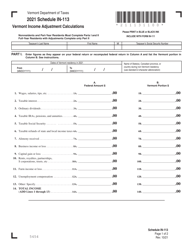

This version of the form is not currently in use and is provided for reference only. Download this version of

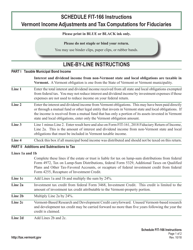

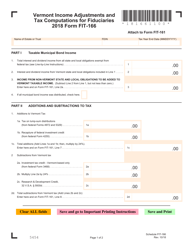

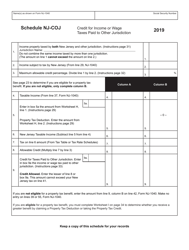

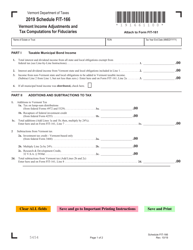

Instructions for Schedule FIT-166

for the current year.

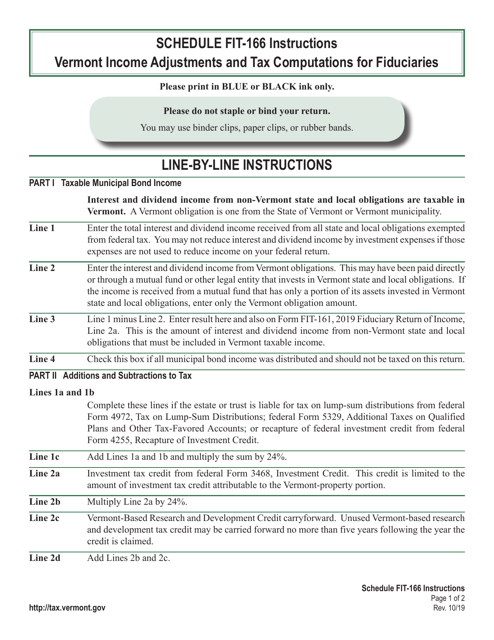

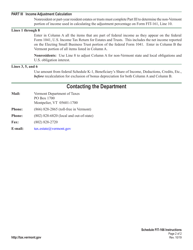

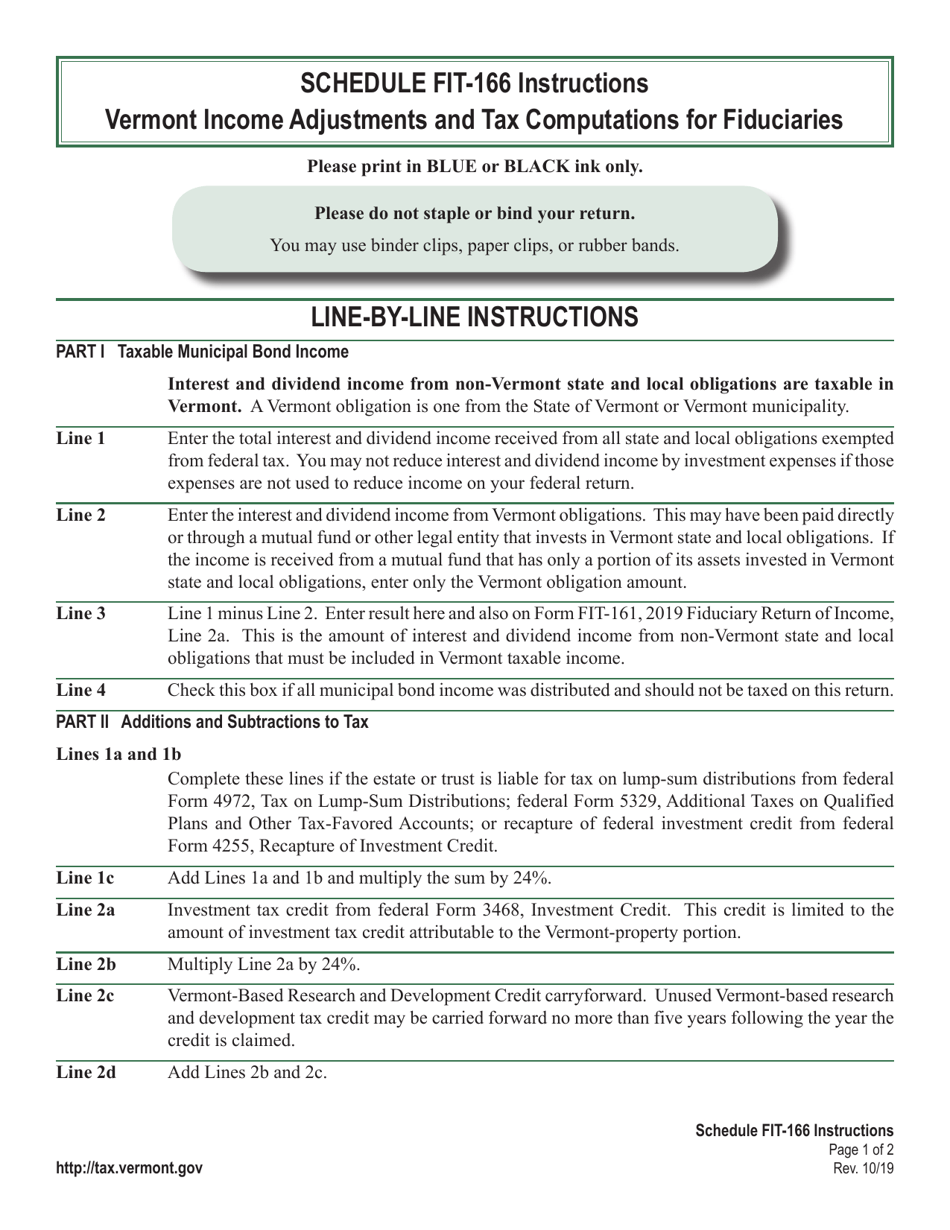

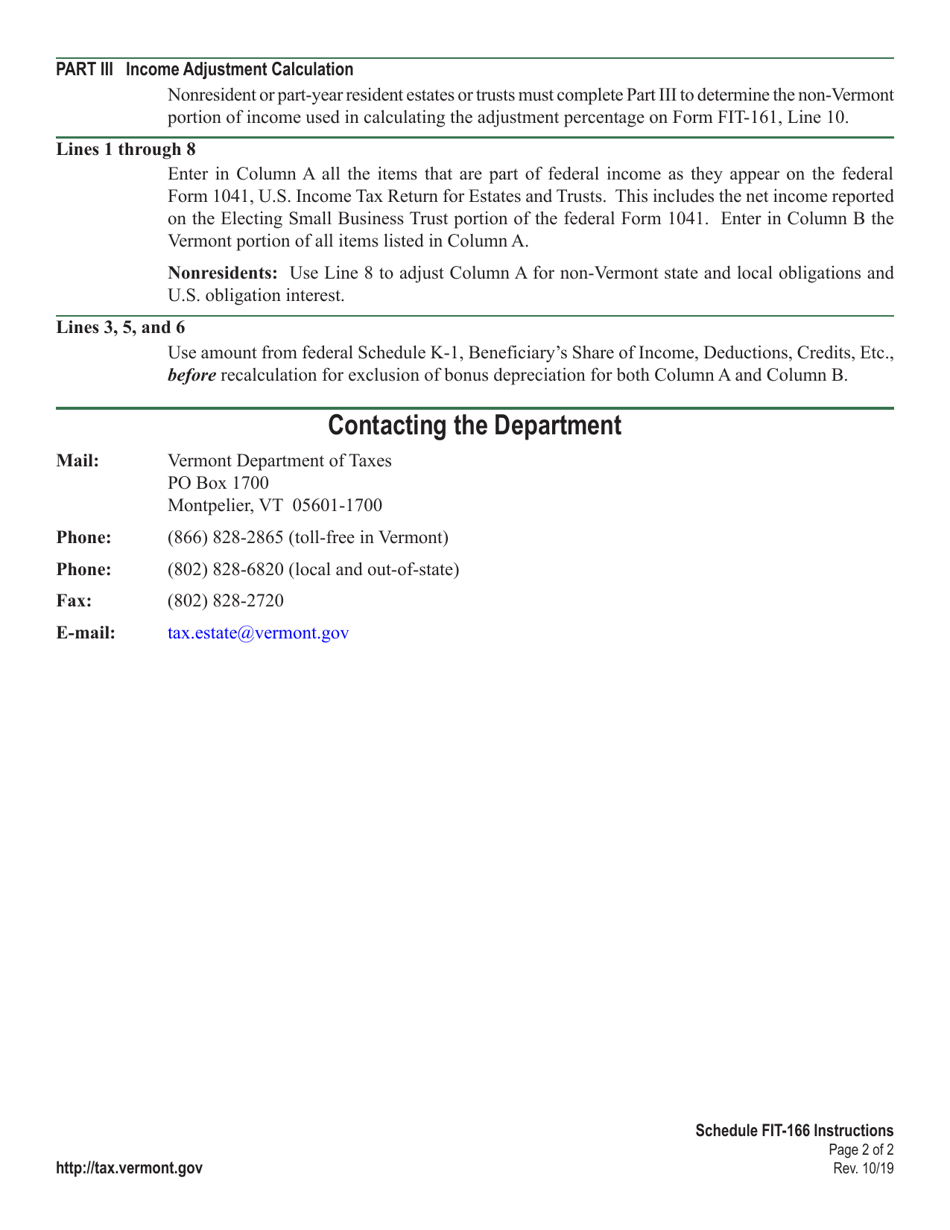

Instructions for Schedule FIT-166 Vermont Income Adjustments and Tax Computations for Fiduciaries - Vermont

This document contains official instructions for Schedule FIT-166 , Vermont Tax Computations for Fiduciaries - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule FIT-166?

A: Schedule FIT-166 is a tax form used by fiduciaries in Vermont to report income adjustments and calculate taxes.

Q: Who needs to file Schedule FIT-166?

A: Fiduciaries in Vermont who are responsible for the income and tax liability of a trust or estate need to file Schedule FIT-166.

Q: What information is required for Schedule FIT-166?

A: Schedule FIT-166 requires information on income adjustments, deductions, and credits for the trust or estate.

Q: What are income adjustments?

A: Income adjustments are changes made to the trust or estate's taxable income, such as deductions or additions.

Q: How do I calculate taxes on Schedule FIT-166?

A: Taxes on Schedule FIT-166 are calculated based on the taxable income of the trust or estate, using the tax rates provided by the Vermont Department of Taxes.

Q: Are there any specific instructions for filling out Schedule FIT-166?

A: Yes, there are specific instructions provided by the Vermont Department of Taxes on how to complete Schedule FIT-166 accurately.

Q: When is the deadline to file Schedule FIT-166?

A: The deadline to file Schedule FIT-166 for fiduciaries in Vermont is the same as the deadline for filing the federal Form 1041, which is usually April 15th.

Q: Can I e-file Schedule FIT-166?

A: Yes, Vermont allows fiduciaries to e-file Schedule FIT-166 through approved software or tax professionals.

Q: What happens if I don't file Schedule FIT-166?

A: If you are required to file Schedule FIT-166 and fail to do so, you may face penalties and interest on any unpaid taxes.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.