This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-W

for the current year.

Instructions for IRS Form 1120-W Estimated Tax for Corporations

This document contains official instructions for IRS Form 1120-W , Estimated Tax for Corporations - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-W is available for download through this link.

FAQ

Q: What is IRS Form 1120-W?

A: IRS Form 1120-W is used by corporations to estimate their quarterly tax payments.

Q: Who needs to file IRS Form 1120-W?

A: Corporations that are required to pay estimated taxes must file Form 1120-W.

Q: What are estimated taxes for corporations?

A: Estimated taxes are quarterly tax payments made by corporations to cover their tax liability for the year.

Q: How often is IRS Form 1120-W filed?

A: Form 1120-W is filed quarterly, with deadlines falling in April, June, September, and December.

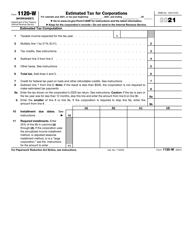

Q: What information is required on IRS Form 1120-W?

A: Form 1120-W requires information on the corporation's income, deductions, and tax credits to calculate the estimated tax liability.

Q: What happens if a corporation doesn't file Form 1120-W?

A: Failure to file Form 1120-W or underpaying estimated taxes may result in penalties and interest charges.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.