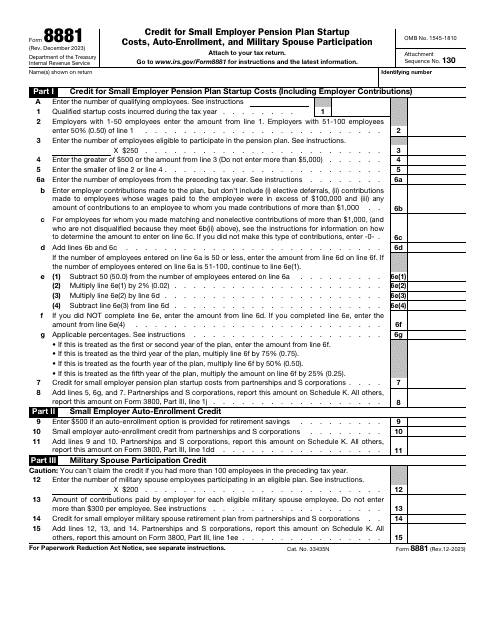

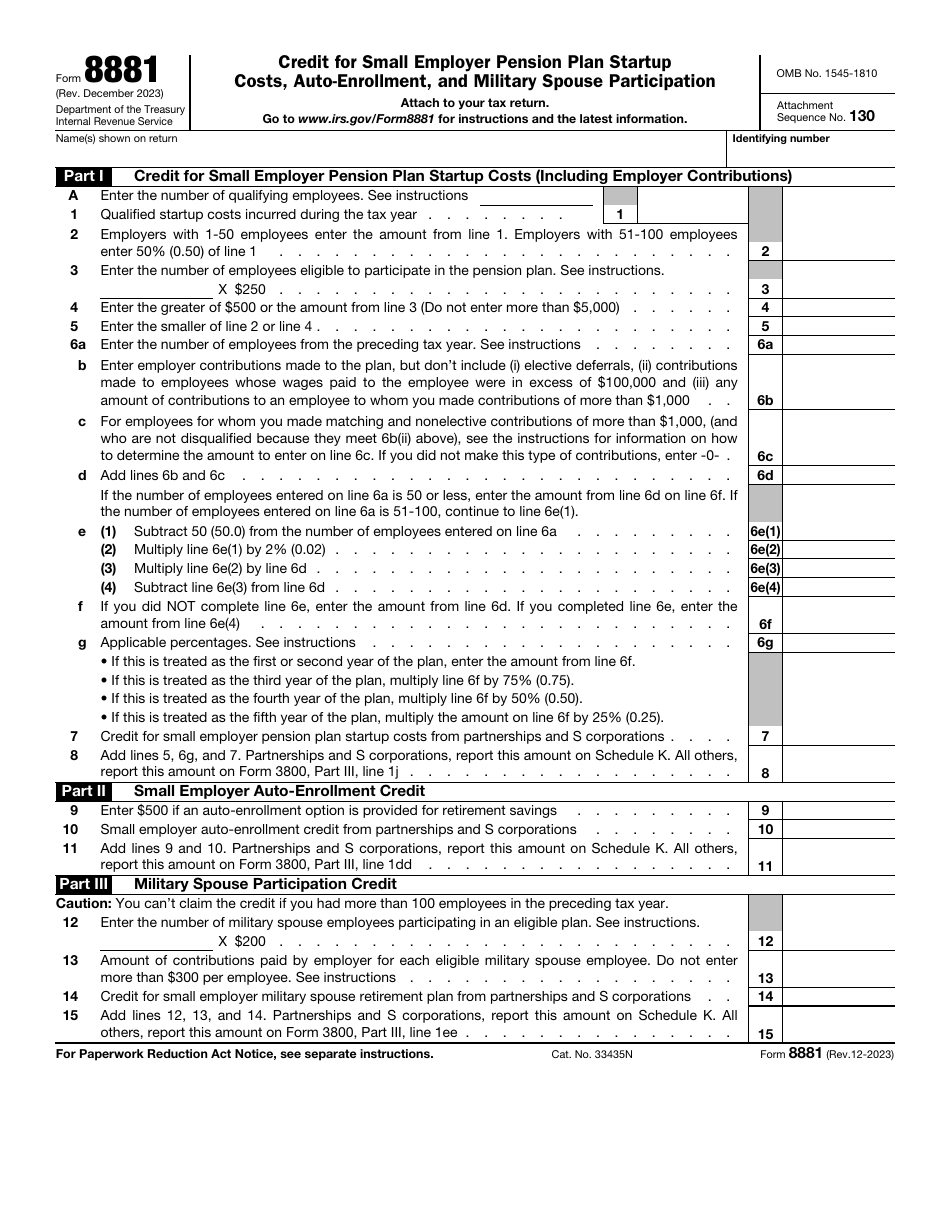

IRS Form 8881 Credit for Small Employer Pension Plan Startup Costs, Auto-enrollment, and Military Spouse Participation

Fill PDF Online

Fill out online for free

without registration or credit card

What Is IRS Form 8881?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8881 through the link below or browse more documents in our library of IRS Forms.