This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1120-S

for the current year.

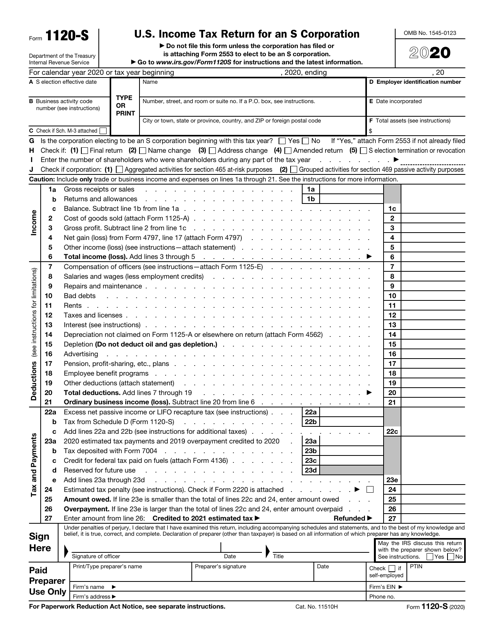

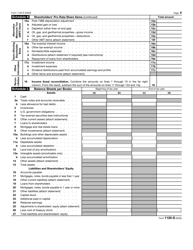

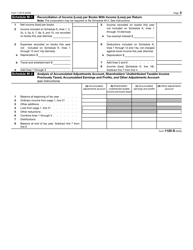

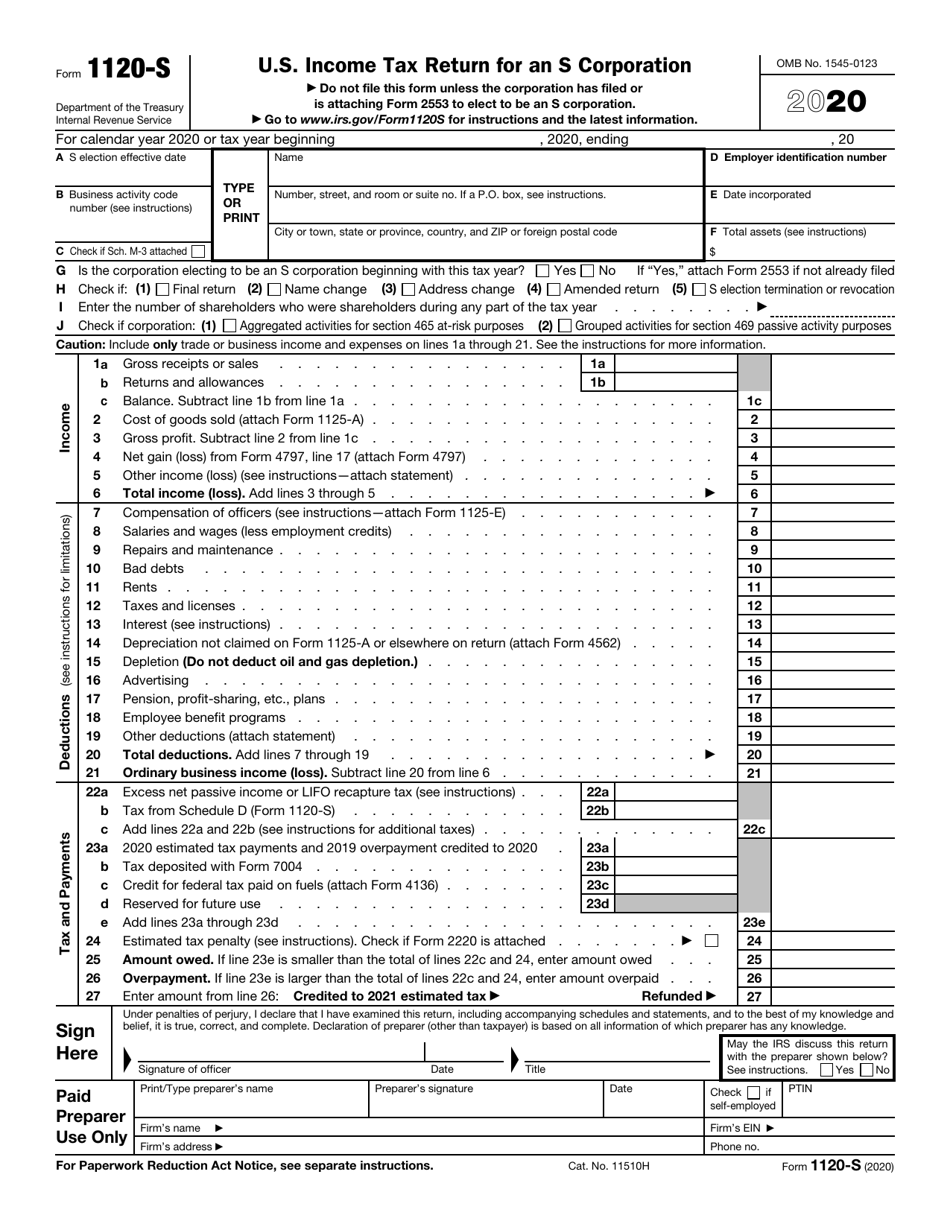

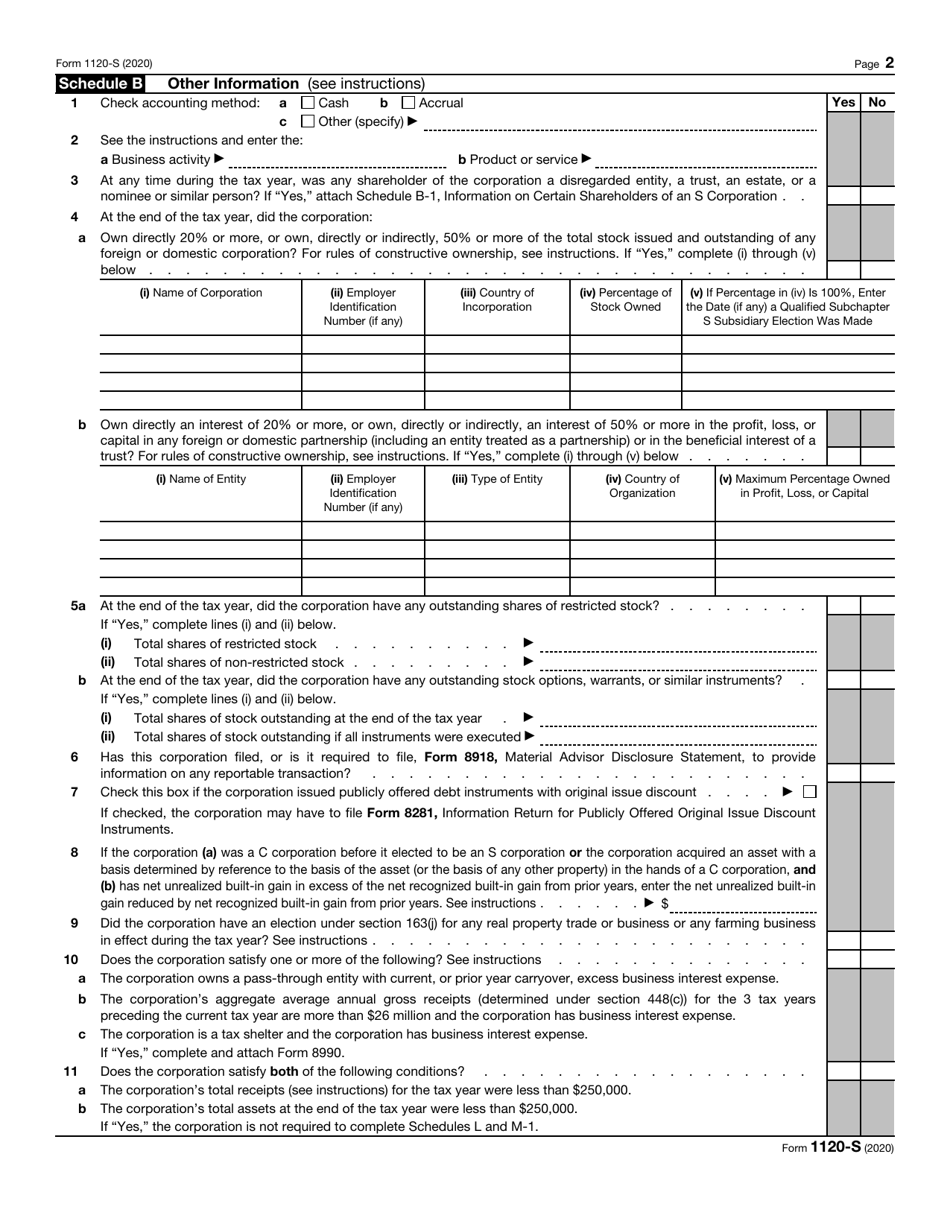

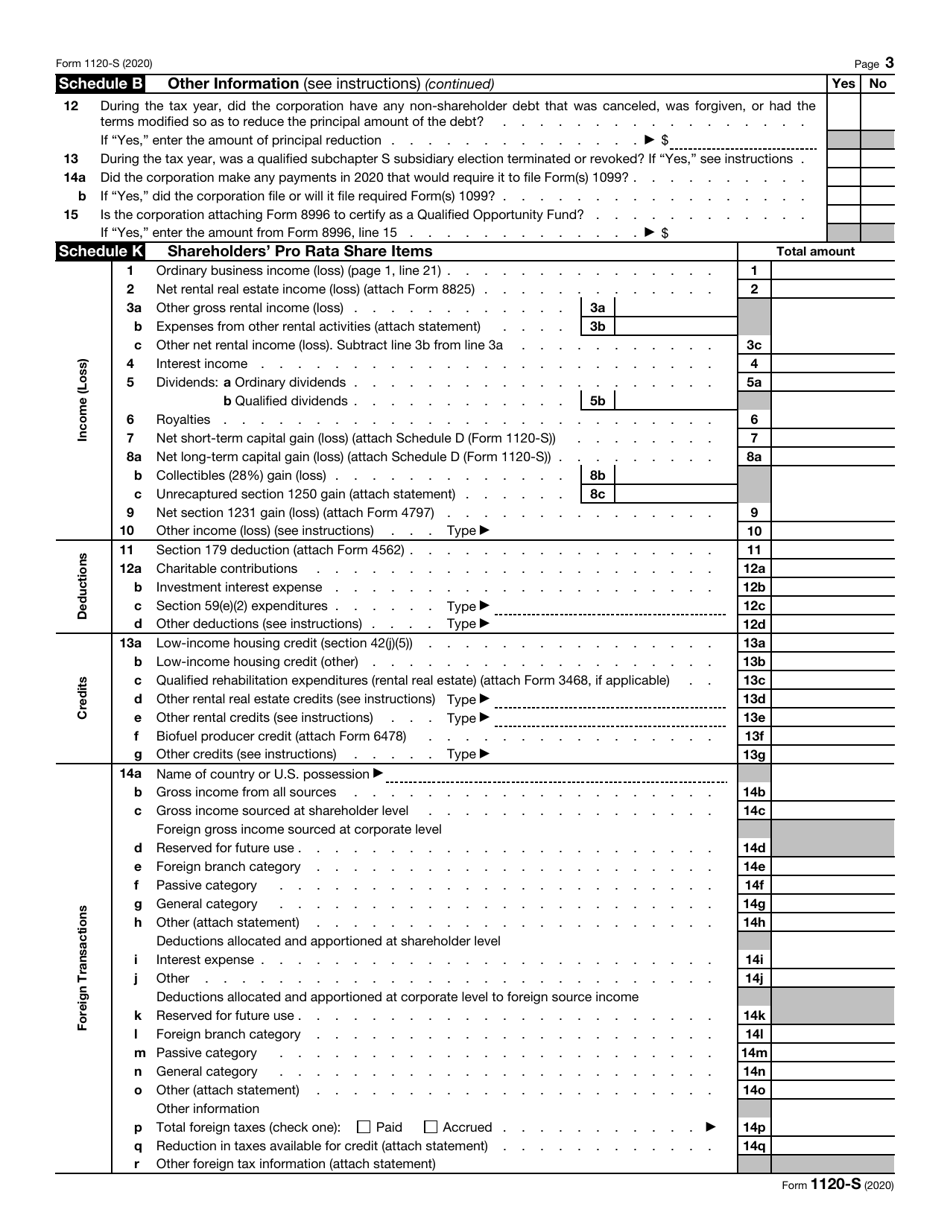

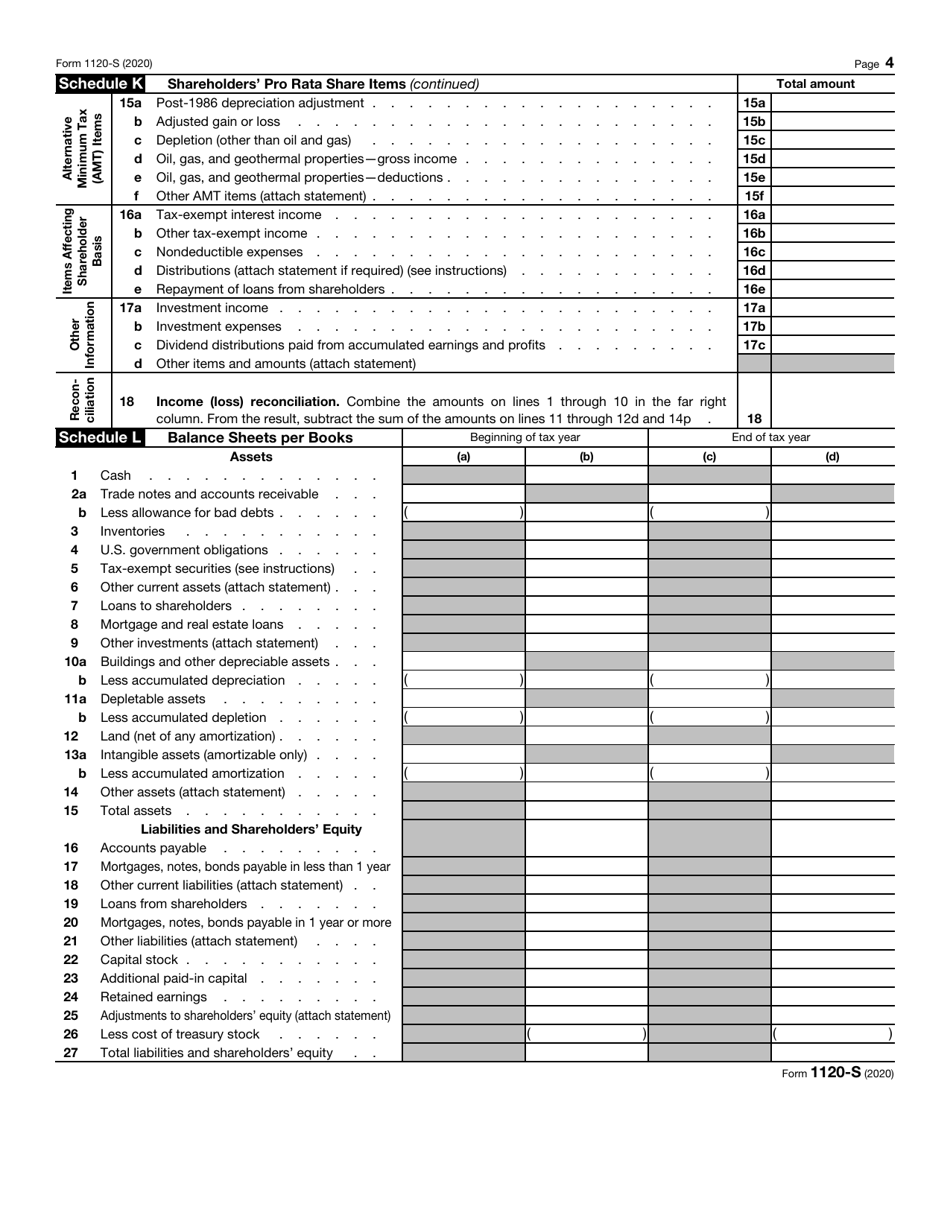

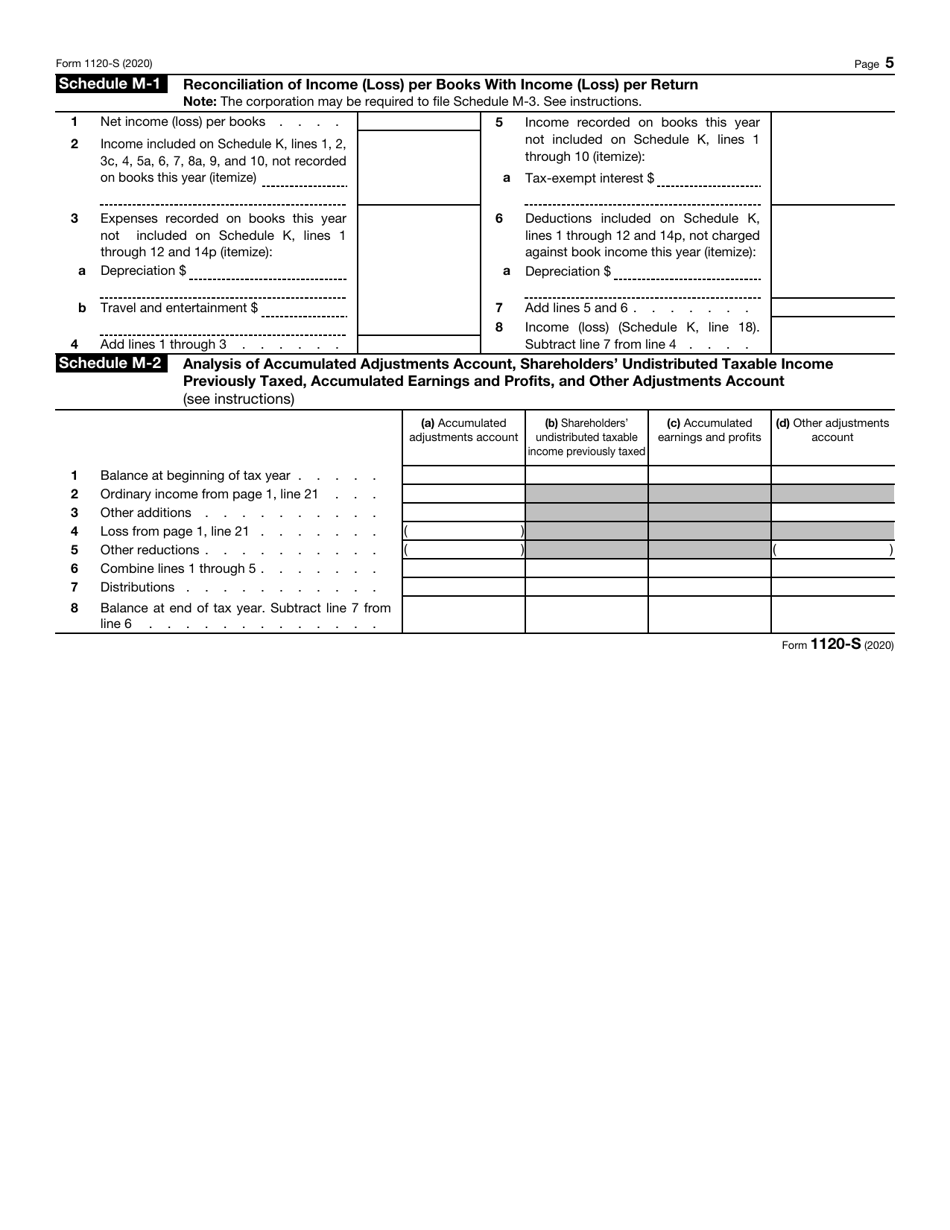

IRS Form 1120-S U.S. Income Tax Return for an S Corporation

What Is IRS Form 1120-S?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-S?

A: IRS Form 1120-S is the U.S. Income Tax Return for an S Corporation.

Q: Who needs to file IRS Form 1120-S?

A: S Corporations need to file IRS Form 1120-S.

Q: What information is required to complete IRS Form 1120-S?

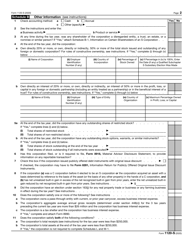

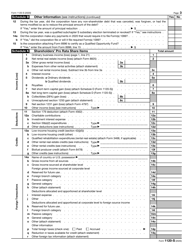

A: IRS Form 1120-S requires information about the S Corporation's income, deductions, credits, and other relevant details.

Q: When is IRS Form 1120-S due?

A: IRS Form 1120-S is generally due on the 15th day of the 3rd month after the end of the tax year (March 15th for calendar year taxpayers).

Q: Can IRS Form 1120-S be filed electronically?

A: Yes, IRS Form 1120-S can be filed electronically.

Q: Are there any penalties for late filing of IRS Form 1120-S?

A: Yes, there are penalties for late filing of IRS Form 1120-S. It's important to file on time to avoid these penalties.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-S through the link below or browse more documents in our library of IRS Forms.