This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8985, 8985-V

for the current year.

Instructions for IRS Form 8985, 8985-V

This document contains official instructions for IRS Form 8985 , and IRS Form 8985-V . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8985 is available for download through this link. The latest available IRS Form 8985-V can be downloaded through this link.

FAQ

Q: What is IRS Form 8985?

A: IRS Form 8985 is used by taxpayers to report certain transactions that result in a basis adjustment under section 965.

Q: When should I use IRS Form 8985?

A: You should use IRS Form 8985 if you have certain transactions that result in a basis adjustment under section 965.

Q: How do I file IRS Form 8985?

A: You can file IRS Form 8985 by mail or electronically through the IRS e-file system.

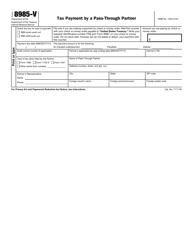

Q: What is IRS Form 8985-V?

A: IRS Form 8985-V is a payment voucher that you can use when mailing a payment for Form 8985.

Q: When should I use IRS Form 8985-V?

A: You should use IRS Form 8985-V if you are mailing a payment for Form 8985.

Q: How do I fill out IRS Form 8985-V?

A: To fill out IRS Form 8985-V, you will need to enter your name, address, Social Security number or taxpayer identification number, and the payment amount.

Instruction Details:

- This 9-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.