This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990

for the current year.

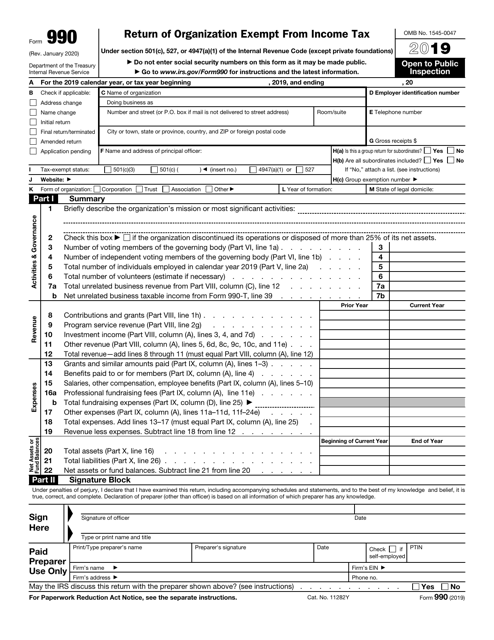

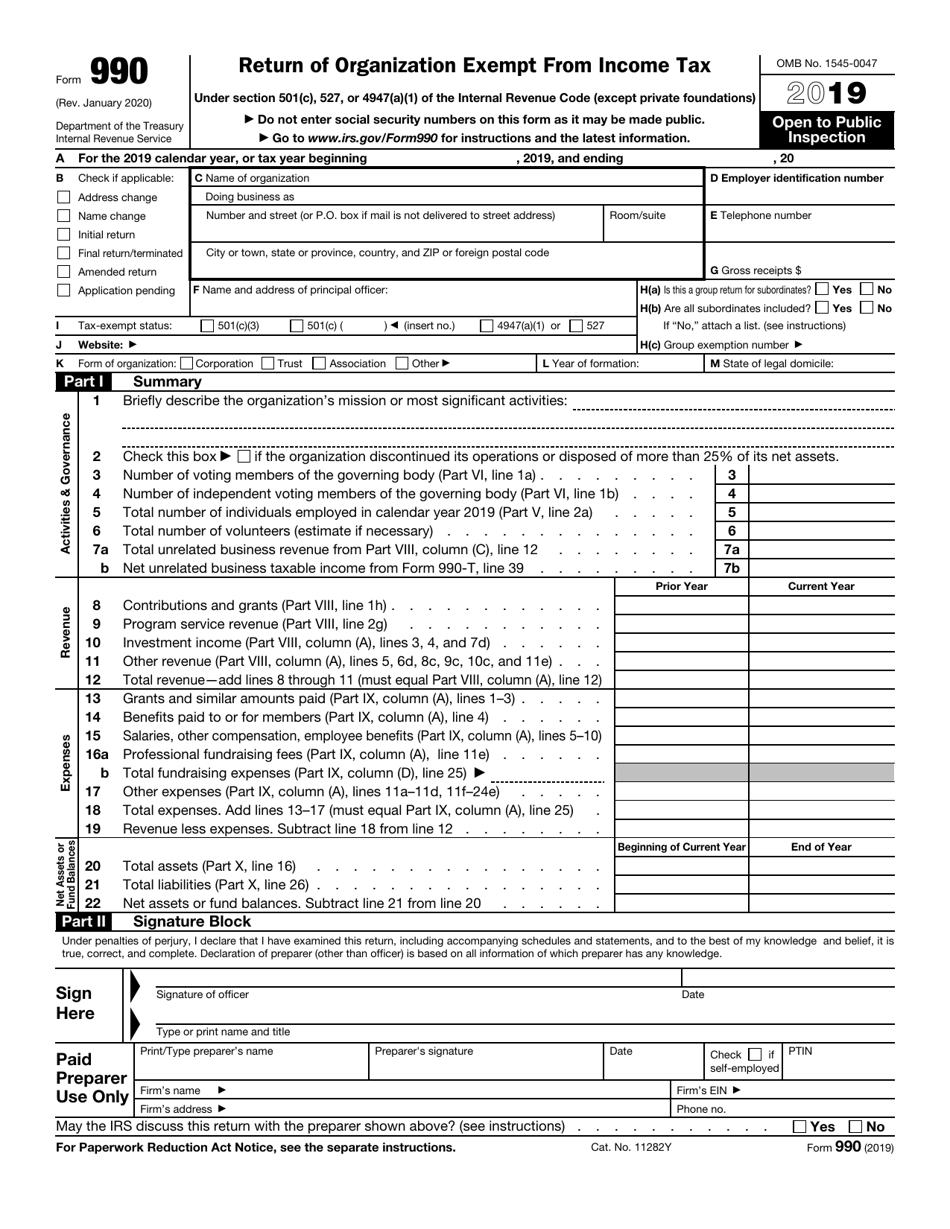

IRS Form 990 Return of Organization Exempt From Income Tax

What Is Form 990?

IRS Form 990, Return of Organization Exempt from Income Tax , is a form used to provide the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other information required by Section 6033. It is an annual information return that must be filled out by most tax-exempt organizations, nonexempt charitable trusts, and certain political organizations.

The issuing department of the IRS Form 990, also known as the nonprofit tax return form is the IRS . The form was last revised in 2019 . Find a fillable Form 990 below.

When Is Form 990 Due?

The due date for Form 990 is the 15th day of the 5th month after the end of your organization's accounting period. If it falls on a legal holiday, Saturday, or Sunday, submit your form on the next business day.

If you dissolve, terminate, or liquidate your organization, submit the return of organization exempt from income tax form by the 15th day of the 5th month after termination, liquidation, or dissolution. If you were not able to meet the deadline, enclose a separate attachment with the reason for not filing on time. If you need to extend the filing deadline, submit Form 8868, Application for Automatic Extension of Time to File an Exempt Organization Return.

If you still fail to submit before the Form 990 due dates, you will have to pay a $20 penalty for each day the failure persists. The large organizations whose gross receipt exceeds $1,046,500 will have to pay $100 per day. The maximum penalty will not exceed $10,000 (or $52,000 for large organizations) or 5% of the organization's gross receipts for the year, whichever is less.

IRS Form 990 Schedules

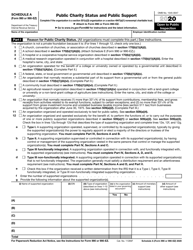

- Schedule A, Public Charity Status and Public Support.

- Schedule B, Schedule of Contributors.

- Schedule C, Political Campaign and Lobbying Activities.

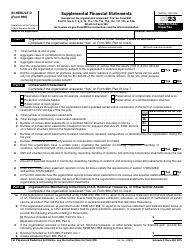

- Schedule D, Supplemental Financial Statements.

- Schedule E, Schools.

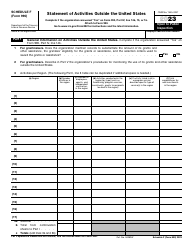

- Schedule F, Statement of Activities Outside the United States.

- Schedule G, Supplemental Information Regarding Fundraising or Gaming Activities.

- Schedule H, Hospitals.

- Schedule I, Grants and Other Assistance to Organizations, Governments, and Individuals in the United States.

- Schedule J, Compensation Information.

- Schedule K, Supplemental Information on Tax-Exempt Bonds.

- Schedule L, Transactions with Interested Persons.

- Schedule M, Noncash Contributions.

- Schedule N, Liquidation, Termination, Dissolution, or Significant Disposition of Assets.

- Schedule O, Supplemental Information to Form 990.

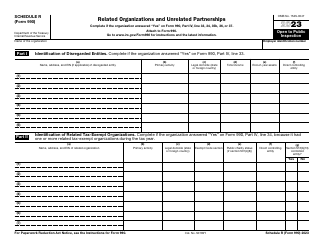

- Schedule R, Related Organizations and Unrelated Partnerships.

IRS Form 990 Instructions

The IRS provides detailed Form 990 instructions. A step-by-step guide is provided below.

How to Fill Out Form 990?

Fill out the IRS Form 990 as follows:

- Heading. Items A - M. Most of the items in this part are self-explanatory. Pay attention to Item H. If you answer "Yes" in line H(a) but "No" in line H(b), attach a list with the names, addresses, and Employer Identification Number for every organization included in the group return. Do not use Schedule O for this purpose.

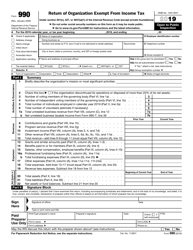

- Part I. Summary. Fill out this part after the other parts are completed because most of the information it reports is provided elsewhere on the form.

- Part II. Signature Block. Sign the return if you are the current president, a vice president, chief accounting officer, treasurer, assistant treasurer, or any other corporate officer authorized to sign for the organization.

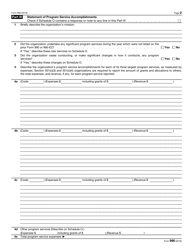

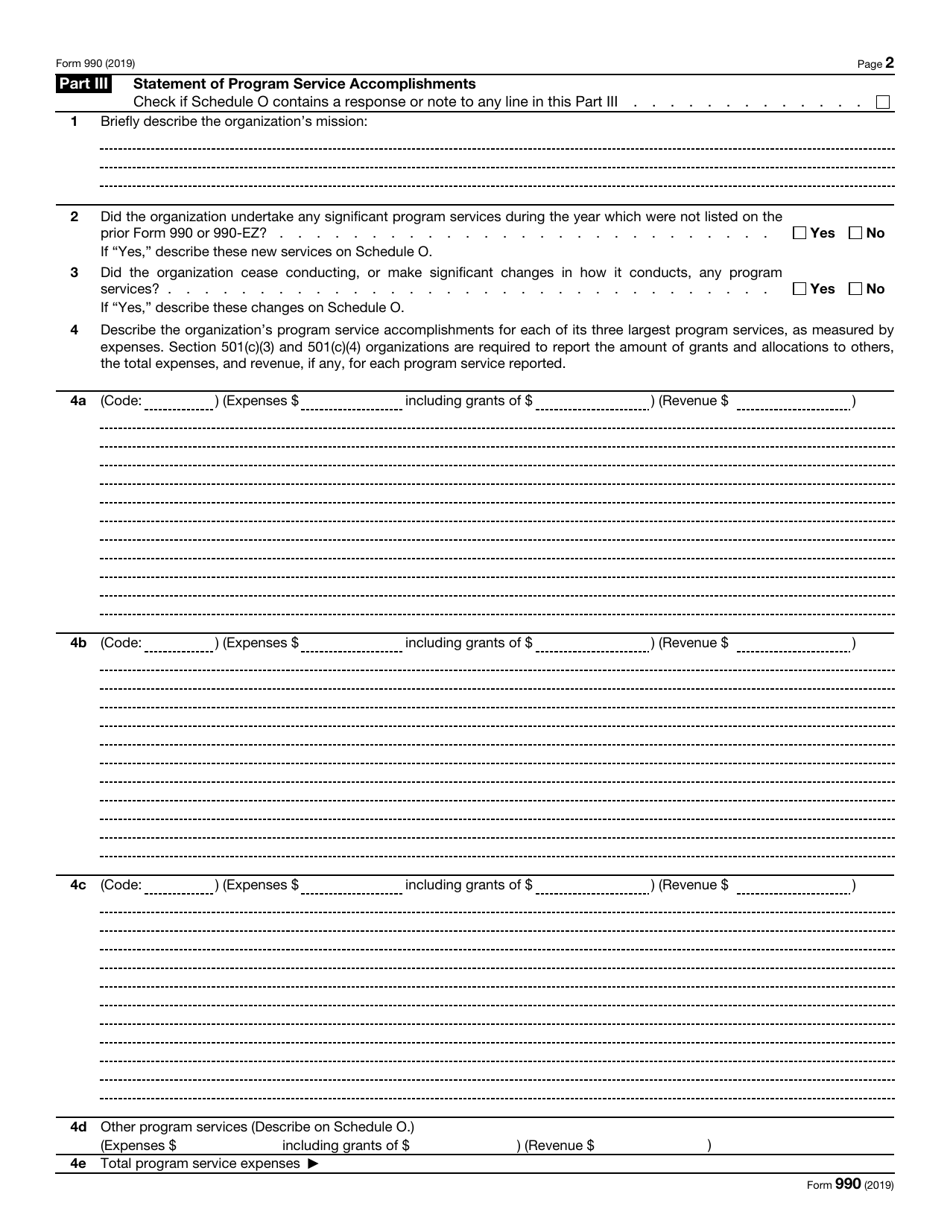

- Part III. Statement of Program Service Accomplishments. If the Schedule O contains any information related to this part, check the box on the head of the form. Report in this part the program service accomplishments of your organization. Program services are activities of your organization that serve its exempt purpose, like charitable activities;

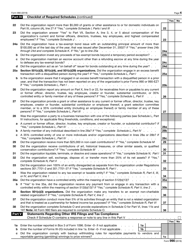

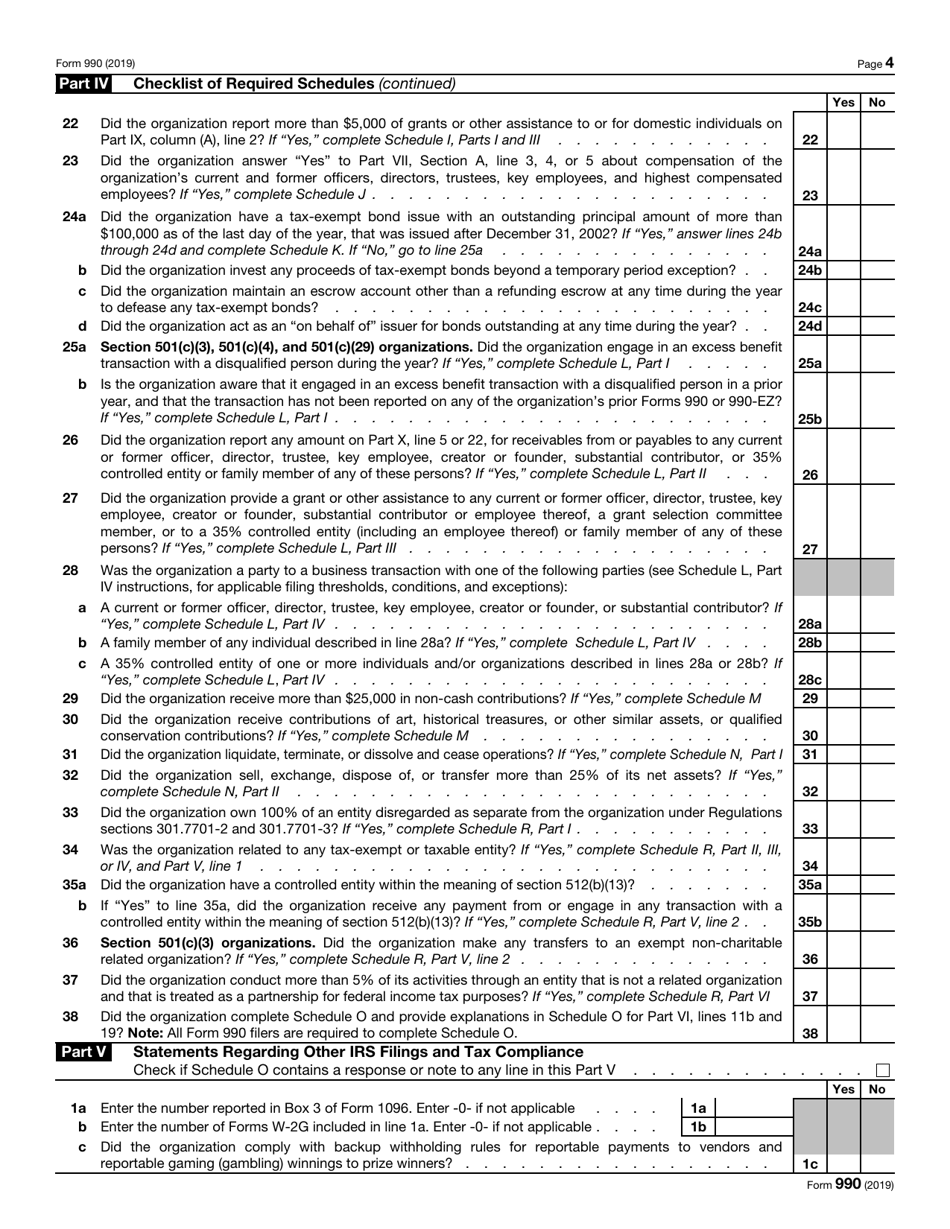

- Part IV. Checklist of Required Schedules. Fill out the applicable schedule for each "Yes" answer;

- Part V. Statements Regarding Other IRS Filings and Tax Compliance. Some lines in this part pertain to other IRS forms;

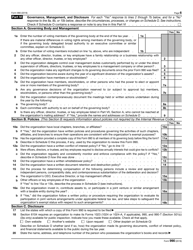

- Part VI. Governance, Management, and Disclosure. Enter information about the organization's governing body, management, disclosure practices, and governance policies;

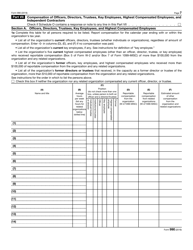

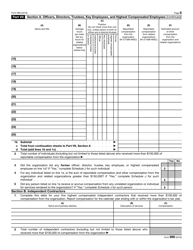

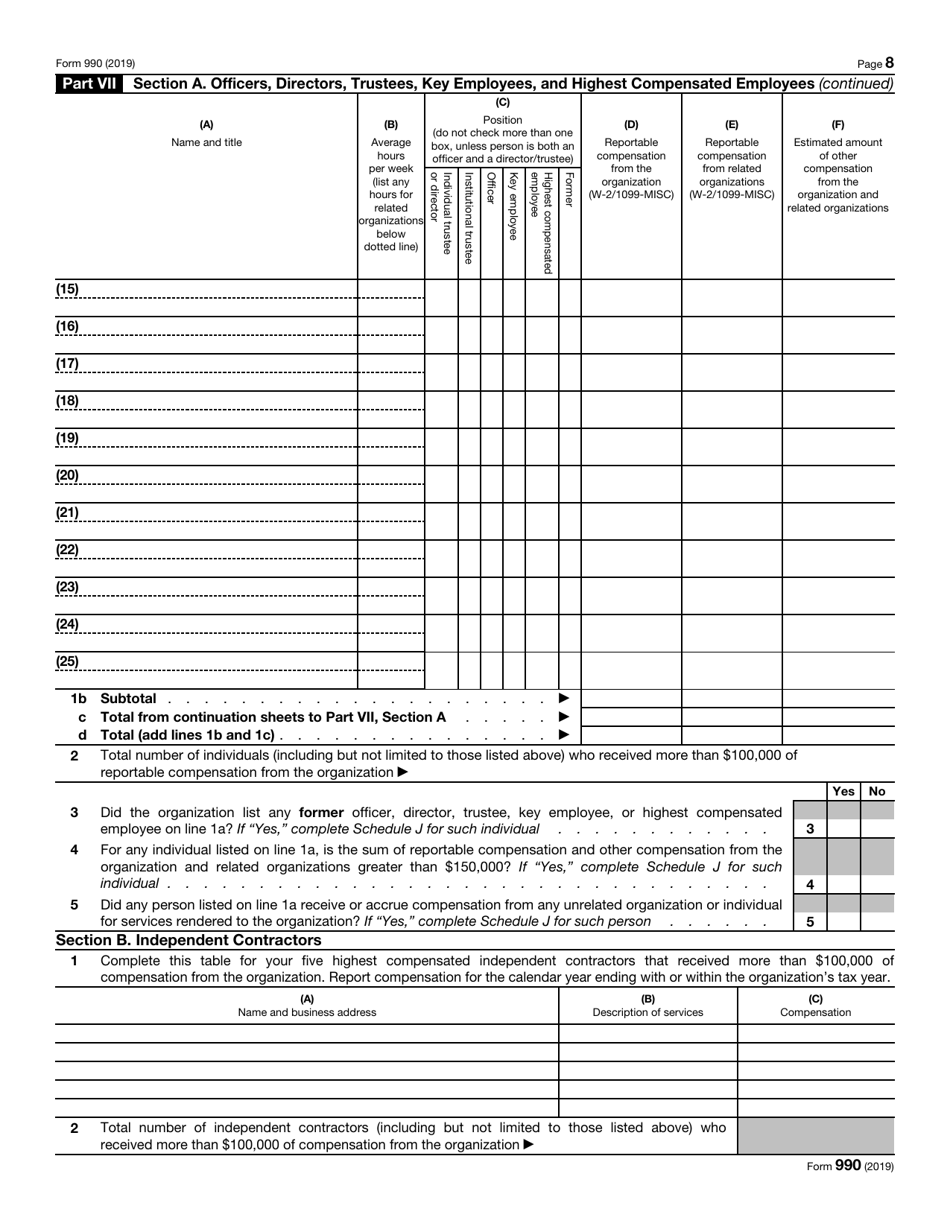

- Part VII. Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and Independent Contractors. List here current or former officers, trustees, directors, key employees, highest compensated employees, and current independent contractors of your organization. Specify their relevant compensation information;

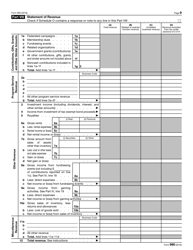

- Part VIII. Statement of Revenue. Report all sources of revenue in this part;

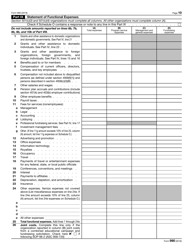

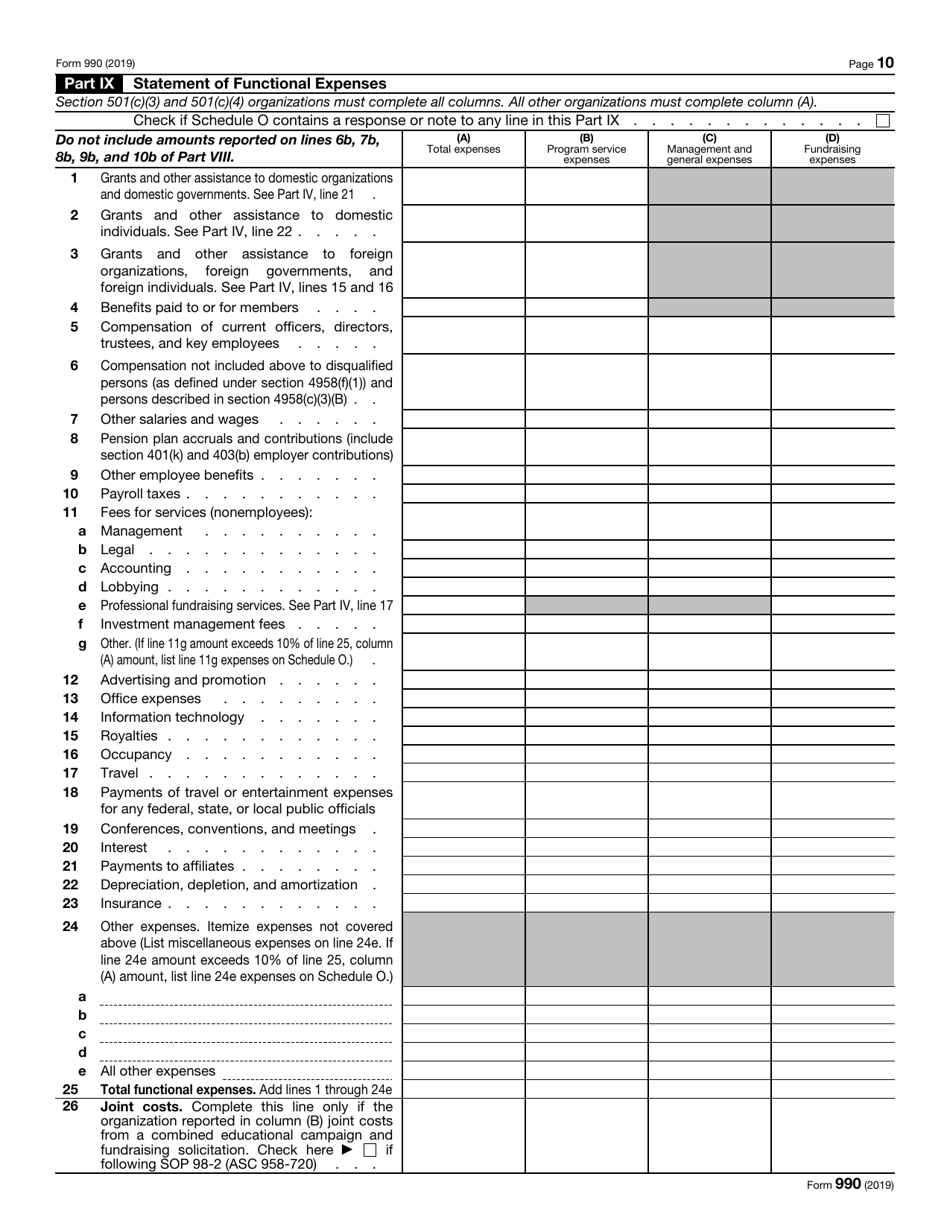

- Part IX. Statement of Functional Expenses. Use the regular accounting method your organization applies to fill out this part. If the regular accounting system of your organization does not allocate expenses, use any reasonable method of allocation;

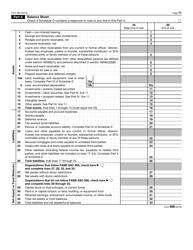

- Part X. Balance Sheet. This part is obligatory for completion. A substitute balance sheet is not accepted;

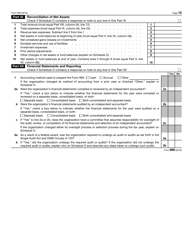

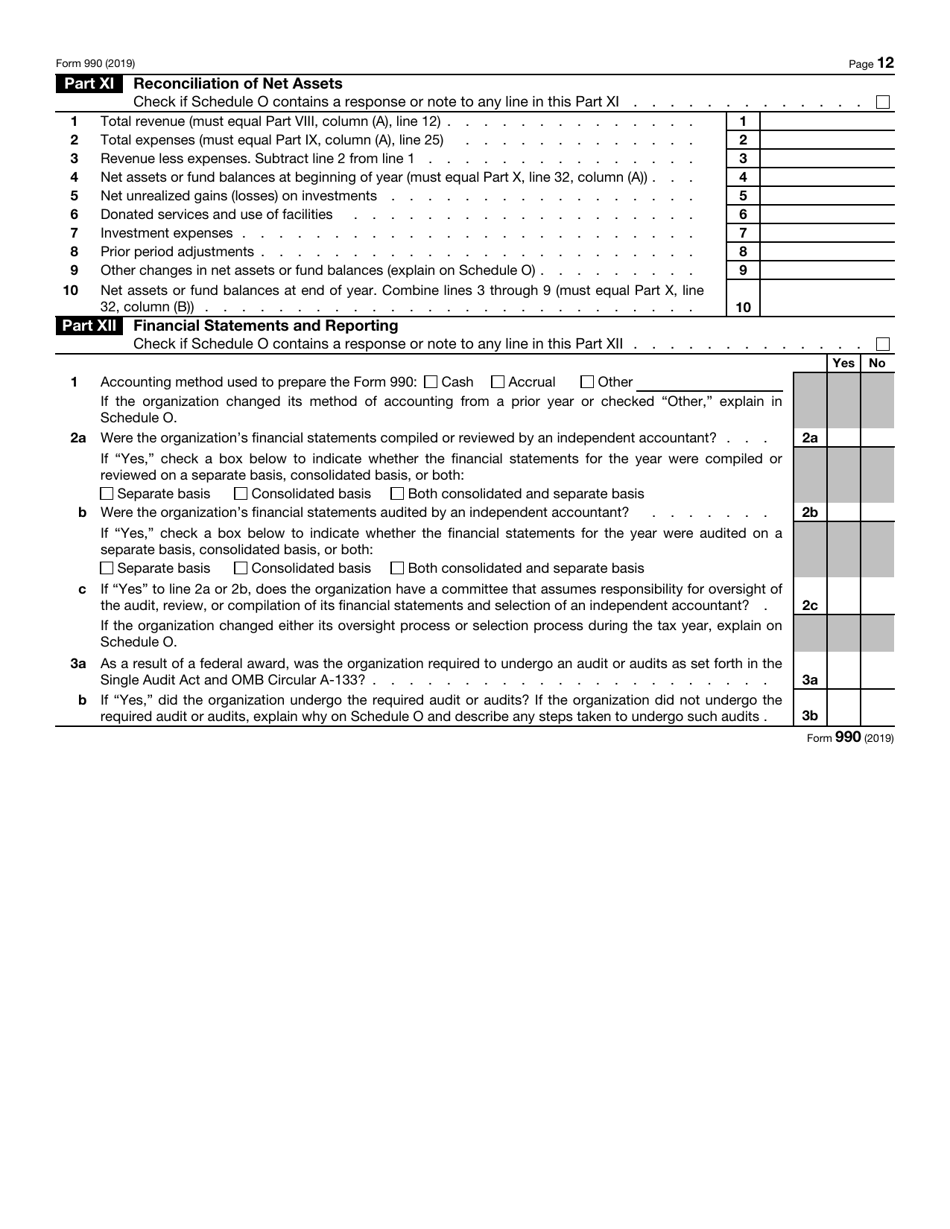

- Part XI. Reconciliation of Net Assets. Self-explanatory;

- Part XII. Financial Statements and Reporting. Answer the questions and provide all the required explanations on Schedule O.

IRS 990 Related Forms:

- Form 990-EZ, Short Form Return of Organization Exempt from Income Tax;

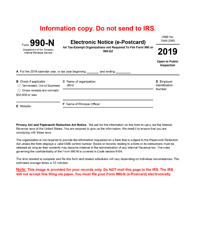

- Form 990-N, Electronic Notice (e-Postcard);

- Form 990-PF, Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation;

- Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code;

- Form 1023-EZ Instructions, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code;

- Form 1024, Application for Recognition of Exemption Under Section 501(a);

- Form 1128, Application to Adopt, Change or Retain a Tax Year;

- Form 2848, Power of Attorney and Declaration of Representative;

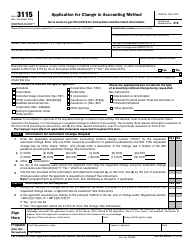

- Form 3115, Application for Change in Accounting Method;

- Form 4506, Request for Copy of Tax Return;

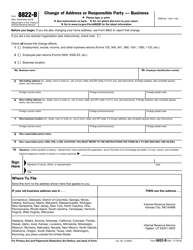

- Form 8822-B, Change of Address or Responsible Party - Business;

- Form 8868, Application for Extension of Time to File an Exempt Organization Return.