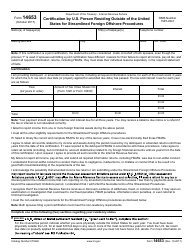

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule F

for the current year.

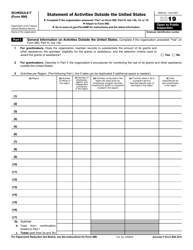

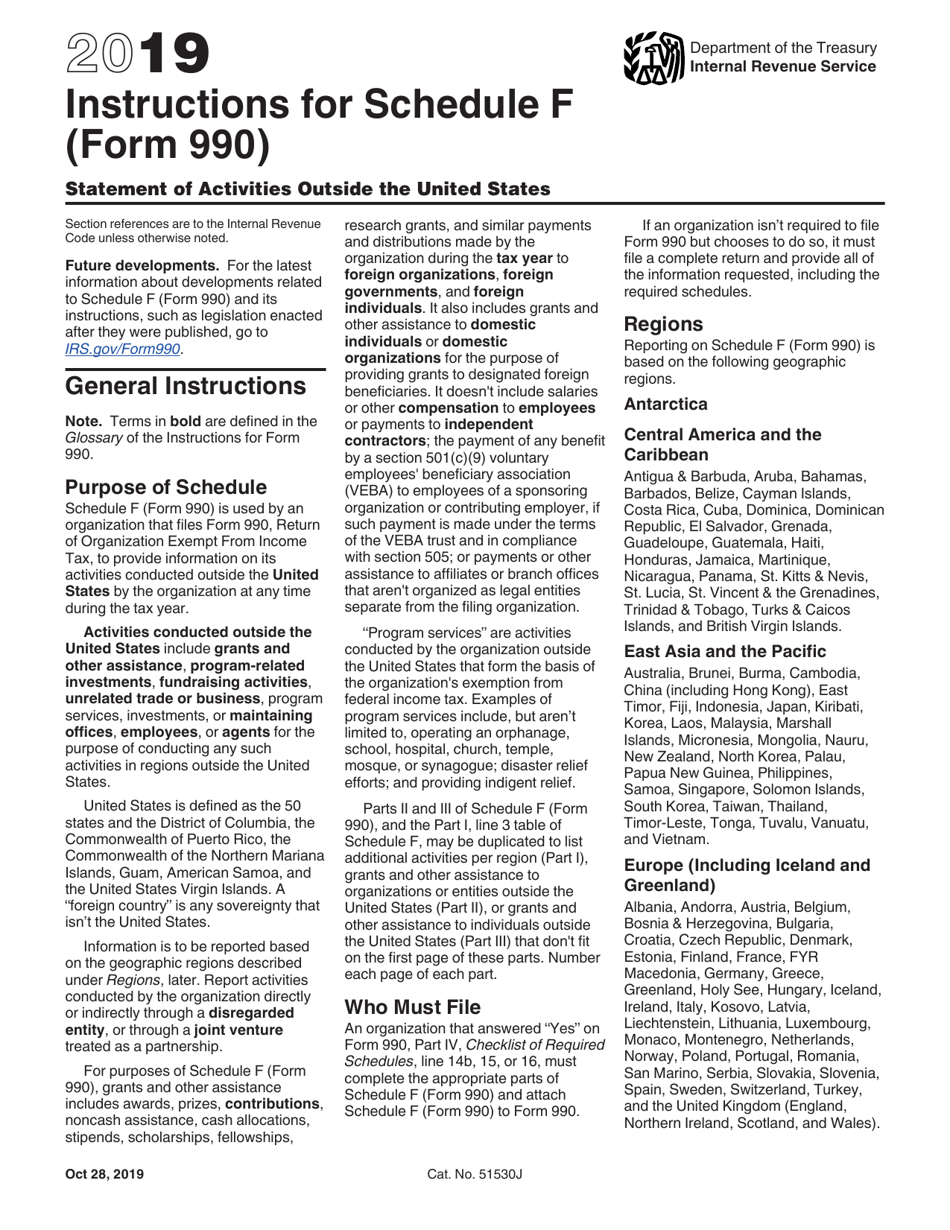

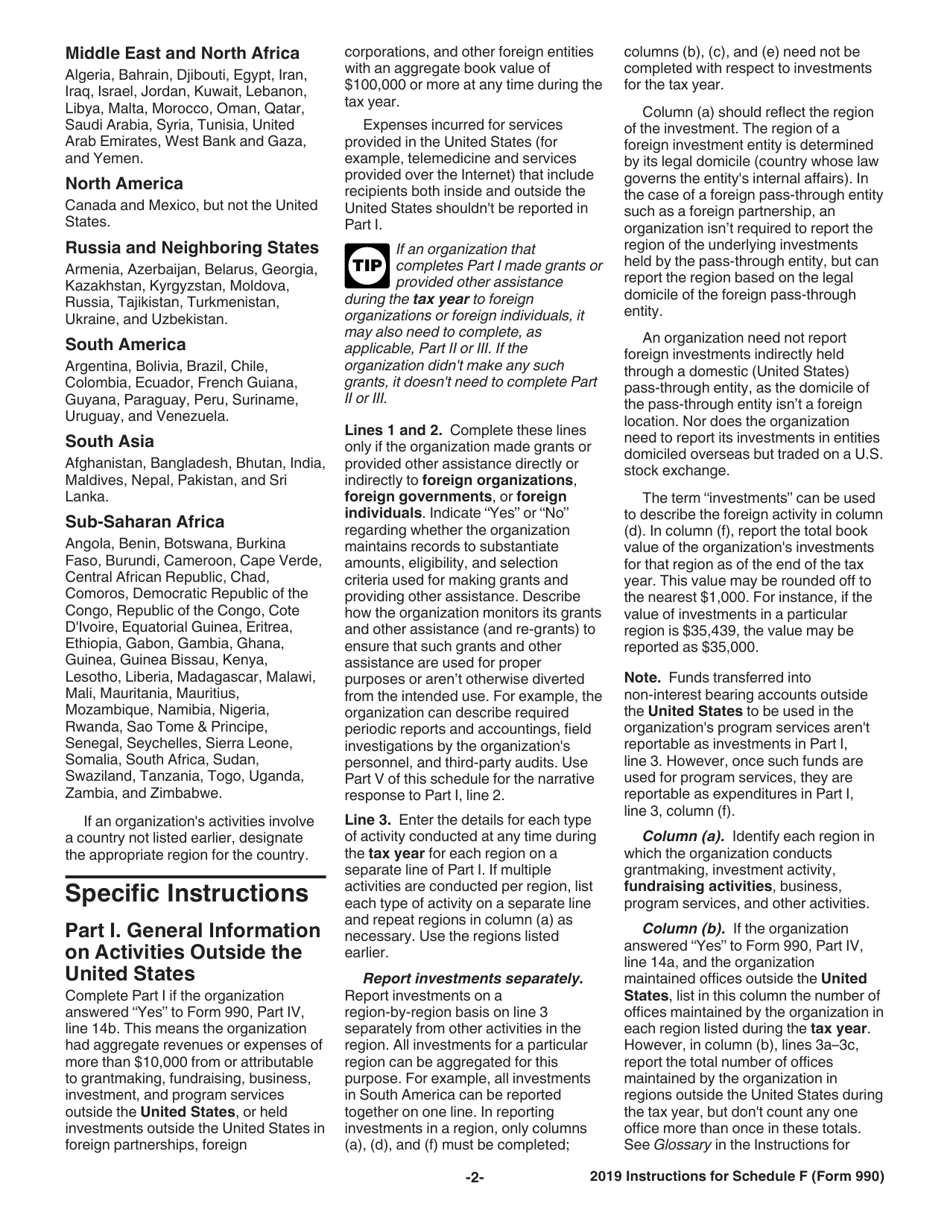

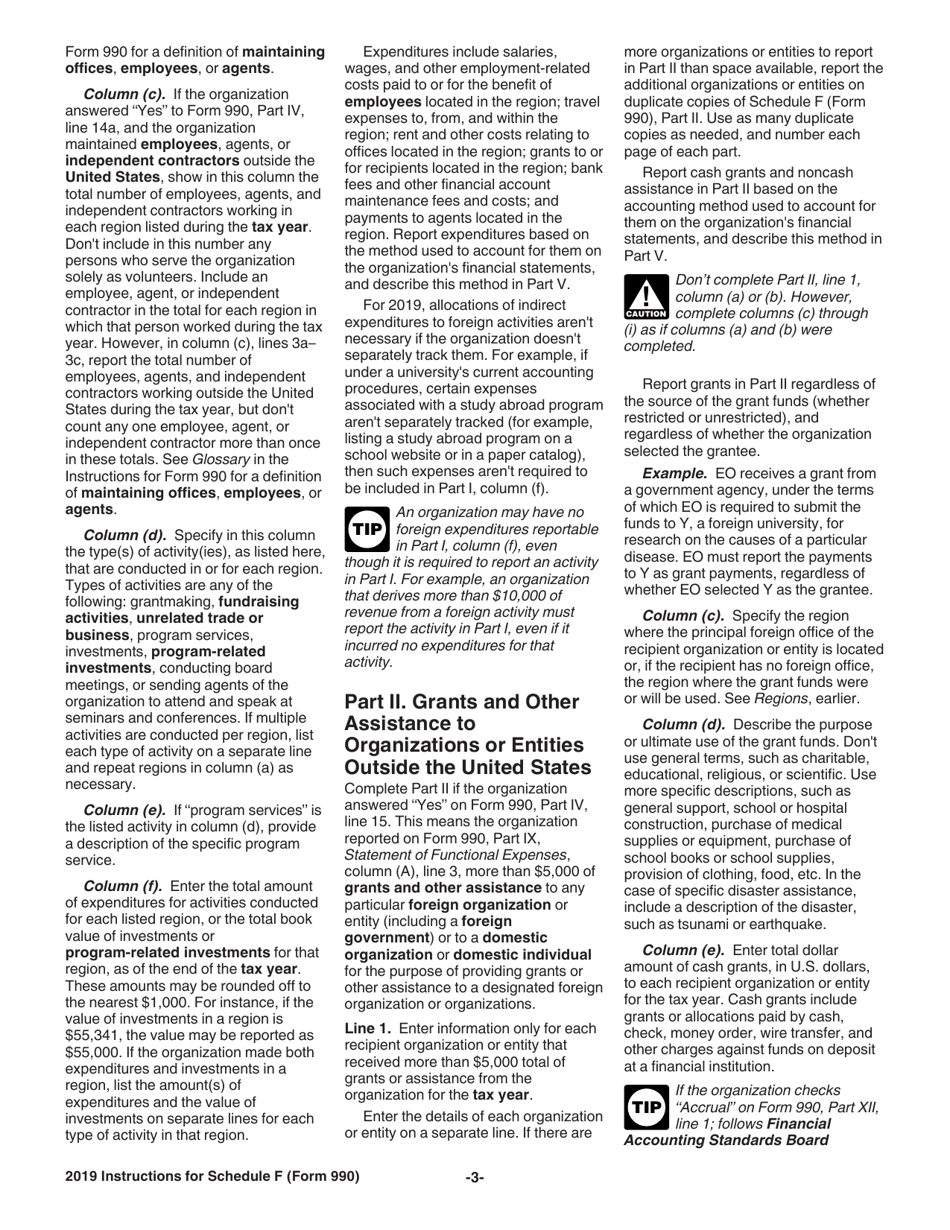

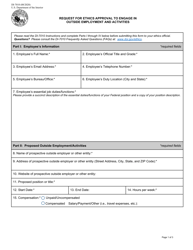

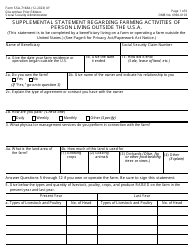

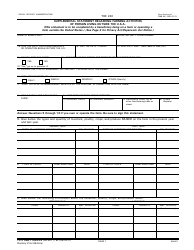

Instructions for IRS Form 990 Schedule F Statement of Activities Outside the United States

This document contains official instructions for IRS Form 990 Schedule F, Statement of Activities Outside the United States - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule F is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule F?

A: IRS Form 990 Schedule F is a form used by tax-exempt organizations to report their activities outside the United States.

Q: Who needs to file IRS Form 990 Schedule F?

A: Tax-exempt organizations that have activities outside the United States need to file IRS Form 990 Schedule F.

Q: What activities need to be reported on IRS Form 990 Schedule F?

A: Any activities conducted by a tax-exempt organization outside the United States, such as grants, programs, or investments, need to be reported on IRS Form 990 Schedule F.

Q: What information is required on IRS Form 990 Schedule F?

A: IRS Form 990 Schedule F requires information about the organization's activities outside the United States, including the purpose of the activity, the countries involved, and the amount of financial support provided.

Q: When is the deadline to file IRS Form 990 Schedule F?

A: IRS Form 990 Schedule F is due on the same date as the organization's Form 990, which is typically the 15th day of the fifth month after the end of the organization's fiscal year.

Q: Are there any penalties for not filing IRS Form 990 Schedule F?

A: Yes, tax-exempt organizations that fail to file IRS Form 990 Schedule F or provide inaccurate information may face penalties imposed by the IRS.

Q: Can I file IRS Form 990 Schedule F electronically?

A: Yes, tax-exempt organizations can file IRS Form 990 Schedule F electronically using the IRS's electronic filing system.

Q: Do I need to attach any supporting documents with IRS Form 990 Schedule F?

A: Depending on the specific activities and financial transactions being reported, tax-exempt organizations may need to attach certain supporting documents with IRS Form 990 Schedule F.

Q: Is IRS Form 990 Schedule F required for all tax-exempt organizations?

A: Not all tax-exempt organizations are required to file IRS Form 990 Schedule F. Only those that have activities outside the United States need to file this form.

Instruction Details:

- This 5-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.