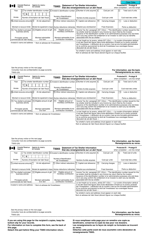

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC71

for the current year.

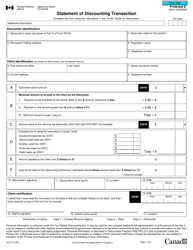

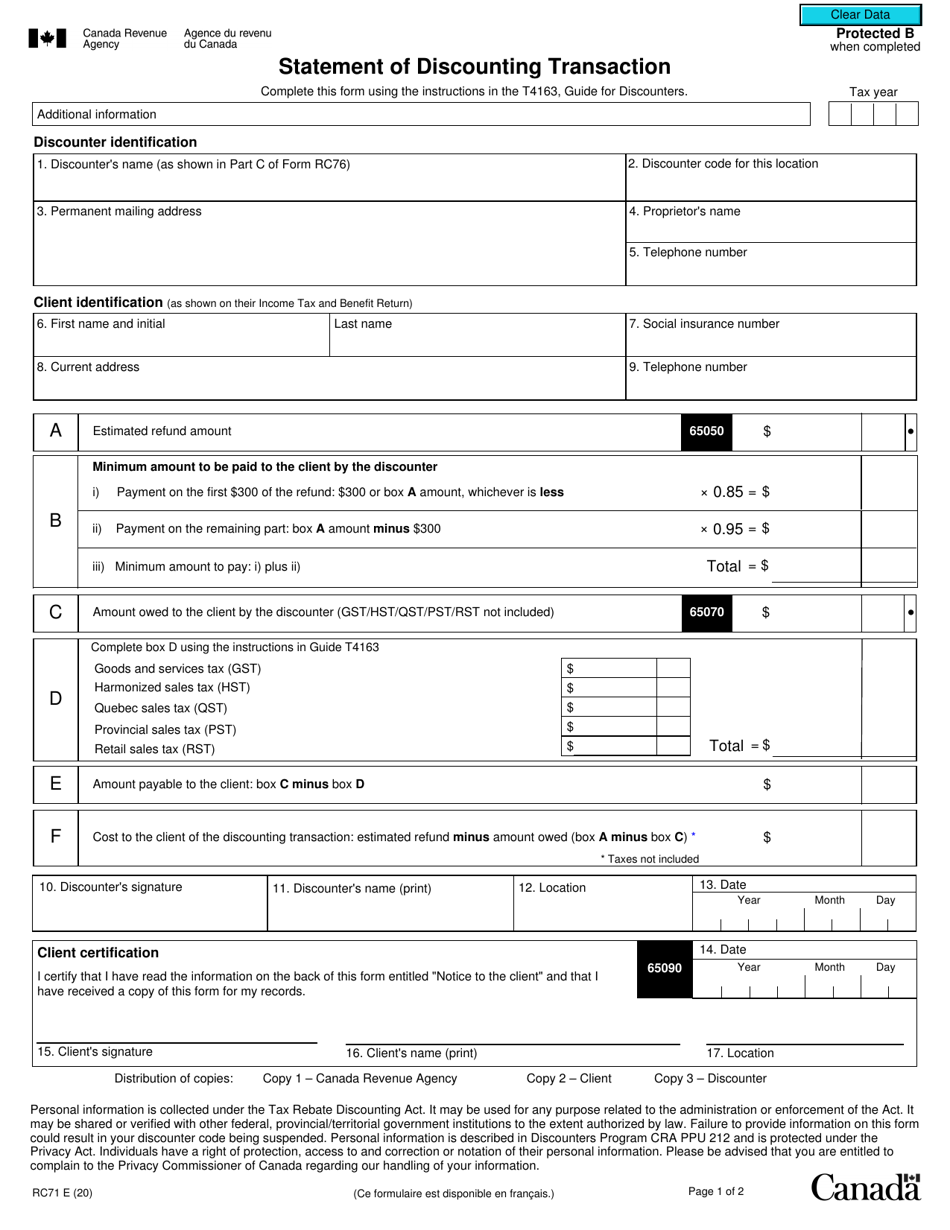

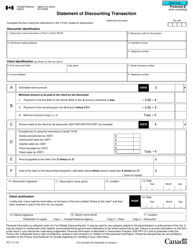

Form RC71 Statement of Discounting Transaction - Canada

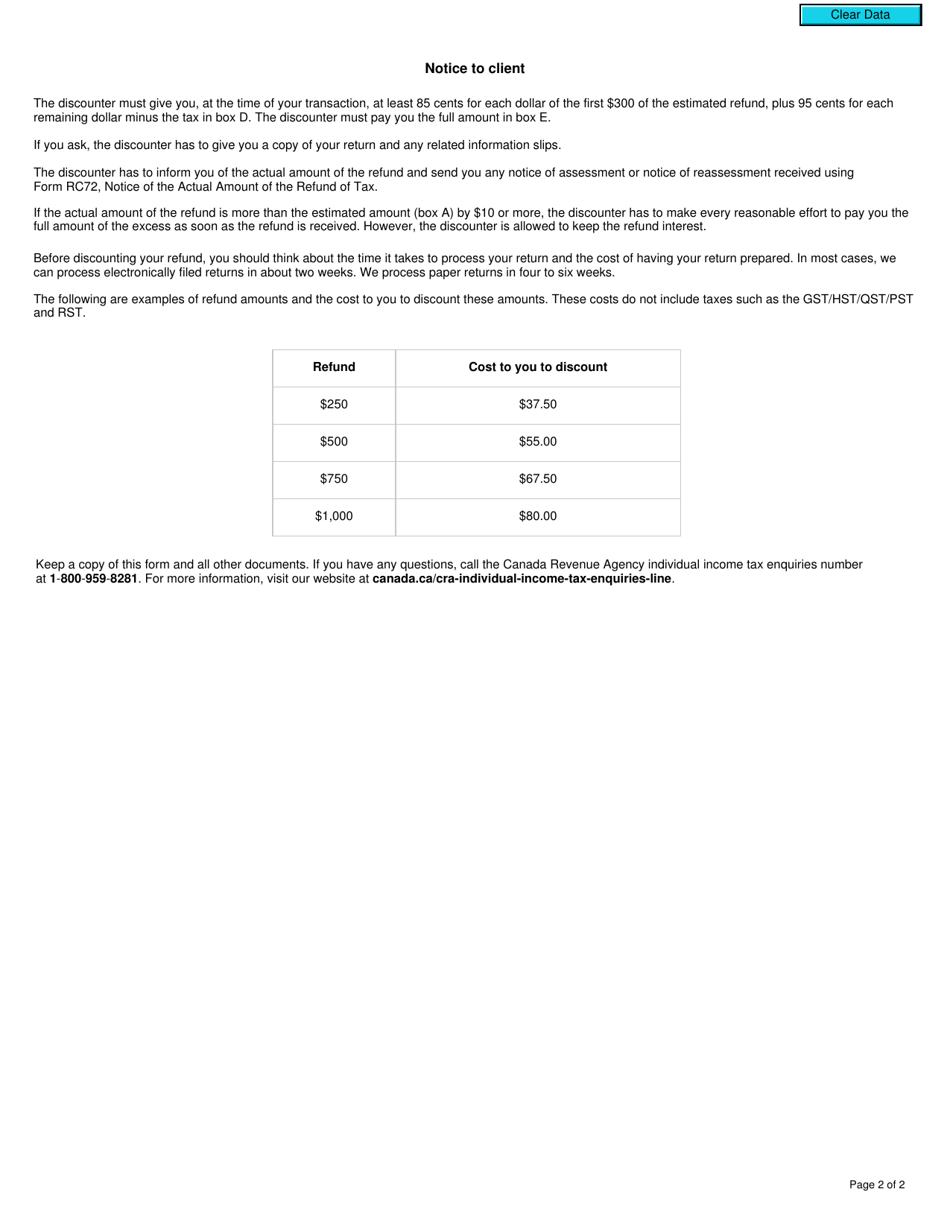

The Form RC71 Statement of Discounting Transaction is used in Canada by businesses to report certain types of financial transactions involving the discounting of accounts receivable or other debts. It provides information about the discounting of debts and the related parties involved.

The Form RC71 Statement of Discounting Transaction in Canada is filed by the person or business that is involved in the discounting transaction.

FAQ

Q: What is Form RC71?

A: Form RC71 is the Statement of Discounting Transaction in Canada.

Q: What is a discounting transaction?

A: A discounting transaction is a financial transaction in which a taxpayer sells or assigns a receivable for less than its face value to a third party.

Q: Who needs to file Form RC71?

A: Taxpayers who have engaged in discounting transactions in Canada are required to file Form RC71.

Q: What information is required in Form RC71?

A: Form RC71 requires information about the discounting transaction, including the taxpayer's identification details, the date and amount of the transaction, and information about the counterparty.

Q: When is the deadline to file Form RC71?

A: The deadline for filing Form RC71 is generally within 90 days after the end of the taxpayer's fiscal year.

Q: Are there any penalties for not filing Form RC71?

A: Yes, failure to file Form RC71 or providing false or misleading information can result in penalties imposed by the CRA.

Q: Can I e-file Form RC71?

A: Currently, Form RC71 cannot be e-filed and must be filed by mail.

Q: Can I get assistance with filling out Form RC71?

A: If you need assistance with filling out Form RC71, you can contact the CRA or consult a tax professional.