This version of the form is not currently in use and is provided for reference only. Download this version of

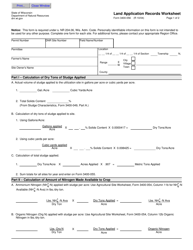

Instructions for Form SL-202C

for the current year.

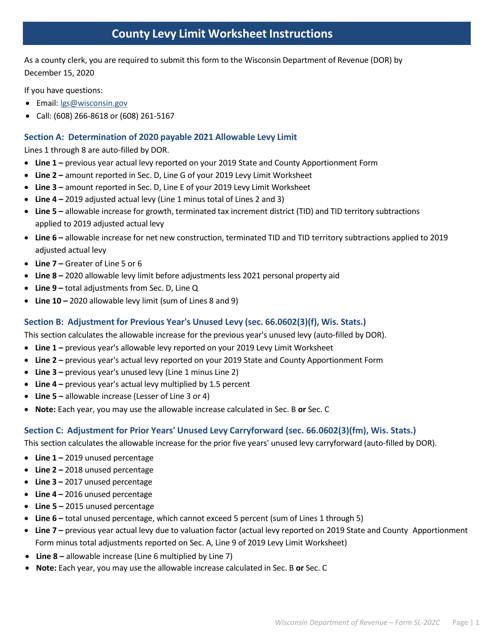

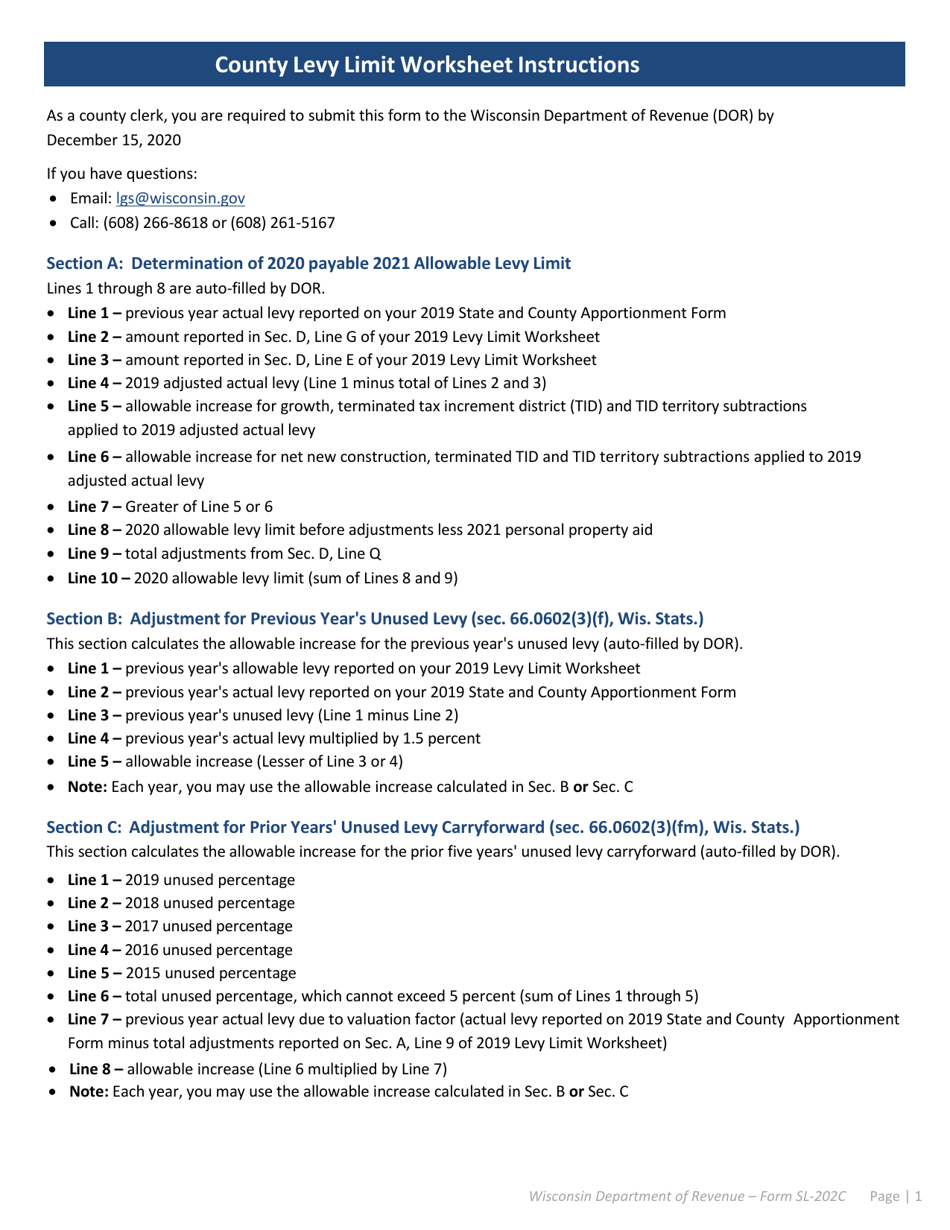

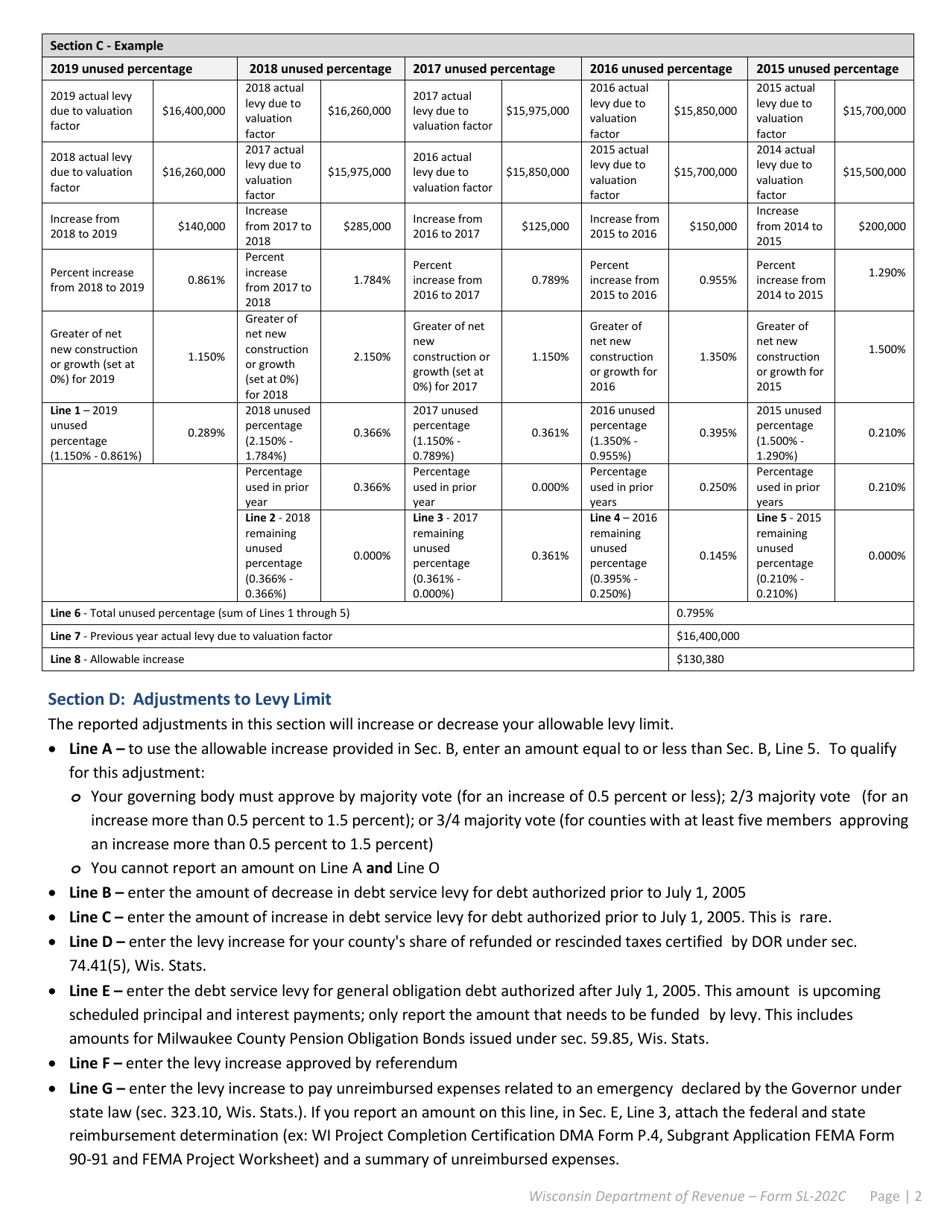

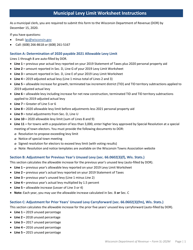

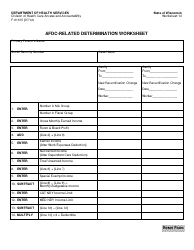

Instructions for Form SL-202C County Levy Limit Worksheet - Wisconsin

This document contains official instructions for Form SL-202C , County Levy Limit Worksheet - a form released and collected by the Wisconsin Department of Revenue.

FAQ

Q: What is Form SL-202C?

A: Form SL-202C is the County Levy Limit Worksheet in Wisconsin.

Q: What is the purpose of Form SL-202C?

A: The purpose of Form SL-202C is to calculate the county levy limit in Wisconsin.

Q: Who needs to fill out Form SL-202C?

A: County officials in Wisconsin are responsible for filling out Form SL-202C.

Q: What information is required to fill out Form SL-202C?

A: To fill out Form SL-202C, county officials need to provide information about county revenues and expenditures.

Q: Can I request an extension to submit Form SL-202C?

A: You may request an extension to submit Form SL-202C by contacting the Wisconsin Department of Revenue.

Q: Is Form SL-202C the only form required for calculating the county levy limit in Wisconsin?

A: No, other forms and calculations may be required depending on the specific circumstances of the county.

Q: Who can I contact for help or clarification regarding Form SL-202C?

A: For help or clarification regarding Form SL-202C, you can contact the Wisconsin Department of Revenue or consult with a tax professional.

Q: Is Form SL-202C specific to Wisconsin only?

A: Yes, Form SL-202C is specific to calculating the county levy limit in Wisconsin and may not be applicable in other states.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.