Change in the Canadian Mortgage Market - Caamp

The Canadian Mortgage Market - CAAMP is the Canadian Association of Accredited Mortgage Professionals. It is a professional organization that represents mortgage professionals across Canada and provides education, advocacy, and standards for the mortgage industry. It does not specifically deal with changes in the mortgage market, but rather supports and promotes the industry as a whole.

FAQ

Q: What is Caamp?

A: Caamp stands for Canadian Association of Accredited Mortgage Professionals.

Q: What is the Canadian Mortgage Market?

A: The Canadian Mortgage Market refers to the industry and activities related to the borrowing and lending of money for the purpose of purchasing or refinancing residential properties in Canada.

Q: What has changed in the Canadian Mortgage Market?

A: There have been multiple changes in the Canadian Mortgage Market, including new mortgage rules, stricter lending criteria, and increased interest rates.

Q: What are the new mortgage rules?

A: New mortgage rules include stress testing for uninsured mortgages, which require borrowers to qualify at a higher interest rate.

Q: What is stress testing for uninsured mortgages?

A: Stress testing for uninsured mortgages is a measure introduced by the government to ensure that borrowers can still afford their mortgage payments if interest rates rise.

Q: What is stricter lending criteria?

A: Stricter lending criteria refers to lenders requiring borrowers to provide more detailed financial information and meet higher credit score requirements.

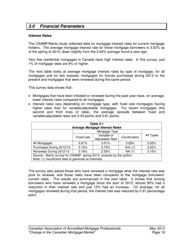

Q: Why have interest rates increased?

A: Interest rates have increased due to a variety of factors, including changes in the economy and monetary policy decisions by the Bank of Canada.

Q: How do these changes affect borrowers?

A: These changes can make it more difficult for some borrowers to qualify for a mortgage or afford their mortgage payments.

Q: What should borrowers do in response to these changes?

A: Borrowers should carefully review their financial situation, consider consulting a mortgage professional, and explore various mortgage options to find the best fit for their needs.