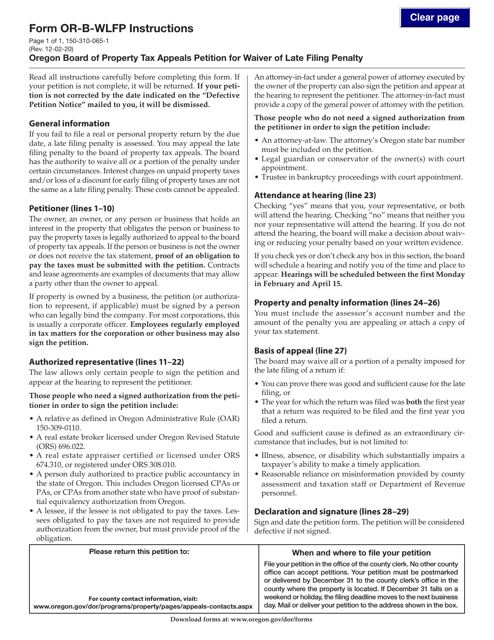

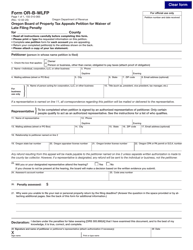

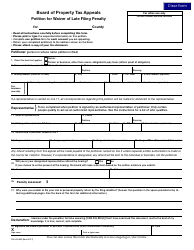

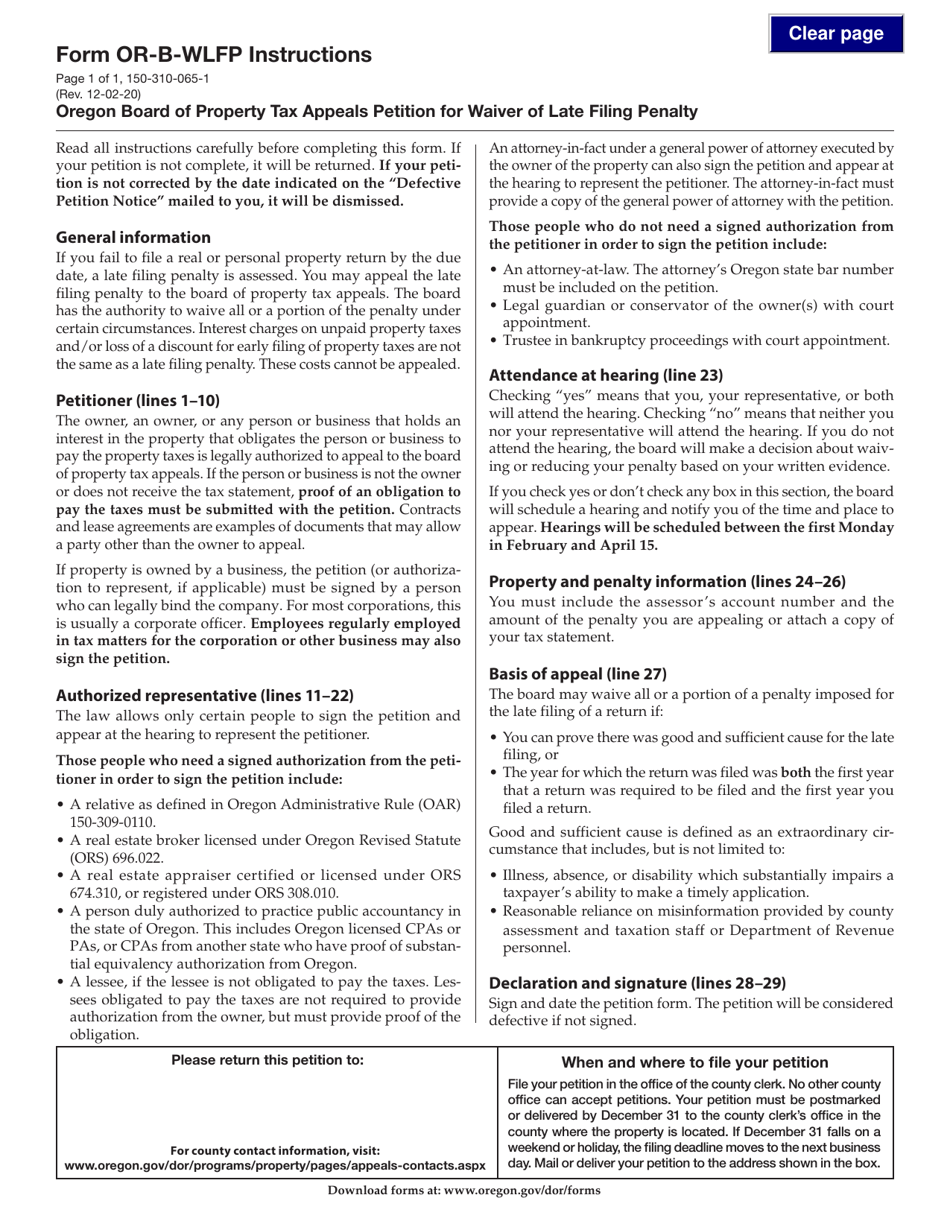

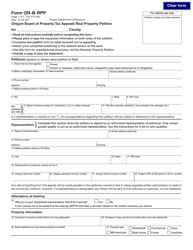

Instructions for Form OR-B-WLFP, 150-310-065 Oregon Board of Property Tax Appeals Petition for Waiver of Late Filing Penalty - Oregon

This document contains official instructions for Form OR-B-WLFP , and Form 150-310-065 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-B-WLFP (150-310-065) is available for download through this link. The latest available Form 150-310-065 can be downloaded through this link.

FAQ

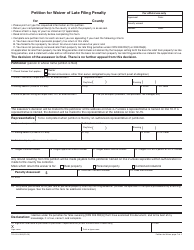

Q: What is Form OR-B-WLFP?

A: Form OR-B-WLFP is the Oregon Board of Property Tax Appeals Petition for Waiver of Late Filing Penalty.

Q: What is the purpose of Form OR-B-WLFP?

A: The purpose of Form OR-B-WLFP is to request a waiver of the late filing penalty for property tax appeals.

Q: Who is required to file Form OR-B-WLFP?

A: Any individual or entity who wants to request a waiver of the late filing penalty for property tax appeals in Oregon must file Form OR-B-WLFP.

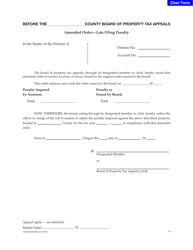

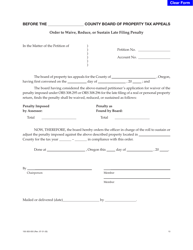

Q: Is there a deadline for filing Form OR-B-WLFP?

A: Yes, Form OR-B-WLFP must be filed within 30 days of the mailing date of the order assessing the late filing penalty.

Q: What information is required on Form OR-B-WLFP?

A: Form OR-B-WLFP requires the petitioner's contact information, property tax account number, reason for requesting a waiver, and supporting documentation.

Q: How long does it take to process Form OR-B-WLFP?

A: The processing time for Form OR-B-WLFP may vary, but the petitioner will be notified of the decision within a reasonable timeframe.

Q: What happens after submitting Form OR-B-WLFP?

A: After submitting Form OR-B-WLFP, the Oregon Board of Property Tax Appeals will review the petition and supporting documentation to determine whether to grant the waiver.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.