This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form SL-202M

for the current year.

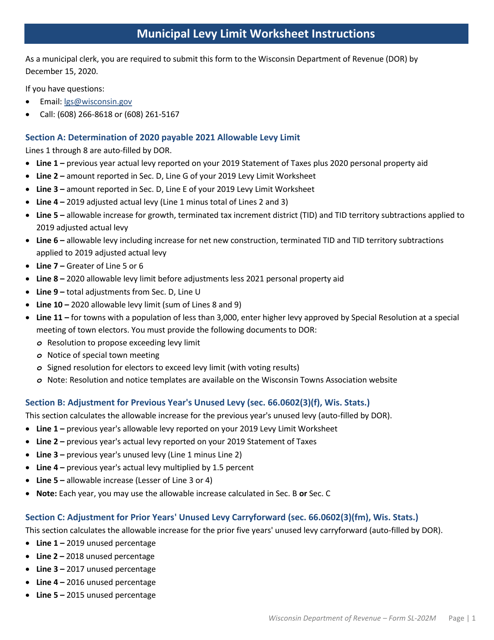

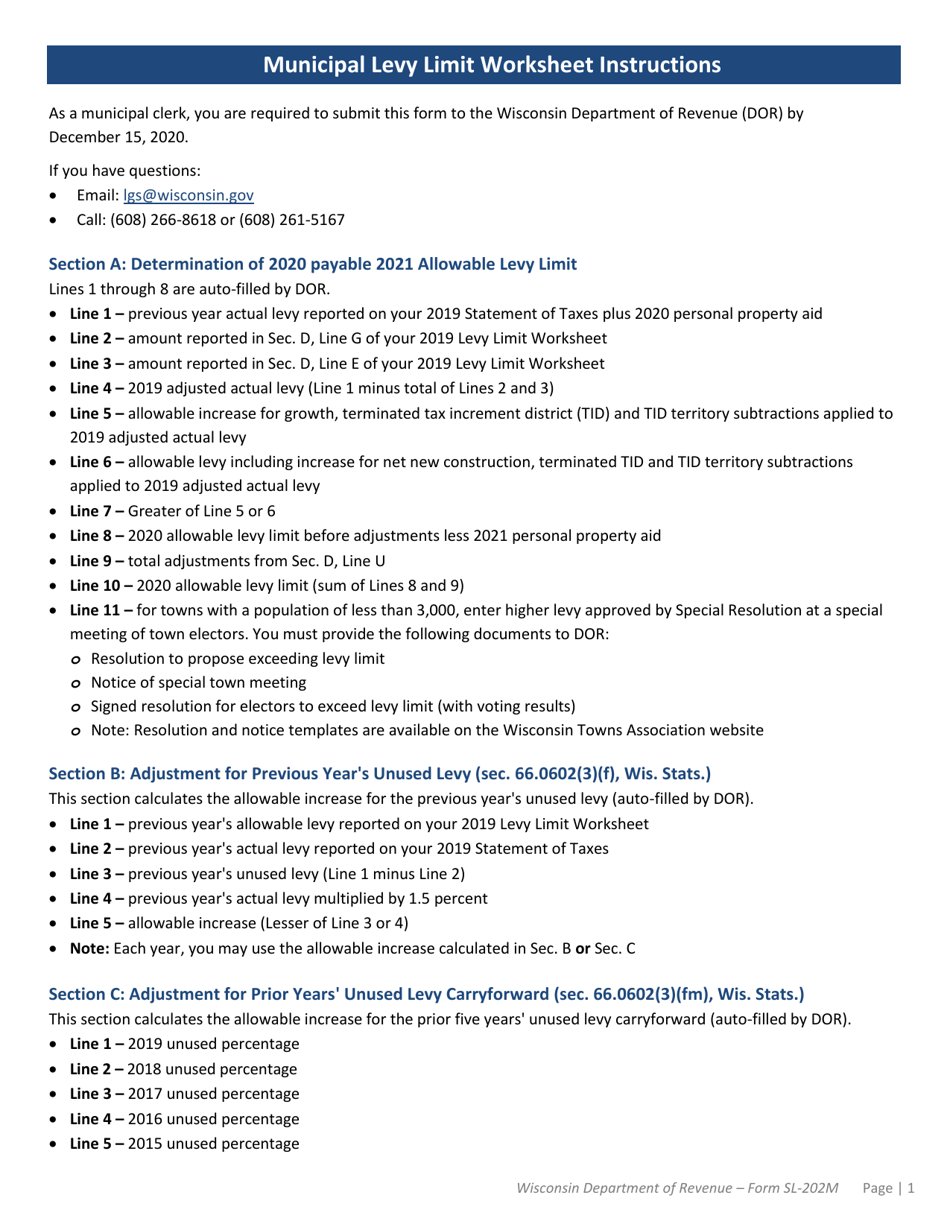

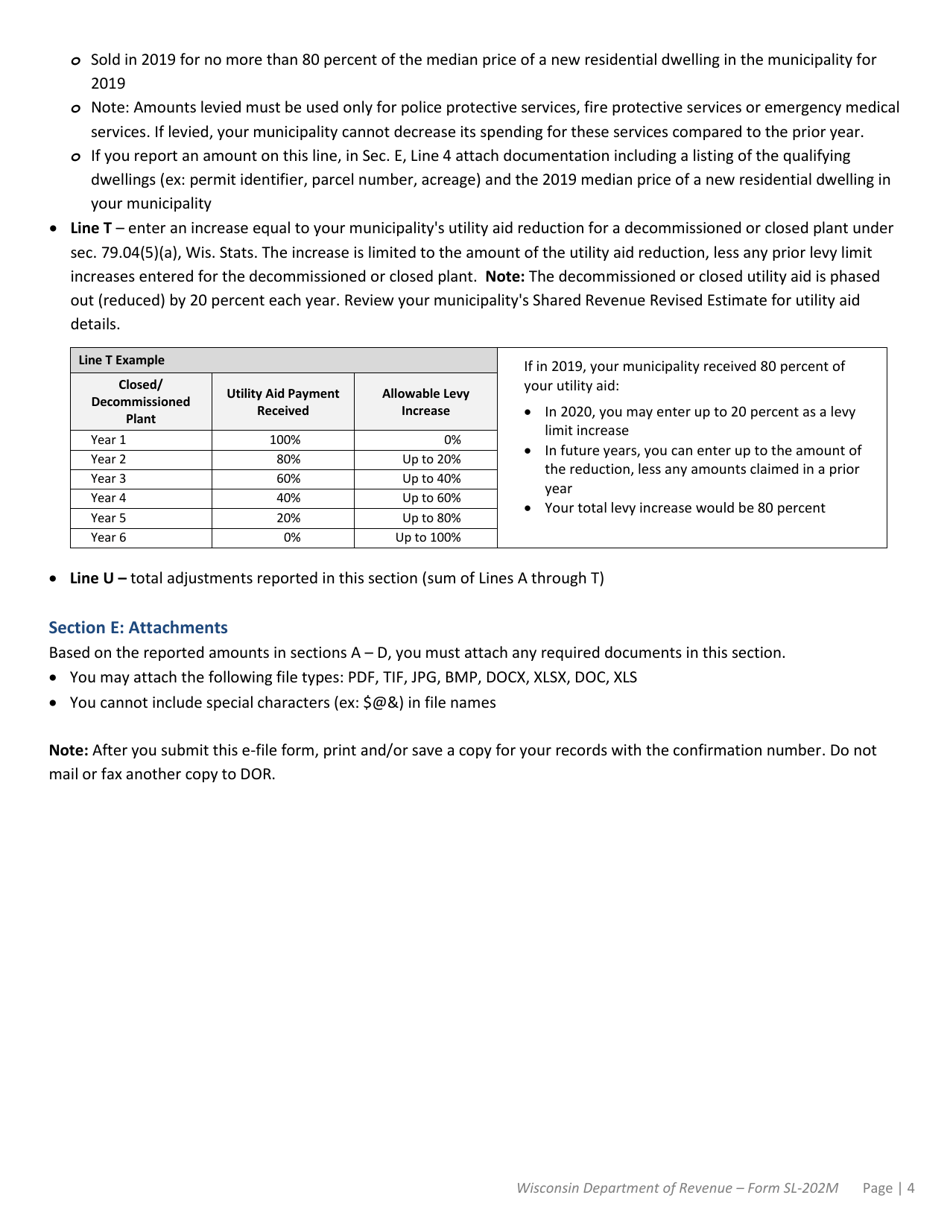

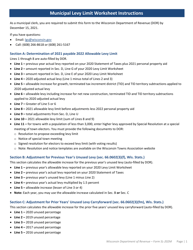

Instructions for Form SL-202M Municipal Levy Limit Worksheet - Wisconsin

This document contains official instructions for Form SL-202M , Municipal Levy Limit Worksheet - a form released and collected by the Wisconsin Department of Revenue.

FAQ

Q: What is Form SL-202M?

A: Form SL-202M is the Municipal Levy Limit Worksheet in Wisconsin.

Q: What is the purpose of Form SL-202M?

A: The purpose of Form SL-202M is to calculate the municipal levy limit.

Q: Who needs to fill out Form SL-202M?

A: Municipalities in Wisconsin need to fill out Form SL-202M.

Q: What information is required to fill out Form SL-202M?

A: Form SL-202M requires information about the municipality's revenues, expenditures, and debt.

Q: What happens after Form SL-202M is filled out?

A: After Form SL-202M is filled out, the municipality can determine its limit for the next fiscal year.

Q: Are there any penalties for not submitting Form SL-202M?

A: Failure to submit Form SL-202M may result in the municipality losing eligibility for certain state aids and shared revenues.

Q: Is there a deadline for filing Form SL-202M?

A: Yes, the deadline for filing Form SL-202M is generally January 31st of each year.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.