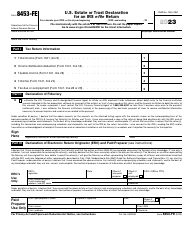

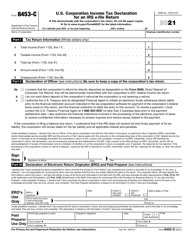

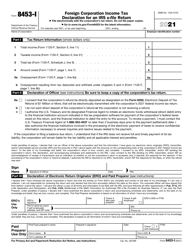

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 2848

for the current year.

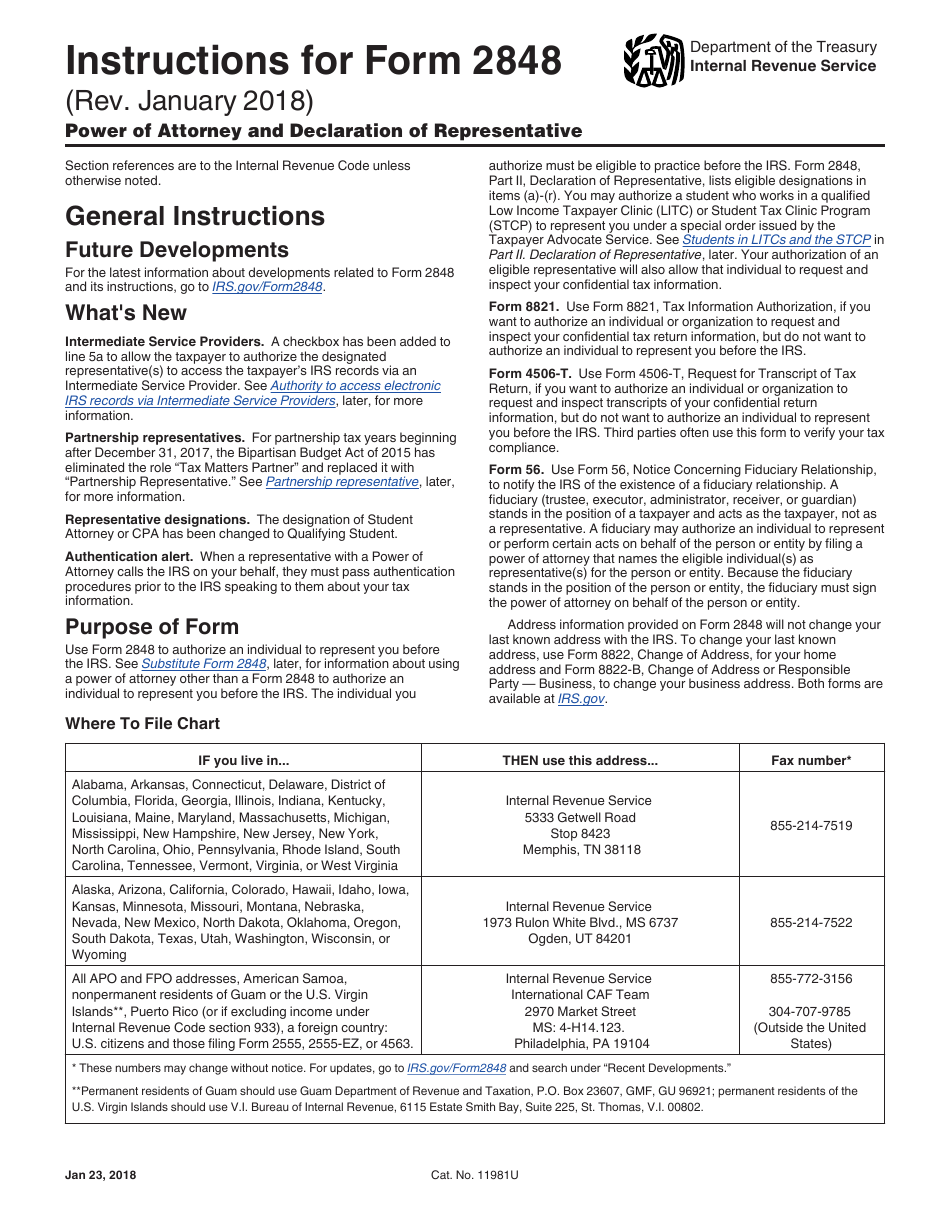

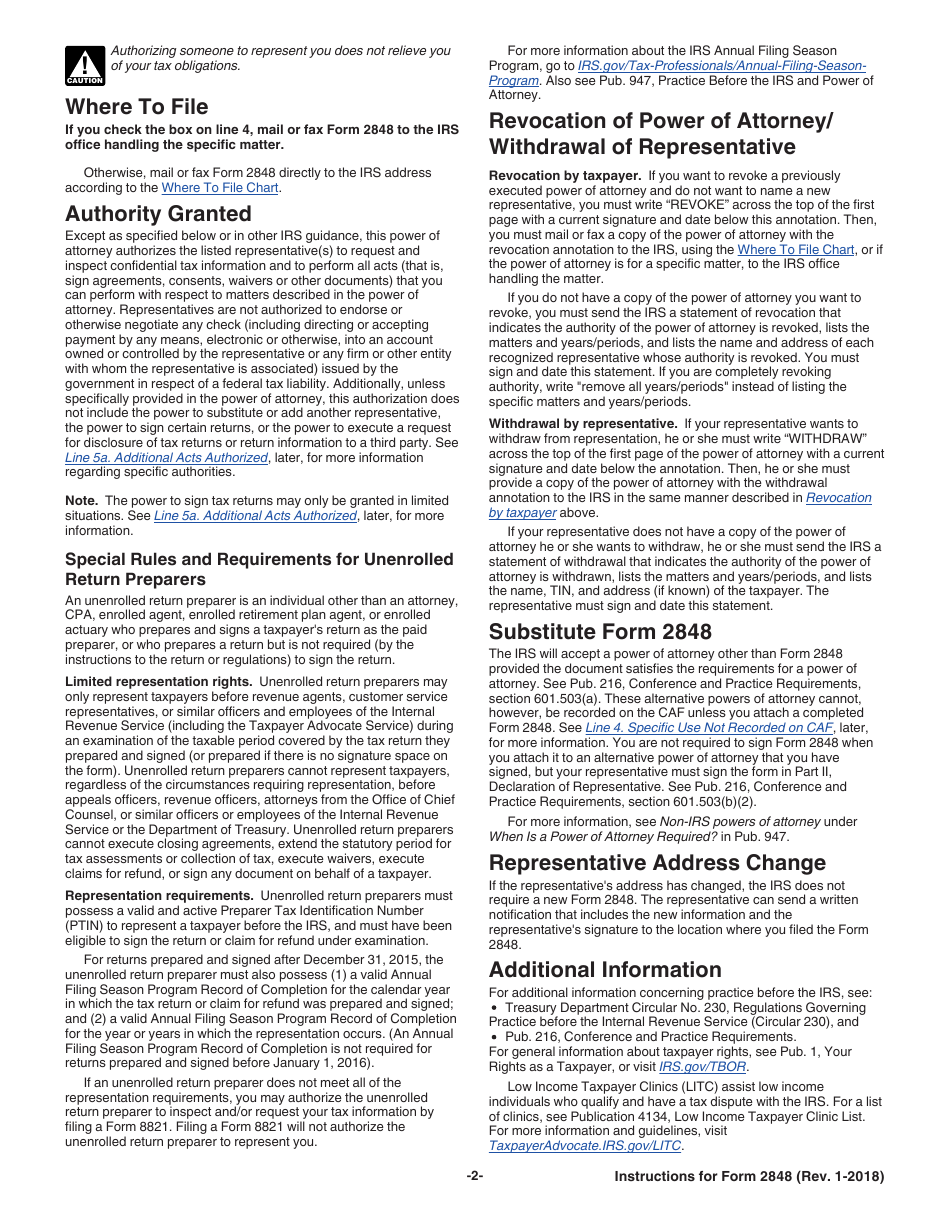

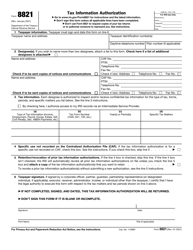

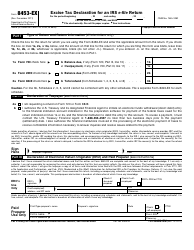

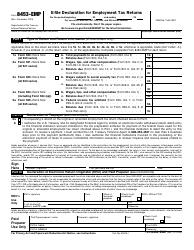

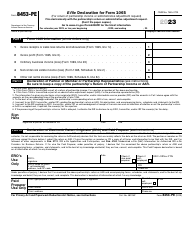

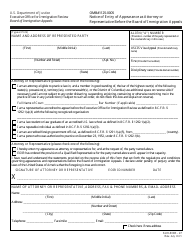

Instructions for IRS Form 2848 Power of Attorney and Declaration of Representative

This document contains official instructions for IRS Form 2848 , Power of Attorney and Declaration of Representative - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2848 is available for download through this link.

FAQ

Q: What is Form 2848?

A: Form 2848 is the Power of Attorney and Declaration of Representative.

Q: What is the purpose of Form 2848?

A: The purpose of Form 2848 is to authorize someone to represent you before the IRS.

Q: Who should file Form 2848?

A: You should file Form 2848 if you want to grant someone the authority to act on your behalf before the IRS.

Q: How do I fill out Form 2848?

A: You need to provide your personal information, the representative's information, and specify the tax matters the representative is authorized to handle.

Q: Do I need to sign Form 2848?

A: Yes, both you and the representative must sign Form 2848.

Q: How long does Form 2848 remain in effect?

A: Form 2848 remains in effect until you revoke it or it expires.

Q: Can I use Form 2848 for state tax matters?

A: No, Form 2848 is only for authorizing representation before the IRS.

Q: Can I use Form 2848 for multiple tax years?

A: Yes, you can use Form 2848 to authorize representation for multiple tax years.

Q: What happens if I no longer want the representative to act on my behalf?

A: You can revoke Form 2848 by sending a written statement to the IRS office handling your tax matters.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.