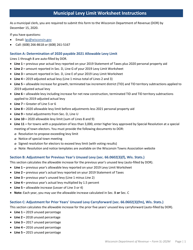

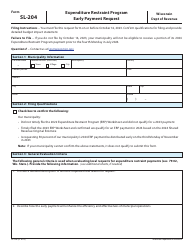

Instructions for Form SL-203 Expenditure Restraint Program Worksheet - Wisconsin

This document contains official instructions for Form SL-203 , Expenditure Restraint Program Worksheet - a form released and collected by the Wisconsin Department of Revenue.

FAQ

Q: What is Form SL-203?

A: Form SL-203 is the Expenditure Restraint Program Worksheet.

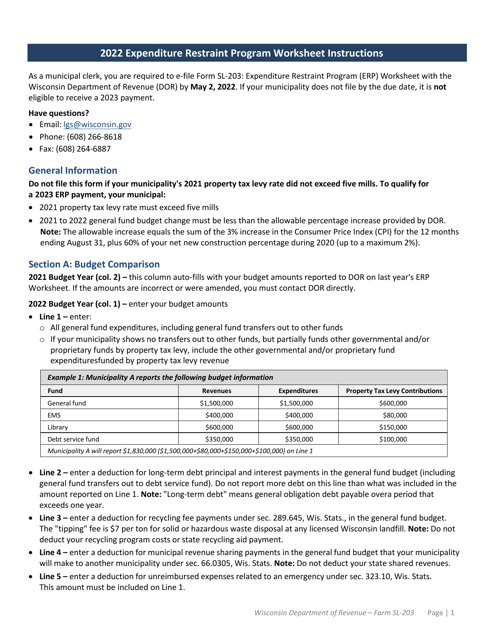

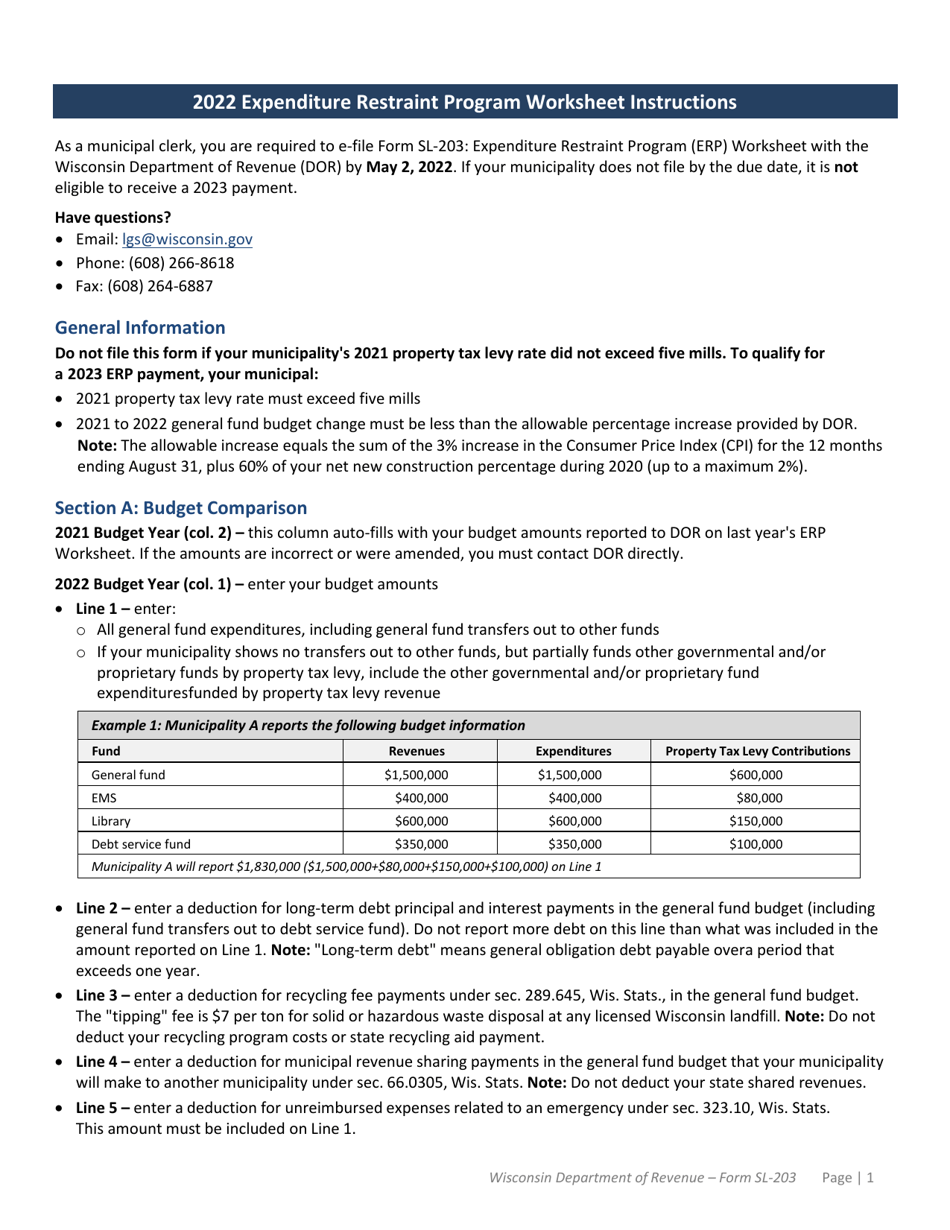

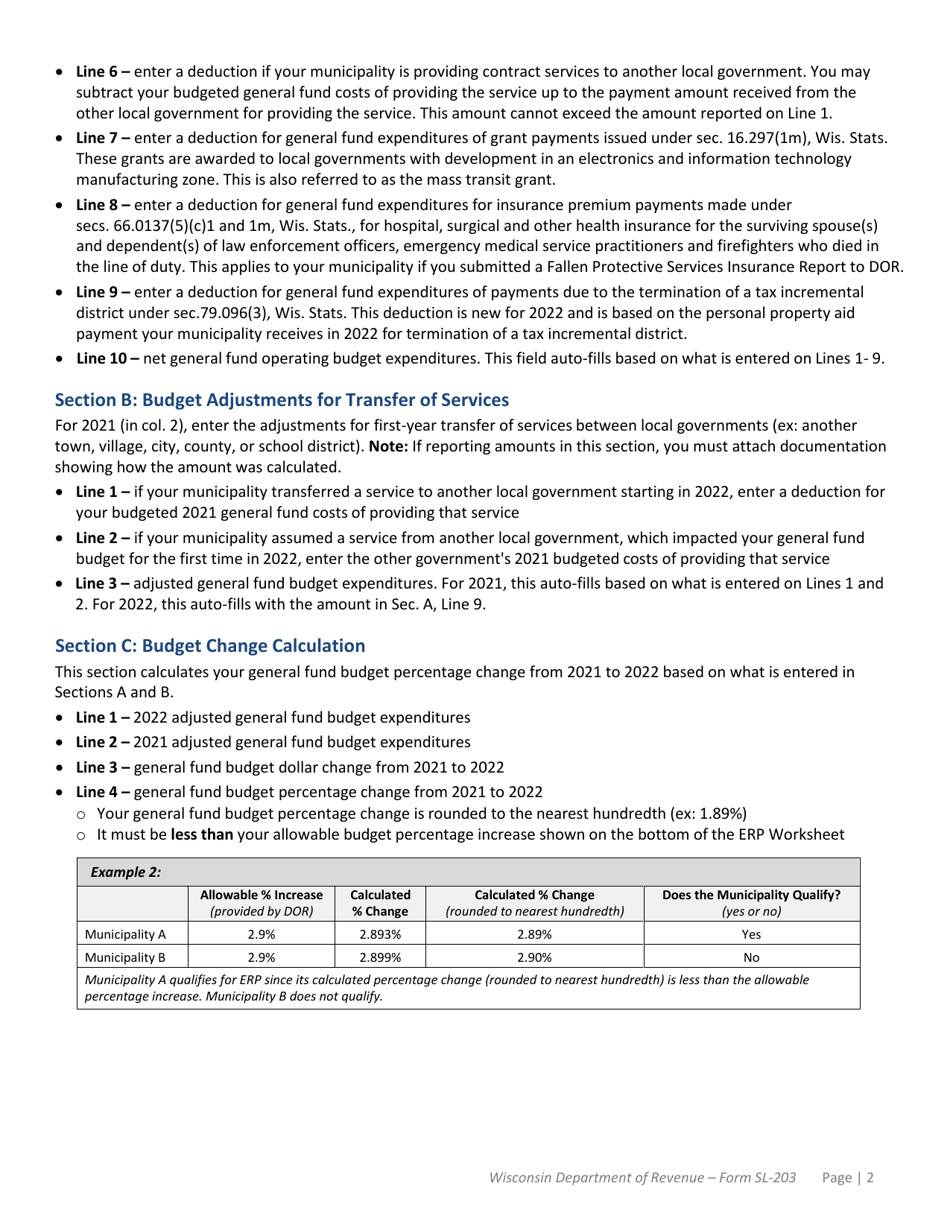

Q: What is the Expenditure Restraint Program?

A: The Expenditure Restraint Program is a program in Wisconsin that limits certain local government expenditures.

Q: What is the purpose of Form SL-203?

A: The purpose of Form SL-203 is to calculate and report expenditures for the Expenditure Restraint Program.

Q: Who needs to fill out Form SL-203?

A: Local governments in Wisconsin that participate in the Expenditure Restraint Program need to fill out Form SL-203.

Q: When is Form SL-203 due?

A: Form SL-203 is typically due on or before July 1st of each year.

Q: What information is required on Form SL-203?

A: Form SL-203 requires information about the local government's expenditures, revenue, and other relevant financial data.

Q: Is there a penalty for not filing Form SL-203?

A: Yes, there may be penalties for failing to file Form SL-203 or for providing inaccurate or incomplete information.

Q: Are there any exemptions from the Expenditure Restraint Program?

A: Yes, certain local governments may be exempt from the program based on their population or other factors.

Q: Who can I contact for help with Form SL-203?

A: You can contact the Wisconsin Department of Revenue or your local government for assistance with Form SL-203.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.