This version of the form is not currently in use and is provided for reference only. Download this version of

Form M-1

for the current year.

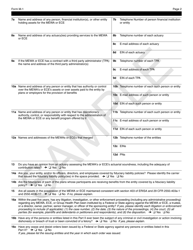

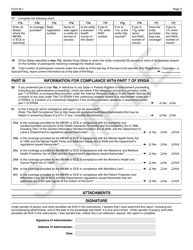

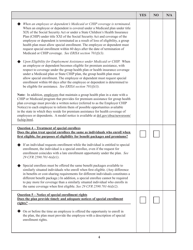

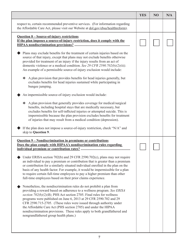

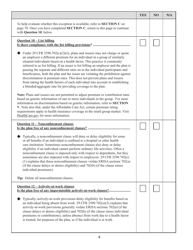

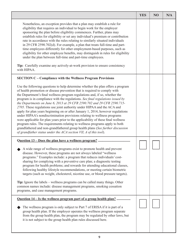

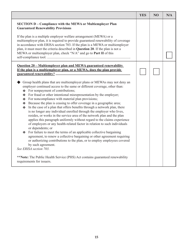

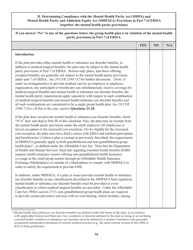

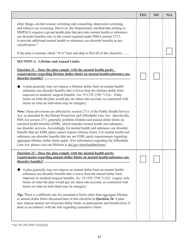

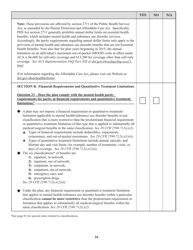

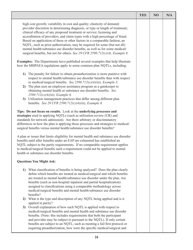

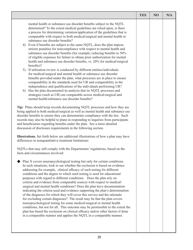

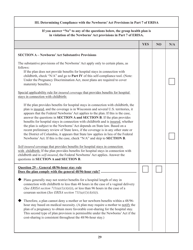

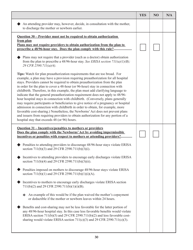

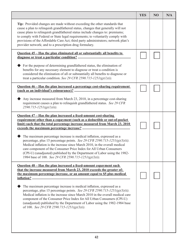

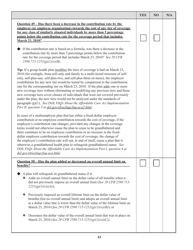

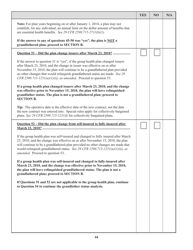

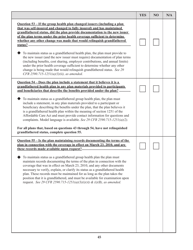

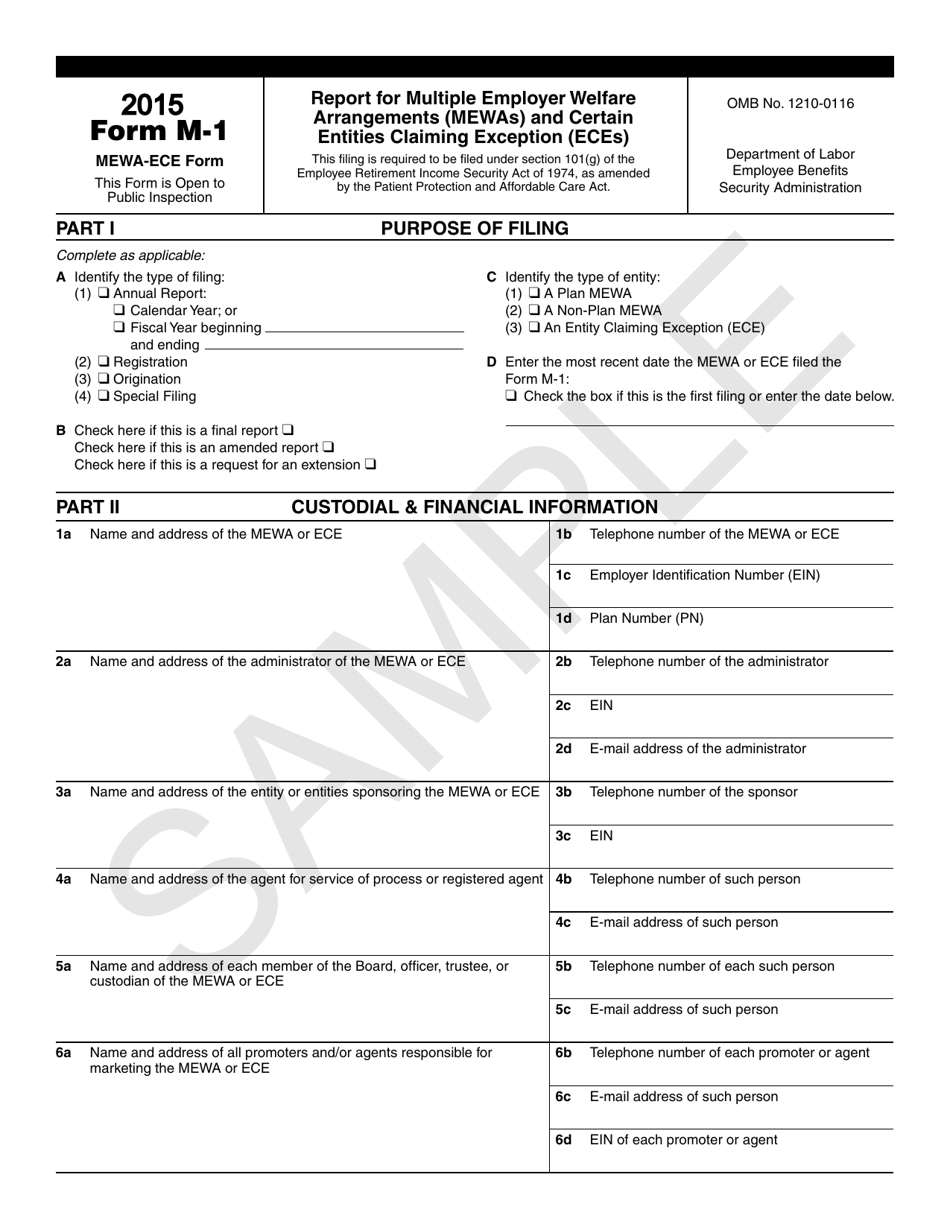

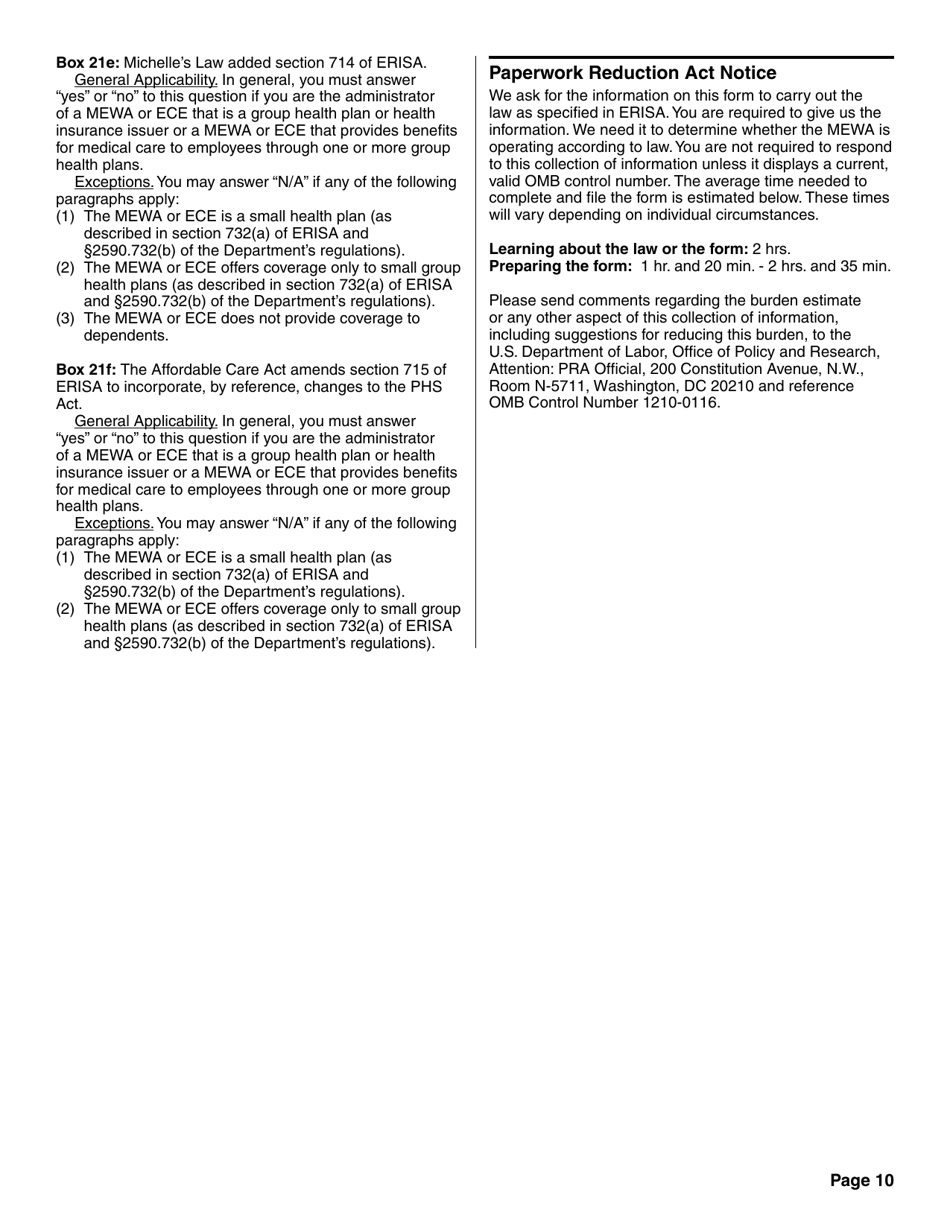

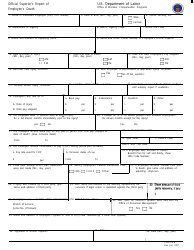

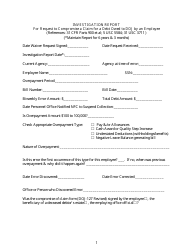

Form M-1 Report for Multiple Employer Welfare Arrangements (Mewas) and Certain Entities Claiming Exception (Eces)

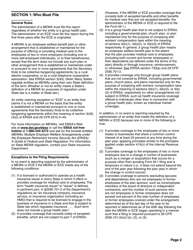

What Is Form M-1?

This is a legal form that was released by the U.S. Department of Labor and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-1?

A: Form M-1 is a report for Multiple Employer Welfare Arrangements (MEWAs) and certain entities claiming exception (ECEs).

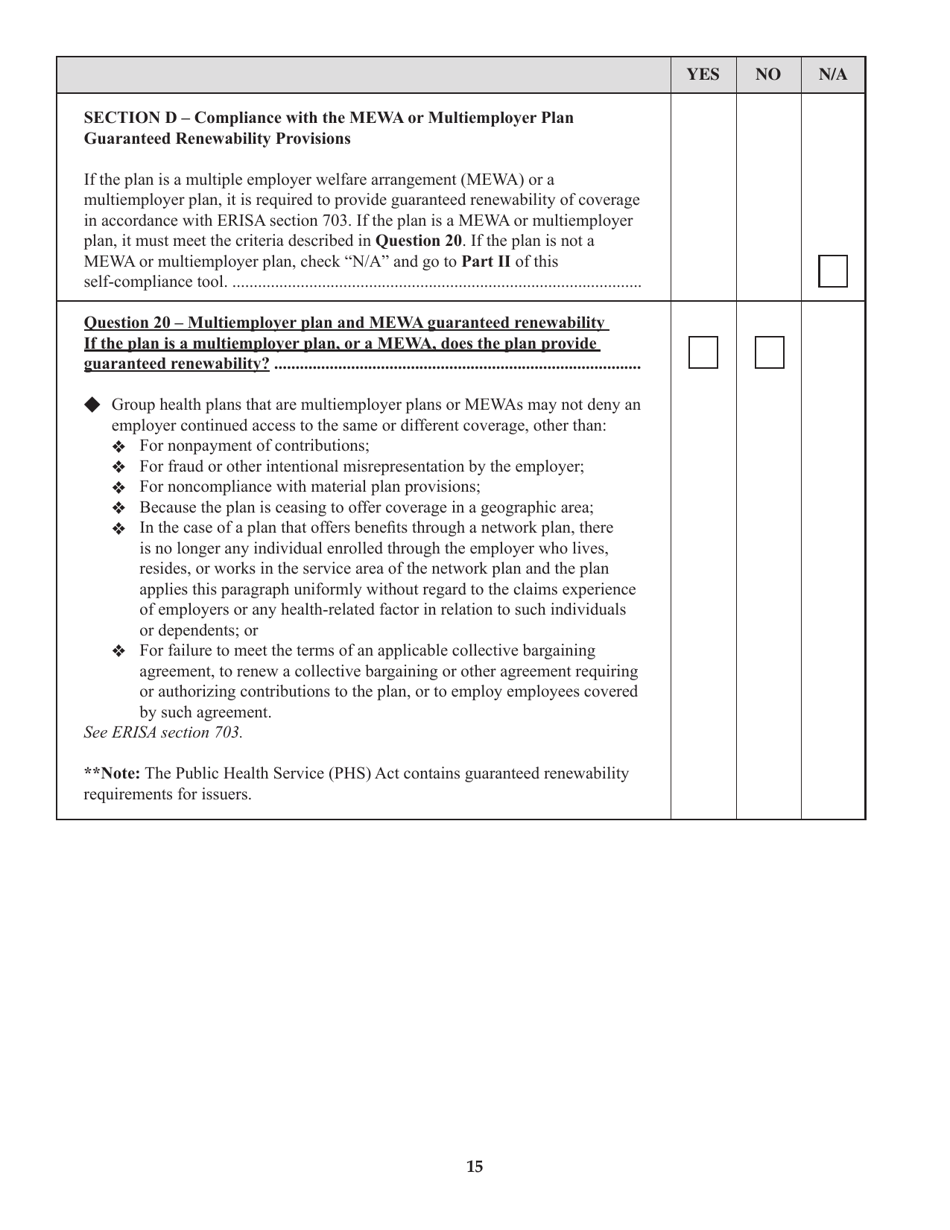

Q: What are Multiple Employer Welfare Arrangements (MEWAs)?

A: MEWAs are arrangements that provide welfare benefits, such as health insurance, to the employees of two or more employers.

Q: What are Certain Entities Claiming Exception (ECEs)?

A: ECEs are entities that claim exception from some or all requirements of being classified as a MEWA.

Q: Who needs to file Form M-1?

A: MEWAs and ECEs are required to file Form M-1.

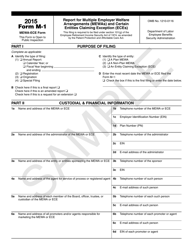

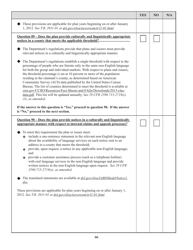

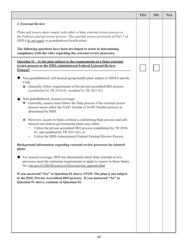

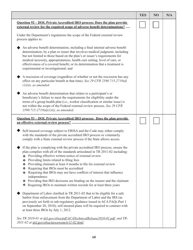

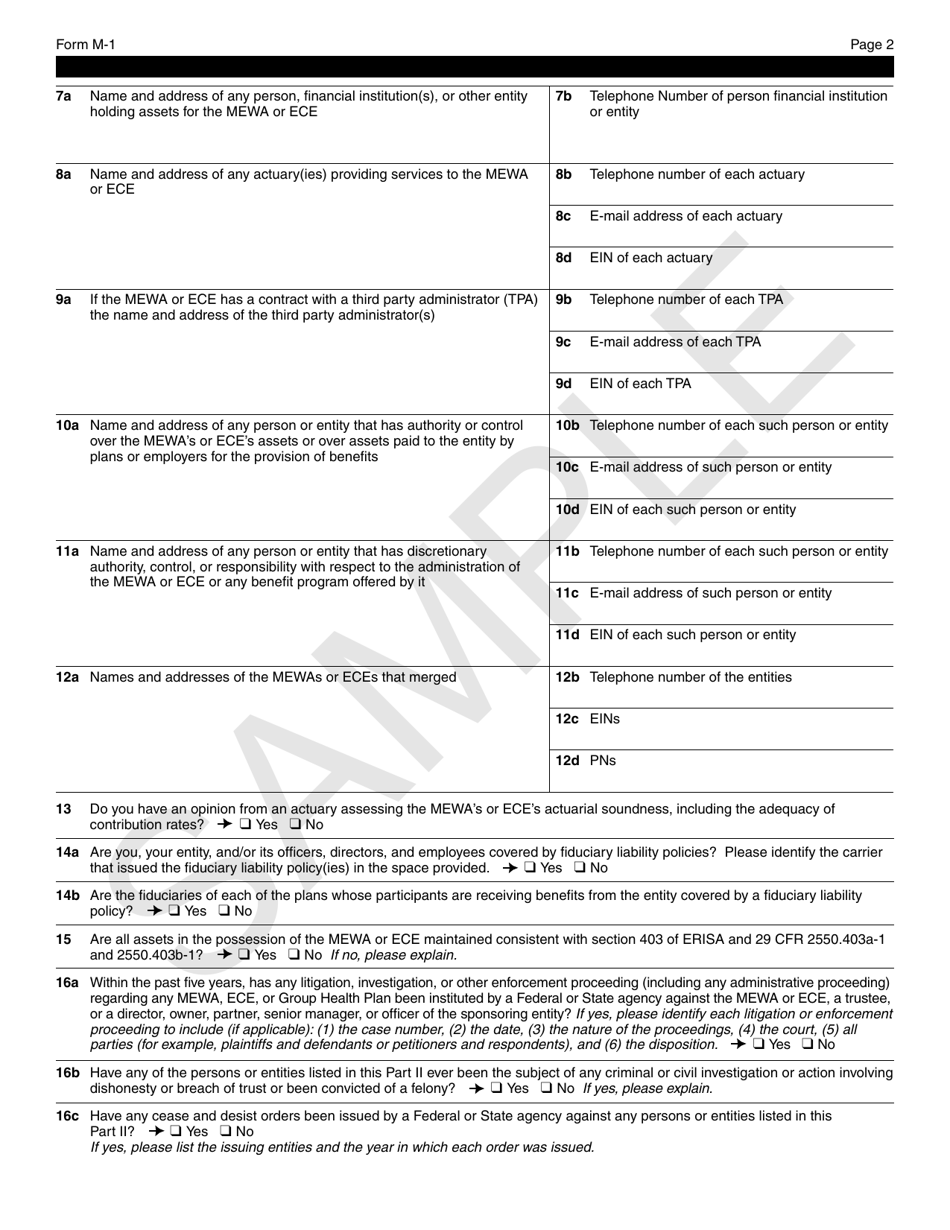

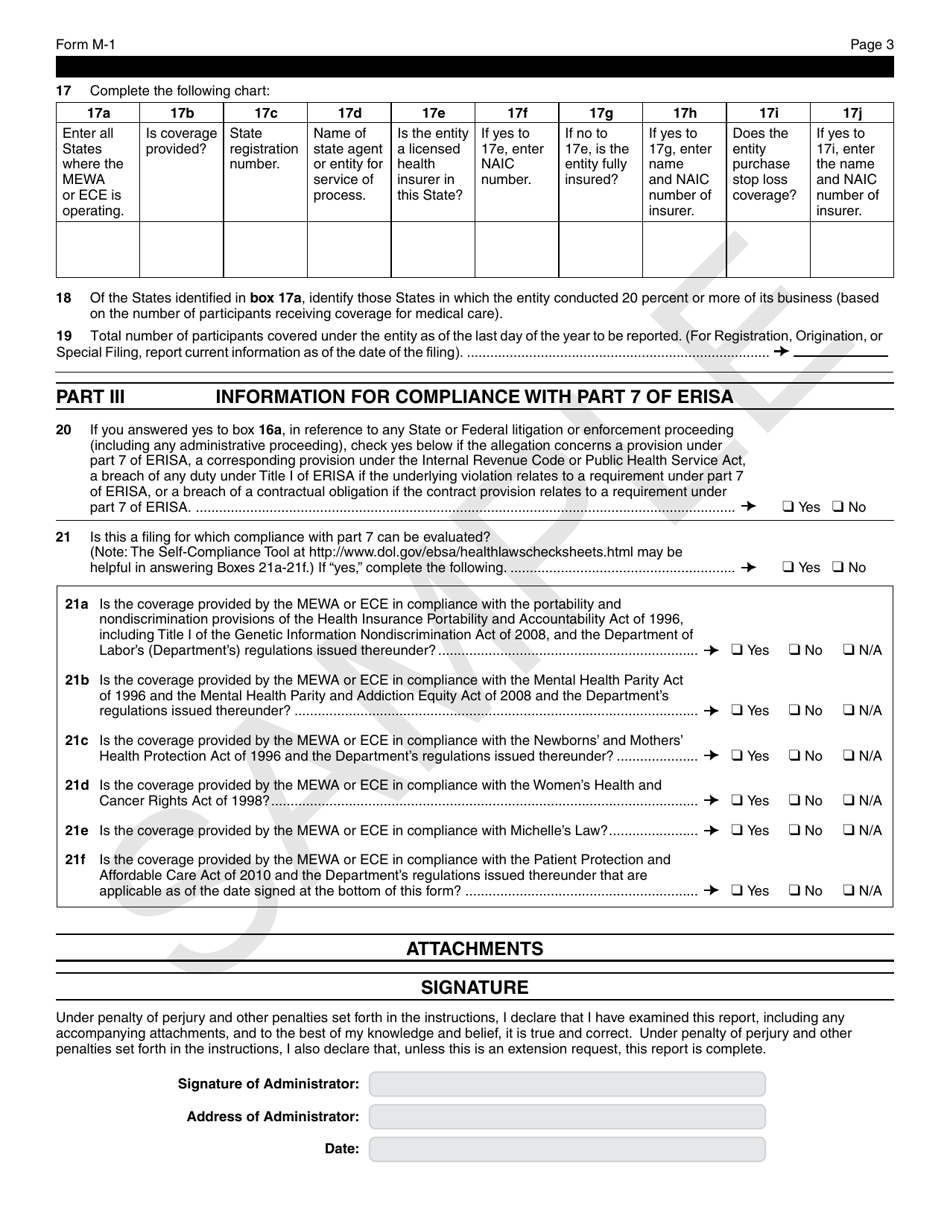

Q: What information is reported on Form M-1?

A: Form M-1 requires reporting on the structure, operation, and financial condition of the MEWA or ECE.

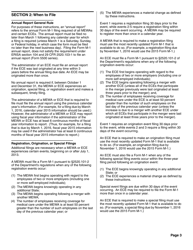

Q: When is Form M-1 due?

A: Form M-1 is due by the last day of the seventh month after the end of the MEWA's or ECE's plan year.

Q: Are there any penalties for not filing Form M-1?

A: Yes, failure to file Form M-1 can result in penalties and sanctions imposed by the Department of Labor.

Form Details:

- The latest available edition released by the U.S. Department of Labor;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-1 by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor.