This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 3520-A

for the current year.

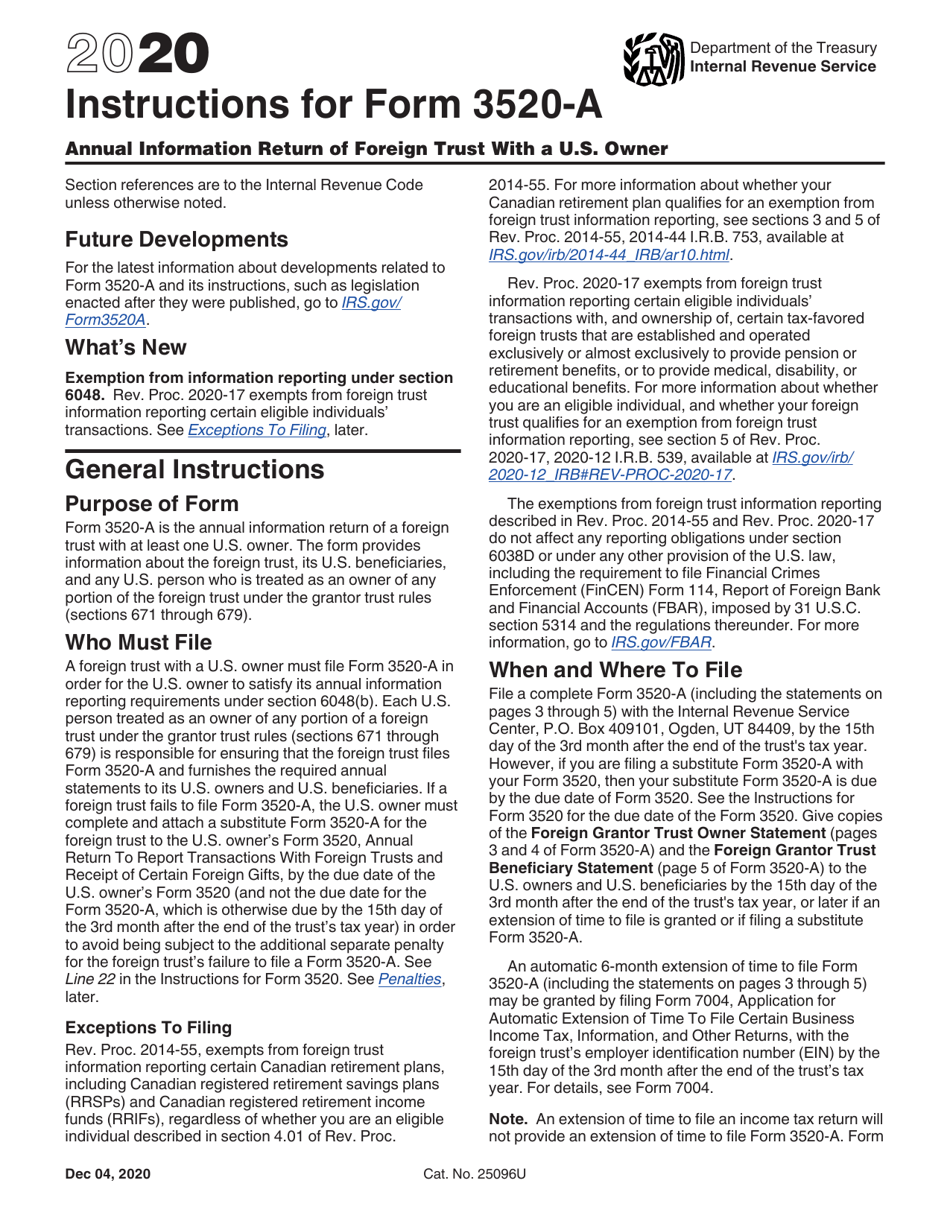

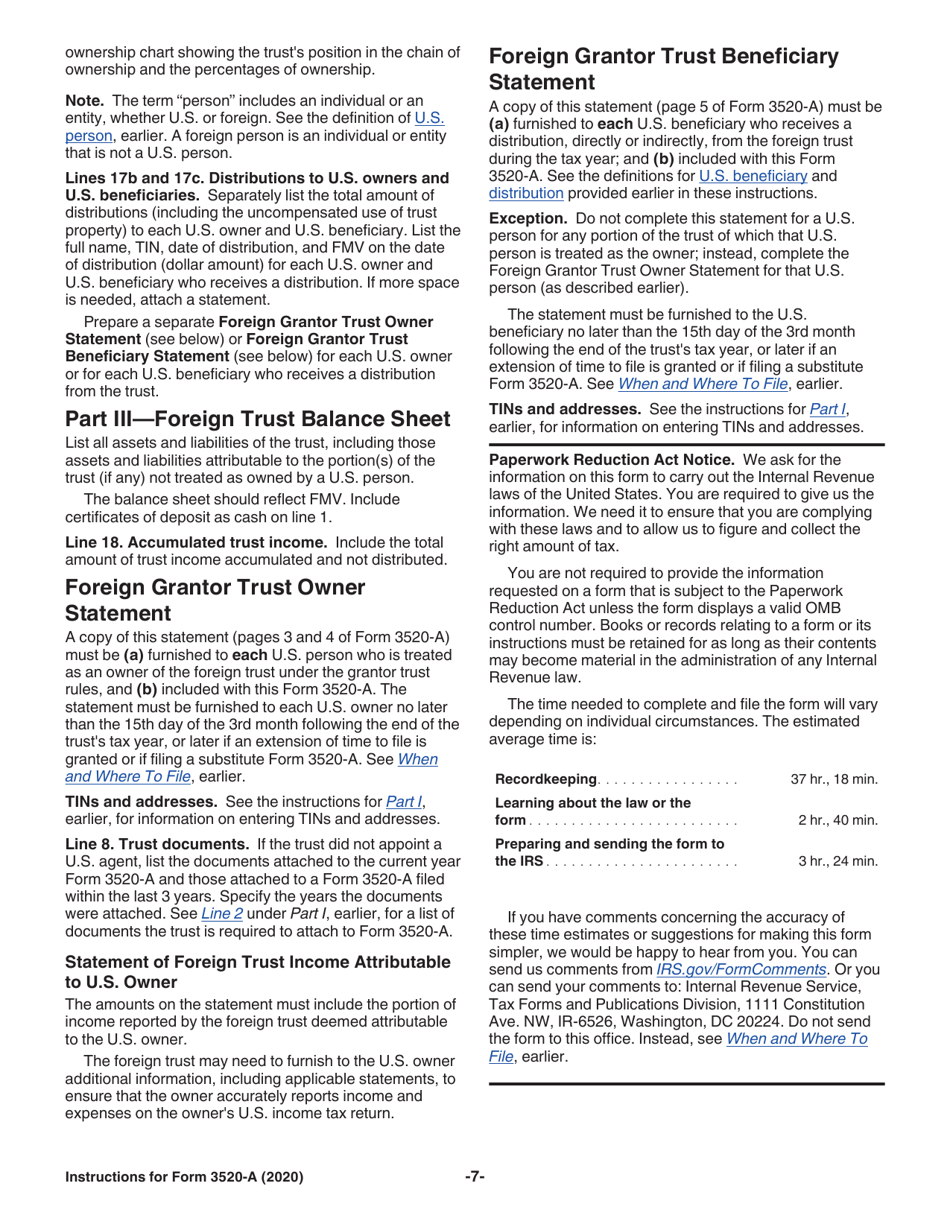

Instructions for IRS Form 3520-A Annual Information Return of Foreign Trust With a U.S. Owner

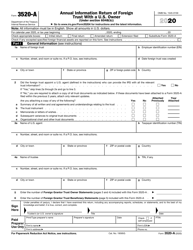

This document contains official instructions for IRS Form 3520-A , Annual Information Return of Foreign Trust With a U.S. Owner - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 3520-A is available for download through this link.

FAQ

Q: What is IRS Form 3520-A?

A: IRS Form 3520-A is the Annual Information Return of Foreign Trust with a U.S. Owner.

Q: Who needs to file IRS Form 3520-A?

A: Any U.S. person who is treated as an owner of a foreign trust should file IRS Form 3520-A.

Q: What information is required on IRS Form 3520-A?

A: IRS Form 3520-A requires information about the foreign trust, the U.S. owner, and any distributions from the trust.

Q: When is the deadline for filing IRS Form 3520-A?

A: The deadline for filing IRS Form 3520-A is the 15th day of the 3rd month after the end of the trust's tax year.

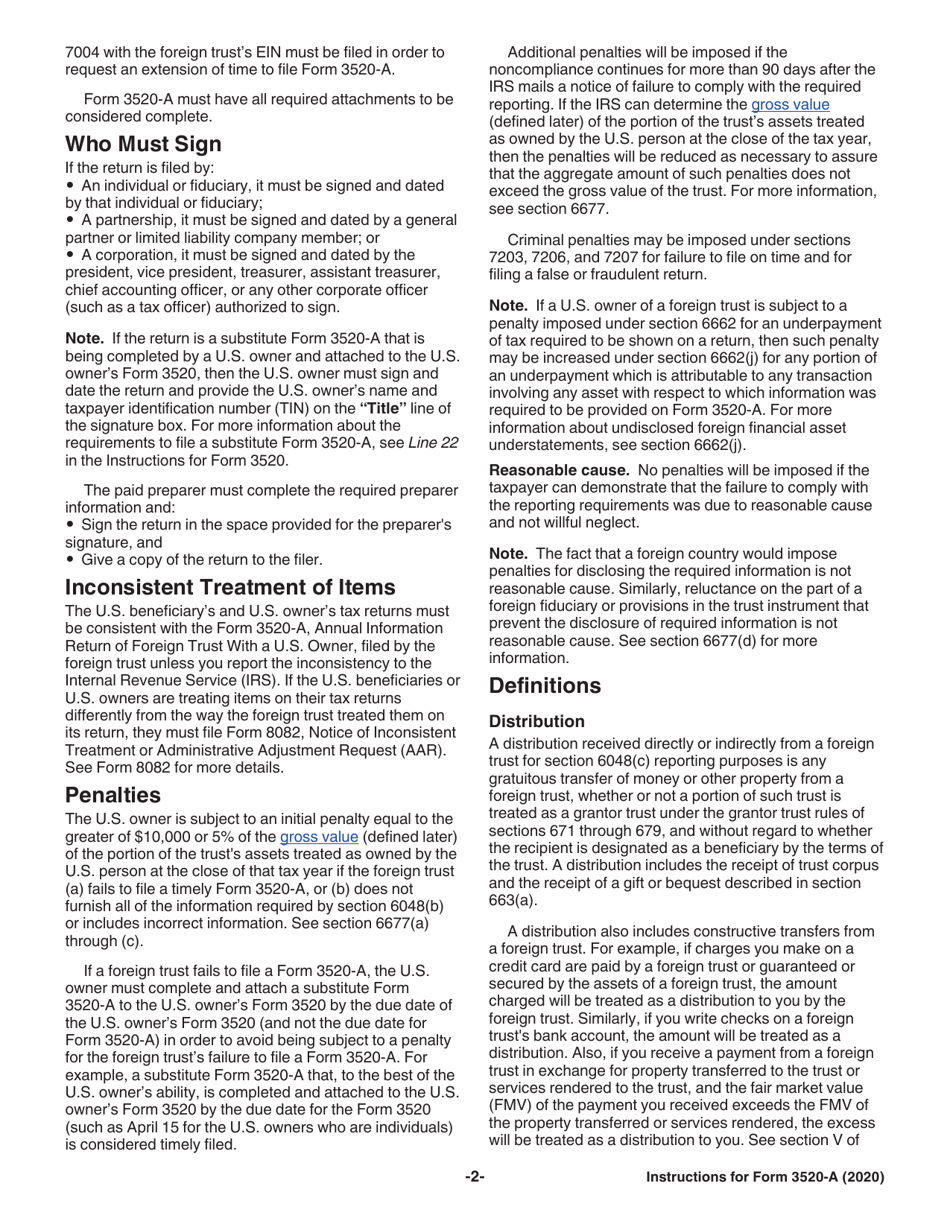

Q: Are there any penalties for not filing IRS Form 3520-A?

A: Yes, there are penalties for not filing IRS Form 3520-A, including monetary fines and potential criminal charges.

Q: Can I file IRS Form 3520-A electronically?

A: No, you cannot file IRS Form 3520-A electronically. It must be filed by mail.

Q: Do I need to attach any supporting documents with IRS Form 3520-A?

A: Yes, certain supporting documents, such as financial statements and transaction records, may need to be attached to IRS Form 3520-A.

Q: Is professional help recommended for filing IRS Form 3520-A?

A: Yes, it is recommended to seek professional help, such as a tax advisor or accountant, when filing IRS Form 3520-A.

Q: What should I do if I have more questions about IRS Form 3520-A?

A: If you have more questions about IRS Form 3520-A, you should contact the IRS directly or consult with a tax professional.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.