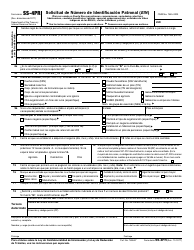

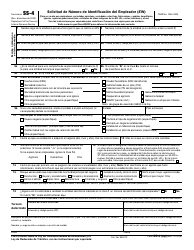

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form SS-4

for the current year.

Instructions for IRS Form SS-4 Application for Employer Identification Number (Ein)

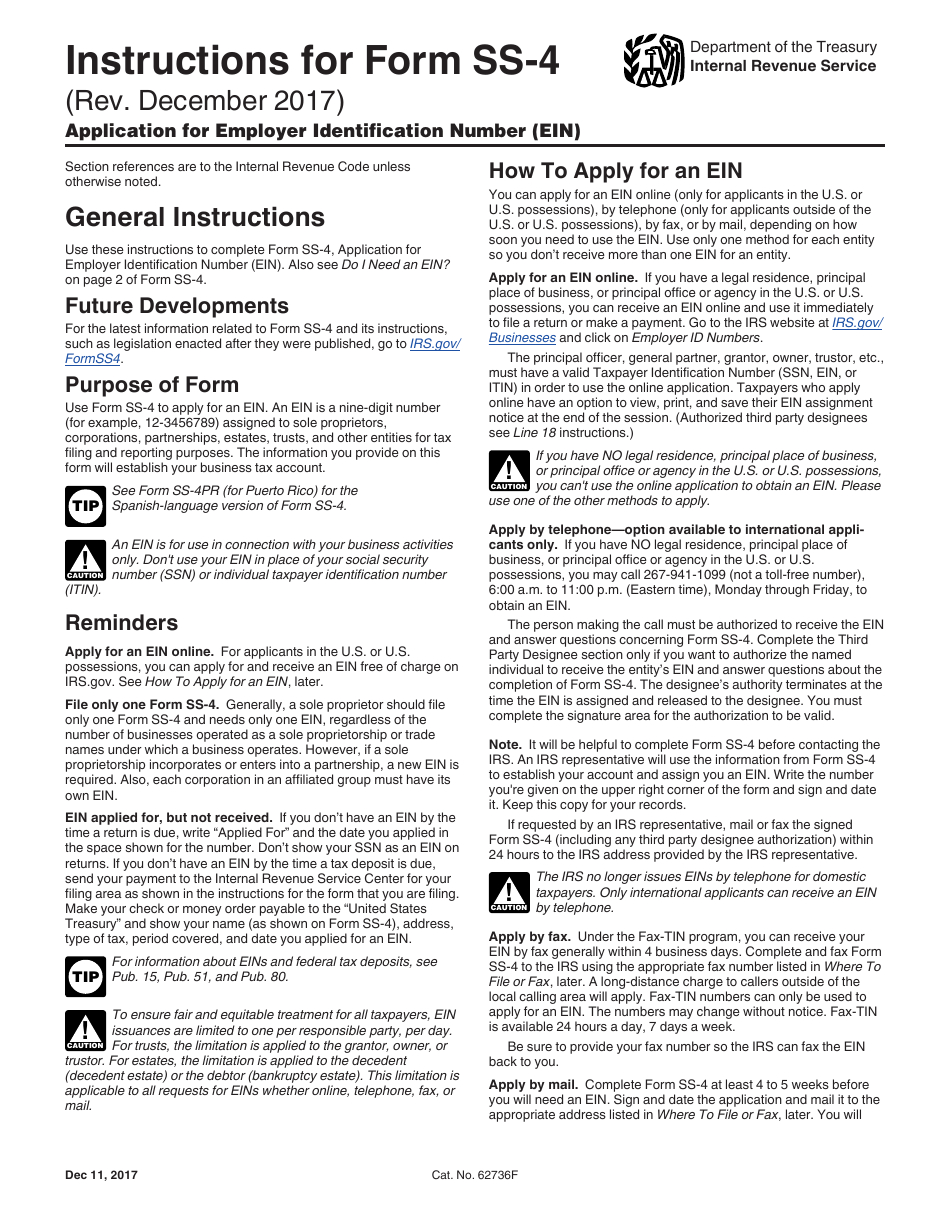

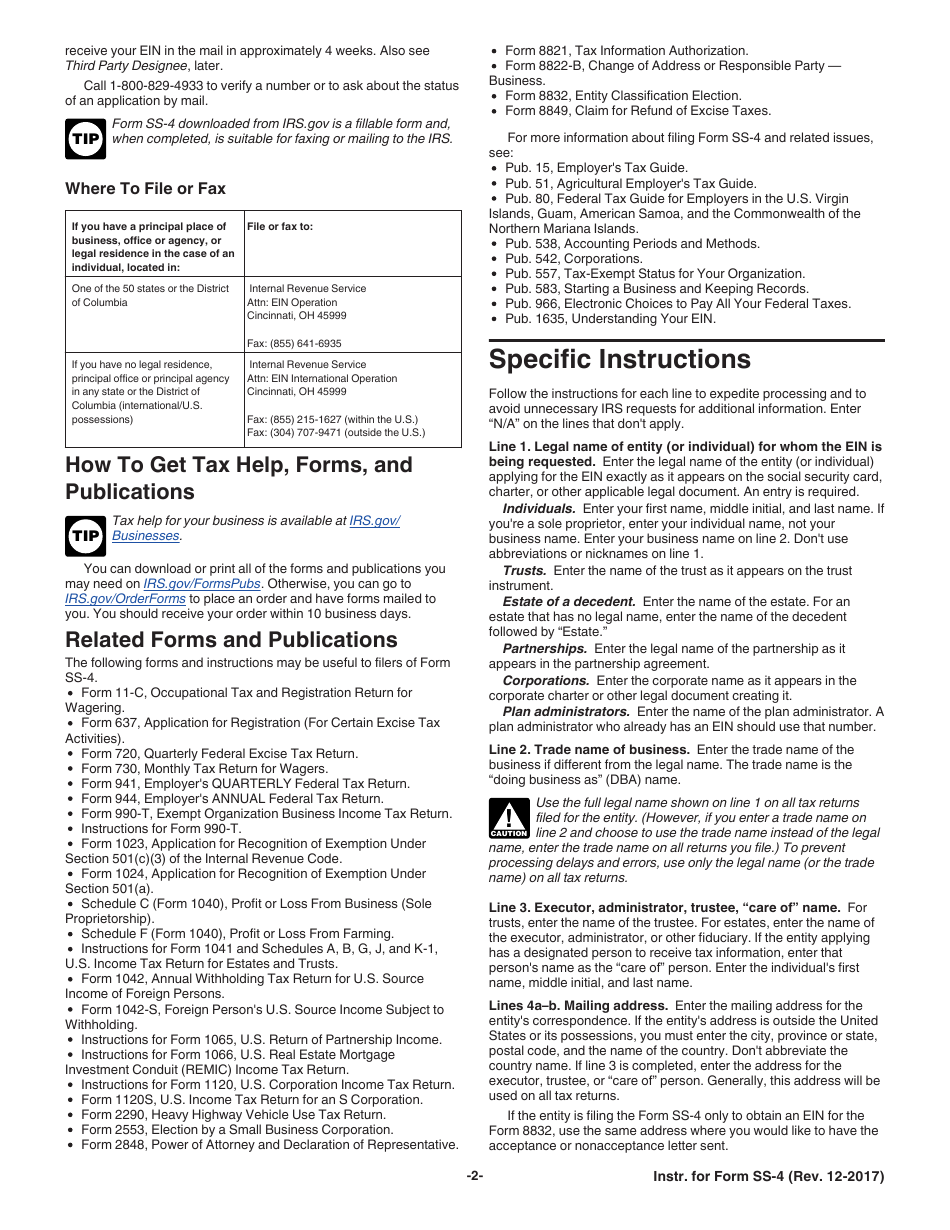

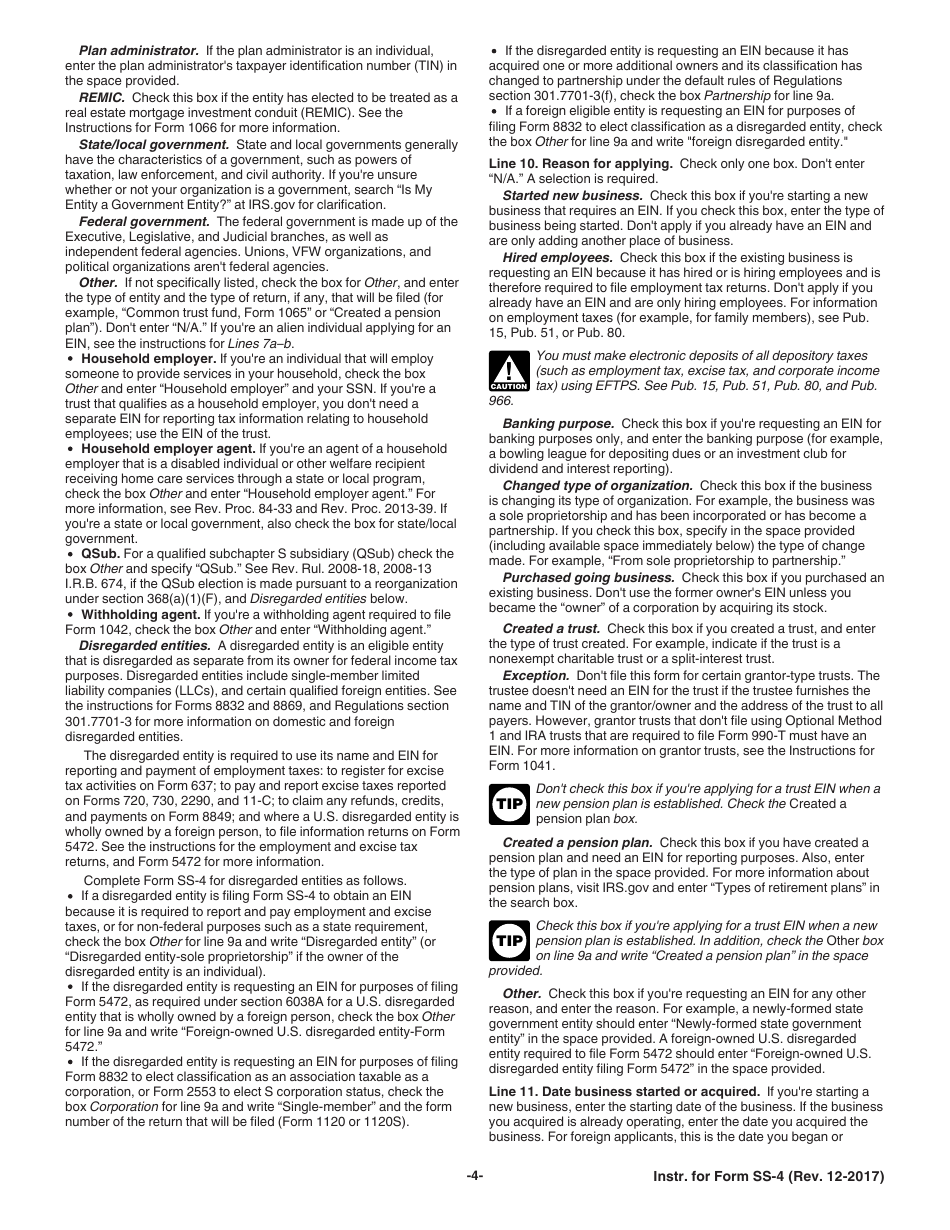

This document contains official instructions for IRS Form SS-4 , Application for Employer Identification Number (Ein) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form SS-4 is available for download through this link.

FAQ

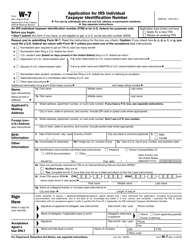

Q: What is Form SS-4?

A: Form SS-4 is an application for an Employer Identification Number (EIN).

Q: Who needs to fill out Form SS-4?

A: Anyone who is starting a business or other type of organization and needs an EIN.

Q: What information do I need to provide on Form SS-4?

A: You will need to provide information about your business or organization, such as the name, address, and type of entity.

Q: Is there a fee to apply for an EIN?

A: No, there is no fee to apply for an EIN.

Q: What is an EIN used for?

A: An EIN is used to identify a business or other type of organization for tax purposes.

Q: Do I need an EIN if I am a sole proprietor?

A: If you are a sole proprietor and do not have any employees, you may be able to use your Social Security Number instead of an EIN, but it is recommended to obtain an EIN for your business.

Instruction Details:

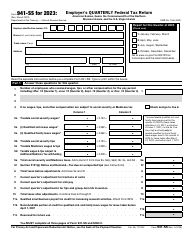

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.