This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 3520-A

for the current year.

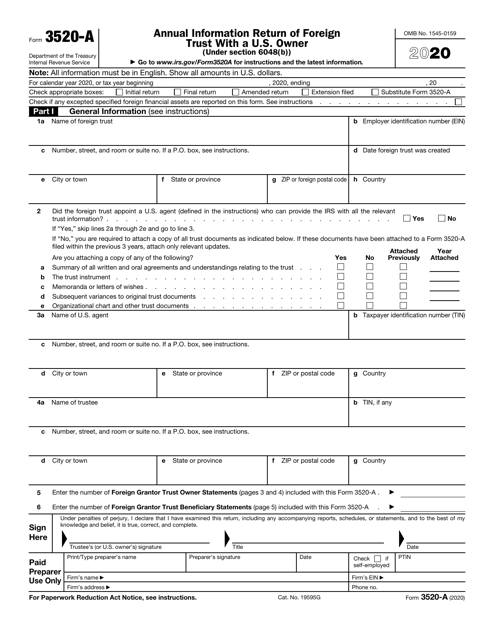

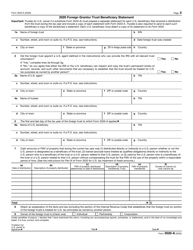

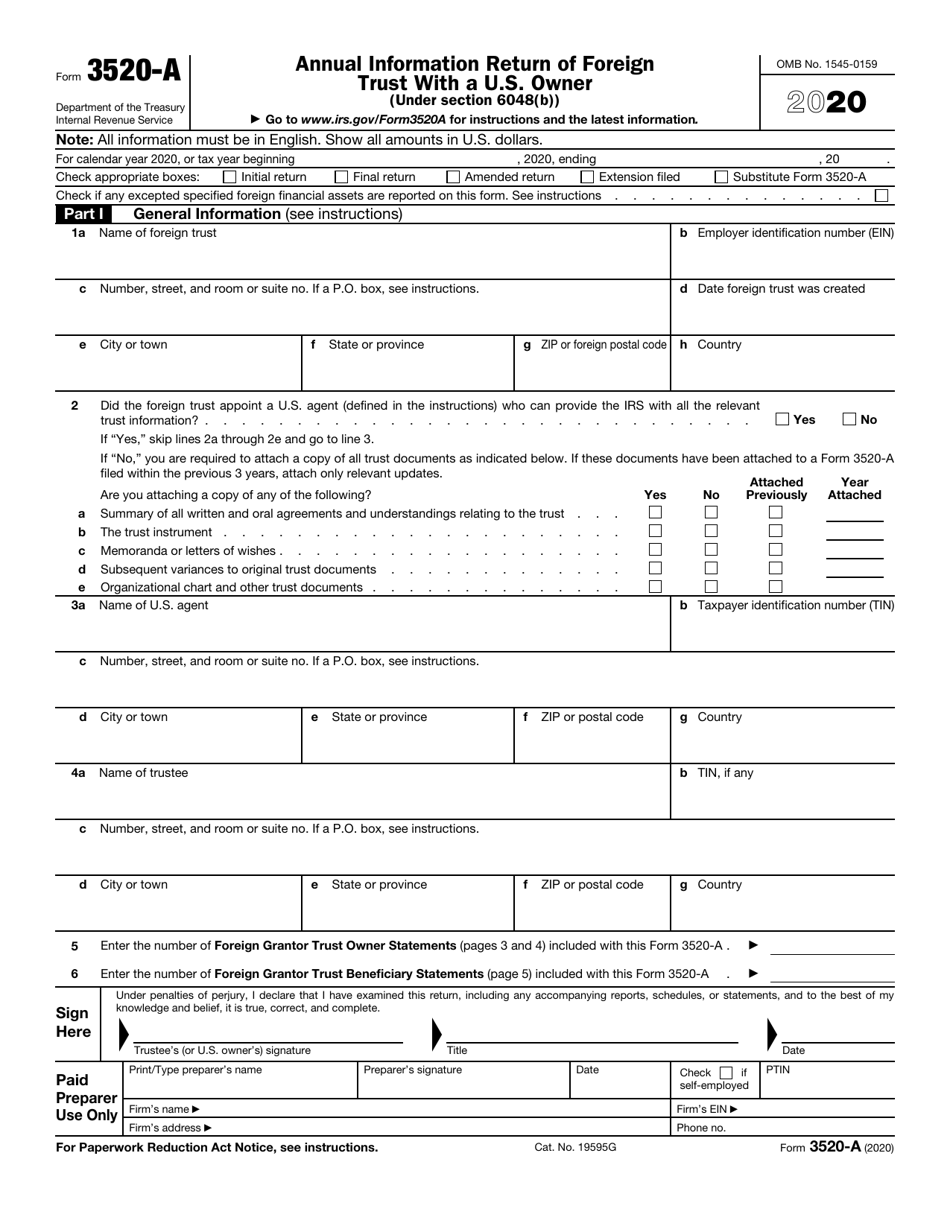

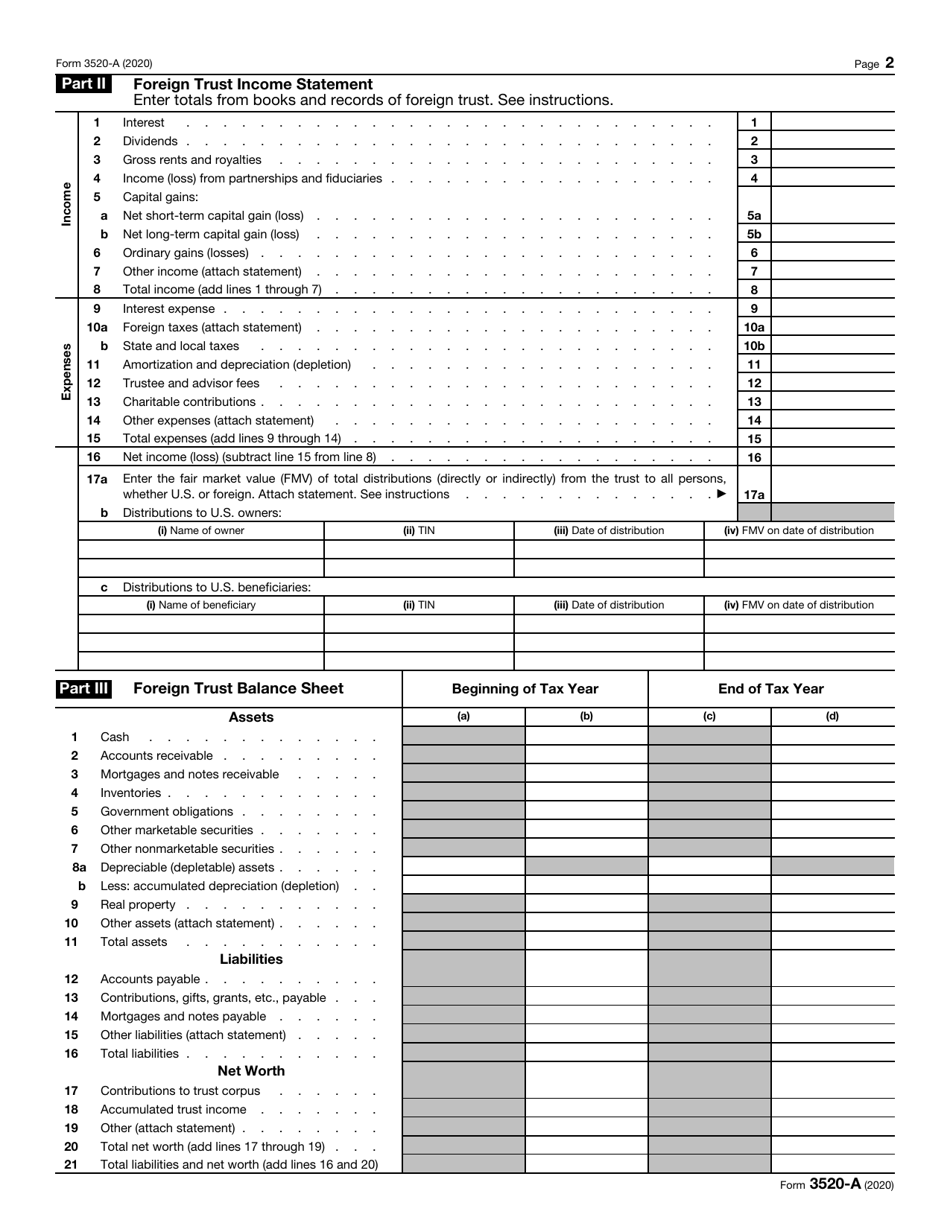

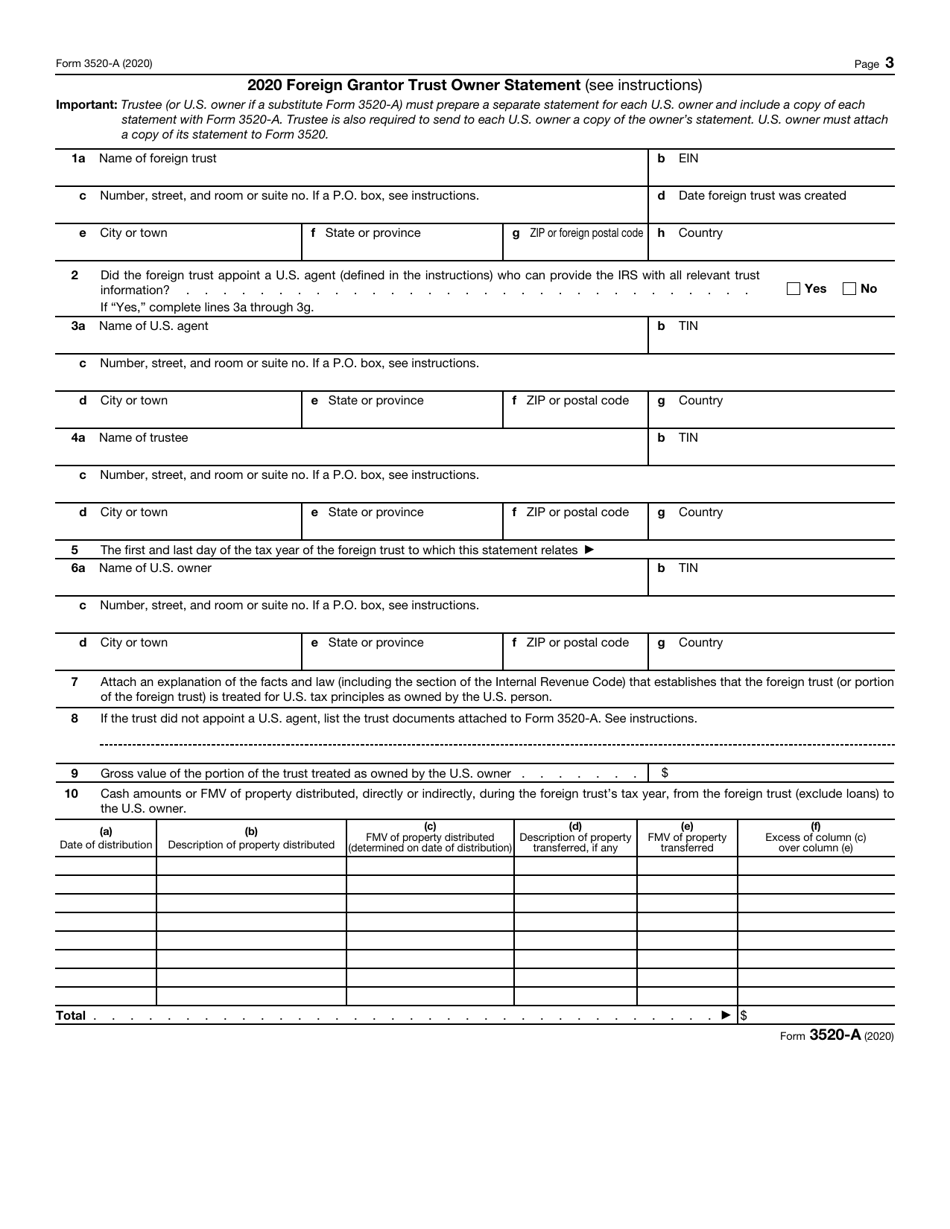

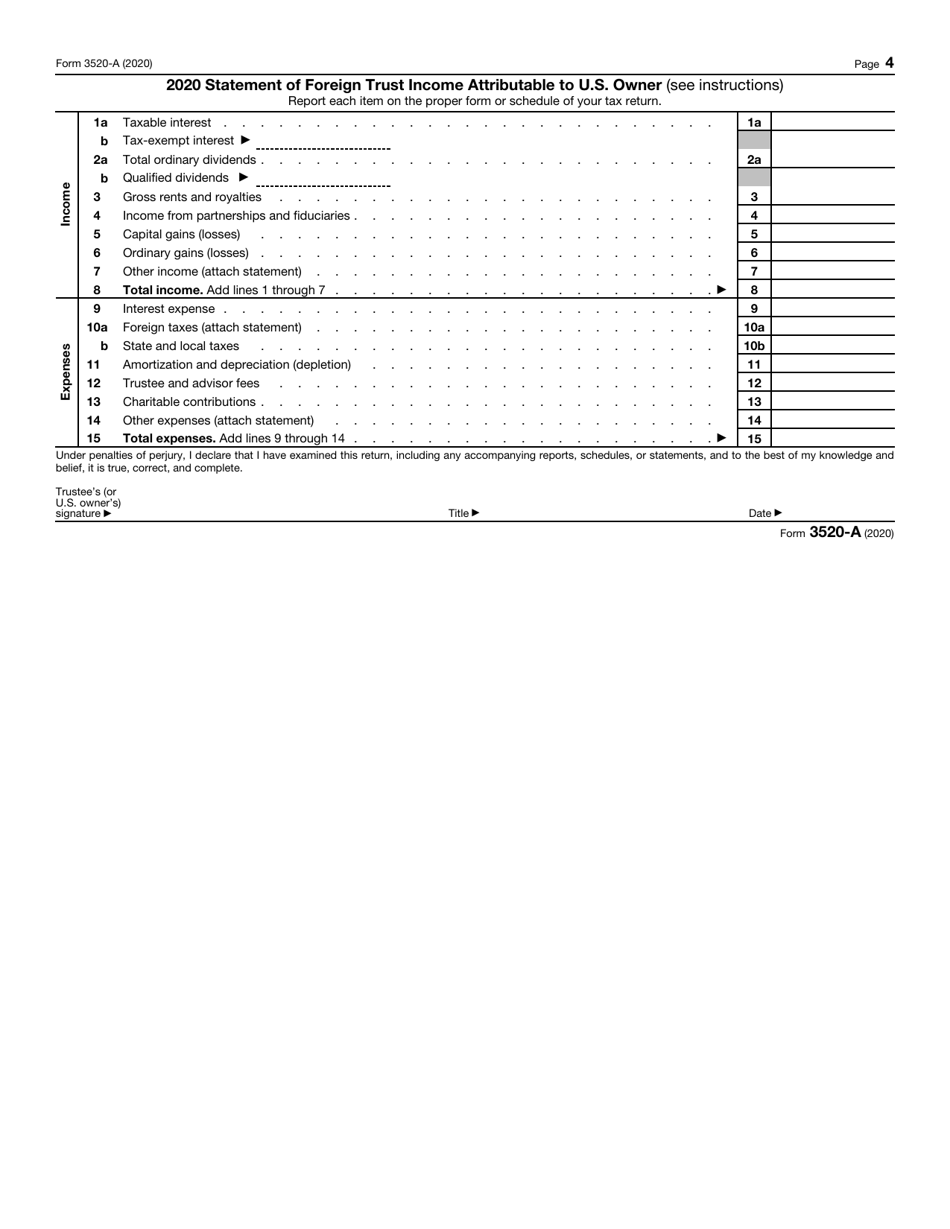

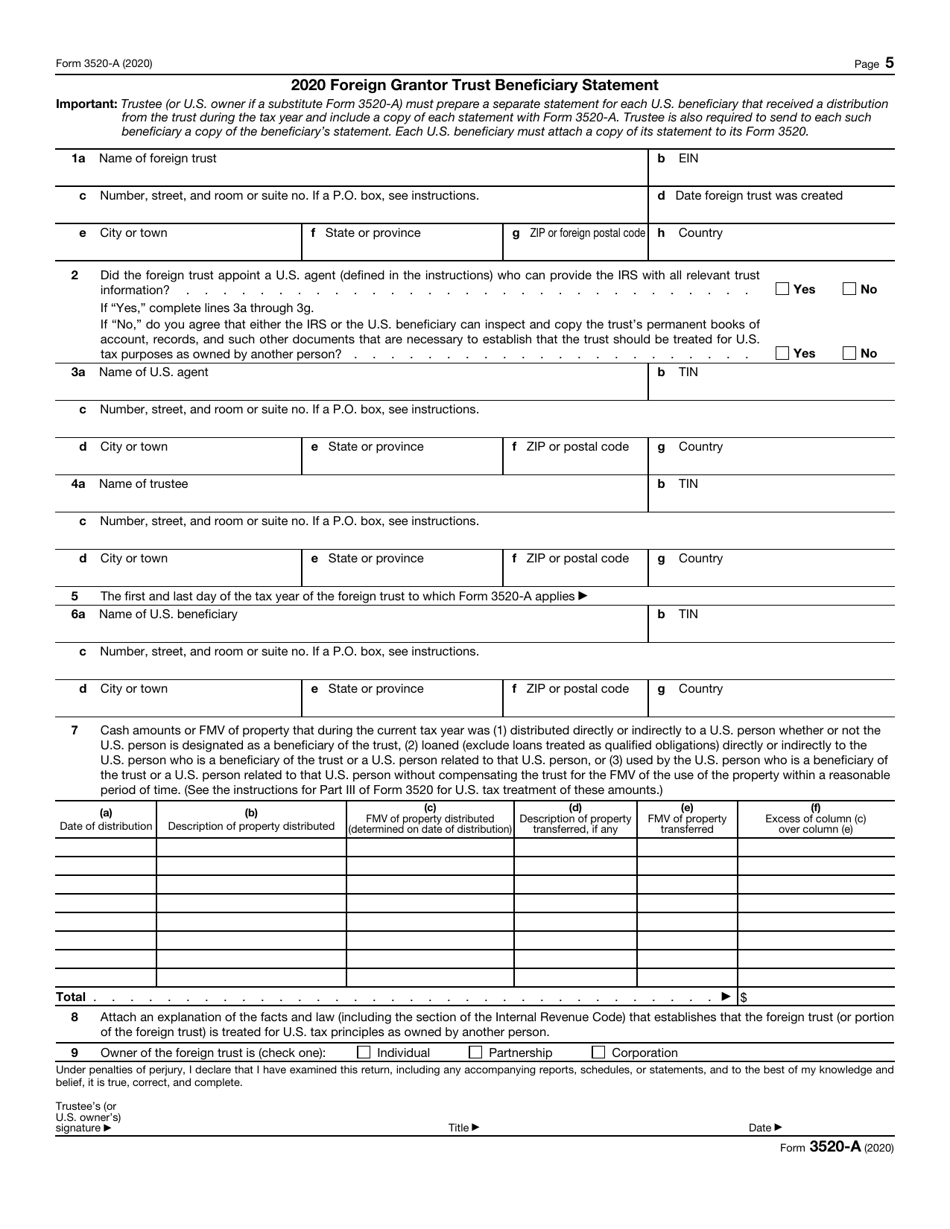

IRS Form 3520-A Annual Information Return of Foreign Trust With a U.S. Owner

What Is IRS Form 3520-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 3520-A?

A: IRS Form 3520-A is the Annual Information Return of Foreign Trust with a U.S. Owner.

Q: Who needs to file IRS Form 3520-A?

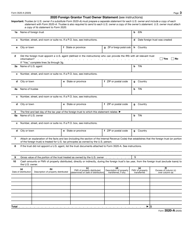

A: Anyone who is a U.S. person that is treated as the owner of a foreign trust needs to file IRS Form 3520-A.

Q: What is a foreign trust?

A: A foreign trust is a trust that is not considered a domestic trust under the U.S. tax laws.

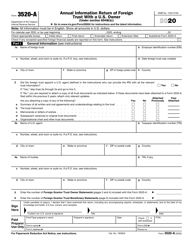

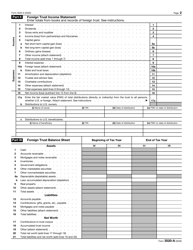

Q: What information is required on IRS Form 3520-A?

A: IRS Form 3520-A requires information about the foreign trust, its U.S. owner, and any distributions or withdrawals from the trust.

Q: When is the deadline for filing IRS Form 3520-A?

A: IRS Form 3520-A is due on the 15th day of the 3rd month following the end of the trust's tax year.

Q: What are the consequences of not filing IRS Form 3520-A?

A: Failure to file IRS Form 3520-A may result in penalties, including monetary fines.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 3520-A through the link below or browse more documents in our library of IRS Forms.