This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule D

for the current year.

Instructions for IRS Form 990 Schedule D Supplemental Financial Statements

This document contains official instructions for IRS Form 990 Schedule D, Supplemental Financial Statements - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule D?

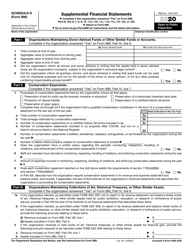

A: IRS Form 990 Schedule D is a supplemental form used to provide additional financial information for organizations filing Form 990 or 990-EZ.

Q: Who is required to file IRS Form 990 Schedule D?

A: Tax-exempt organizations that have financial statements with more than $250,000 in assets or $100,000 in gross receipts are generally required to file Form 990 Schedule D.

Q: What information is required on IRS Form 990 Schedule D?

A: IRS Form 990 Schedule D requires organizations to report their assets, liabilities, revenues, expenses, and other financial information in order to provide a comprehensive financial picture.

Q: When is the deadline to file IRS Form 990 Schedule D?

A: The deadline to file IRS Form 990 Schedule D is the same as the deadline for filing Form 990 or 990-EZ, which is the 15th day of the 5th month after the end of the organization's fiscal year.

Q: Are there any penalties for late filing of IRS Form 990 Schedule D?

A: Yes, there are penalties for late filing of IRS Form 990 Schedule D. The penalty is $20 per day, with a maximum penalty of $10,000 or 5% of the organization's gross receipts, whichever is less.

Q: Can I file IRS Form 990 Schedule D electronically?

A: Yes, organizations can file IRS Form 990 Schedule D electronically using the IRS's Modernized e-File (MeF) system.

Q: Do all tax-exempt organizations need to file IRS Form 990 Schedule D?

A: No, not all tax-exempt organizations need to file IRS Form 990 Schedule D. The requirement to file this form depends on the organization's financial statements and the thresholds mentioned earlier.

Q: Is there a fee for filing IRS Form 990 Schedule D?

A: No, there is no fee for filing IRS Form 990 Schedule D. It is provided by the IRS as a required form for tax-exempt organizations to report their financial information.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.