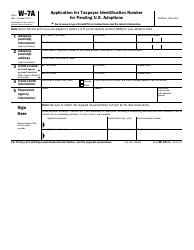

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form SS-4

for the current year.

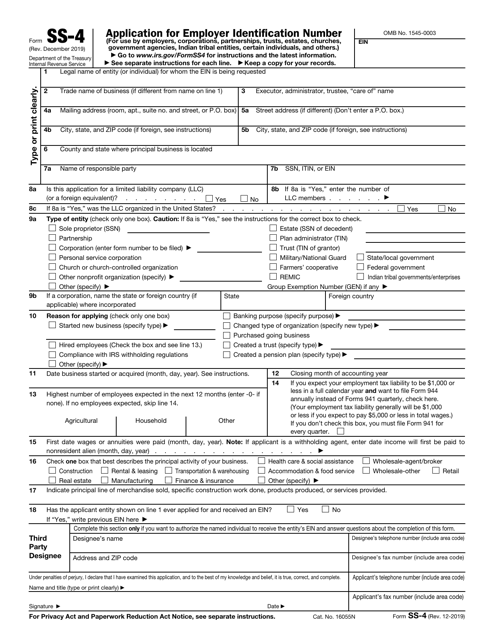

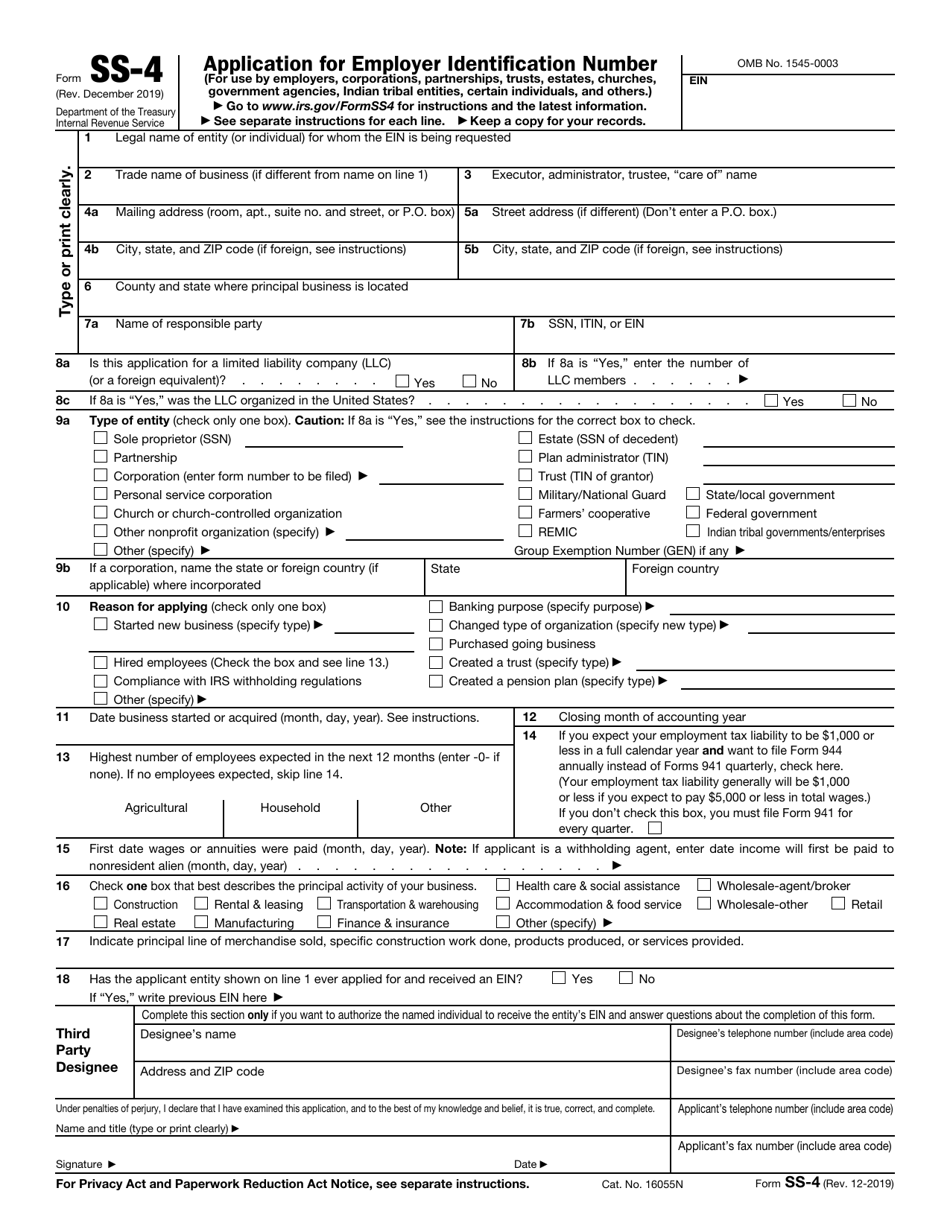

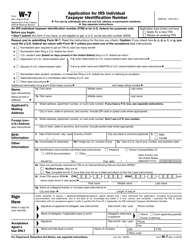

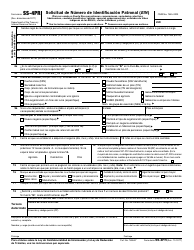

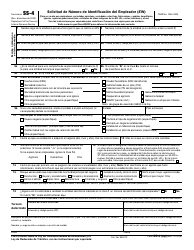

IRS Form SS-4 Application for Employer Identification Number

What Is Form SS-4?

IRS Form SS-4, Application for Employer Identification Number (EIN) , is a legal document filled out by various businesses that want to be assigned an employer identification number (EIN), also known as the tax identification number or federal employer identification number, for identifying and tax reporting. Without this number, it is impossible to track federal income tax payments and determine the amount of tax owed. It will be linked to your Internal Revenue Service (IRS) records and bank accounts. An EIN is used by all types of businesses - trusts, estates, government agencies, partnerships, corporations, etc. - even if they do not have any employees.

Alternate Name:

- Employer Identification Number Application.

The latest version of the form was issued on December 1, 2019 , with all previous editions obsolete. You can download a fillable Form SS-4 PDF through the link below.

Form SS-4 Instructions

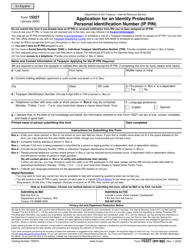

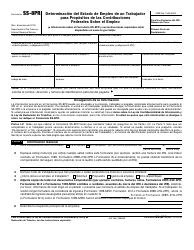

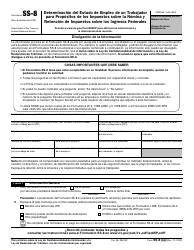

Provide the following details in the SS-4 Form:

- Write down your legal name and trade name (for businesses). Identify a designated individual who will receive tax information and the entity's responsible party - a person who controls or owns the business. Add your mailing and street addresses an entity's primary physical location.

- If your business is a limited liability company, check the appropriate box, record the number of its members, and state whether it was organized in the U.S.

- Indicate the type of entity you are filing for. If it is a corporation, enter the state or foreign country where it is incorporated.

- Check one applicable box to select the reason for applying - you have started a new business, hired employees, changed the type of organization, or require the EIN for banking purposes.

- Enter the date business started or was acquired and the closing month of the accounting year.

- State the highest number of employees you expect in the next year.

- Check the box if your employment tax liability will be $1,000 or less during the taxable year and you want to file Form 944, Employer's Annual Federal Tax Return, in order to pay employment taxes once a year.

- Indicate the date when the business with employees began paying annuities and wages.

- Describe the principal activity and line of products, services, or merchandise the entity works with, produces, or provides.

- If you have ever applied for the EIN, check the box and write down your previous EIN.

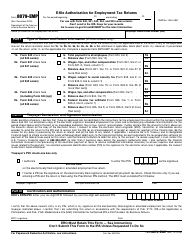

- Authorize the identified individual to receive the business's EIN and provide their contact details.

- Enter your name and title, sign and date the form.

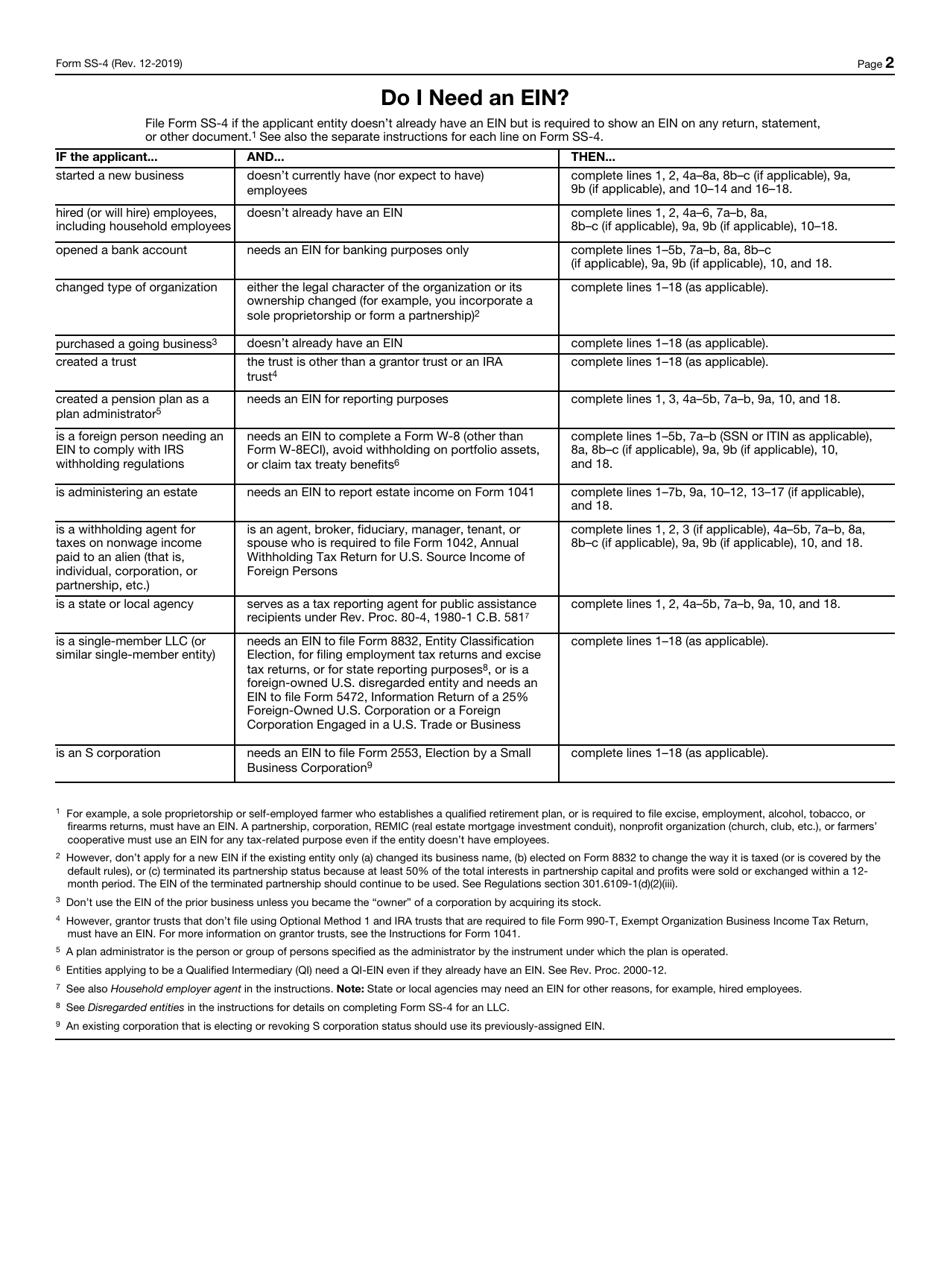

The second page of the form provides taxpayers with detailed information about the items on the application that must be completed in various situations. If you are looking for more information on the form, you may consult the separate Official Form SS-4 Instructions, also issued by the IRS.

Where to Mail SS-4?

Form SS-4 mailing address depends on your location:

- If your legal residence or principal place of business is located in one of the fifty states or the District of Columbia, submit the form to the IRS, Attn: EIN, Operation, Cincinnati, OH 45999;

- If you do not have a legal residence or principal office in any of the states or the District of Columbia, file the application to the IRS, Attn: EIN International Operation, Cincinnati, OH 45999.

Send the application at least four to five weeks before you will need to use the EIN. You or an authorized individual will receive the EIN in the mail in approximately one month.