This version of the form is not currently in use and is provided for reference only. Download this version of

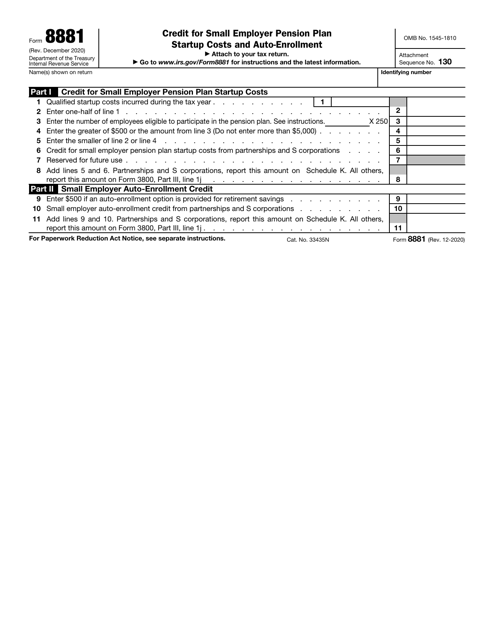

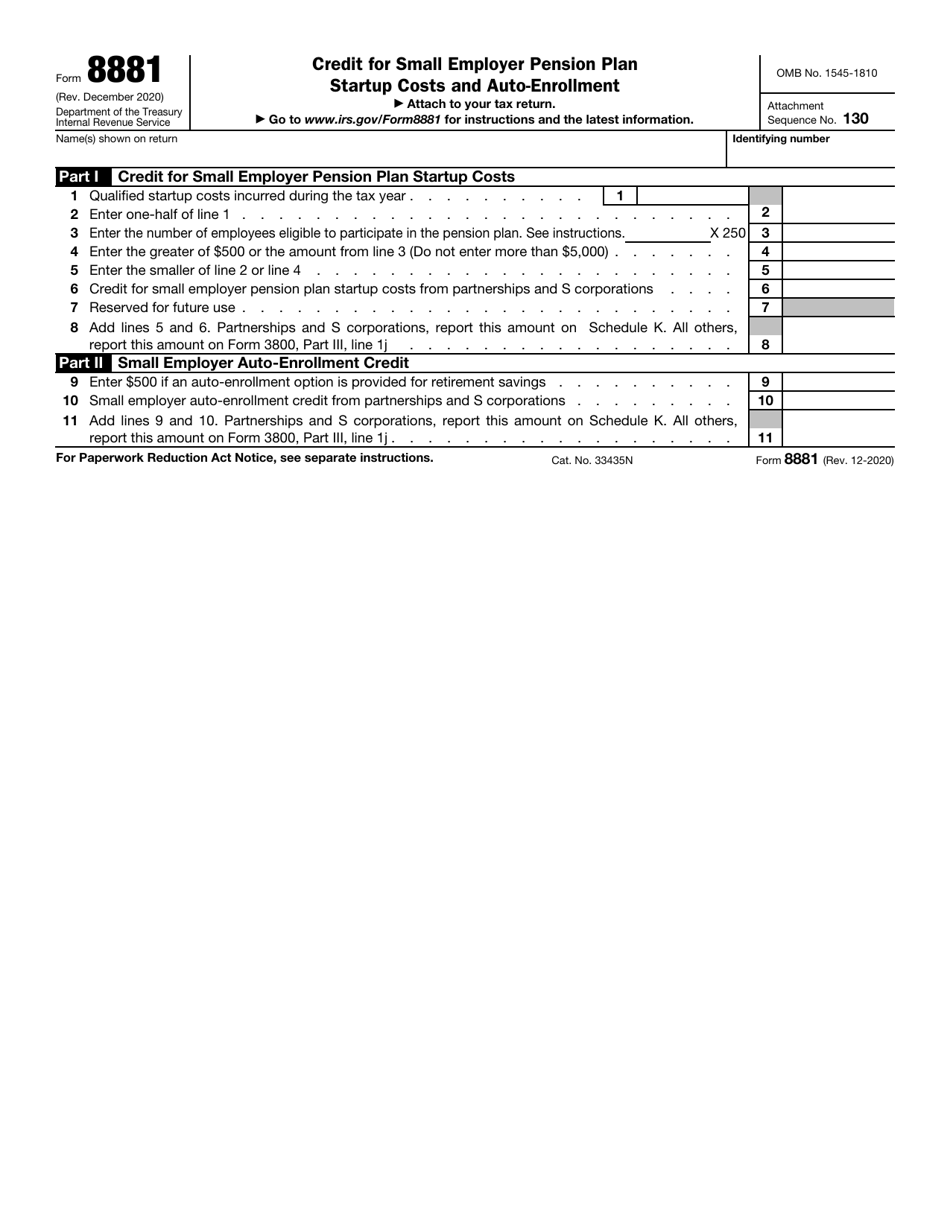

IRS Form 8881

for the current year.

IRS Form 8881 Credit for Small Employer Pension Plan Startup Costs and Auto-enrollment

What Is IRS Form 8881?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8881?

A: IRS Form 8881 is used to claim the Credit for Small Employer Pension Plan Startup Costs and Auto-enrollment.

Q: What does the form cover?

A: The form covers the credit for eligible small employers who set up a new retirement plan or add an automatic enrollment feature to an existing plan.

Q: What are small employer pension plan startup costs?

A: Small employer pension plan startup costs are the expenses incurred when setting up and administering a retirement plan.

Q: What is auto-enrollment?

A: Auto-enrollment is a feature in a retirement plan where eligible employees are automatically enrolled unless they choose to opt out.

Q: Who is eligible for the credit?

A: Eligible employers are those with 100 or fewer employees who received at least $5,000 in compensation in the previous year.

Q: How much is the credit?

A: The credit is up to 50% of the eligible startup costs, with a maximum credit of $500 for each of the first three years of the plan.

Q: How do I claim the credit?

A: To claim the credit, you need to complete and attach Form 8881 to your tax return for the year in which the expenses were paid or incurred.

Q: Are there any deadlines to claim the credit?

A: Yes, the credit must be claimed in the tax year in which the eligible expenses were paid or incurred.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8881 through the link below or browse more documents in our library of IRS Forms.