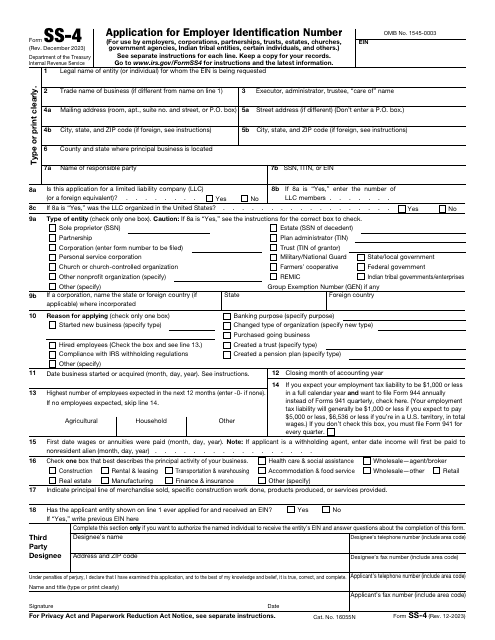

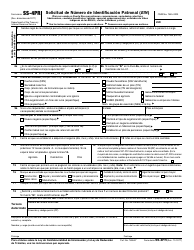

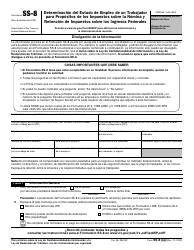

IRS Form SS-4 Application for Employer Identification Number

What Is IRS Form SS-4?

IRS Form SS-4, Application for Employer Identification Number (EIN), is a fiscal document used by taxpayers - from sole proprietors to corporations - to ask tax organizations for a unique identification number.

Alternate Names:

- Employer Identification Number Application;

- Tax Form SS-4;

- EIN Form;

- Federal Form SS-4.

Let the authorities know about your company, explain the reason behind the application, and get a number you will be able to use in all tax matters and all upcoming transactions with customers and associates.

This application was issued by the Internal Revenue Service (IRS) in , rendering older editions of the form obsolete. An IRS Form SS-4 fillable version is available for download below.

Check out the SS-4 Series of forms to see more IRS documents in this series.

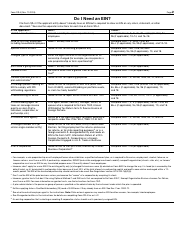

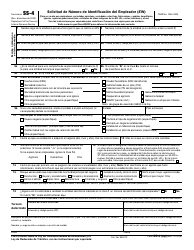

What Is Form SS-4 Used For?

Prepare and submit the Federal Form SS-4 to get an EIN for your business or organization you manage. The purpose of the EIN is to have a unique number that not only identifies your business for tax purposes when you are dealing with the government but also confirms you run a legitimate entity when signing agreements with business partners and offering products and services to your clients.

Whether you are hiring people to work for you on a permanent basis, opening a bank account to carry out various financial transactions, or getting permits and licenses necessary to conduct your business in the first place, you will be asked to disclose your EIN, and getting it is the first step - use the EIN Form to receive this number from the fiscal authorities.

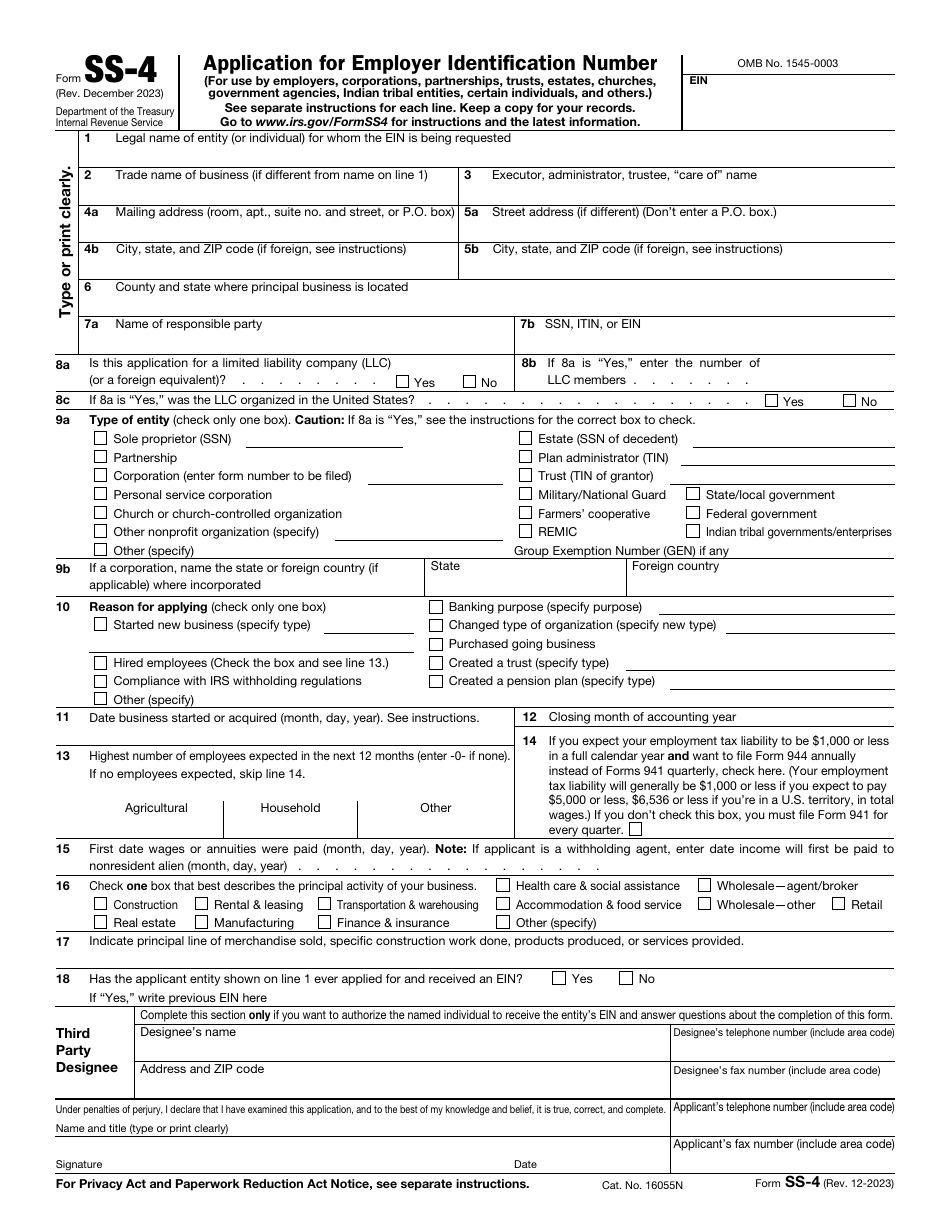

Form SS-4 Instructions

Follow these Form SS-4 Instructions to get an EIN:

-

State your full name or the name of your entity. The name you write down has to match the one indicated in the official documentation of your organization - for instance, an agreement that established your partnership or the corporate charter. Sole proprietors must record their own names.

-

Add the trade name if it is different from the legal one. Taxpayers are recommended to include their legal names only so that fiscal authorities do not delay the processing of the form. Identify the person who is supposed to receive information on behalf of the entity - it may be an administrator or personal representative.

-

Enter your correspondence address, specify the country and state where your main office is located, and state the name and taxpayer identification number of the individual in charge of the organization - the person who controls its assets and makes decisions as a principal officer or owner.

-

Check the appropriate box to confirm the form is filed by the limited liability company. Clarify the number of members in the entity if you answered yes and specify whether the organization was formed in the United States. Read the list of entity types and pick the one that applies to you - you can put a tick in one box only. In case you represent the interests of the corporation, add the name of the foreign country or state of incorporation.

-

Elaborate on the reason to submit an application - your entity may have been just formed, you require an EIN because you employ individuals now, a financial institution has asked you to provide an EIN, or you changed the type of organization. An EIN will be necessary if you set up a trust or pension plan. If the reason for filing is different, explain it in the document.

-

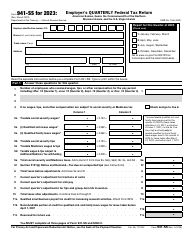

Indicate when you started the business or purchased it, add the last month of the fiscal period you follow, and state the maximum number of employees you are planning to have over the next year. In case your employment tax liability is going to be low, claim your eligibility to submit IRS Form 944, Employer's Annual Federal Tax Return. If you have employees already, write down the date when you started paying their salaries. Select the area closest to the activities your business conducts. Use the blank space to outline the products you sell, the work you do, or the services your entity renders. In case you had an EIN in the past, answer "yes" and indicate the number.

-

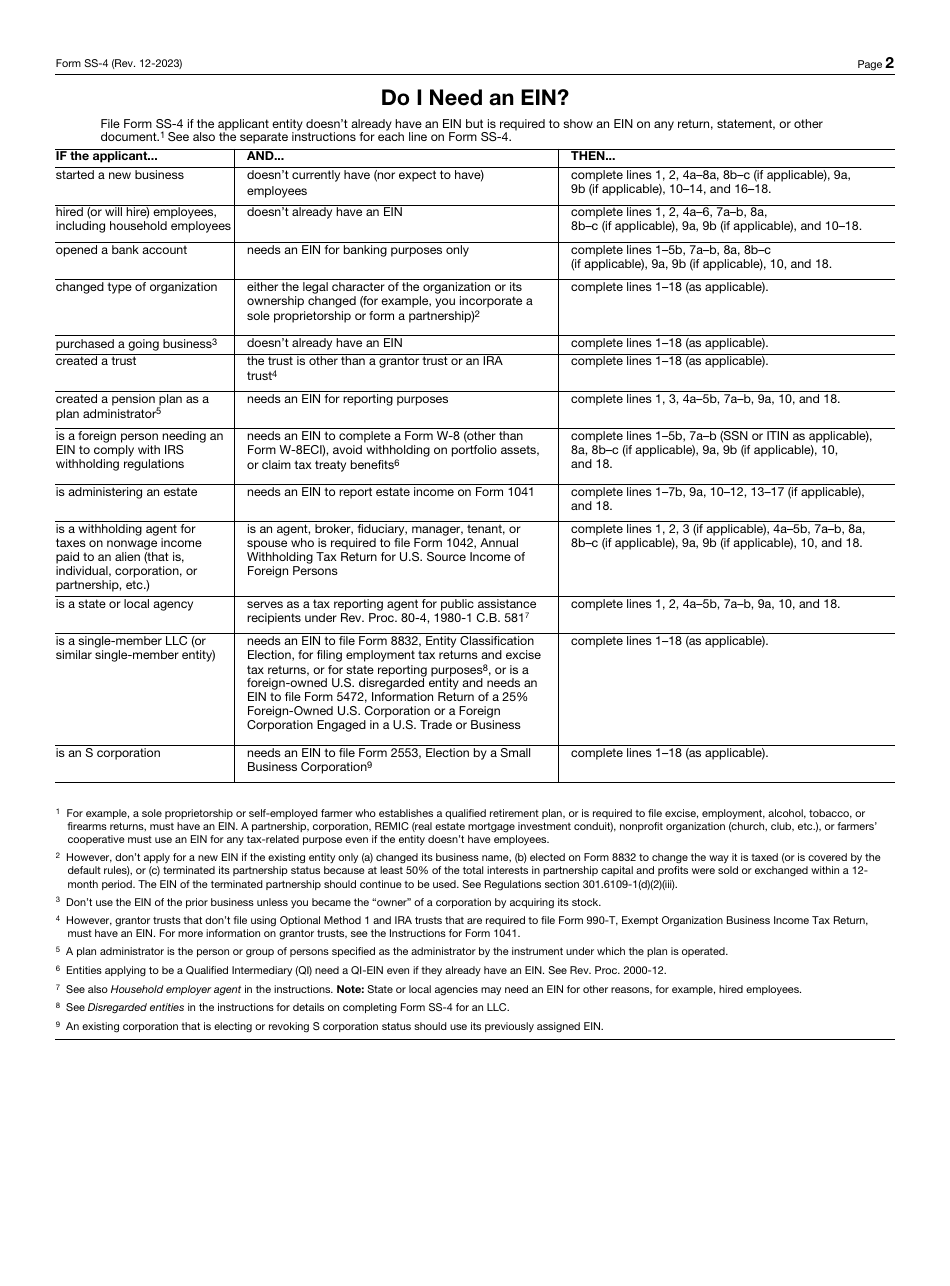

Certify the paperwork - sign the document and write down your name, title, and actual date. The signature must be handwritten - a Form SS-4 electronic signature is not accepted at the moment. In order to let the IRS reach out to you, the application has to contain your telephone number and fax number. It is permitted to identify an individual to receive the EIN as well as confirm they are allowed to discuss the matters with tax organs - write down the name and contact information of this person if necessary. Refer to the SS-4 Form instructions on the second page of the instrument to see what lines you need to fill out if you require further guidance.

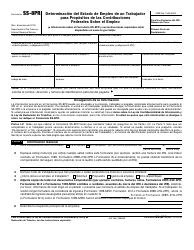

Where to Mail Form SS-4?

There are two different addresses for the SS-4 Tax Form - the details depend on the location of the individual or corporation submitting the paperwork:

-

Send the application to the IRS, Attn: EIN Operation, Cincinnati, OH 45999, if you are living or carrying out your business operation in one of the states or the District of Columbia.

-

File the instrument with the IRS, Attn: EIN International Operation, Cincinnati, OH 45999, if you mail the papers while residing abroad or acting on behalf of an organization that does not have an office in one of the states.

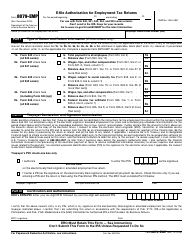

Where to Fax Form SS-4?

Taxpayers are allowed to file Form SS-4 via fax if this is more convenient to them - it is possible to get your EIN within four business days after submitting the document. This is one of the easiest ways to apply for EIN since you can do it at any time during the day or night, without waiting for a local post office to open.

The fax number is 855-641-6935 if you reside in any of the fifty states or the District of Columbia. In case you do not have a permanent residence at the moment or the corporation, entity, or agency you represent does not have an office anywhere in the country, the number you should use is 855-215-1627. If you are currently abroad, the correct fax number is 304-707-9471.

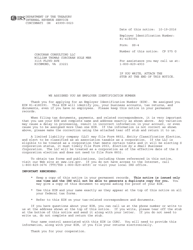

How to Get a Copy of Your SS-4 Form?

If you want to obtain a copy of the Tax Form SS-4 for the records of your organization, you can do it in two different ways - either download it from the IRS website after filing an application online or reach out to the tax authorities by calling their Business and Specialty Tax Line. Note that if a potential business partner or financial entity asks for proof the EIN is truly yours, you can show them an assignment letter you received from fiscal organs to confirm the EIN was obtained legally.