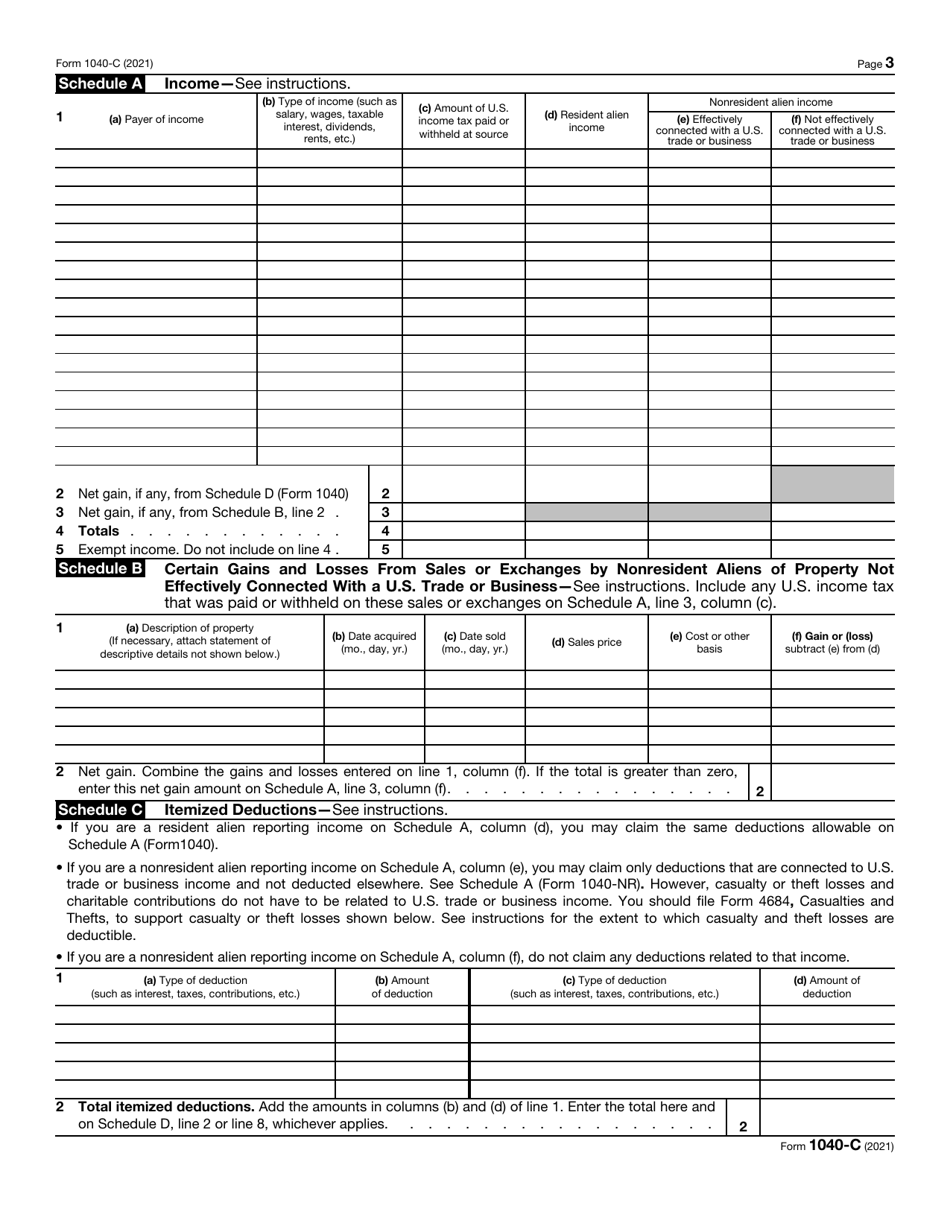

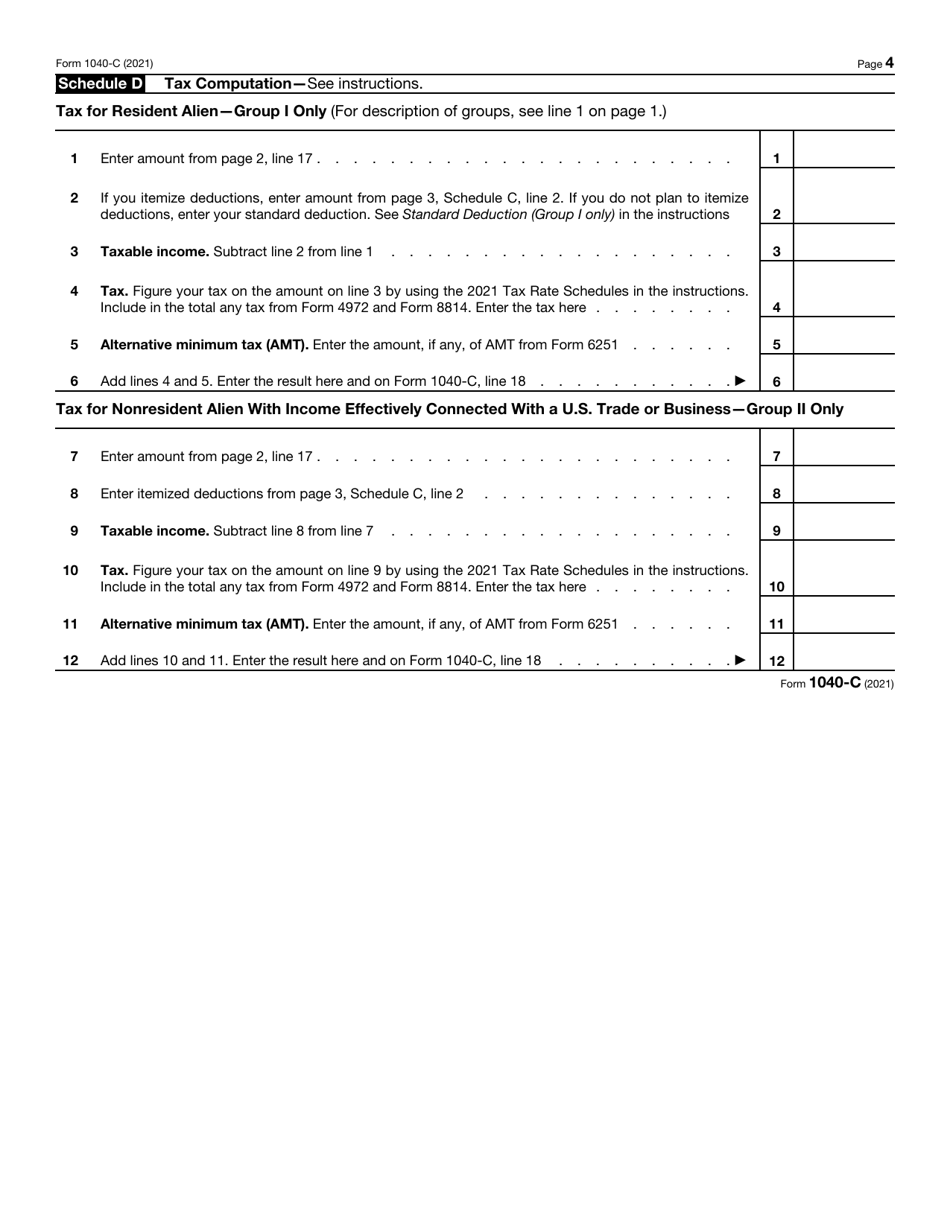

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-C through the link below or browse more documents in our library of IRS Forms.