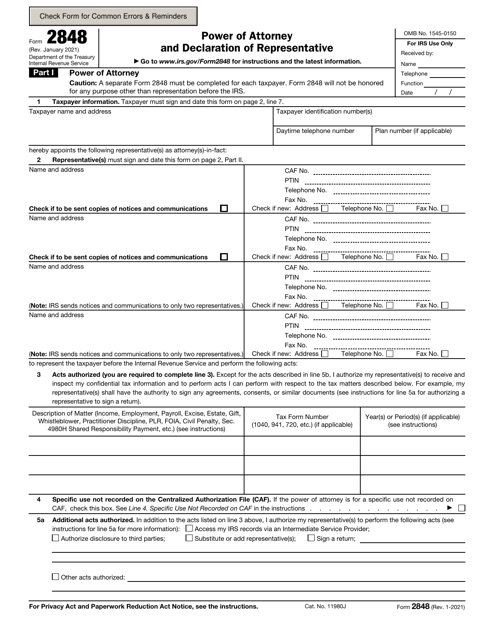

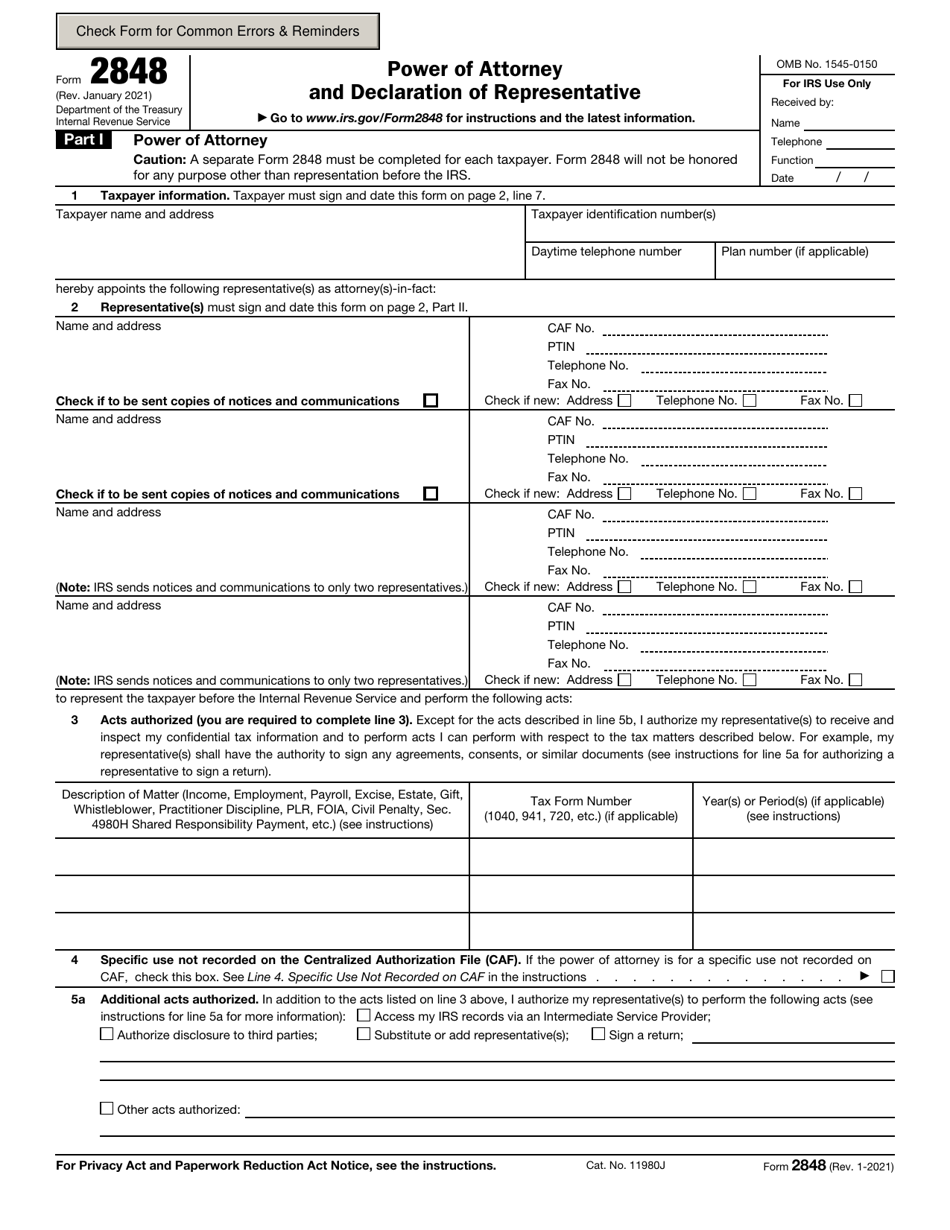

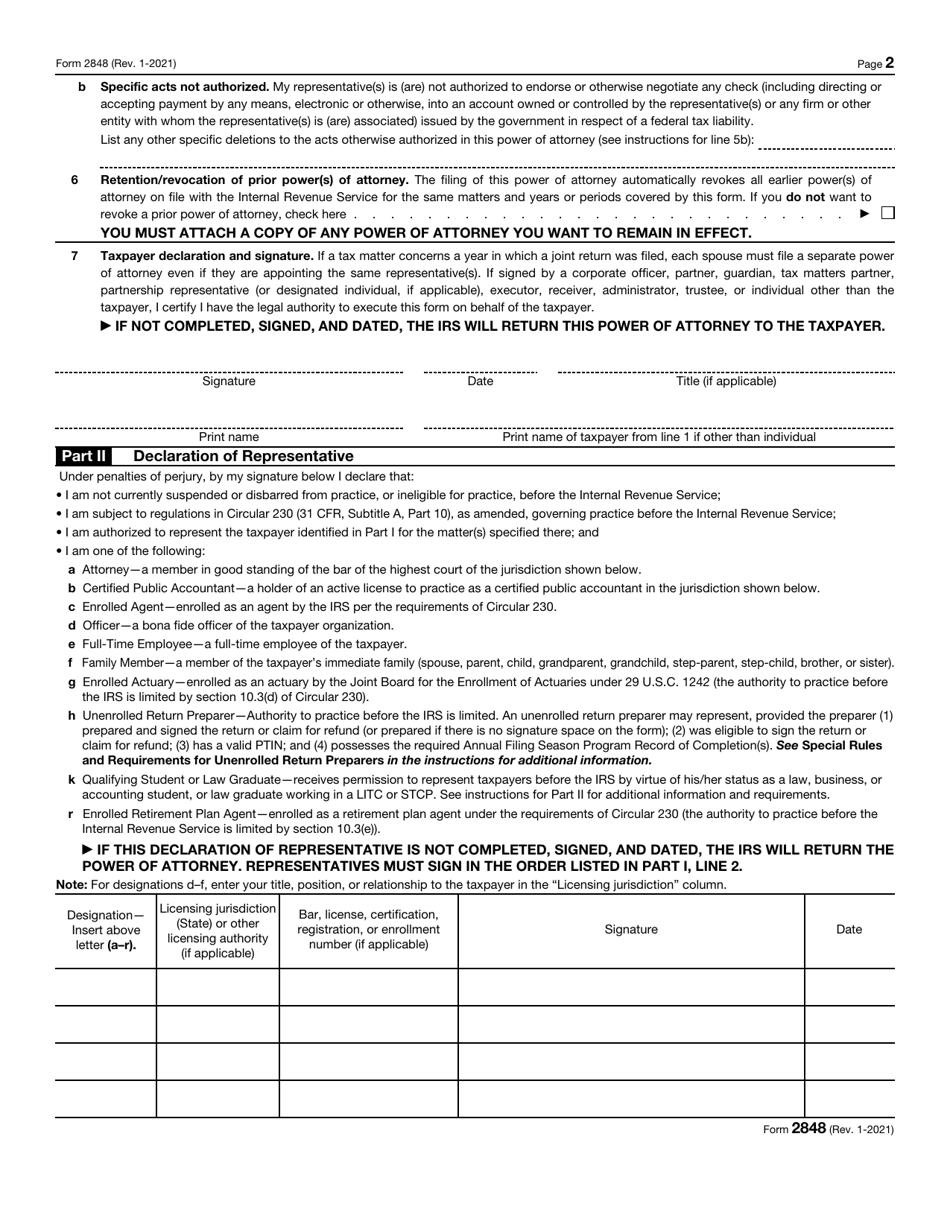

IRS Form 2848 Power of Attorney and Declaration of Representative

What Is IRS Form 2848?

IRS Form 2848, Power of Attorney and Declaration of Representative, is a formal statement used by a taxpayer to entrust their representative to perform specific actions in their name.

Alternate Names:

- Tax Form 2848;

- POA Form 2848.

If you want your family member or legal counsel to receive documentation from fiscal authorities and respond the right way or you need to file an appeal to settle any dispute with tax organs, you can do it with the assistance of another person as long as they have an authorization you filled out and signed.

This form was released by the Internal Revenue Service (IRS) in - previous editions of the authorization are now outdated. You may download an IRS Form 2848 fillable version via the link below.

What Is Form 2848 Used For?

Complete and submit IRS Form 2848 if you require another person to deal with the IRS while you are occupied with other matters or simply unable to take care of complicated issues that demand knowledge and skills you do not have. Taxpayers have an opportunity to ask their relatives, lawyers, and professional tax preparers to help them out with tax documentation and potential communication with fiscal authorities but to make it official, they have to authorize the individual properly.

While you are not relieved of your tax duties, the IRS will reach out to the person you named in the authorization and talk about tax matters you specify in writing whether you are negotiating a refund, going through a difficult audit, or letting the representative prepare and certify your tax return.

Form 8821 Vs. Form 2848

Due to their similarities, Form 2848 is sometimes confused with Form 8821, Tax Information Authorization. However, there is a big difference between them in the amount of rights that they allow representatives to hold during the process. While Form 8821 gives a qualified individual access to a taxpayer's confidential information dedicated to their tax return, it doesn't give them the right to act on behalf of a taxpayer. Form 2848 gives the eligible individual both features, so if a filer is interested in a representative who will interact with the IRS and see any of their confidential information, they should choose Form 2848.

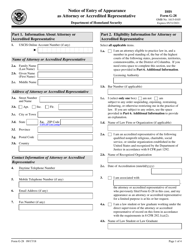

Form 2848 Instructions

The Form 2848 Instructions are as follows:

-

Identify yourself - write down your full name, taxpayer identification number, mailing address, telephone number, and the number of the plan (the latter is required if the objective of the document is to represent the interests of the employee).

-

List the details of people you want to authorize as your representatives. You need to state their names, addresses, telephone numbers, and fax numbers. Every individual must have their own Centralized Authorization File (CAF) number as well as a Preparer Tax Identification Number (PTIN). It is allowed to submit the form without the CAF number assigned to the representative - in this case, write down "none" so that fiscal authorities provide the number. However, you may only give the power of attorney to the individual who at the very least applied for a PTIN. Check the appropriate box to confirm you agree to one or two representatives identified in writing receiving formal notices from the IRS.

-

Provide a full description of the tax matter you want the representative to deal with instead of you. It is necessary to specify whether you want this individual to handle your income tax or penalties, indicate the numbers of tax forms they will discuss with the IRS, and the fiscal periods these matters are related to.

-

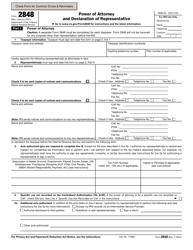

Check boxes to elaborate on additional actions you intend to authorize whether the representative will disclose your tax information to other parties, sign the papers instead of you, or gain access to your tax records. It is also your right to prevent them from carrying out specific actions. Put a tick in the box if you are not revoking the powers of attorney you signed previously and certify the documentation.

-

Obtain consent of the representative to act on your behalf. They must confirm their own status when they sign the instrument - they may be a professional lawyer, your close relative, or even a student who has enough expertise and permission to be authorized to work on matters of this kind. The representative records the letter that describes their status, clarifies their jurisdiction and certification, signs the form, and adds the actual date.

Where to File Form 2848?

After a filer completes the application, they must submit it to the IRS. The address where to file the document depends on the state where an applicant lives.

| The place where the filer lives | IRS address |

| Alabama, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia | Internal Revenue Service 5333 Getwell Road Stop 8423 Memphis, TN 38118 |

| Alaska, Arizona, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wisconsin, Wyoming | Internal Revenue Service 1973 Rulon White Blvd., MS 6737 Ogden, UT 84201 |

| APO and FPO addresses, American Samoa, nonpermanent residents of Guam or the U.S. Virgin Islands, Puerto Rico, U.S. citizens residing in a foreign country | Internal Revenue Service International CAF Team 2970 Market Street MS: 4-H14.123. Philadelphia, PA 19104 |

| Permanent residents of Guam | Guam Department of Revenue and Taxation, PO Box 23607, GMF, GU 96921 |

| Permanent residents of the U.S. Virgin Islands | V.I. Bureau of Internal Revenue, 6115 Estate Smith Bay, Suite 225, St. Thomas, VI 00802 |

Where to Fax Form 2848?

The Form 2848 fax number depends on the location of the taxpayer:

-

If you reside in Alabama, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, or West Virginia, use the 855-214-7519 number.

-

Fax the form to the number 855-214-7522 in case you are currently living in Alaska, Arizona, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wisconsin, or Wyoming.

-

Taxpayers that reside in one of the U.S. territories or use a military address to receive their correspondence must fax the paperwork to the number 855-772-3156.

-

Use the number 304-707-9785 if you live in a foreign country.

How to File Form 2848 Electronically?

It is possible to submit Form 2848 online as long as the authorized representative has confirmed the identity of their client and ensured the document contains an electronic or ink signature. You may use your account on the official IRS website - log in undergoing a process of authentication, answer several questions about the instrument you have at your disposal, and upload the form you received from the taxpayer willing to let you act on their behalf in tax matters.

How to Revoke Form 2848?

If you no longer want the person identified in the POA Form 2848 to represent your interests, you have an opportunity to withdraw your authorization. To do so, write down the word "REVOKE" on the first page of the form, above the form title. Inform fiscal authorities about your decision by mailing a copy of the document marked with the revocation confirmation to the local IRS office - the same one where you filed the paperwork in the first place.

It is possible you do not have the document at your disposal anymore - in this case, revoke the authorization by submitting a detailed statement that certifies your decision, explains the tax matters the representative was involved in, and identifies all the people that acted on your behalf.