This version of the form is not currently in use and is provided for reference only. Download this version of

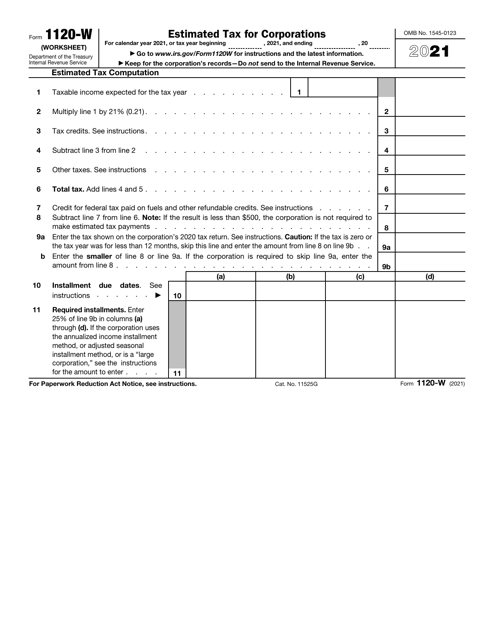

IRS Form 1120-W

for the current year.

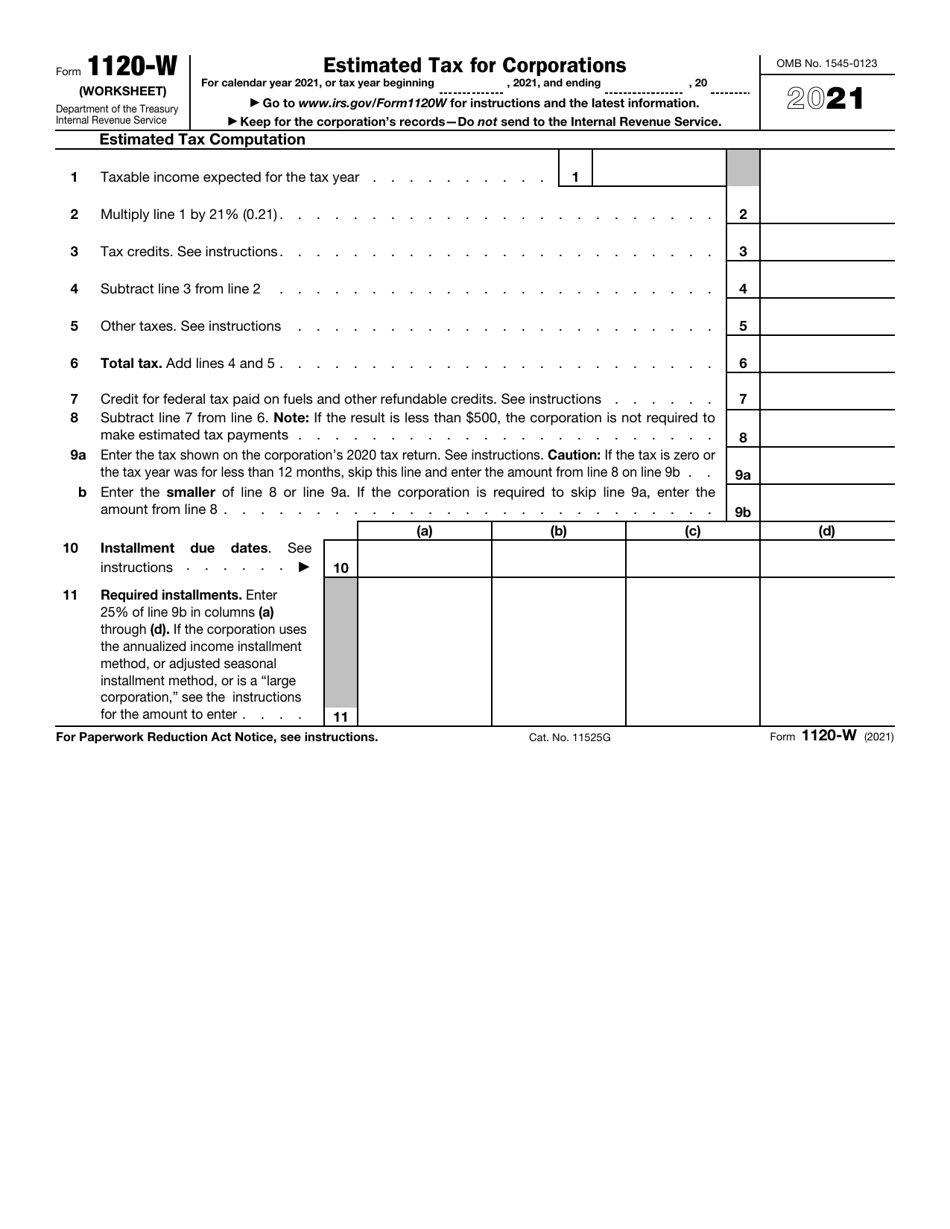

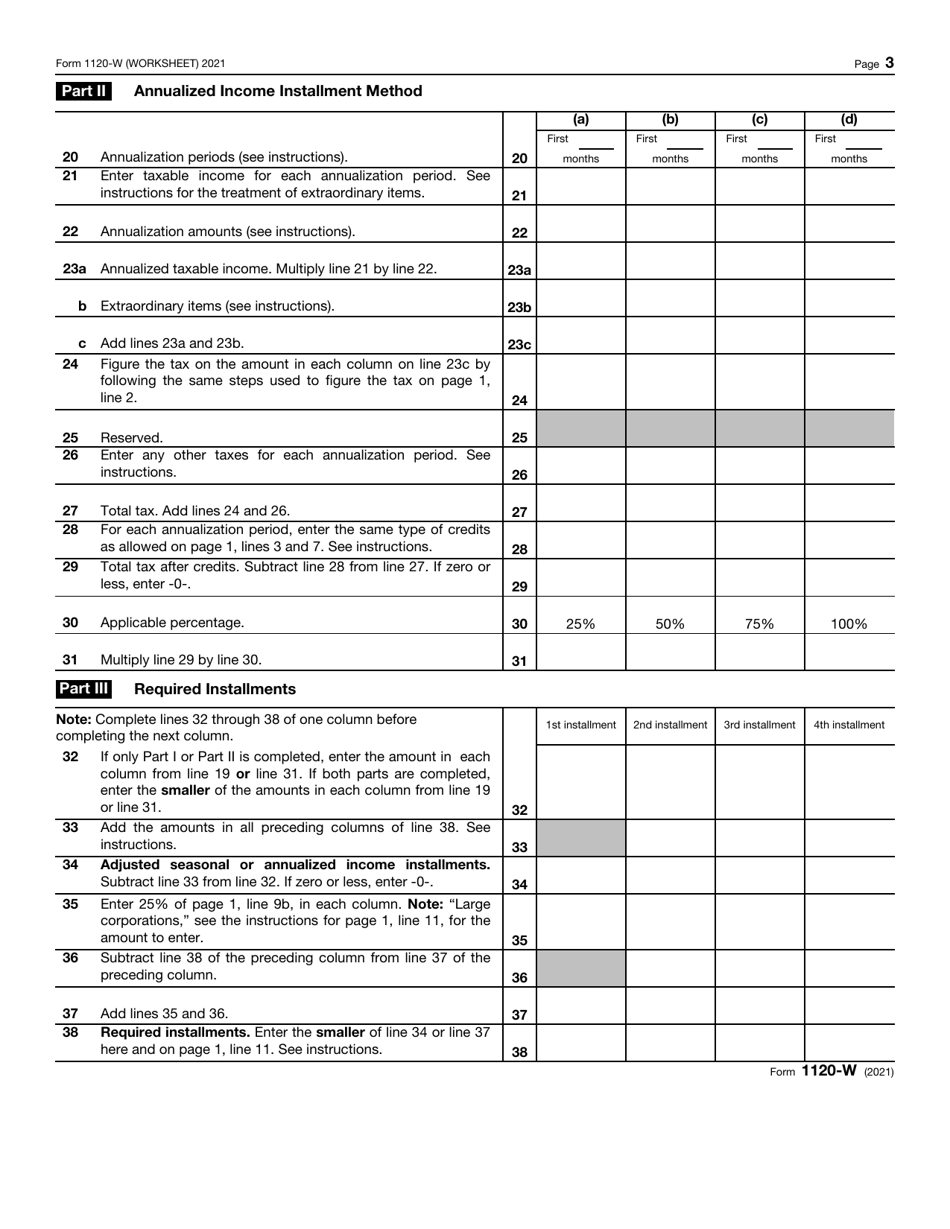

IRS Form 1120-W Estimated Tax for Corporations

What Is IRS Form 1120-W?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-W?

A: IRS Form 1120-W is used by corporations to estimate their tax liability for the year.

Q: Who needs to file IRS Form 1120-W?

A: Corporations that need to make estimated tax payments to the IRS during the year should file Form 1120-W.

Q: What is the purpose of IRS Form 1120-W?

A: The purpose of Form 1120-W is to help corporations calculate the amount of estimated tax they need to pay throughout the year.

Q: When is IRS Form 1120-W due?

A: Form 1120-W is typically due by the 15th day of the 4th, 6th, 9th, and 12th months of the corporation's tax year.

Q: What should I do if I make a mistake on Form 1120-W?

A: If you make a mistake on Form 1120-W, you can correct it by filing an amended return using Form 1120-X.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-W through the link below or browse more documents in our library of IRS Forms.