This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1099-INT, 1099-OID

for the current year.

Instructions for IRS Form 1099-INT, 1099-OID

This document contains official instructions for IRS Form 1099-INT , and IRS Form 1099-OID . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1099-INT?

A: Form 1099-INT is used to report interest income received.

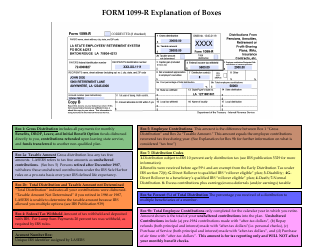

Q: What is IRS Form 1099-OID?

A: Form 1099-OID is used to report original issue discount (OID) income received.

Q: Who needs to file IRS Form 1099-INT?

A: Financial institutions, government agencies, and other entities that pay interest income to individuals or businesses need to file Form 1099-INT.

Q: Who needs to file IRS Form 1099-OID?

A: Financial institutions and other entities that pay OID income to individuals or businesses need to file Form 1099-OID.

Q: What information is required on Form 1099-INT?

A: Form 1099-INT requires information such as the recipient's name, address, and taxpayer identification number, as well as the amount of interest income paid.

Q: What information is required on Form 1099-OID?

A: Form 1099-OID requires information such as the recipient's name, address, and taxpayer identification number, as well as the amount of OID income paid.

Q: When is the deadline to file IRS Form 1099-INT?

A: The deadline to file Form 1099-INT is January 31st of the year following the calendar year in which the interest income was paid.

Q: When is the deadline to file IRS Form 1099-OID?

A: The deadline to file Form 1099-OID is January 31st of the year following the calendar year in which the OID income was paid.

Q: Are there any penalties for not filing IRS Form 1099-INT or 1099-OID?

A: Yes, there are penalties for not filing or for filing incorrect information on Form 1099-INT or 1099-OID. It is important to accurately report interest income and OID income to avoid penalties.

Instruction Details:

- This 8-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.