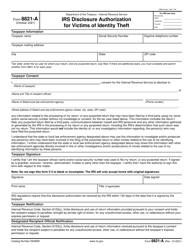

This version of the form is not currently in use and is provided for reference only. Download this version of

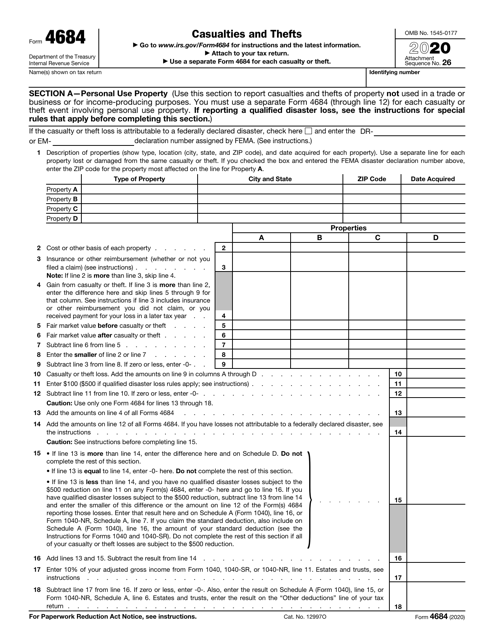

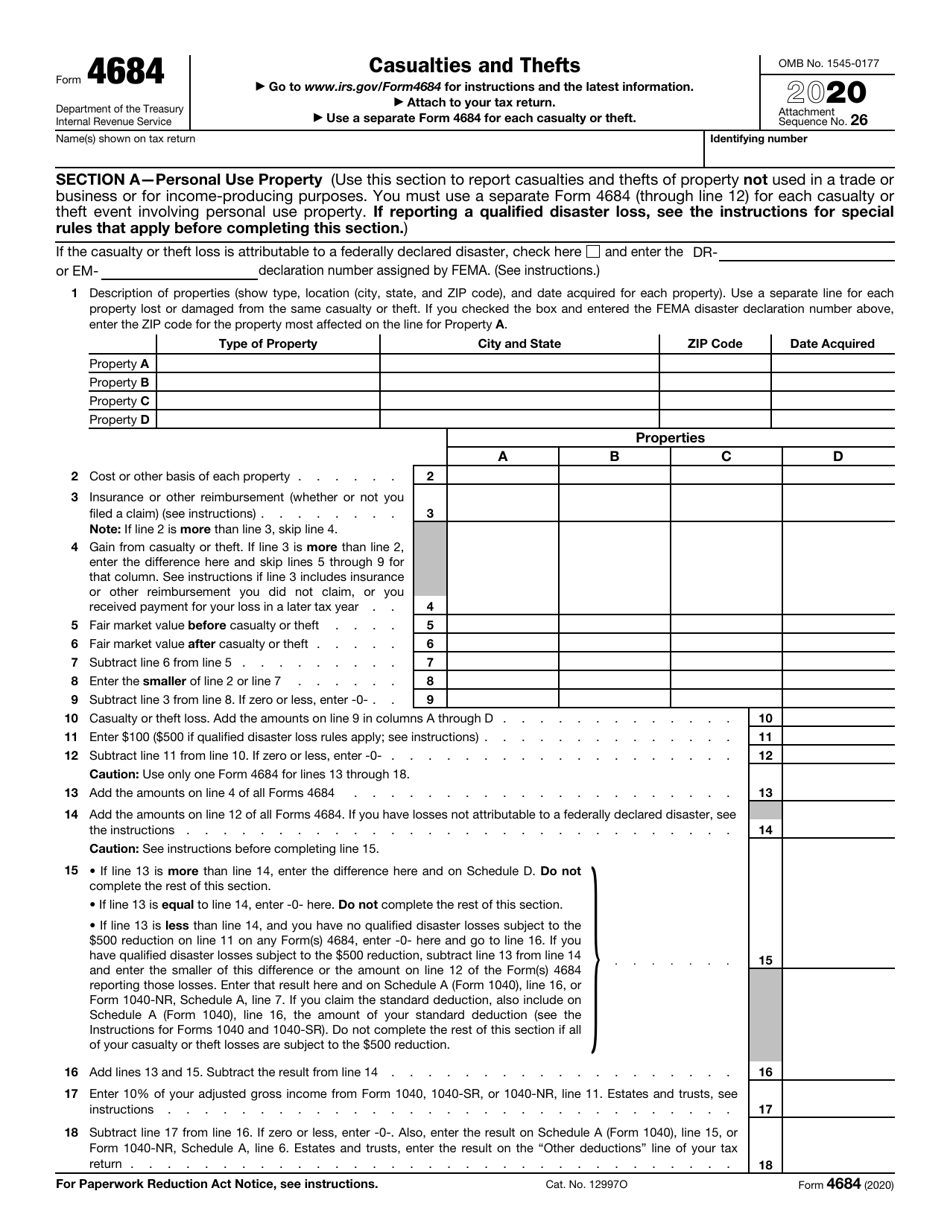

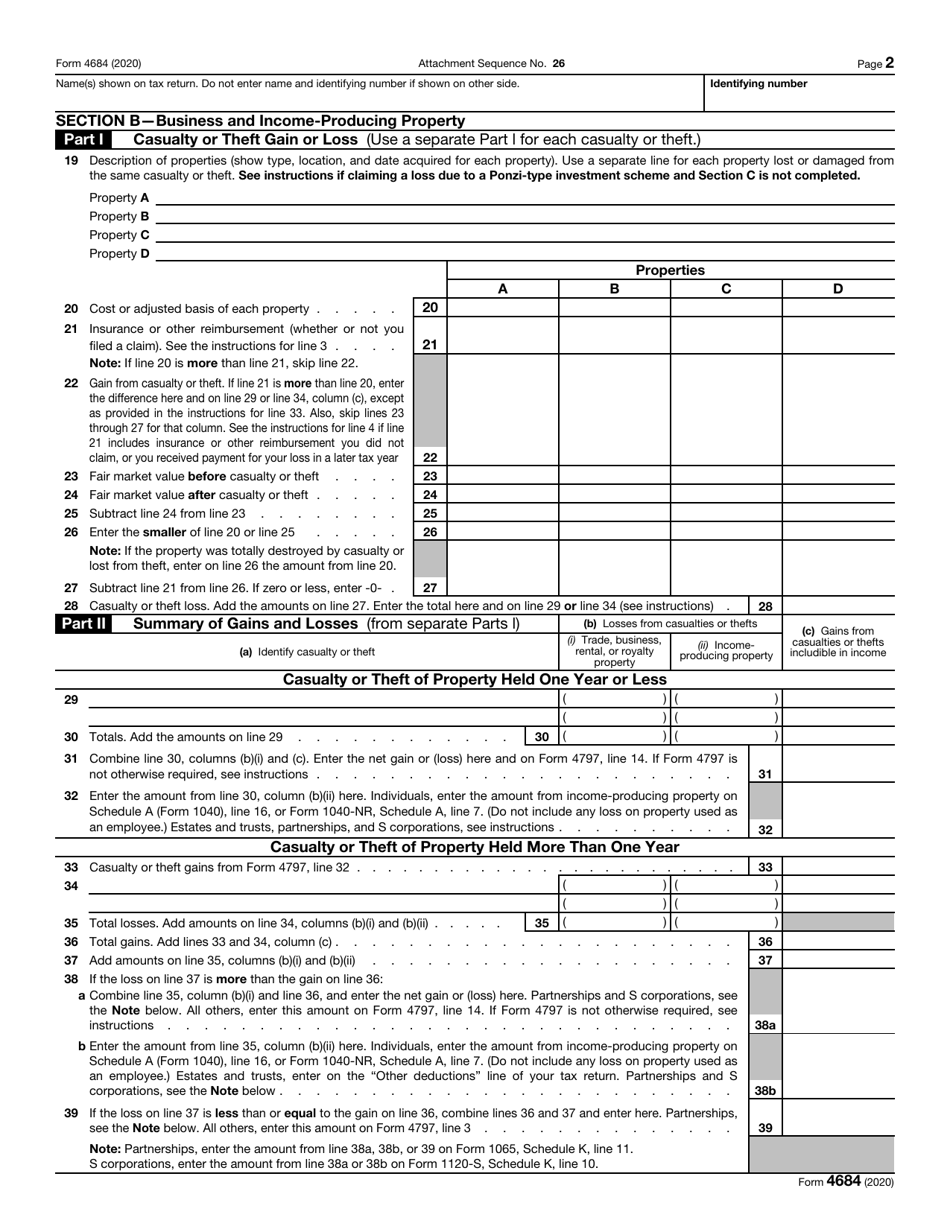

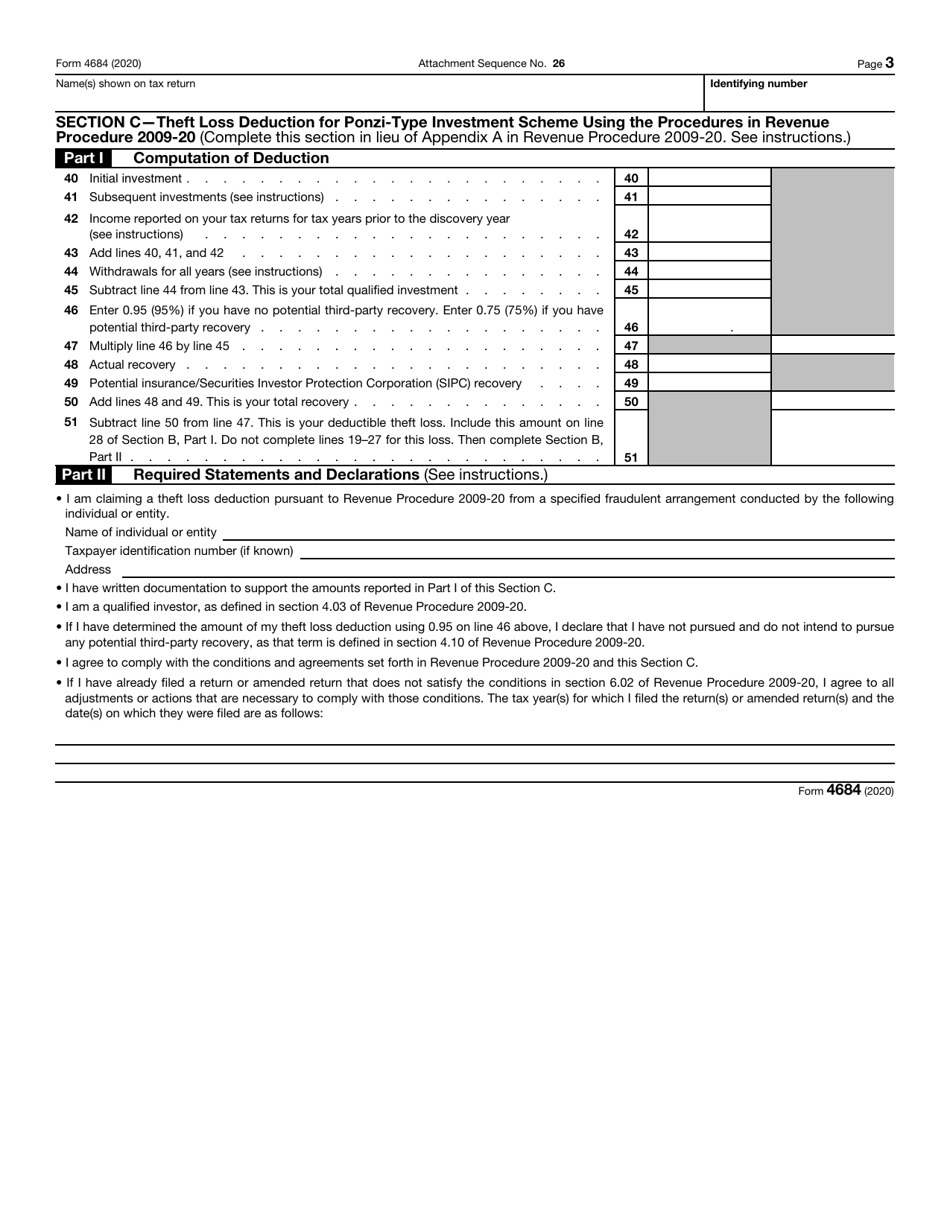

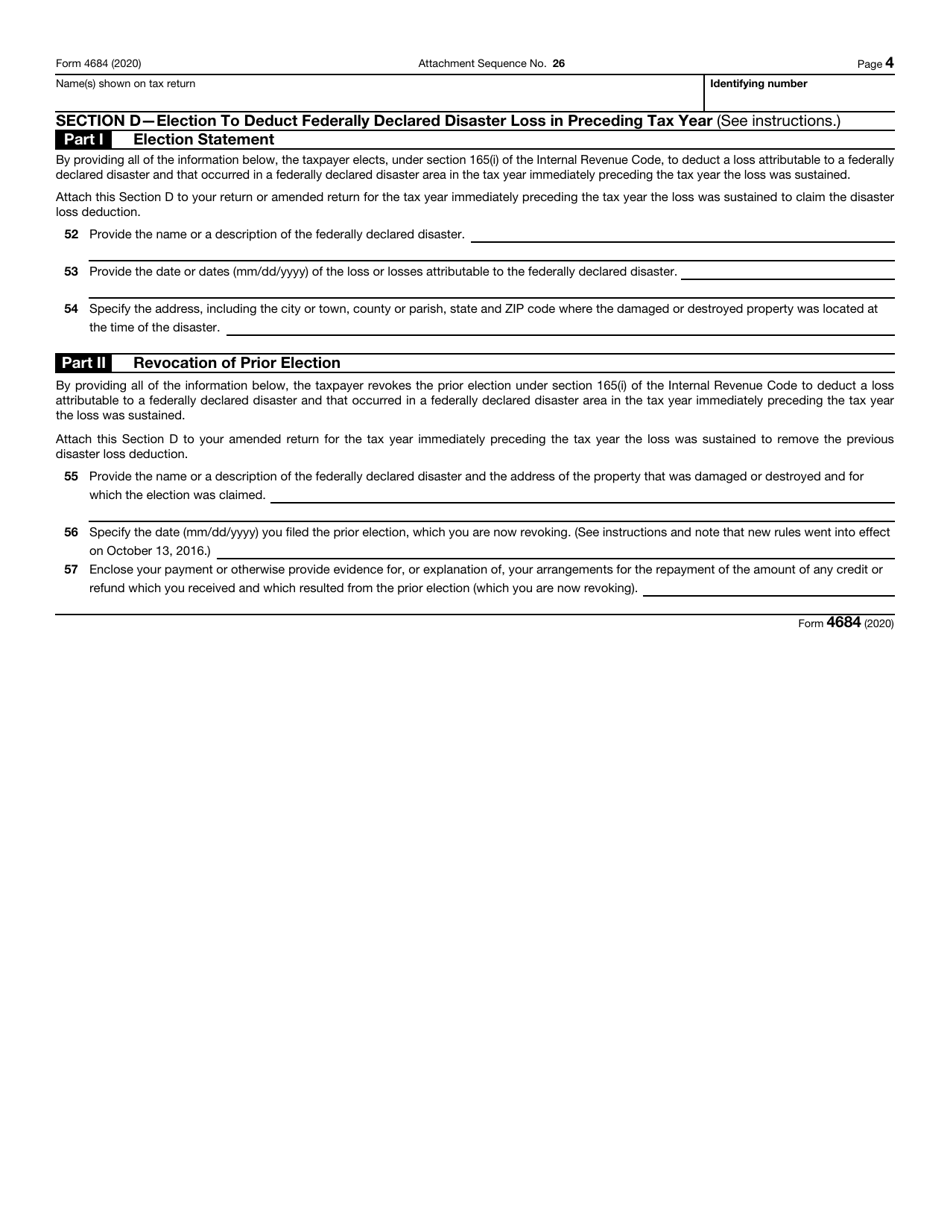

IRS Form 4684

for the current year.

IRS Form 4684 Casualties and Thefts

What Is IRS Form 4684?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

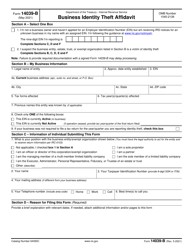

Q: What is IRS Form 4684?

A: IRS Form 4684 is used to report casualties and thefts for tax purposes.

Q: When should I use IRS Form 4684?

A: You should use IRS Form 4684 if you have experienced a casualty or theft and want to claim a tax deduction.

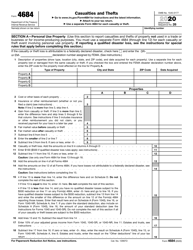

Q: What qualifies as a casualty for Form 4684?

A: A casualty is any sudden, unexpected, or unusual event, such as a natural disaster, fire, or car accident, that causes property damage.

Q: What qualifies as a theft for Form 4684?

A: A theft is the unlawful taking of property, such as burglary or embezzlement.

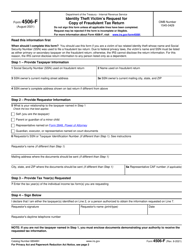

Q: What information do I need to complete IRS Form 4684?

A: You will need to provide details about the nature of the casualty or theft, the amount of the loss, and any insurance reimbursements you received.

Q: Can I claim a deduction for the full amount of the loss?

A: No, you can only claim a deduction for a portion of the loss that is not reimbursed by insurance or other sources.

Q: Is there a deadline for filing Form 4684?

A: Yes, Form 4684 should be filed with your tax return for the year in which the casualty or theft occurred.

Q: Do I need to include any supporting documentation with Form 4684?

A: You should keep any relevant documentation, such as police reports or insurance claim forms, in case of an audit, but you do not need to submit them with Form 4684.

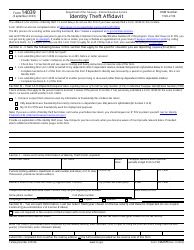

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4684 through the link below or browse more documents in our library of IRS Forms.