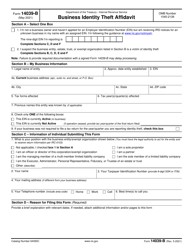

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 4684

for the current year.

Instructions for IRS Form 4684 Casualties and Thefts

This document contains official instructions for IRS Form 4684 , Casualties and Thefts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 4684 is available for download through this link.

FAQ

Q: What is IRS Form 4684?

A: IRS Form 4684 is a form used to report casualties and thefts for individuals, trusts, and estates.

Q: When should I use IRS Form 4684?

A: You should use IRS Form 4684 if you had a casualty or theft loss during the tax year.

Q: What is considered a casualty loss?

A: A casualty loss is a deductible loss that results from the damage, destruction, or loss of your property due to an identifiable event that is sudden, unexpected, or unusual. Examples include car accidents, fires, floods, and storms.

Q: What is considered a theft loss?

A: A theft loss is a deductible loss that results from the unlawful taking and removal of your money or property.

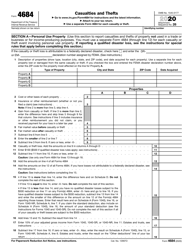

Q: How do I complete IRS Form 4684?

A: IRS Form 4684 has different sections to report various types of losses. You will need to provide information about the type of loss, the property involved, insurance reimbursements, and other details.

Q: Do I need to attach any supporting documentation with IRS Form 4684?

A: Generally, you do not need to attach any supporting documentation when filing your tax return. However, you should keep all relevant records and documents in case you are asked to provide them later.

Instruction Details:

- This 8-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.