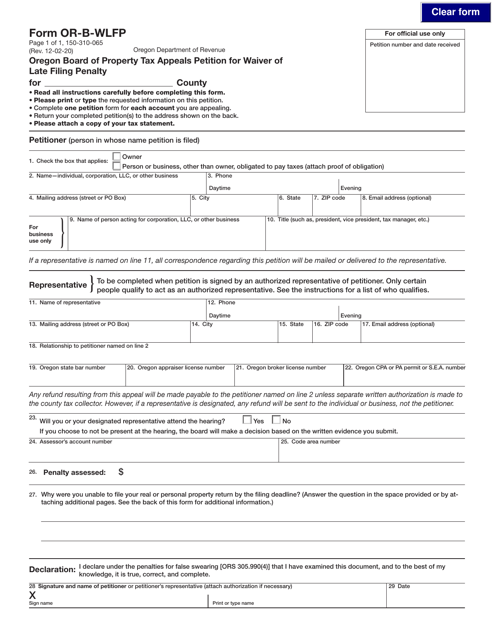

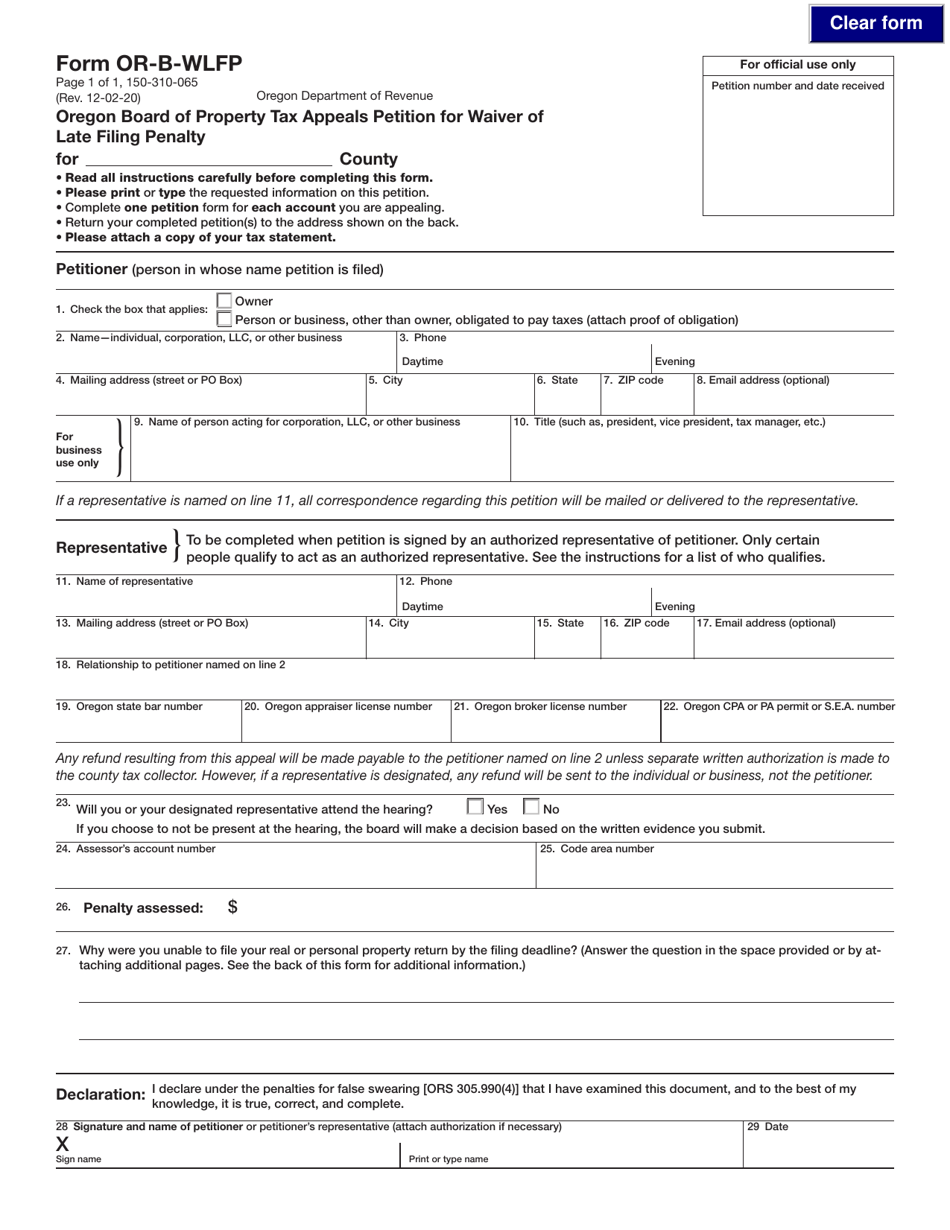

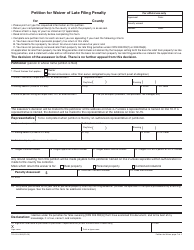

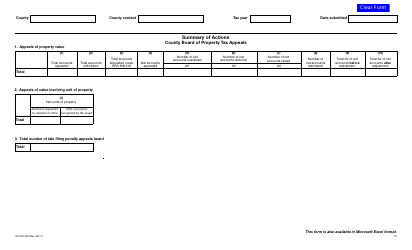

Form OR-B-WLFP (150-310-065) Oregon Board of Property Tax Appeals Petition for Waiver of Late Filing Penalty - Oregon

What Is Form OR-B-WLFP (150-310-065)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is OR-B-WLFP (150-310-065)?

A: OR-B-WLFP (150-310-065) is a form used to petition for a waiver of late filing penalty with the Oregon Board of Property Tax Appeals.

Q: What is the purpose of OR-B-WLFP (150-310-065)?

A: The purpose of OR-B-WLFP (150-310-065) is to request a waiver of the late filing penalty for property tax appeals in Oregon.

Q: How can OR-B-WLFP (150-310-065) be used?

A: OR-B-WLFP (150-310-065) can be used to request a waiver of the late filing penalty if you were unable to file your property tax appeal on time.

Q: Who should use OR-B-WLFP (150-310-065)?

A: OR-B-WLFP (150-310-065) should be used by individuals or entities who need to request a waiver of the late filing penalty for their property tax appeal in Oregon.

Q: What should I do if I need to request a waiver of the late filing penalty for my property tax appeal in Oregon?

A: You should fill out OR-B-WLFP (150-310-065) form and submit it to the Oregon Board of Property Tax Appeals.

Q: Is there a deadline for submitting OR-B-WLFP (150-310-065)?

A: Yes, there is a deadline for submitting OR-B-WLFP (150-310-065). It should be submitted within a certain period after the original deadline for filing your property tax appeal.

Q: What happens after I submit OR-B-WLFP (150-310-065)?

A: After you submit OR-B-WLFP (150-310-065), the Oregon Board of Property Tax Appeals will review your petition and decide whether to grant a waiver of the late filing penalty or not.

Form Details:

- Released on December 2, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-B-WLFP (150-310-065) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.