This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8881

for the current year.

Instructions for IRS Form 8881 Credit for Small Employer Pension Plan Startup Costs and Auto-enrollment

This document contains official instructions for IRS Form 8881 , Credit for Pension Plan Startup Costs and Auto-enrollment - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8881 is available for download through this link.

FAQ

Q: What is IRS Form 8881?

A: IRS Form 8881 is a form used to claim the Credit for Small Employer Pension Plan Startup Costs and Auto-enrollment.

Q: Who can use IRS Form 8881?

A: Small employers who have started a new pension plan for their employees and automatically enroll employees in the plan can use IRS Form 8881.

Q: What is the purpose of IRS Form 8881?

A: The purpose of IRS Form 8881 is to claim a tax credit for the startup costs of a small employer pension plan and the costs associated with auto-enrollment of employees.

Q: What expenses can be claimed on IRS Form 8881?

A: Expenses such as administrative and educational expenses related to the startup of a small employer pension plan and the costs of implementing auto-enrollment can be claimed on IRS Form 8881.

Q: How much is the tax credit for small employer pension plan startup costs?

A: The tax credit for small employer pension plan startup costs is 50% of the eligible expenses, up to a maximum credit of $500 per year for the first three years of the plan.

Q: How do I file IRS Form 8881?

A: IRS Form 8881 should be filed with your annual tax return. The instructions for the form provide detailed information on how to complete and submit it.

Q: Are there any eligibility requirements for the tax credit?

A: Yes, there are eligibility requirements for the tax credit. You must have 100 or fewer employees who received at least $5,000 in compensation from your business in the preceding year.

Q: Can I claim the tax credit for multiple years?

A: Yes, you can claim the tax credit for small employer pension plan startup costs for the first three years of the plan.

Q: Is there a deadline to file IRS Form 8881?

A: IRS Form 8881 should be filed with your annual tax return, which is typically due on April 15th of the following year. However, it's always a good idea to check the specific deadline for the current tax year.

Instruction Details:

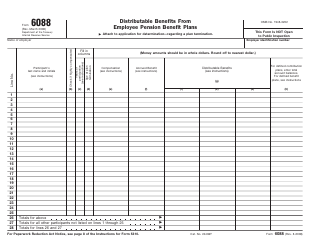

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.