This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-S Schedule D

for the current year.

Instructions for IRS Form 1120-S Schedule D Capital Gains and Losses and Built-In Gains

This document contains official instructions for IRS Form 1120-S Schedule D, Capital Gains and Losses and Built-In Gains - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-S Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 1120-S?

A: IRS Form 1120-S is the U.S. Income Tax Return for an S Corporation.

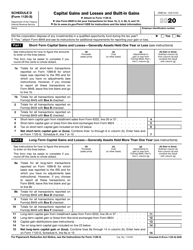

Q: What is Schedule D on Form 1120-S?

A: Schedule D on Form 1120-S is used to report the capital gains and losses of the S Corporation.

Q: What are capital gains and losses?

A: Capital gains are profits made from the sale of assets, while capital losses are losses incurred from the sale of assets.

Q: What is a built-in gain?

A: A built-in gain is the amount of gain that an S Corporation has when it converts from a C Corporation to an S Corporation.

Q: Why is Schedule D needed for an S Corporation?

A: Schedule D is needed to report the capital gains and losses as well as the built-in gains of the S Corporation.

Q: How do I fill out Schedule D on Form 1120-S?

A: You will need to provide details about the assets sold, the dates of purchase and sale, and the amounts of capital gain or loss.

Q: Are there any special rules for built-in gains?

A: Yes, there are special rules that apply to built-in gains, such as a 10-year recognition period and the potential for additional taxes.

Q: Can I e-file Form 1120-S with Schedule D?

A: Yes, you can e-file Form 1120-S with Schedule D using approved e-file providers.

Q: What happens if I make a mistake on Schedule D?

A: If you make a mistake on Schedule D, you may need to file an amended return using Form 1120-X.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.