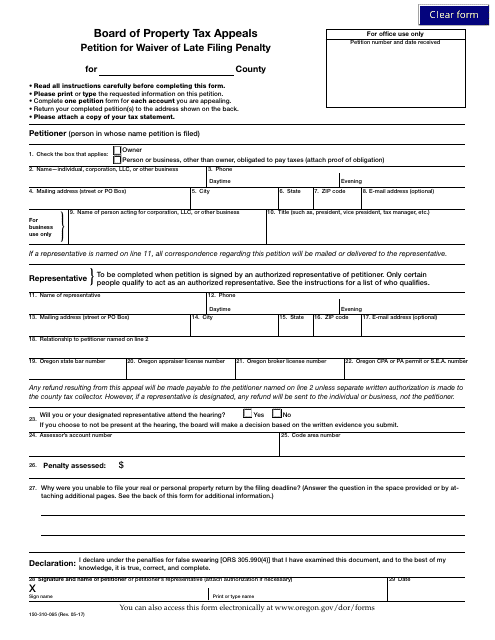

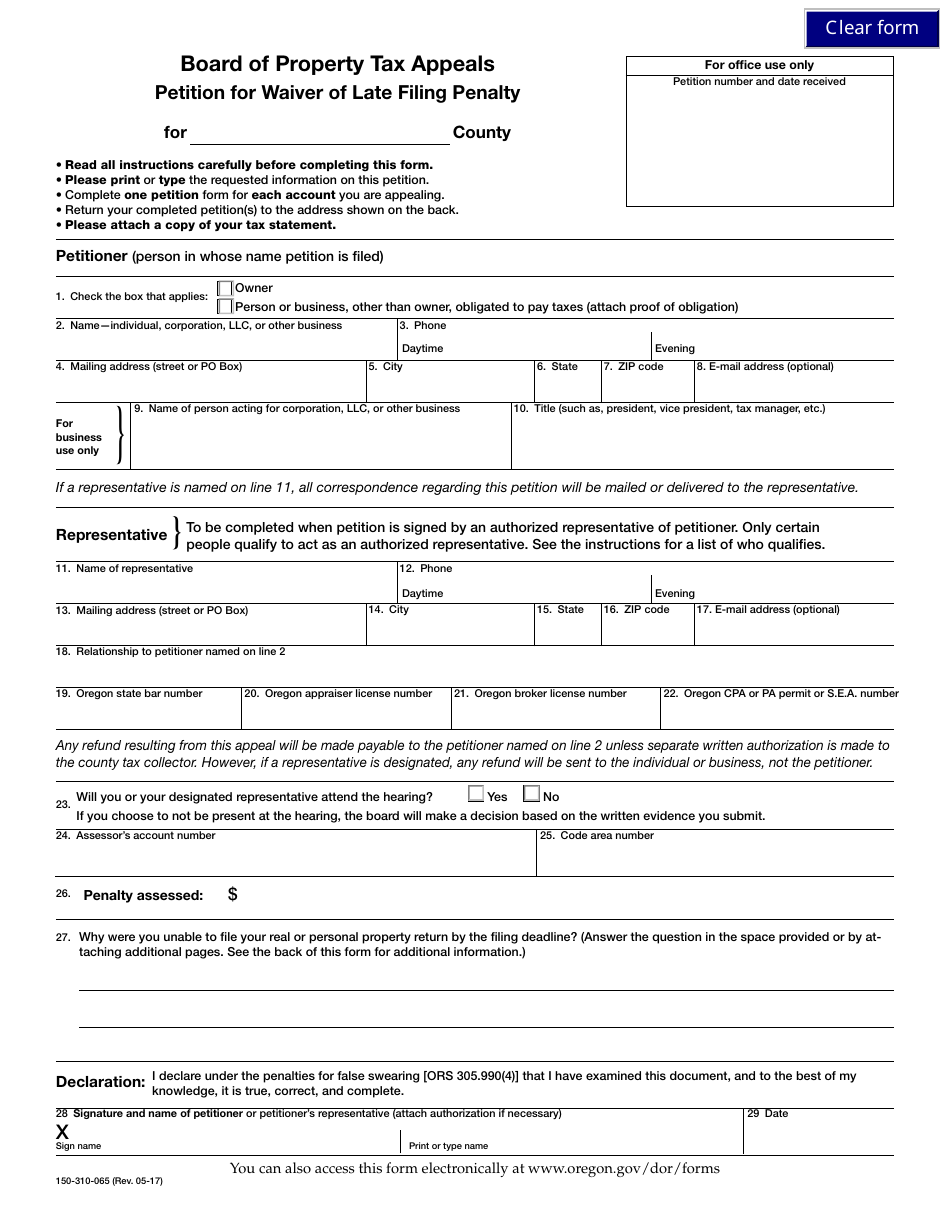

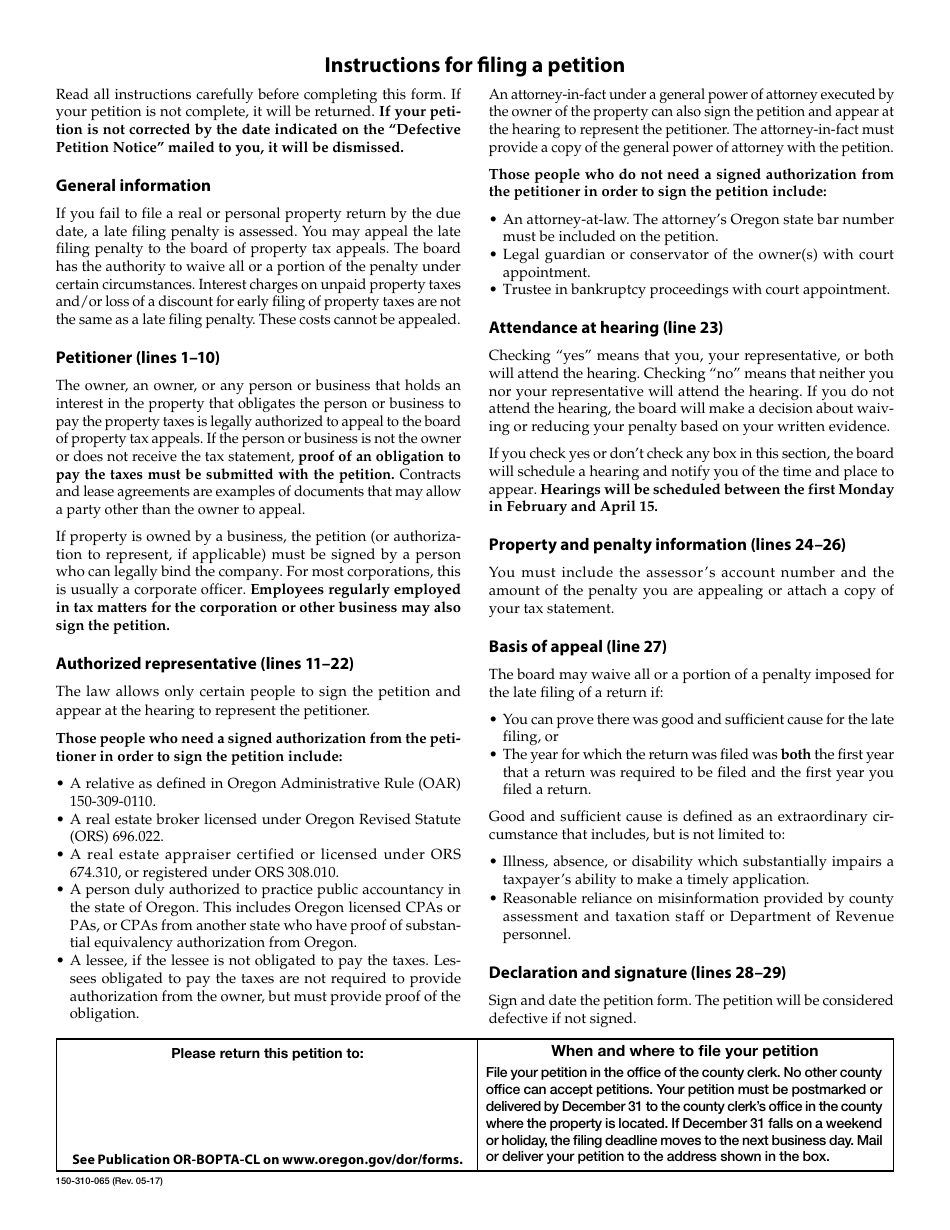

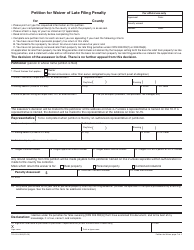

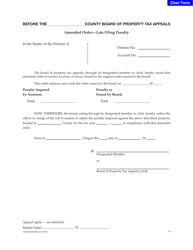

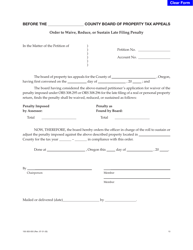

Form 150-310-065 Petition for Waiver of Late Filing Penalty - Oregon

What Is Form 150-310-065?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-310-065?

A: Form 150-310-065 is the Petition for Waiver of Late Filing Penalty in Oregon.

Q: What is the purpose of Form 150-310-065?

A: The purpose of Form 150-310-065 is to request a waiver of the late filing penalty for certain tax returns in Oregon.

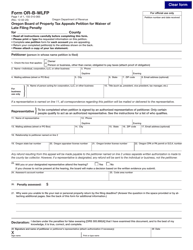

Q: Who can use Form 150-310-065?

A: Individuals and businesses who are subject to a late filing penalty in Oregon can use Form 150-310-065 to request a waiver.

Q: What information is required on Form 150-310-065?

A: Form 150-310-065 requires information such as the taxpayer's name, address, tax year, and explanation for the late filing.

Q: Is there a fee for submitting Form 150-310-065?

A: No, there is no fee for submitting Form 150-310-065.

Q: What happens after submitting Form 150-310-065?

A: The Oregon Department of Revenue will review the petition and make a decision on whether to grant or deny the waiver request.

Q: Can I appeal if my waiver request is denied?

A: Yes, if your waiver request is denied, you have the option to appeal the decision within a certain timeframe.

Q: Is there a deadline for submitting Form 150-310-065?

A: Yes, Form 150-310-065 must be submitted within a specific timeframe from the date of the late filing penalty notice.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-310-065 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.