This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 2848

for the current year.

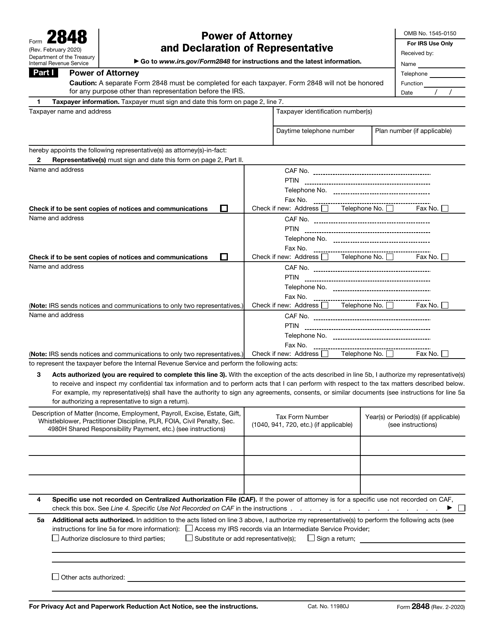

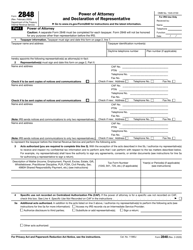

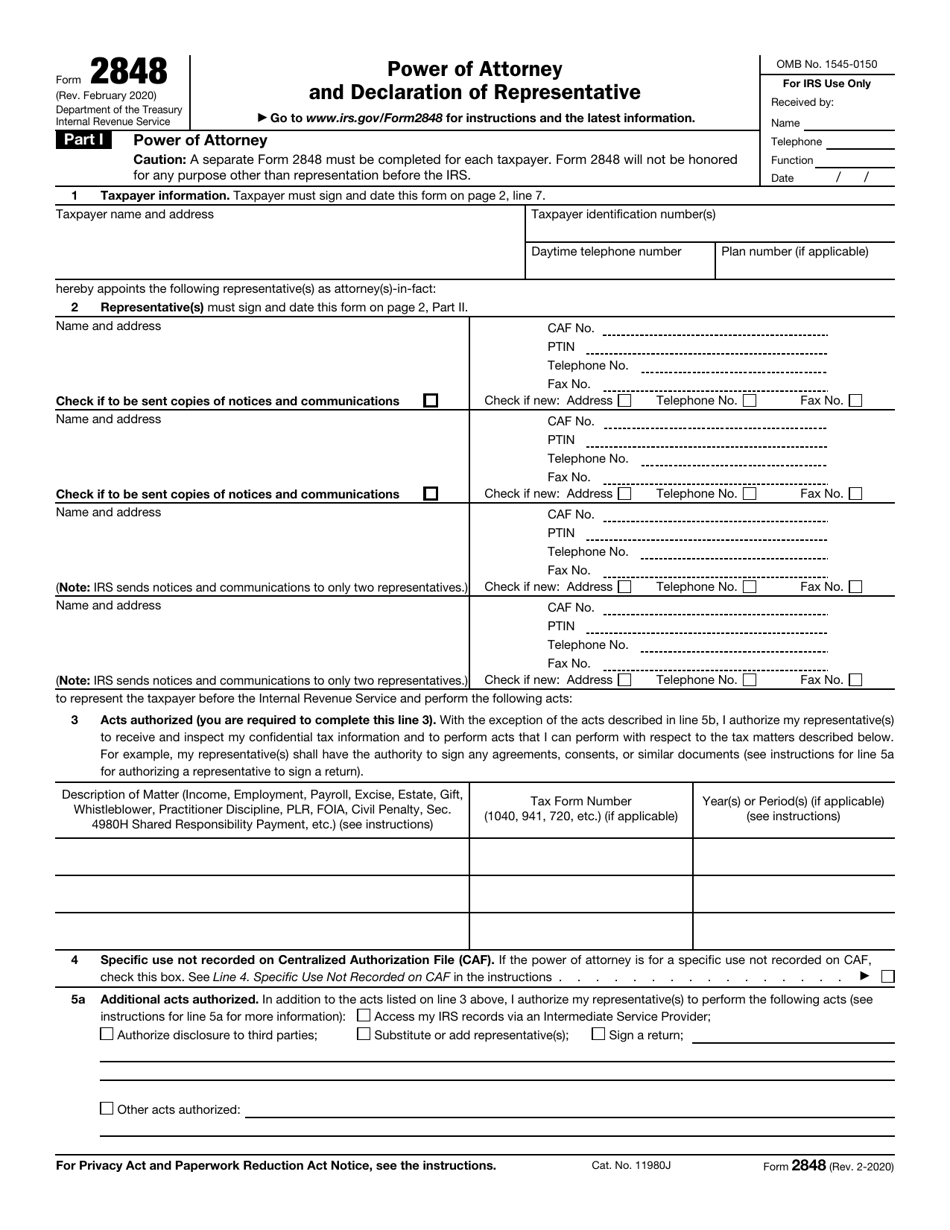

IRS Form 2848 Power of Attorney and Declaration of Representative

What Is Form 2848?

IRS Form 2848, Power of Attorney and Declaration of Representative , is a document released for taxpayers who would like to empower a person to appear on their behalf before the Internal Revenue Service (IRS). The individual who represents a taxpayer, in this case, must be qualified to act as a lawyer and a filer should consider that by using this application they will also empower the authorized person with access to any of their confidential tax information.

If a filer has a dispute with the IRS, but their income is low, they are offered to allow a student from a qualified Low Income Taxpayer Clinic to act on their behalf under a special appearance authorization released by the Taxpayer Advocate Service.

The application was issued by the IRS and was last revised in February 2020 . A Form 2848 fillable version is available for download below.

Form 8821 Vs. Form 2848

Due to their similarities, Form 2848 is sometimes confused with Form 8821, Tax Information Authorization. However, there is a big difference between them in the amount of rights that they allow representatives to hold during the process. While Form 8821 gives a qualified individual access to a taxpayer's confidential information dedicated to their tax return, it doesn't give them the right to act on behalf of a taxpayer. Form 2848 gives the eligible individual both features, so if a filer is interested in a representative who will interact with the IRS and see any of their confidential information, they should choose Form 2848.

Form 2848 Instructions

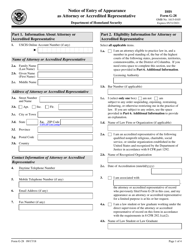

Completing Form 2848 is a straightforward process, however, if a filer is experiencing any difficulties they should follow the official IRS Form 2848 Instructions. The application consists of two parts:

- Power of Attorney . Some of the most important aspects of this part are:

- Information about the taxpayer . In the first part of the document a filer must enter their name, address, daytime telephone number, taxpayer identification number, etc.;

- Information about the representative . Here an applicant must designate their representative's name and address, daytime telephone number, fax number, etc.;

- The acts that a representative is authorized to perform . Individuals use this section to describe acts that a representative is authorized to perform, the description of the matter, tax form number and the period (if applicable);

- Exception from those acts . If an applicant has any specific deletions from the acts their representative is authorized to perform, they should list them here.

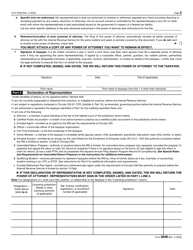

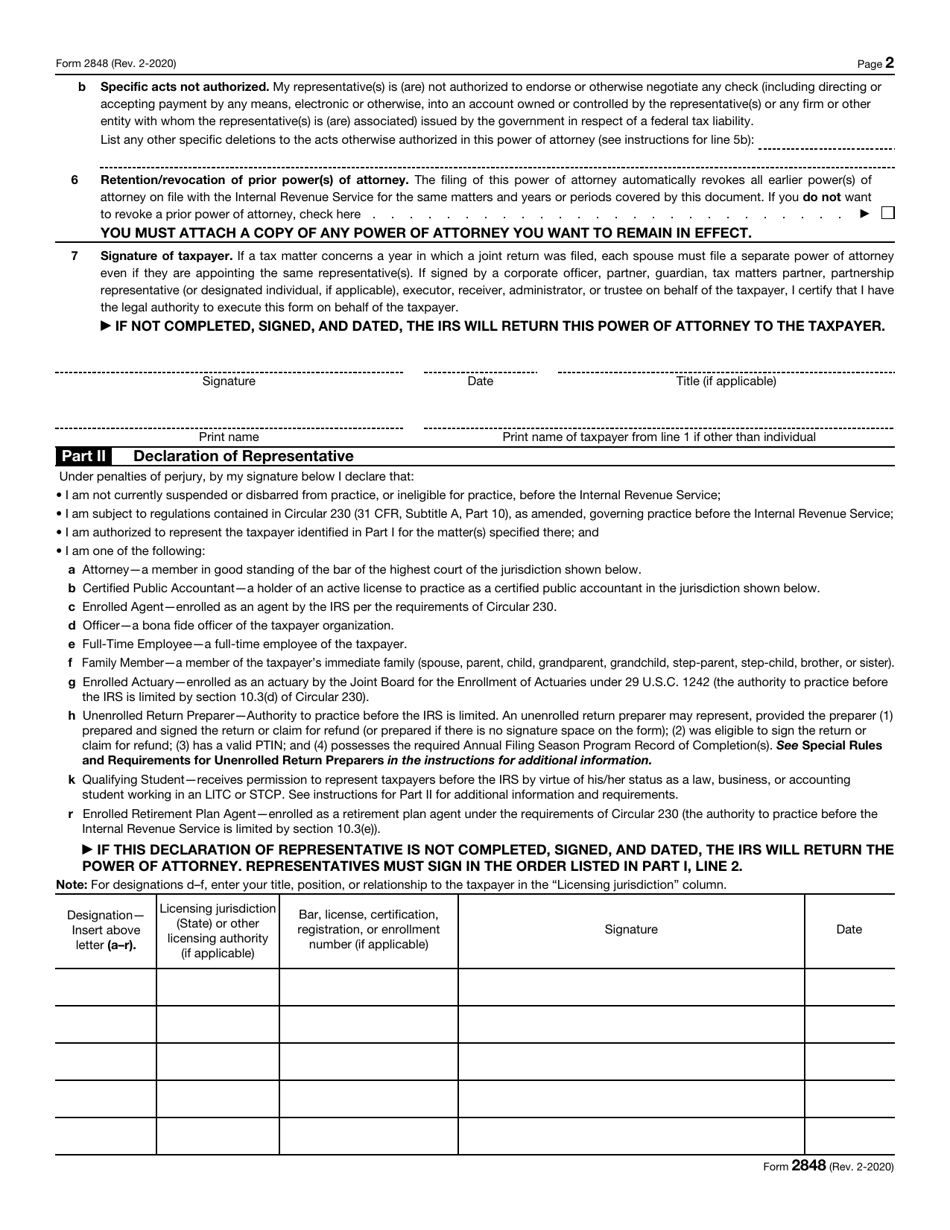

- Declaration of Representative . The second part of the application is supposed to be signed by the representative. Here they declare that they are not disbarred from performing law, ineligible for practice, authorized to act on behalf of a taxpayer, etc. The qualified individual is also presented with a list of designations that they are supposed to choose from when signing the document. They must also state their licensing authority, license number (or certification number, if applicable), and the date when the document was signed.

Where to File Form 2848?

After a filer completes the application, they must submit it to the IRS. The address where to file the document depends on the state where an applicant lives.

| A place where a filer lives | IRS address |

| Alabama, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia | Internal Revenue Service 5333 Getwell Road Stop 8423 Memphis, TN 38118 |

| Alaska, Arizona, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wisconsin, Wyoming | Internal Revenue Service 1973 Rulon White Blvd., MS 6737 Ogden, UT 84201 |

| APO and FPO addresses, American Samoa, nonpermanent residents of Guam or the U.S. Virgin Islands, Puerto Rico, U.S. citizens residing in a foreign country | Internal Revenue Service International CAF Team 2970 Market Street MS: 4-H14.123. Philadelphia, PA 19104 |

| Permanent residents of Guam | Guam Department of Revenue and Taxation, PO Box 23607, GMF, GU 96921 |

| Permanent residents of the U.S. Virgin Islands | V.I. Bureau of Internal Revenue, 6115 Estate Smith Bay, Suite 225, St. Thomas, VI 00802 |