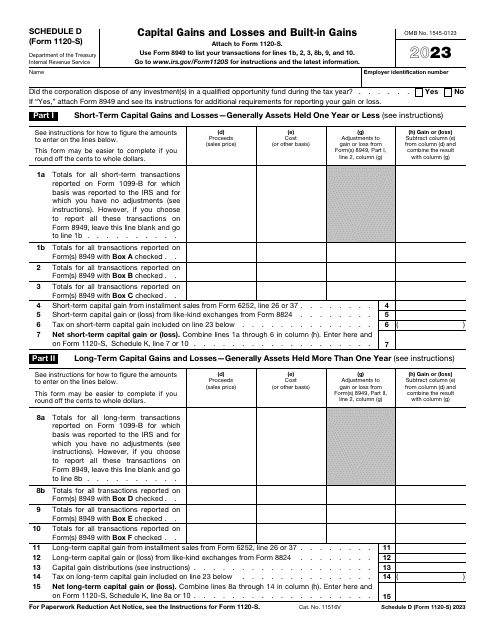

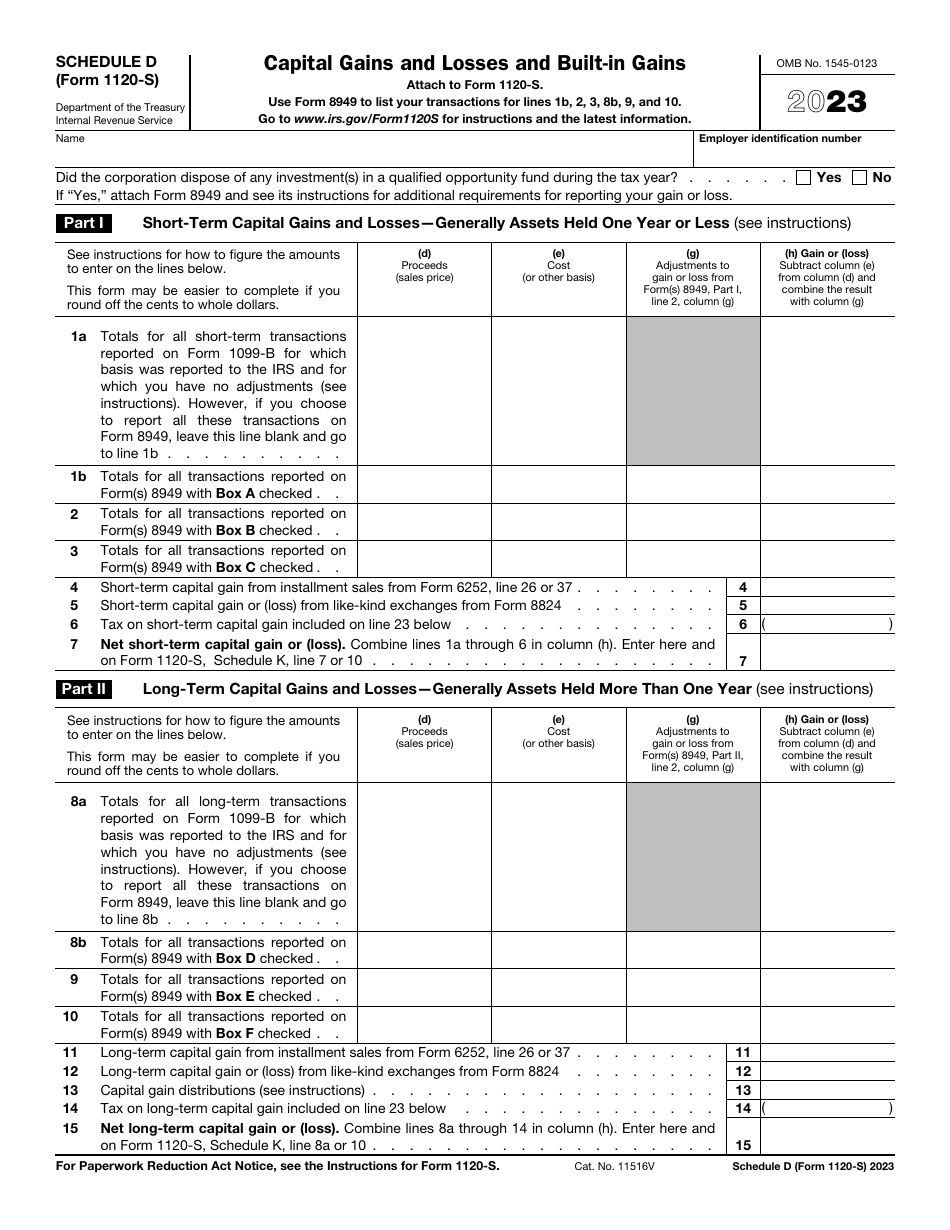

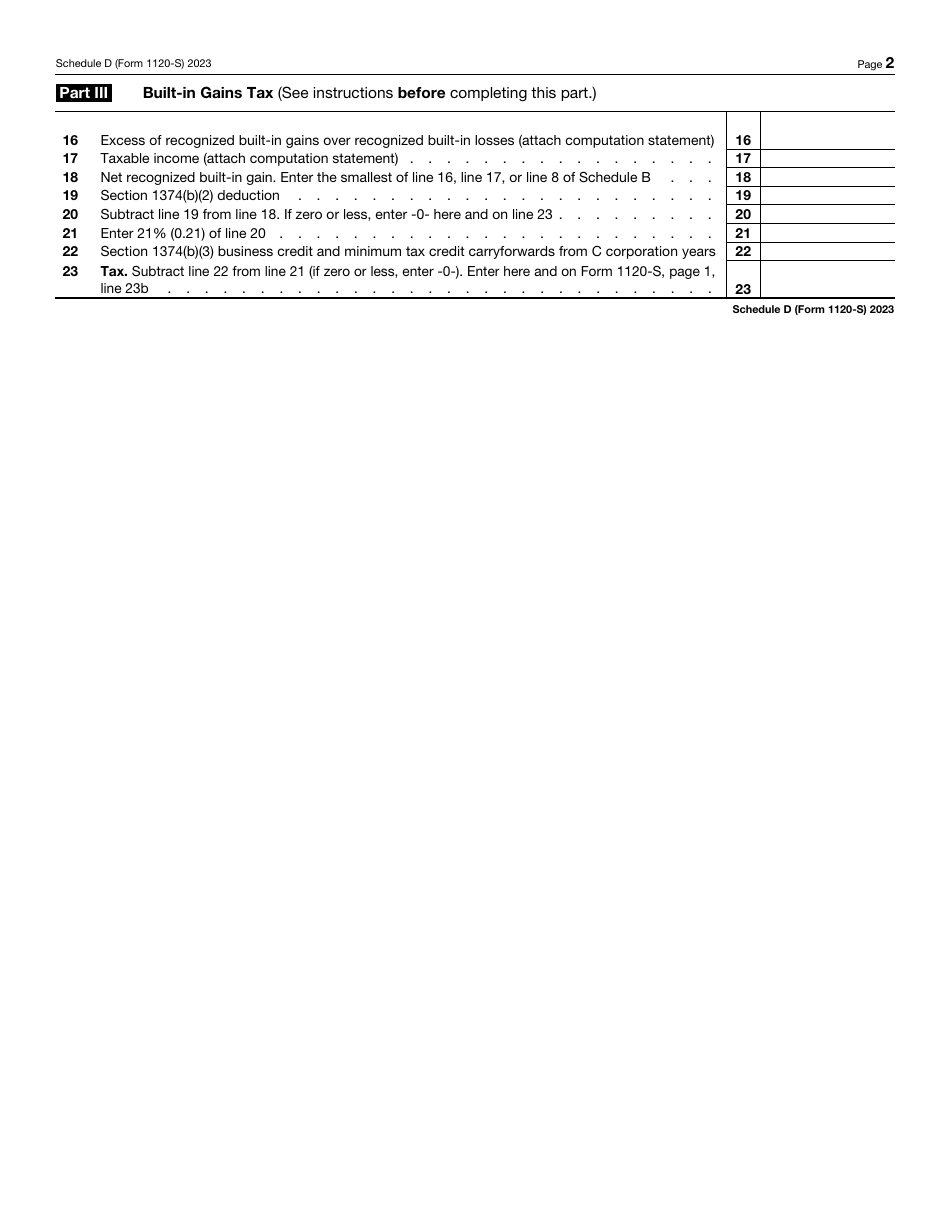

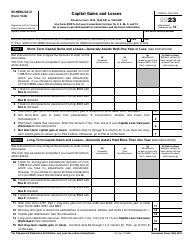

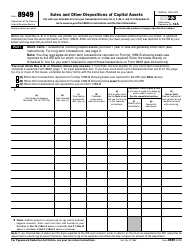

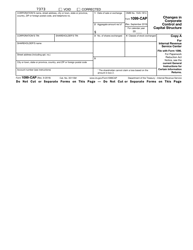

IRS Form 1120-S Schedule D Capital Gains and Losses and Built-In Gains

Fill PDF Online

Fill out online for free

without registration or credit card

What Is IRS Form 1120-S Schedule D?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-S, U.S. Income Tax Return for an S Corporation. Check the official IRS-issued instructions before completing and submitting the form.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-S Schedule D through the link below or browse more documents in our library of IRS Forms.