This version of the form is not currently in use and is provided for reference only. Download this version of

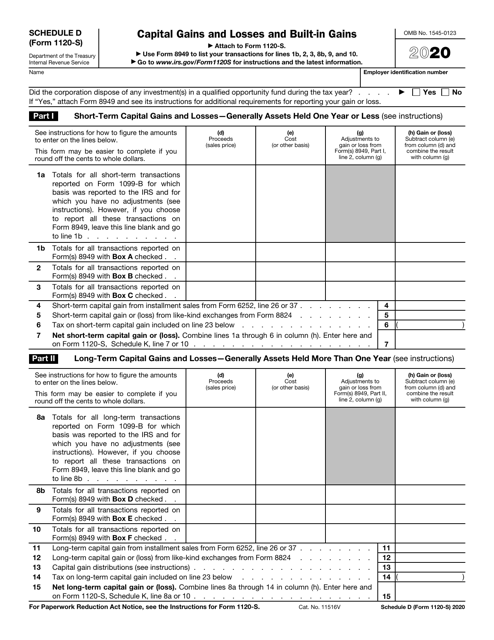

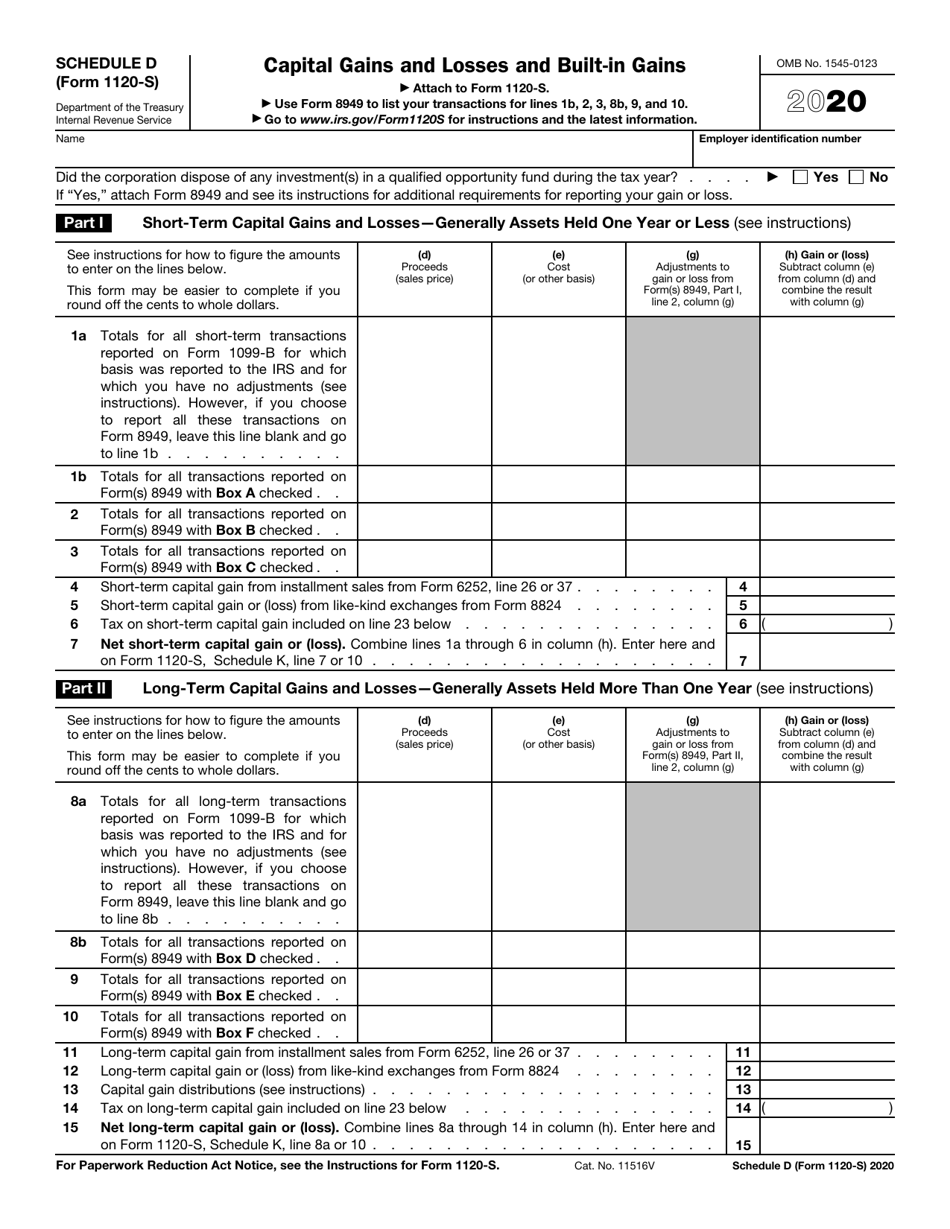

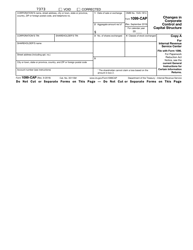

IRS Form 1120-S Schedule D

for the current year.

IRS Form 1120-S Schedule D Capital Gains and Losses and Built-In Gains

What Is IRS Form 1120-S Schedule D?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-S, U.S. Income Tax Return for an S Corporation. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-S?

A: IRS Form 1120-S is a tax form for reporting the income, deductions, and tax liability of S corporations.

Q: What is Schedule D?

A: Schedule D is a part of IRS Form 1120-S that is used to report capital gains and losses from the sale or exchange of assets.

Q: What are capital gains and losses?

A: Capital gains are the profits made from selling or exchanging capital assets, while capital losses are the losses incurred from such transactions.

Q: What is built-in gain?

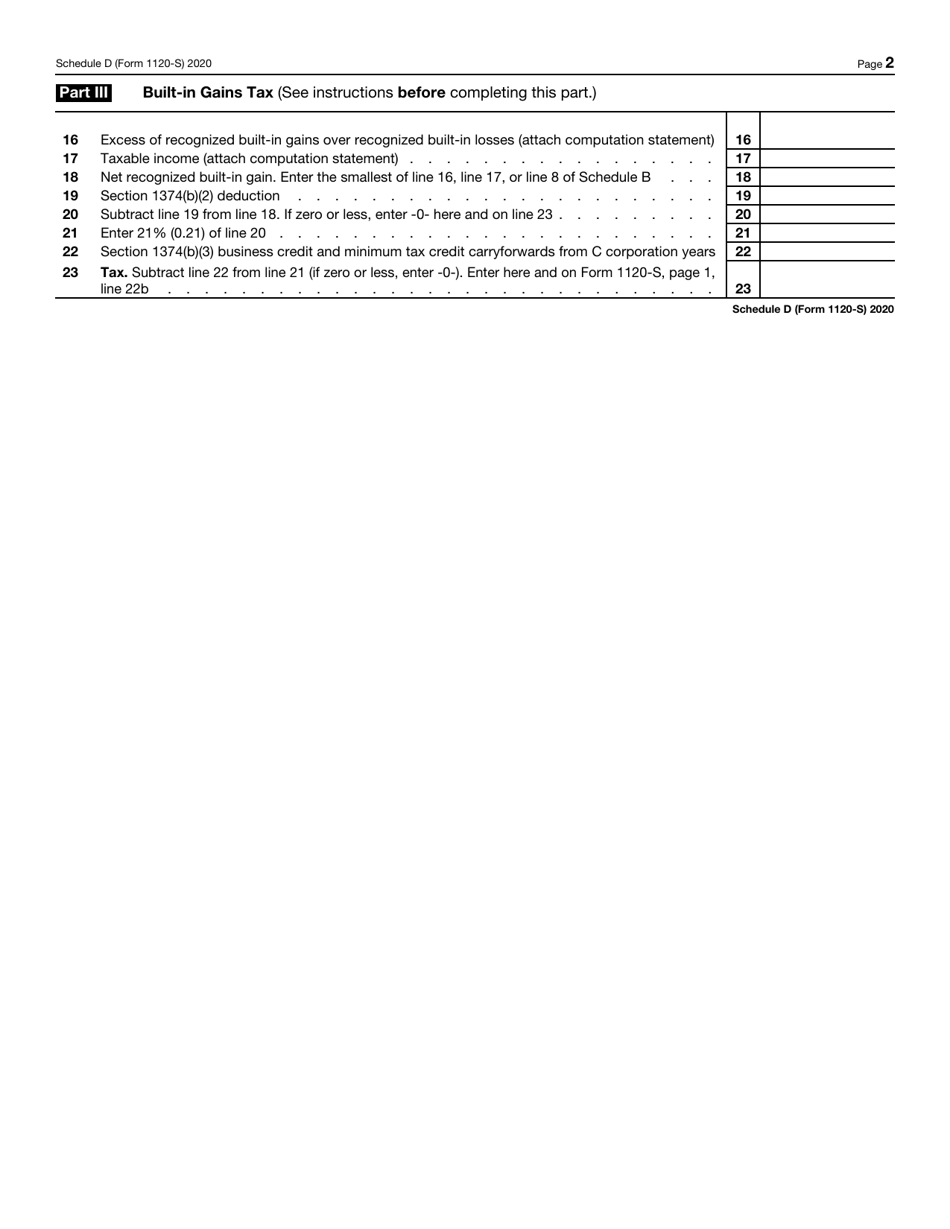

A: Built-in gain refers to the gain that is still inherent in the assets of an S corporation at the time it converts from a C corporation to an S corporation.

Q: How do I complete Schedule D?

A: To complete Schedule D, you will need to provide details of each capital asset sale or exchange, including the purchase date, sale date, cost basis, sale proceeds, and any other relevant information.

Q: When is the deadline for filing Form 1120-S?

A: The deadline for filing Form 1120-S is generally on the 15th day of the third month after the end of the corporation's tax year.

Q: Are there any penalties for not filing or late filing of Form 1120-S?

A: Yes, there can be penalties for not filing or late filing of Form 1120-S. It is important to file the form on time or request an extension if needed.

Q: Can I e-file Form 1120-S?

A: Yes, you can e-file Form 1120-S using IRS-approved software or through a tax professional.

Q: Do I need to include supporting documents with Form 1120-S?

A: You generally do not need to attach supporting documents when filing Form 1120-S. However, you should keep them for your records in case of an audit.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-S Schedule D through the link below or browse more documents in our library of IRS Forms.