This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040-C

for the current year.

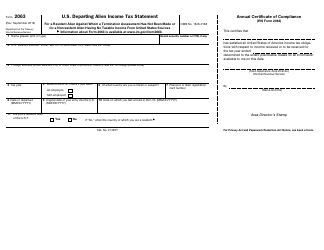

Instructions for IRS Form 1040-C U.S. Departing Alien Income Tax Return

This document contains official instructions for IRS Form 1040-C , U.S. Departing Alien Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-C is available for download through this link.

FAQ

Q: What is Form 1040-C?

A: Form 1040-C is the U.S. Departing Alien Income Tax Return.

Q: Who needs to file Form 1040-C?

A: Non-resident aliens who are leaving the U.S. and need to report their income for the time they were in the U.S.

Q: What is the purpose of Form 1040-C?

A: The purpose of Form 1040-C is to calculate the tax liability for non-resident aliens before leaving the U.S.

Q: How do I file Form 1040-C?

A: You can file Form 1040-C by mail or in person at an IRS office.

Q: When is Form 1040-C due?

A: Form 1040-C is due on the date you are leaving the U.S.

Q: What income should I report on Form 1040-C?

A: You should report all income earned from U.S. sources, including wages, salaries, and business income.

Q: What if I have already filed a regular income tax return?

A: If you have already filed a regular income tax return, you do not need to file Form 1040-C.

Q: Are there any exemptions or deductions available on Form 1040-C?

A: No, there are no exemptions or deductions available on Form 1040-C.

Q: Do I need to include any supporting documents with Form 1040-C?

A: Yes, you should include copies of any forms W-2 or 1099 that you received.

Q: What should I do with Form 1040-C after filing?

A: You should keep a copy of Form 1040-C for your records and submit the original to the IRS.

Instruction Details:

- This 10-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.