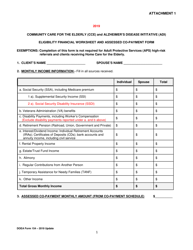

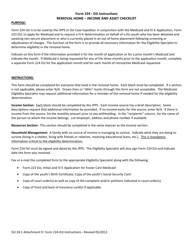

Instructions for DOEA Form 154 Attachment 4 Eligibility Financial Worksheet and Assessed Co-payment Form - Florida

This document contains official instructions for DOEA Form 154 Attachment 4, Eligibility Financial Worksheet and Assessed Co-payment Form - a form released and collected by the Florida Department of Elder Affairs.

FAQ

Q: What is DOEA Form 154 Attachment 4?

A: DOEA Form 154 Attachment 4 is a form used in Florida for eligibility determination.

Q: What is the purpose of the Eligibility Financial Worksheet and Assessed Co-payment Form?

A: The purpose of the form is to assess an individual's financial eligibility and calculate the required co-payment.

Q: Who needs to complete the form?

A: Individuals applying for certain benefits or services in Florida may need to complete this form.

Q: What information is required on the form?

A: The form asks for personal and financial information, including income, assets, and expenses.

Q: What is the co-payment?

A: The co-payment is the amount that an individual may be required to pay towards the cost of services or benefits based on their financial situation.

Q: How is the co-payment calculated?

A: The co-payment is calculated using the information provided on the form, including income and expenses.

Q: Are there any exemptions or exceptions to the co-payment?

A: There may be exemptions or exceptions to the co-payment based on certain circumstances, such as income level or type of benefits being applied for.

Q: What should I do if I have questions or need assistance with the form?

A: If you have questions or need assistance, you can contact the Florida Department of Elder Affairs for guidance.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Florida Department of Elder Affairs.