This version of the form is not currently in use and is provided for reference only. Download this version of

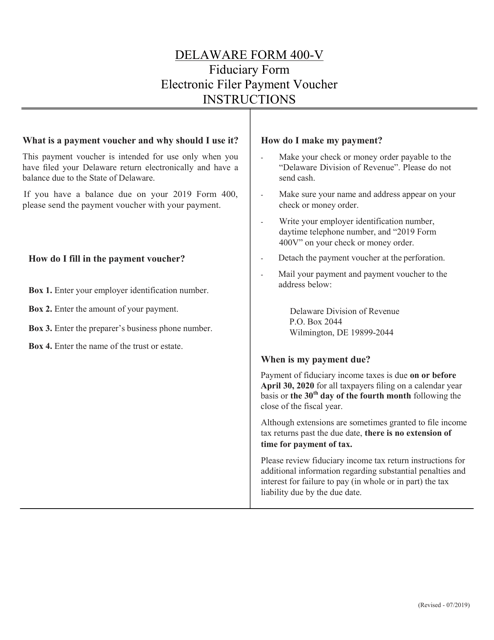

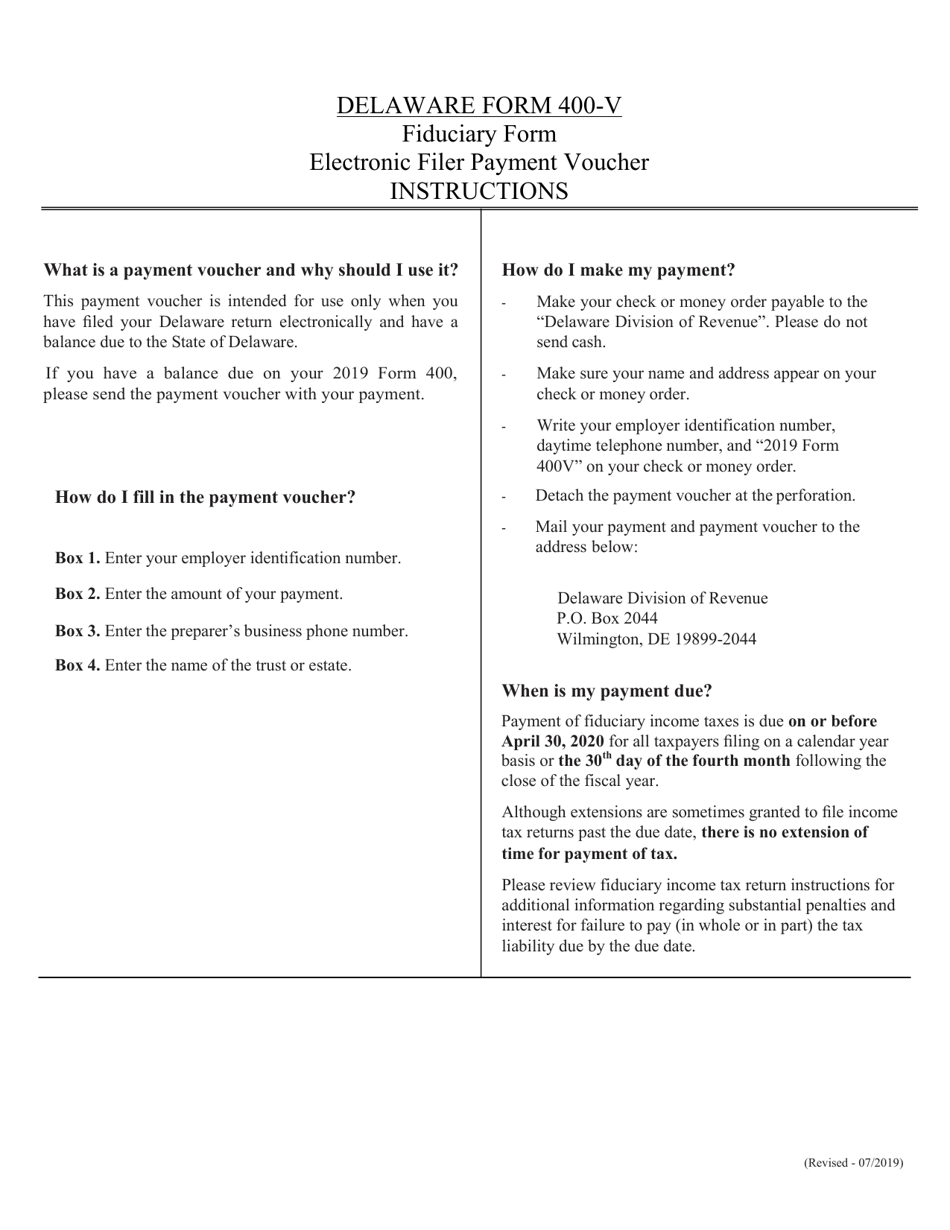

Instructions for Form 400-V

for the current year.

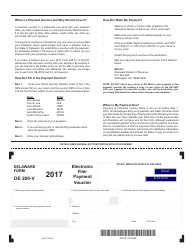

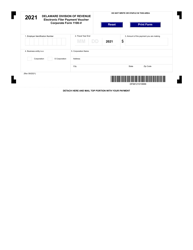

Instructions for Form 400-V Electronic Filer Payment Voucher - Delaware

This document contains official instructions for Form 400-V , Electronic Filer Payment Voucher - a form released and collected by the Delaware Department of Finance - Division of Revenue.

FAQ

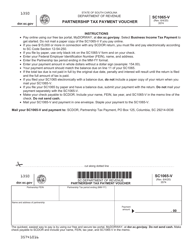

Q: What is Form 400-V?

A: Form 400-V is an electronic filer payment voucher used in Delaware.

Q: What is the purpose of Form 400-V?

A: The purpose of Form 400-V is to make a payment to the state of Delaware.

Q: Who needs to use Form 400-V?

A: Anyone who is required to make a payment to the state of Delaware as an electronic filer needs to use Form 400-V.

Q: What information is required on Form 400-V?

A: Form 400-V requires information such as the filer's name, contact information, payment amount, and payment details.

Q: What are the payment options for Form 400-V?

A: Payment options for Form 400-V include electronic funds transfer (EFT) or credit card payment.

Q: Is there a deadline for submitting Form 400-V?

A: Yes, the deadline for submitting Form 400-V is based on the individual filer's tax return due date.

Q: Can Form 400-V be edited once submitted?

A: No, once Form 400-V is submitted, it cannot be edited. If changes need to be made, a new form must be submitted.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Delaware Department of Finance - Division of Revenue.