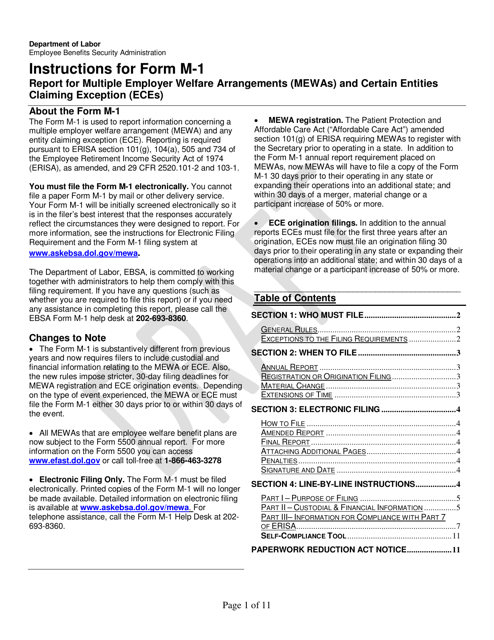

Instructions for Form M-1 Report for Multiple Employer Welfare Arrangements (Mewas) and Certain Entities Claiming Exception (Eces)

This document contains official instructions for Form M-1 , Report for Multiple Employer Welfare Arrangements (Mewas) and Certain Entities Claiming Exception (Eces) - a form released and collected by the U.S. Department of Labor.

FAQ

Q: What is Form M-1?

A: Form M-1 is a report for Multiple Employer Welfare Arrangements (MEWAs) and Certain Entities Claiming Exception (ECEs).

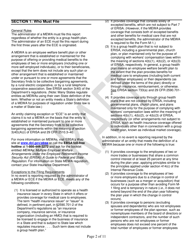

Q: Who needs to file Form M-1?

A: MEWAs and ECEs need to file Form M-1.

Q: What is a Multiple Employer Welfare Arrangement (MEWA)?

A: A MEWA is an employee welfare benefit plan that provides benefits to employees of two or more employers.

Q: What are Certain Entities Claiming Exception (ECEs)?

A: ECEs are entities that claim an exception from the definition of MEWA under federal law.

Q: What information is required to be reported on Form M-1?

A: Form M-1 requires information about the MEWA or ECE, its members, and the benefits provided.

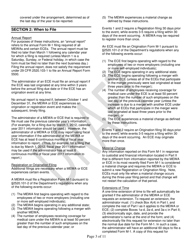

Q: When is Form M-1 due?

A: Form M-1 is due annually, no later than March 1st.

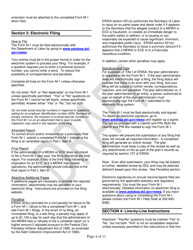

Q: Are there any penalties for not filing Form M-1?

A: Yes, penalties may apply for failing to file or for filing incomplete or inaccurate information on Form M-1.

Instruction Details:

- This 11-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the U.S. Department of Labor.