This version of the form is not currently in use and is provided for reference only. Download this version of

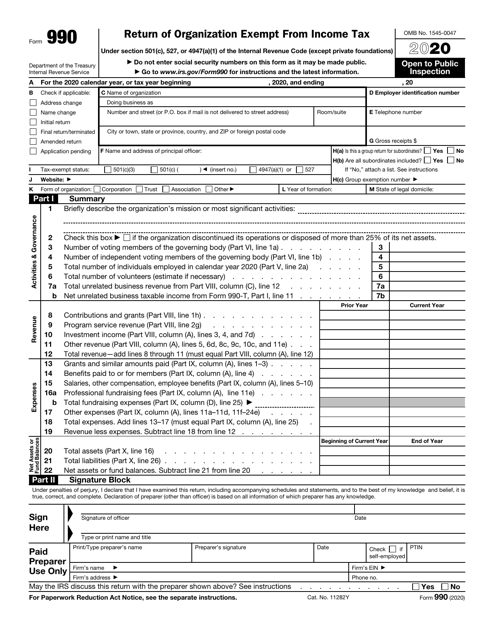

IRS Form 990

for the current year.

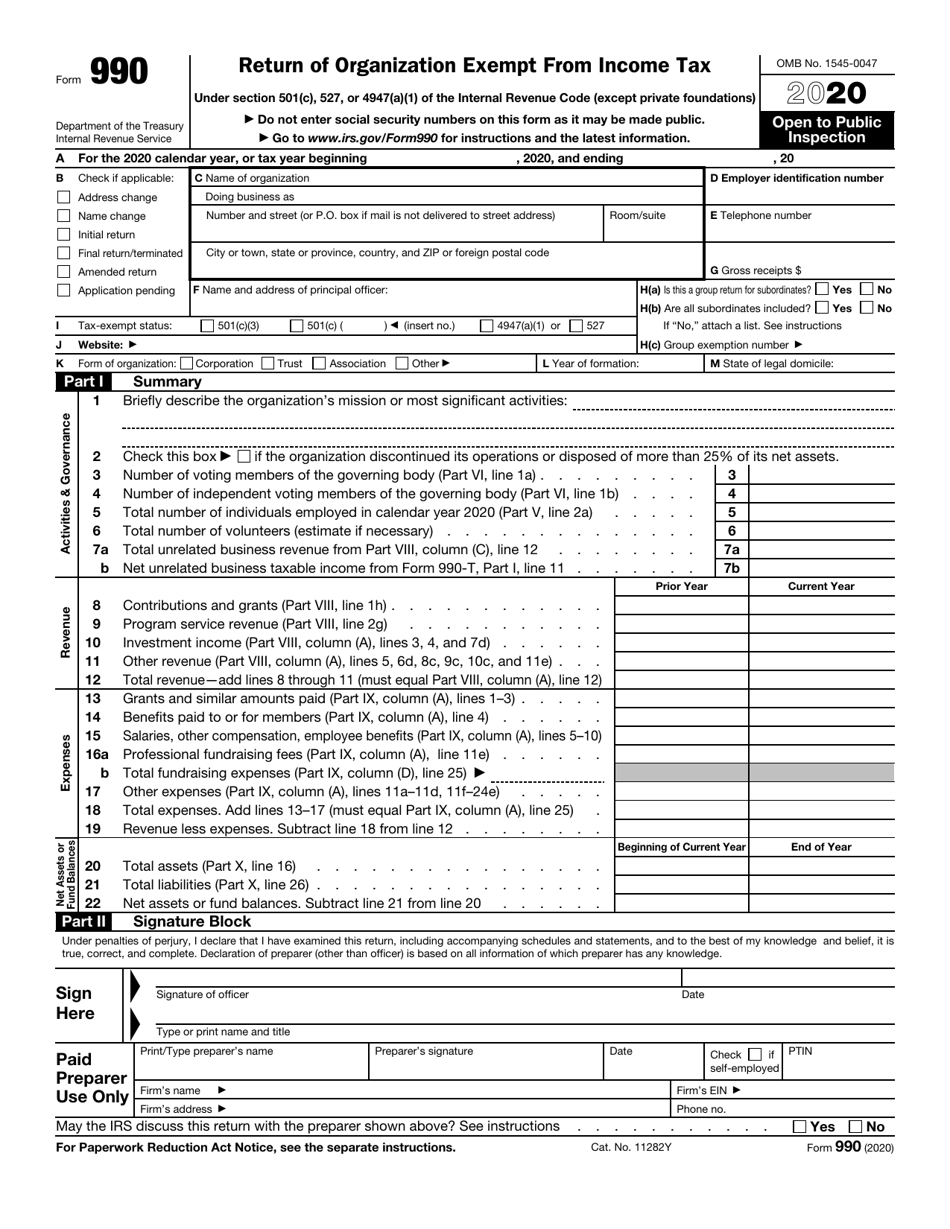

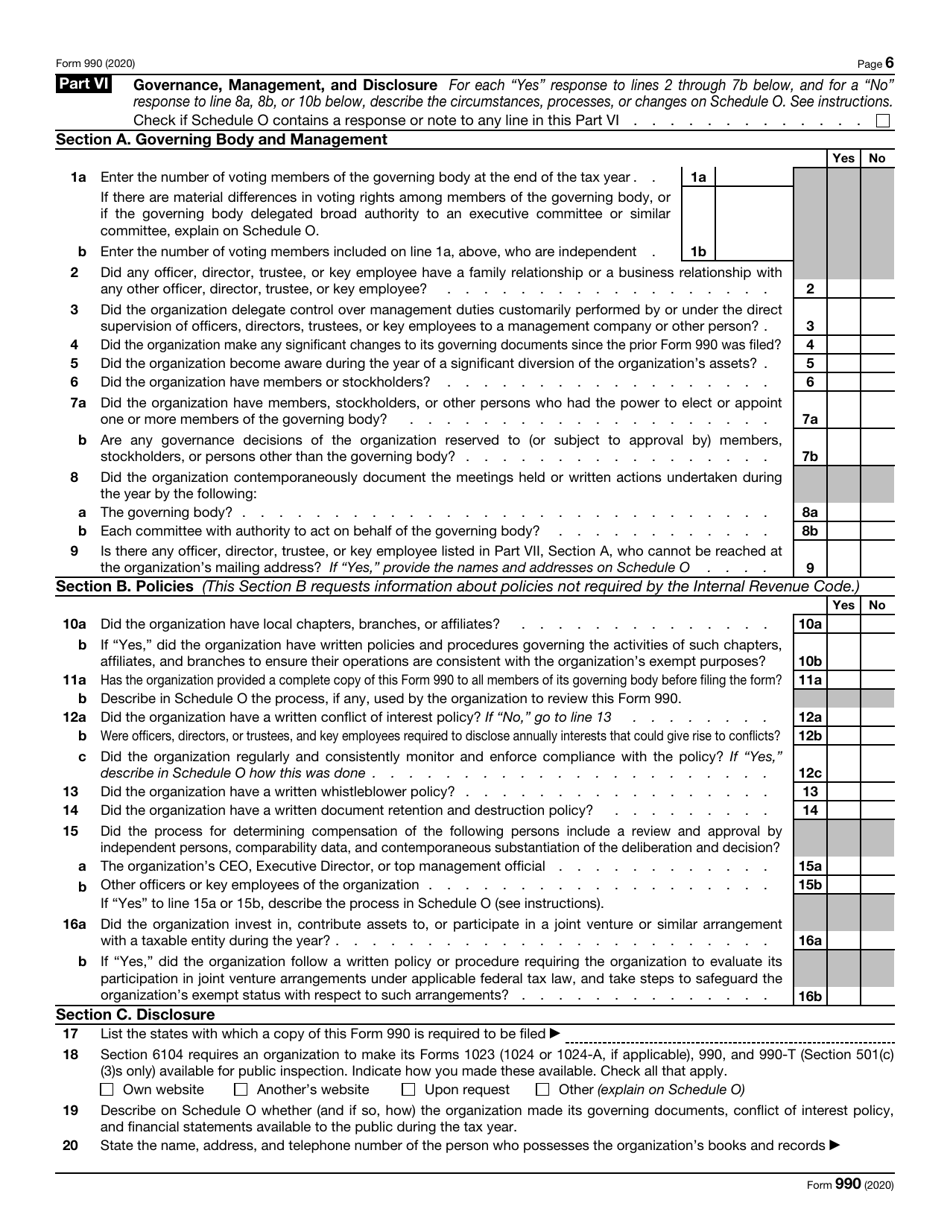

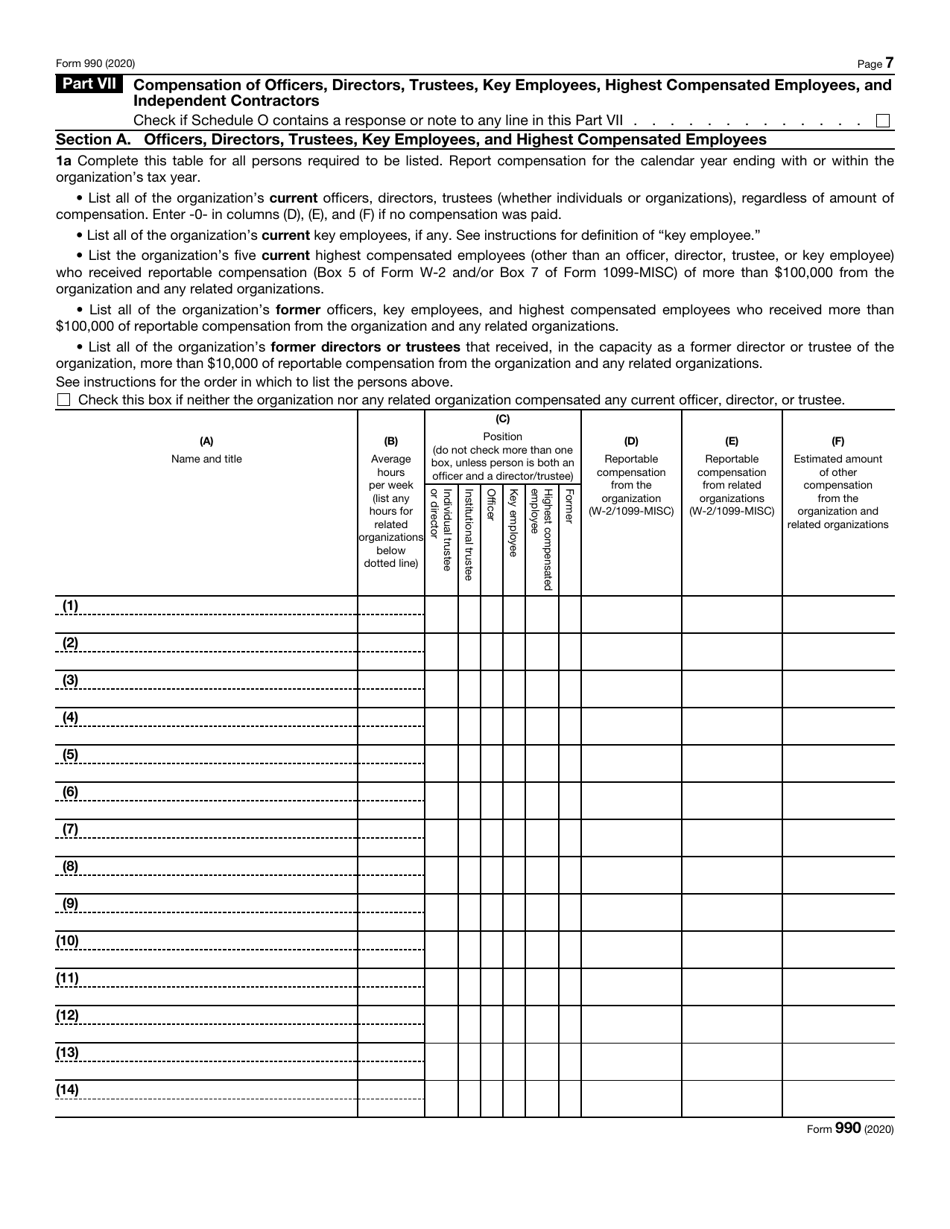

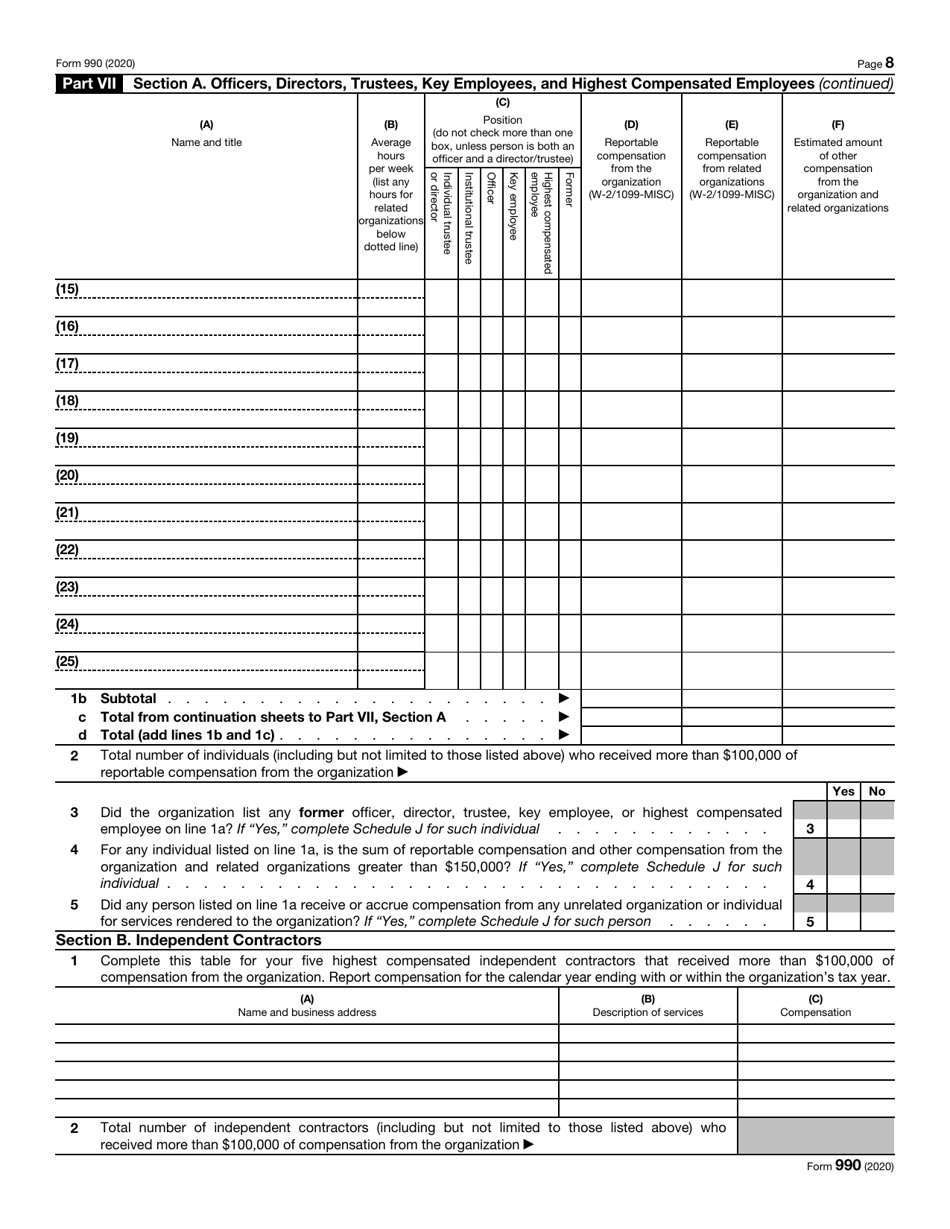

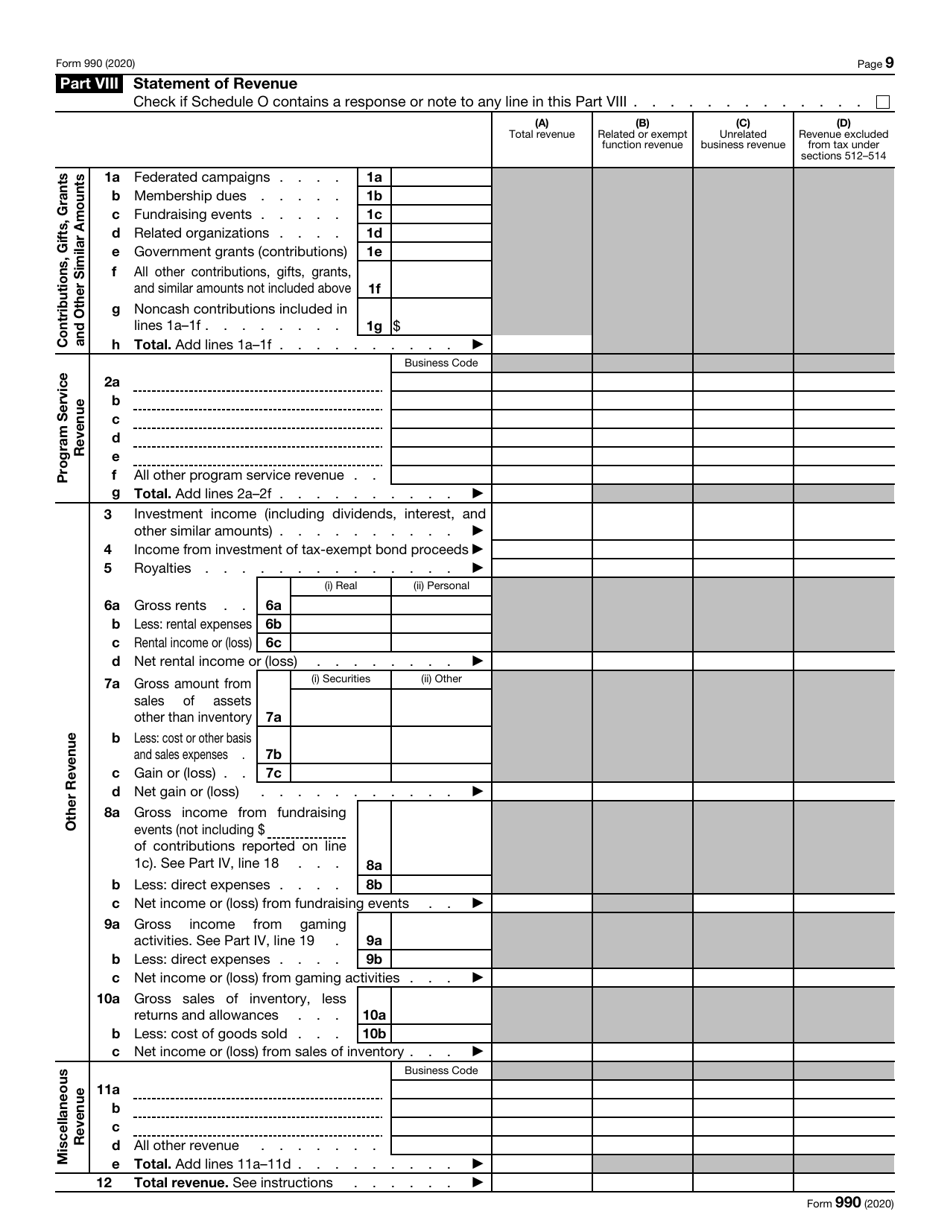

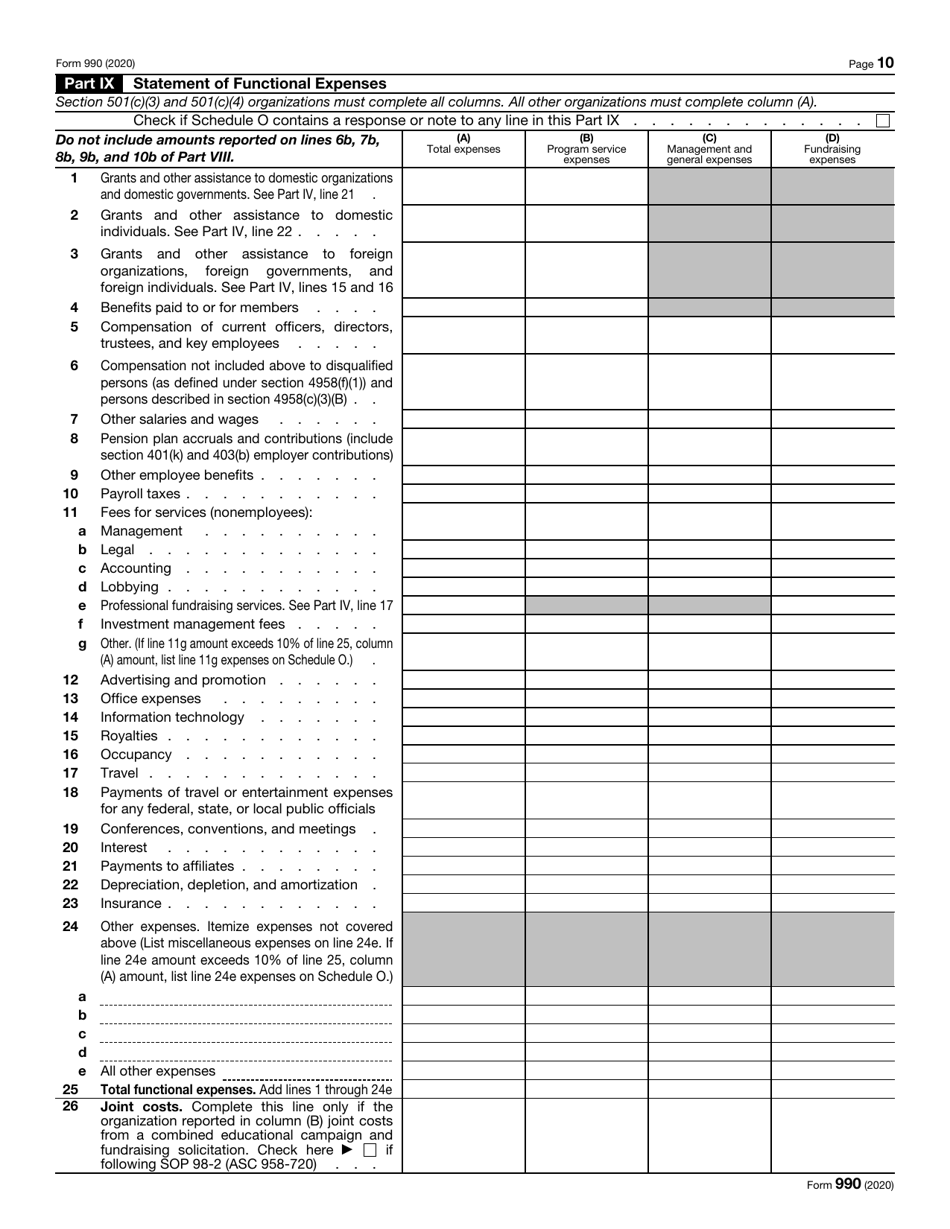

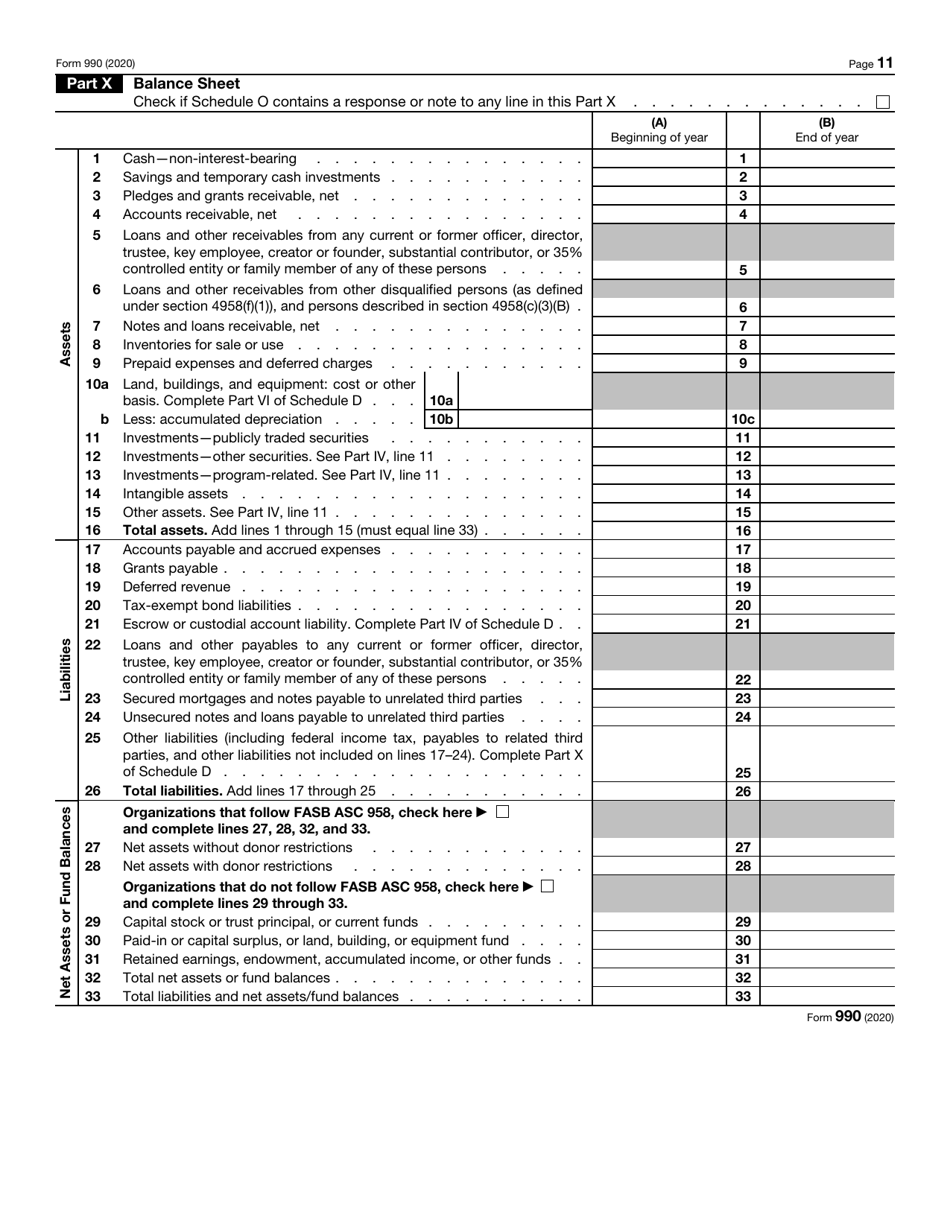

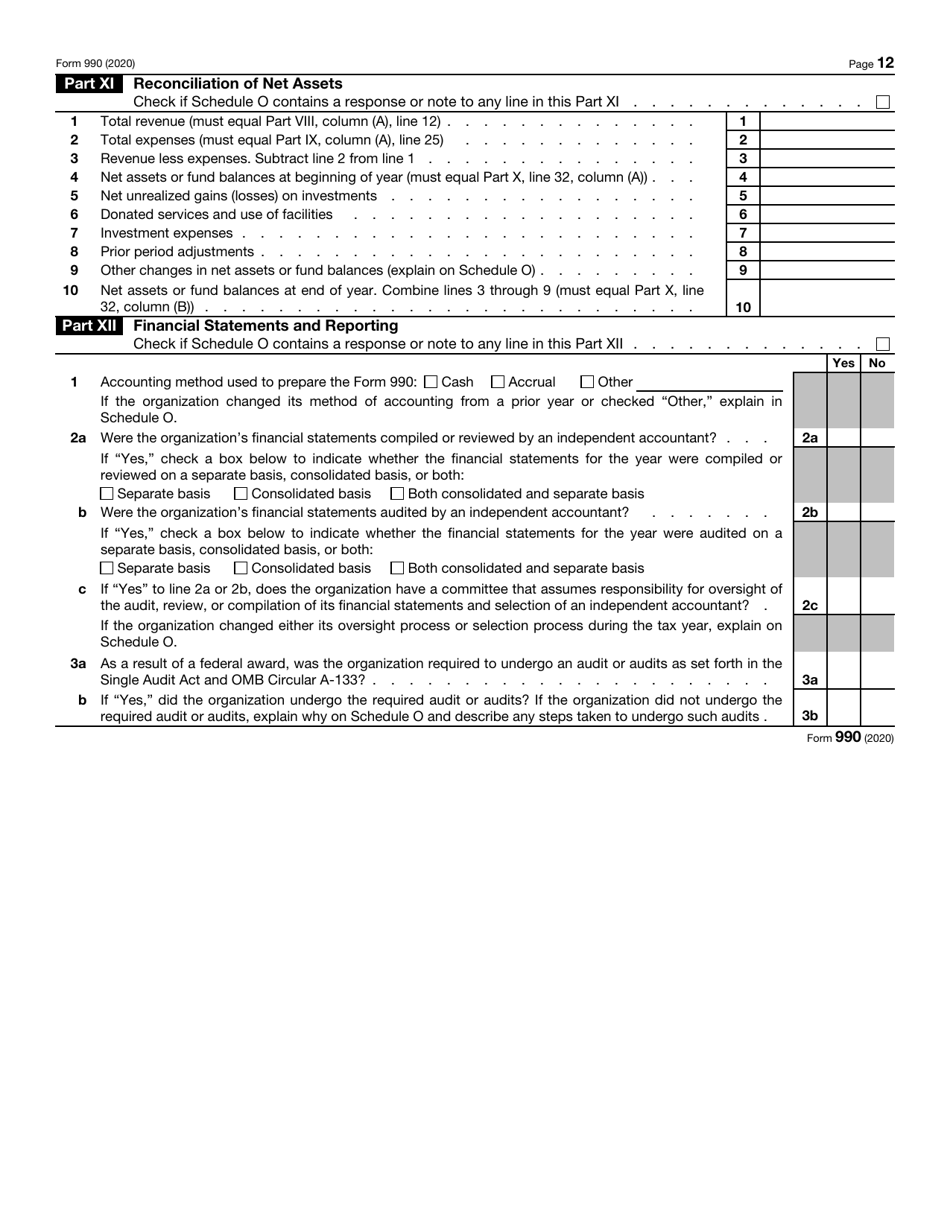

IRS Form 990 Return of Organization Exempt From Income Tax

What Is IRS Form 990?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990?

A: IRS Form 990 is a tax form used by tax-exempt organizations to provide information about their activities, finances, and governance.

Q: Who needs to file IRS Form 990?

A: Most tax-exempt organizations, including charitable, religious, educational, and scientific organizations, need to file Form 990.

Q: When is IRS Form 990 due?

A: The due date for filing IRS Form 990 varies depending on the organization's fiscal year, but it is generally due by the 15th day of the 5th month after the end of the fiscal year.

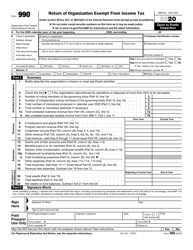

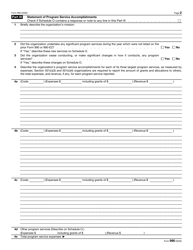

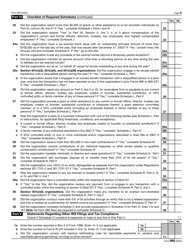

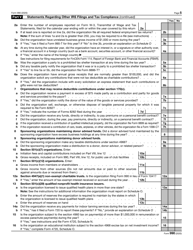

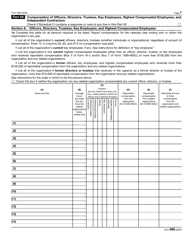

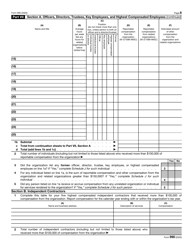

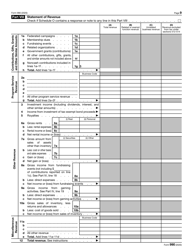

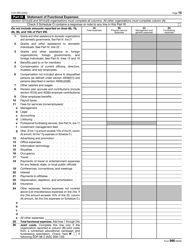

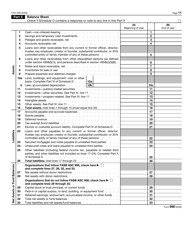

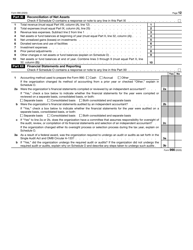

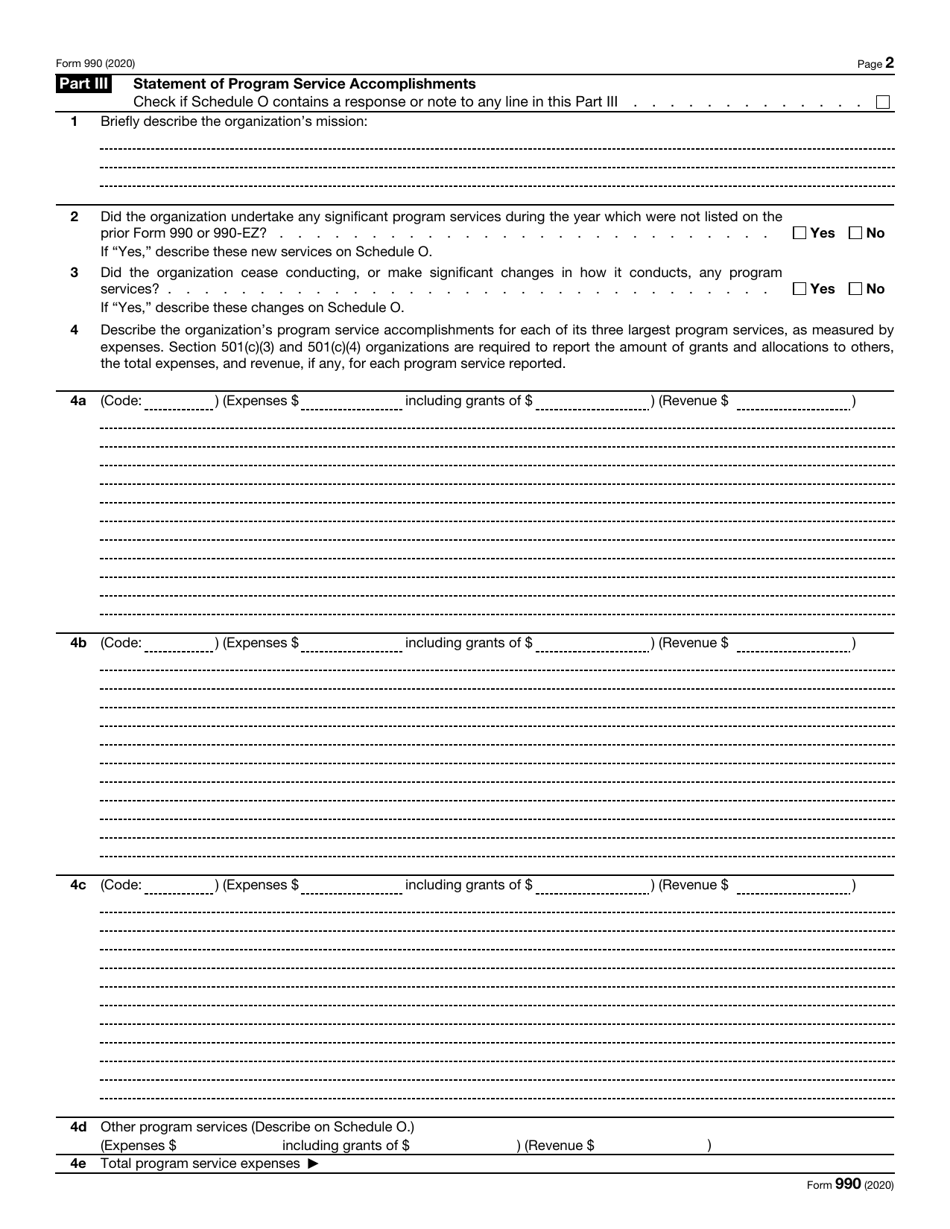

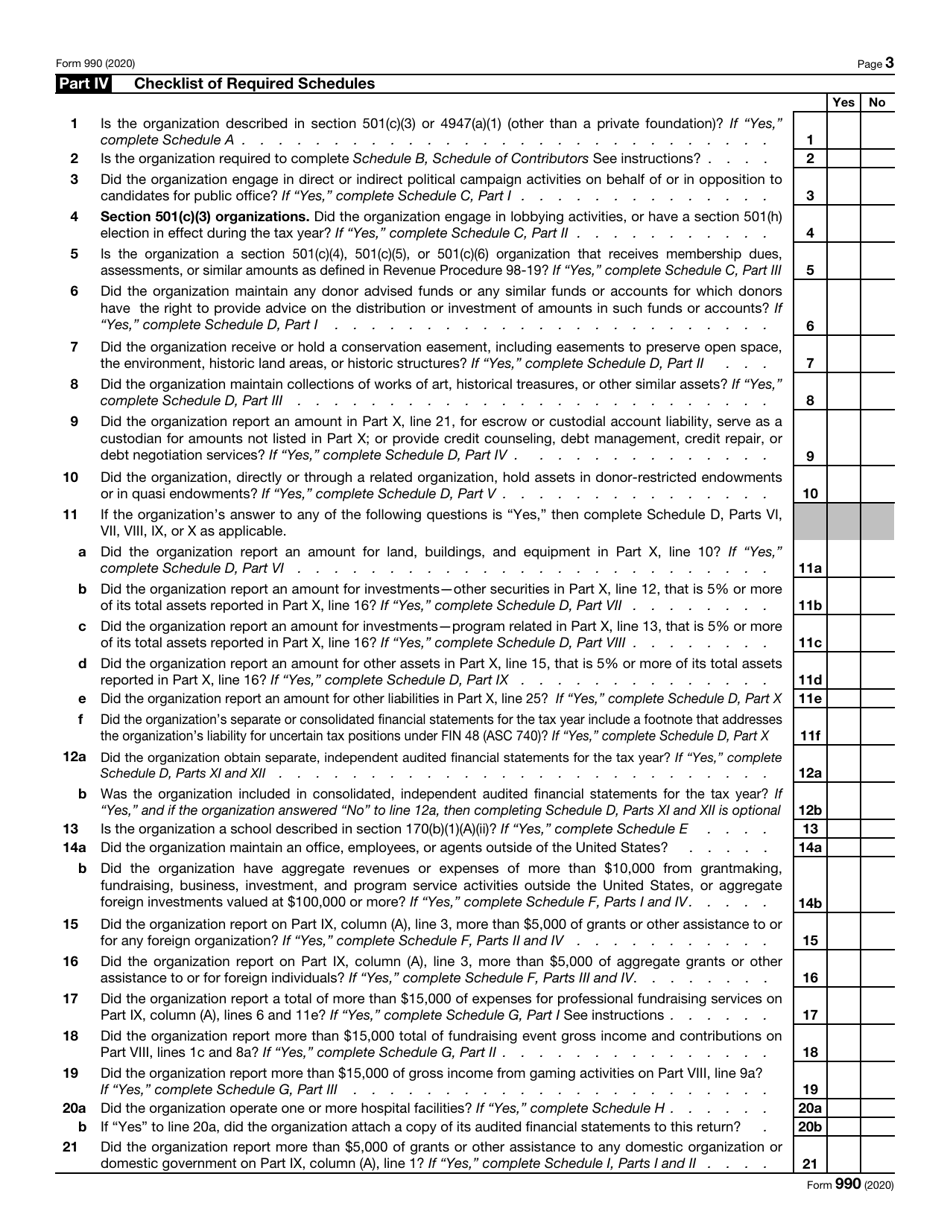

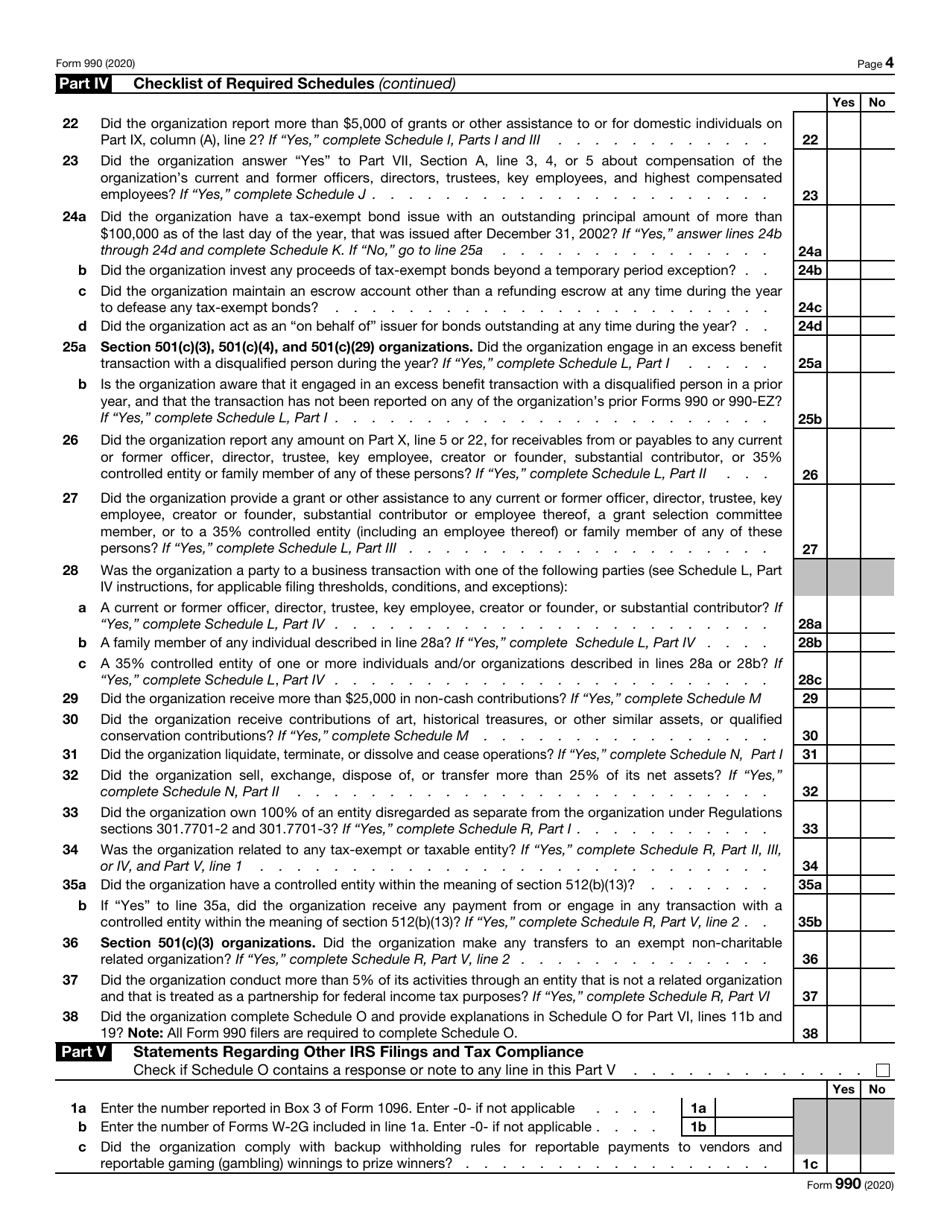

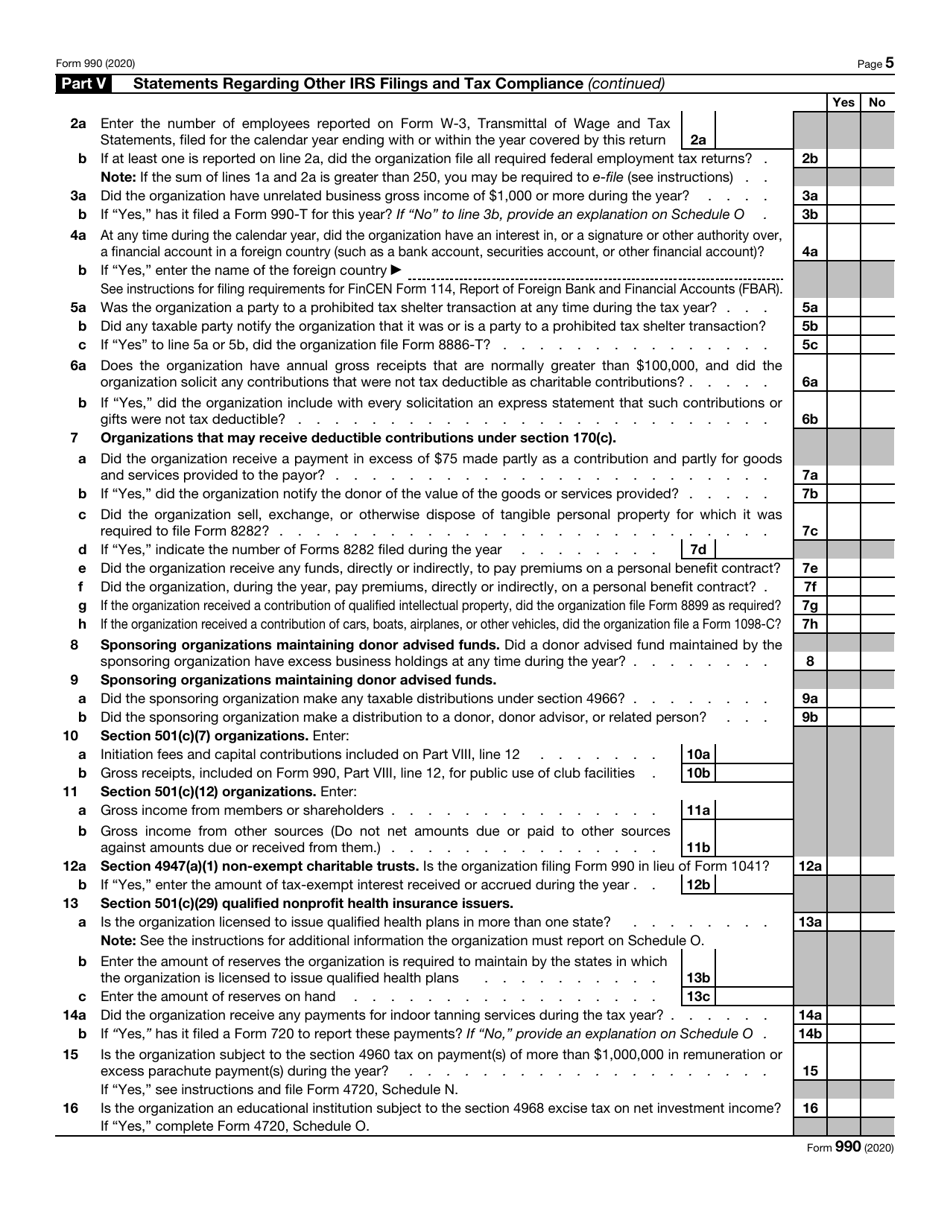

Q: What information does IRS Form 990 require?

A: IRS Form 990 requires organizations to provide information about their mission, programs, finances, executive compensation, and governance practices.

Q: Are there any penalties for not filing IRS Form 990?

A: Yes, failure to file IRS Form 990 or filing it late can result in penalties, including the loss of tax-exempt status for the organization.

Q: Is there a fee for filing IRS Form 990?

A: No, there is no fee for filing IRS Form 990. It is a free form provided by the IRS.

Q: Are there any exceptions to filing IRS Form 990?

A: Some small tax-exempt organizations may be eligible to file a simpler version of IRS Form 990 called Form 990-EZ or Form 990-N (e-Postcard) depending on their annual gross receipts.

Form Details:

- A 12-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 through the link below or browse more documents in our library of IRS Forms.