This version of the form is not currently in use and is provided for reference only. Download this version of

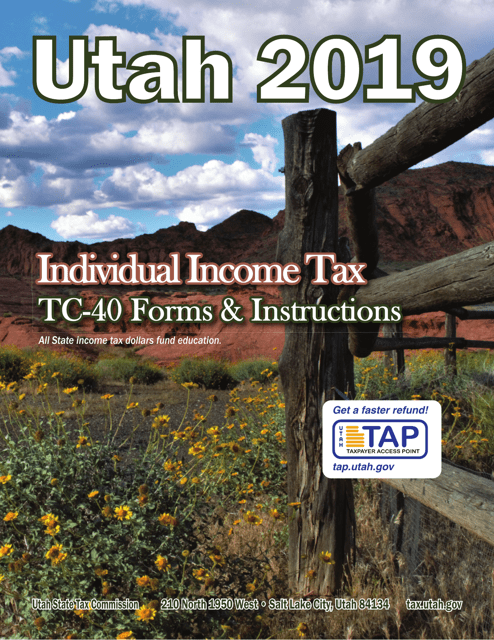

Instructions for Form TC-40

for the current year.

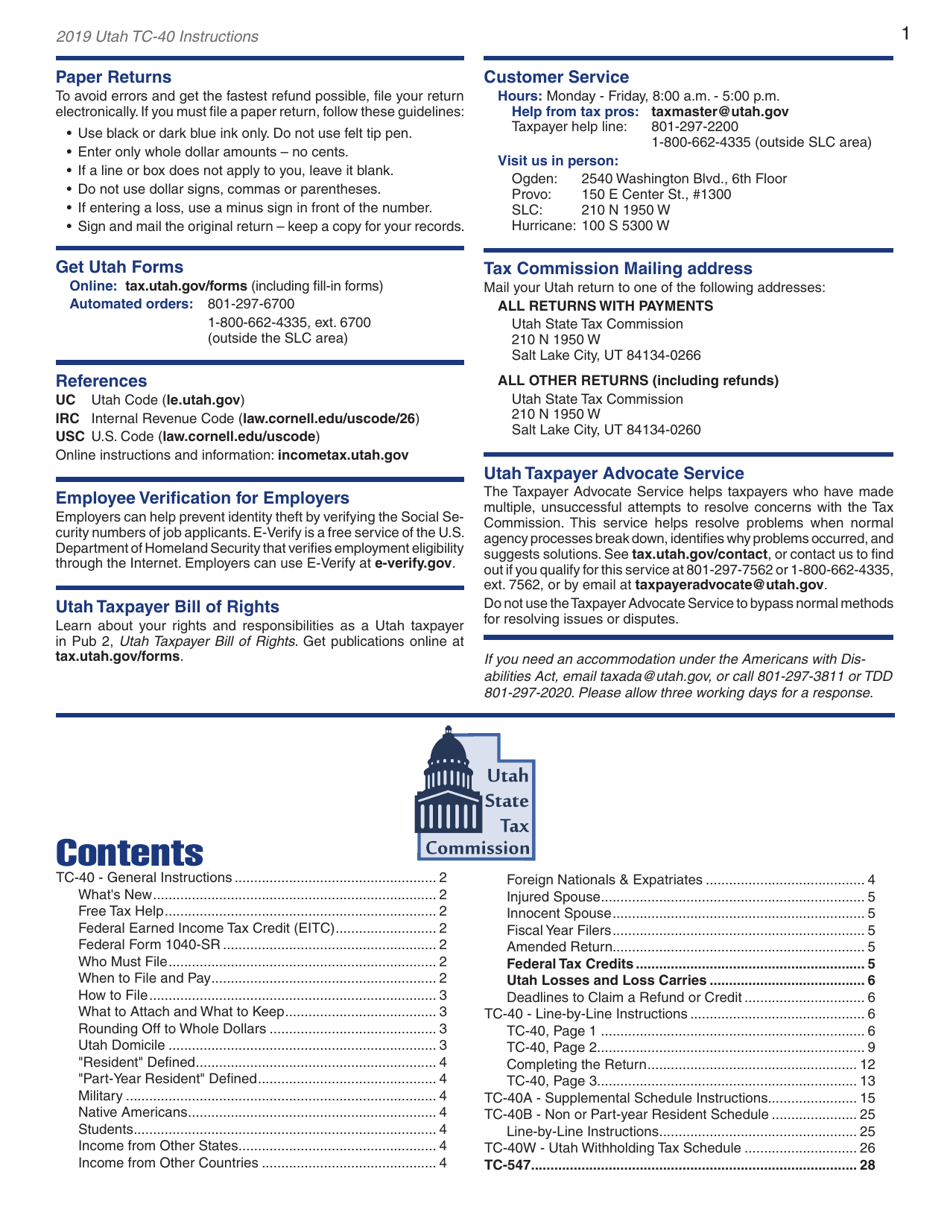

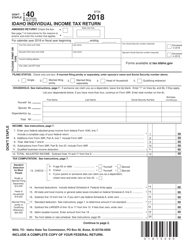

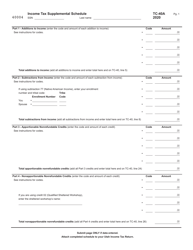

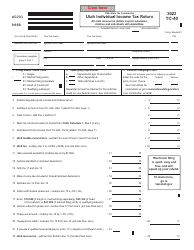

Instructions for Form TC-40 Utah Individual Income Tax Return - Utah

This document contains official instructions for Form TC-40 , Utah Individual Income Tax Return - a form released and collected by the Utah State Tax Commission.

FAQ

Q: What is Form TC-40?

A: Form TC-40 is the Utah Individual Income Tax Return.

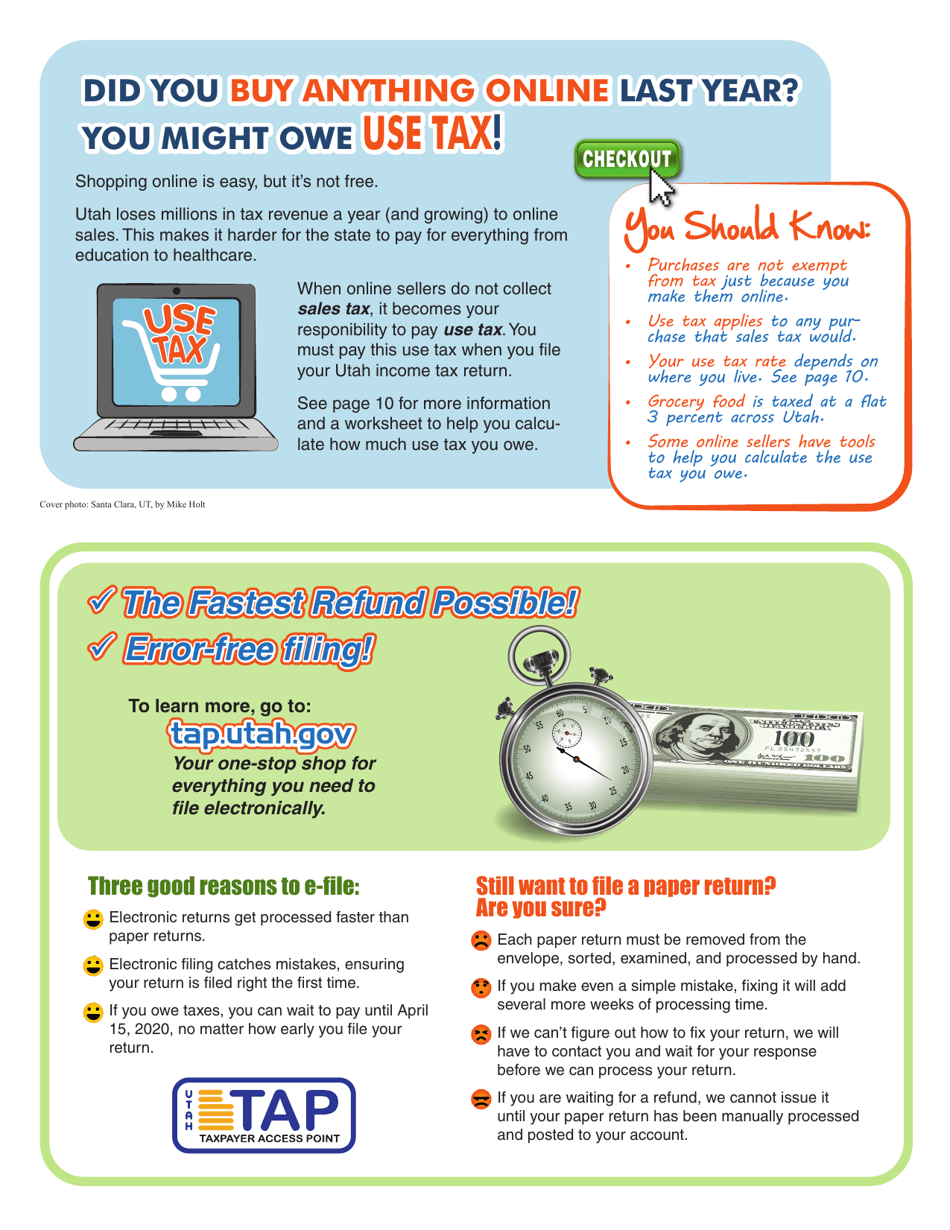

Q: Who needs to file Form TC-40?

A: Any resident of Utah who earned income during the tax year and meets the filing requirements must file Form TC-40.

Q: What are the filing requirements for Form TC-40?

A: You must file if your income exceeds the specified thresholds based on your filing status.

Q: When is the deadline to file Form TC-40?

A: The deadline to file Form TC-40 is April 15th, or the next business day if it falls on a weekend or holiday.

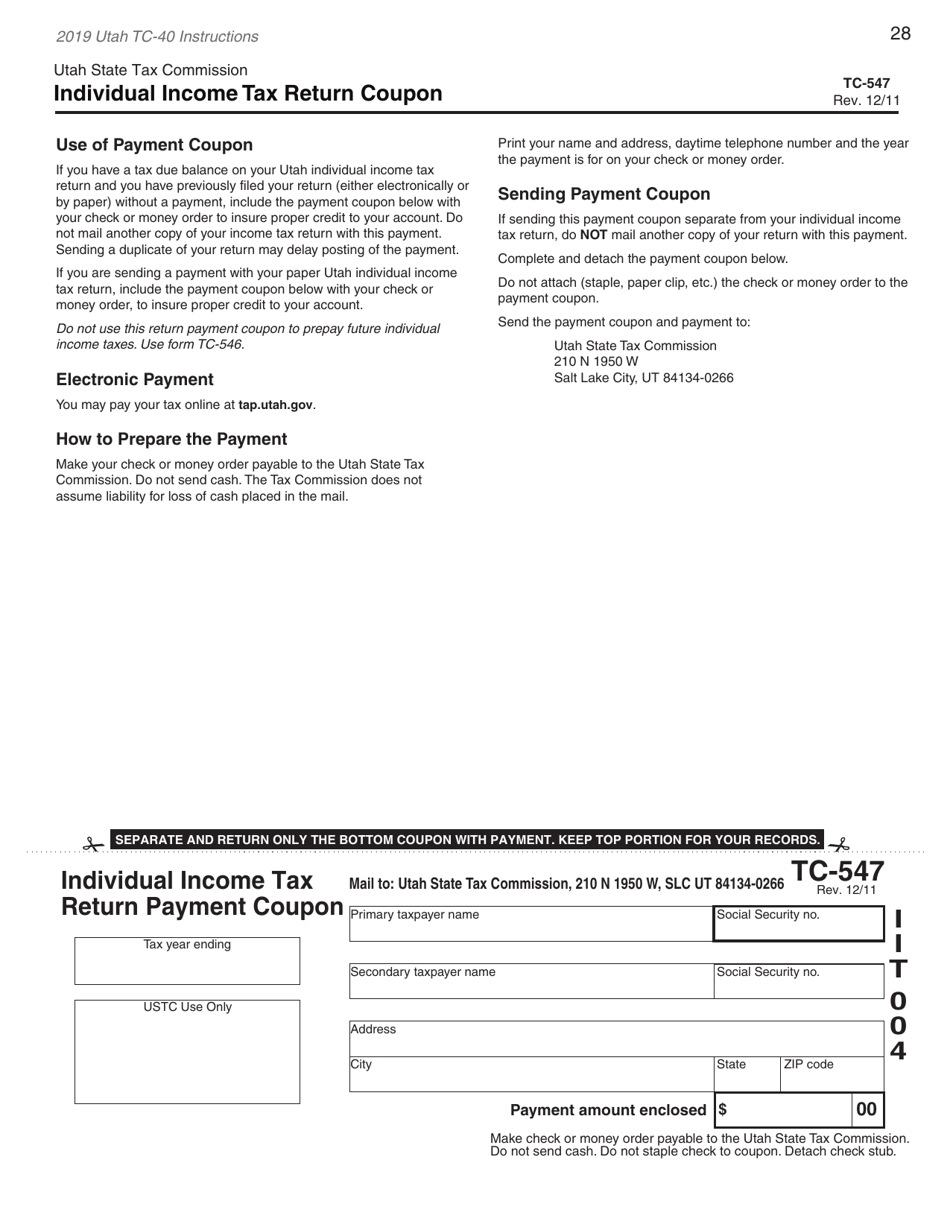

Q: What if I can't pay the amount due on Form TC-40?

A: If you can't pay the full amount due, you should still file the return on time and explore payment options with the Utah State Tax Commission.

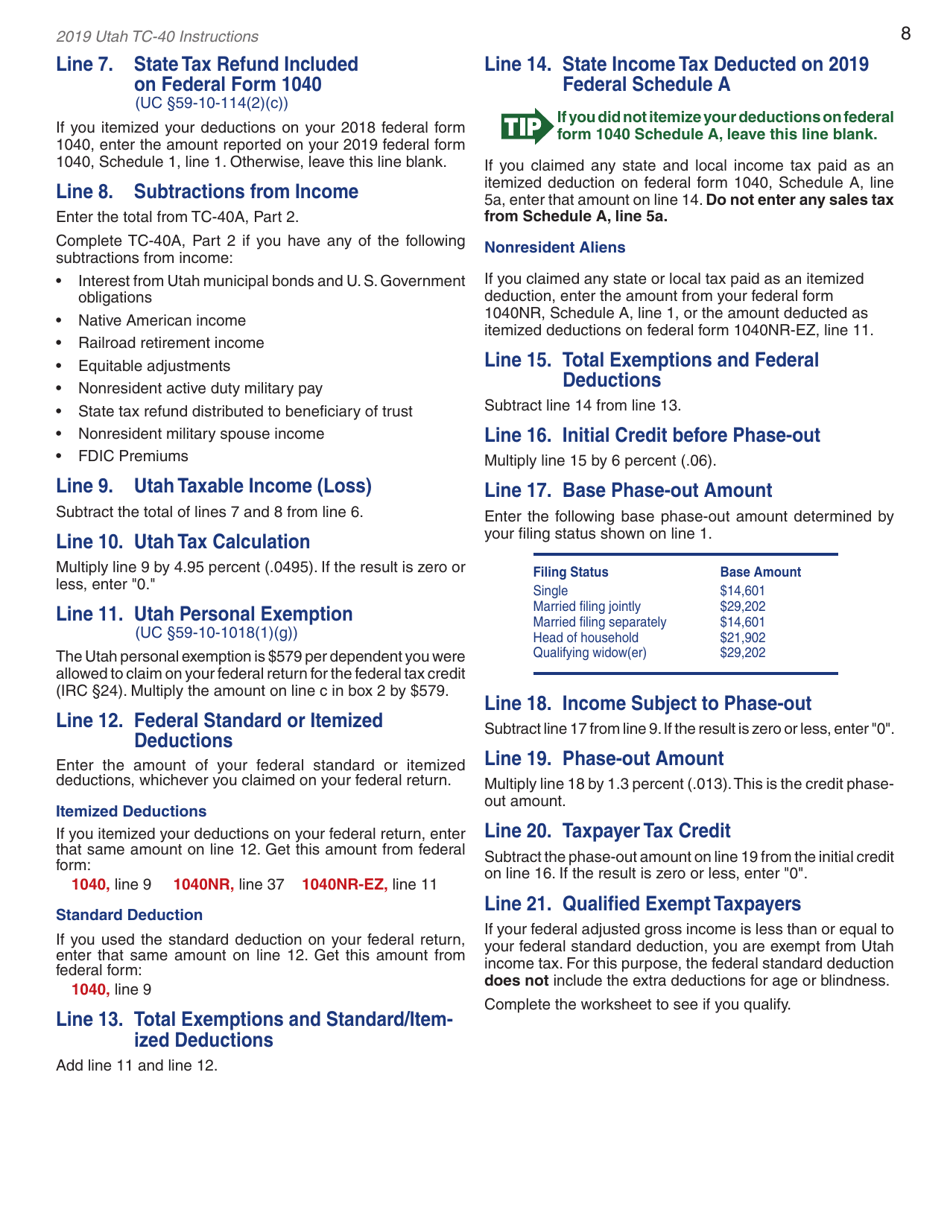

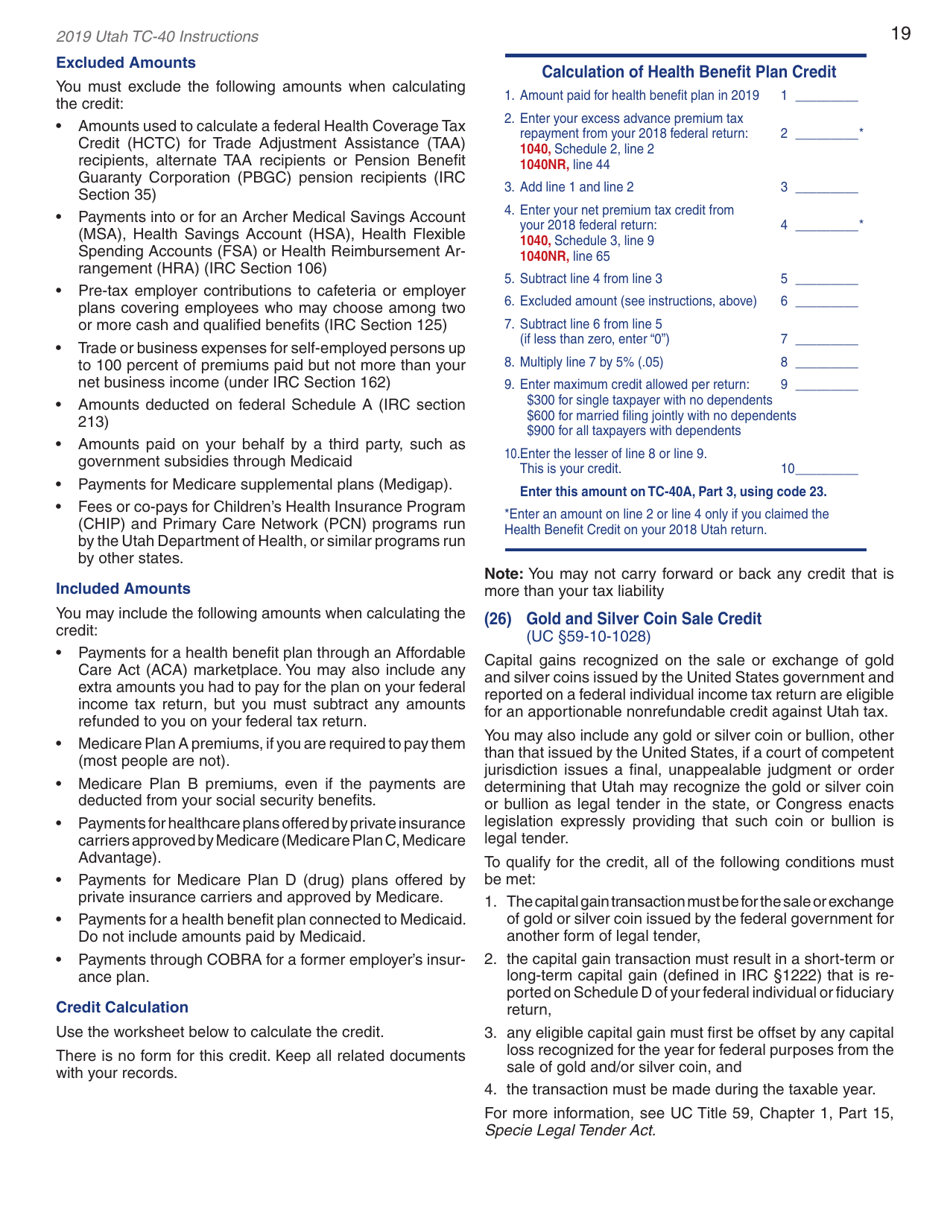

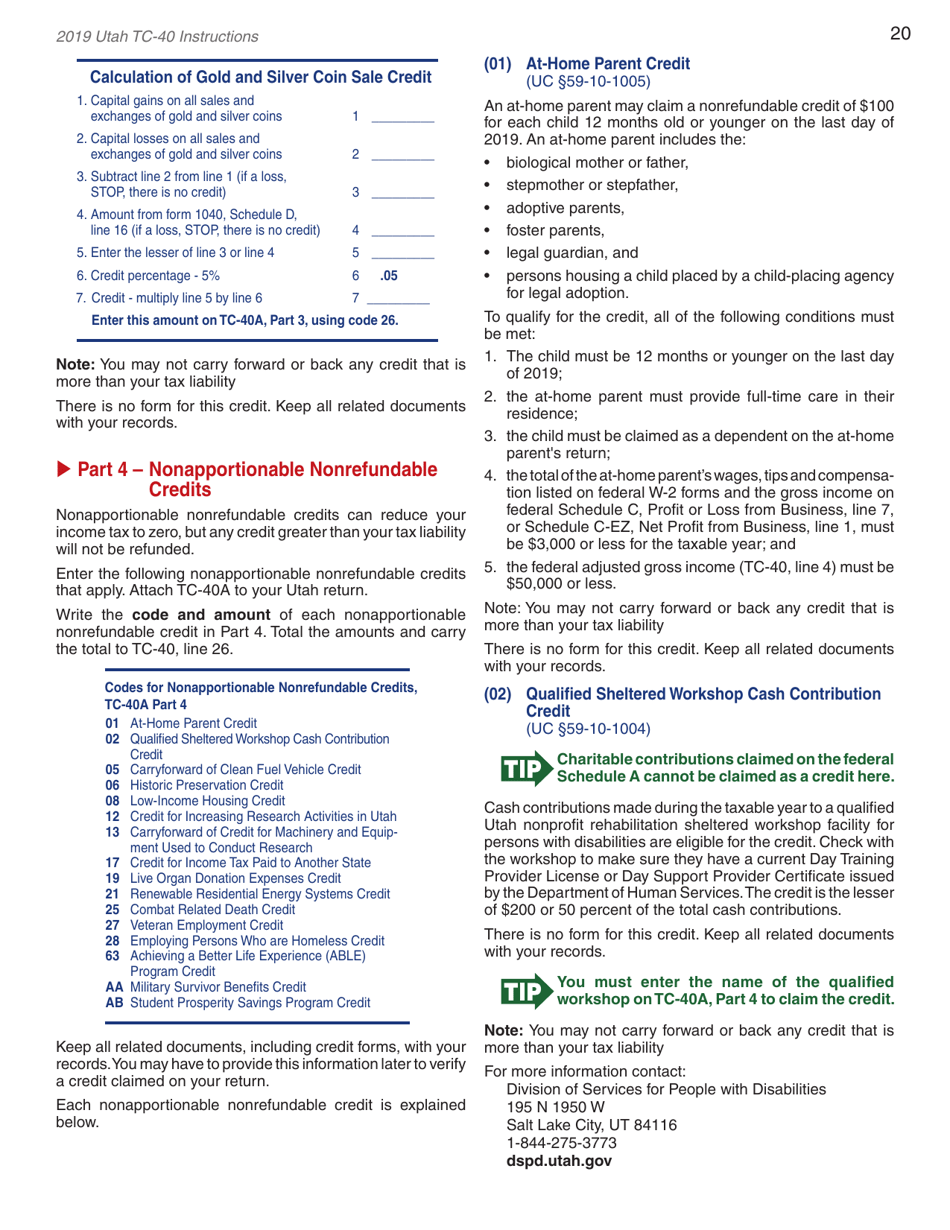

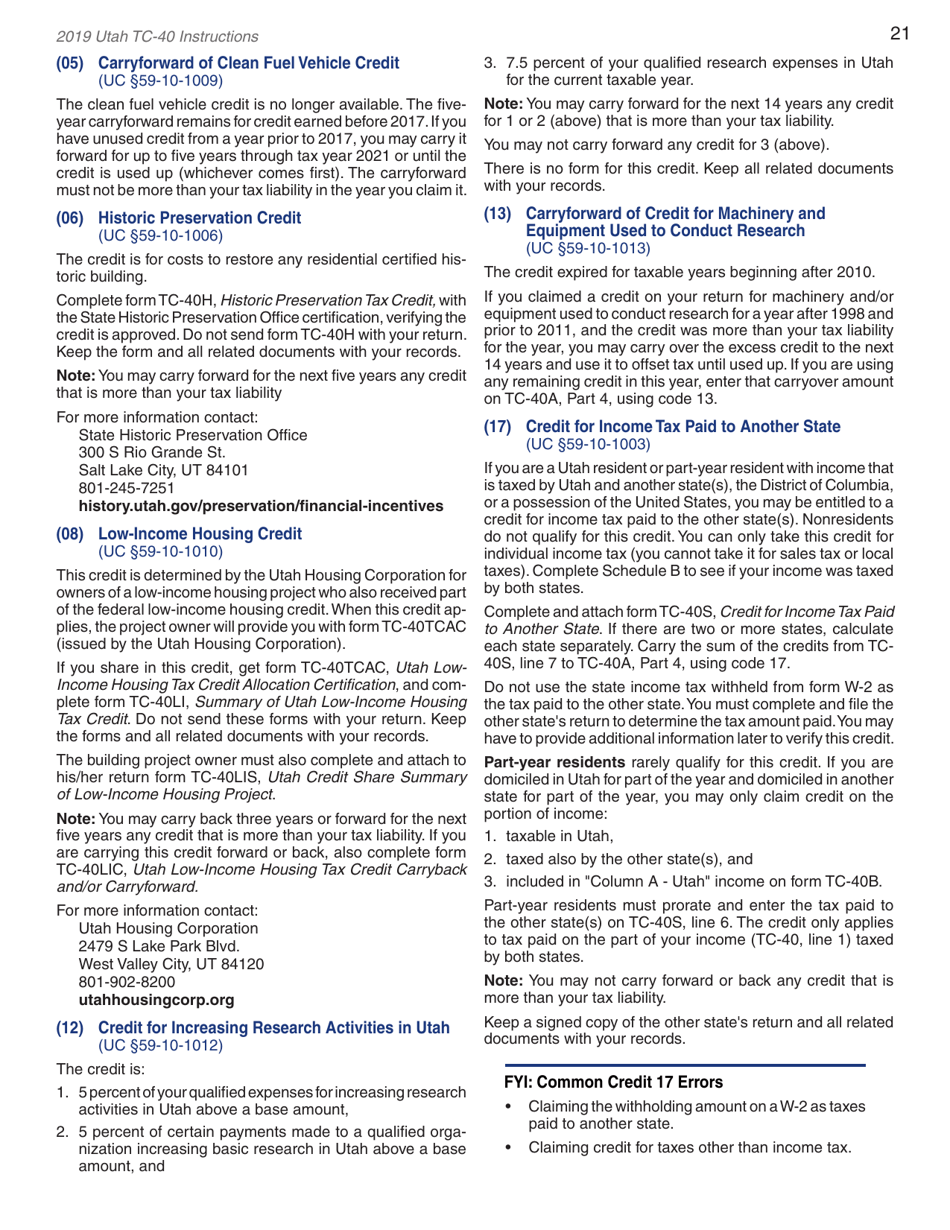

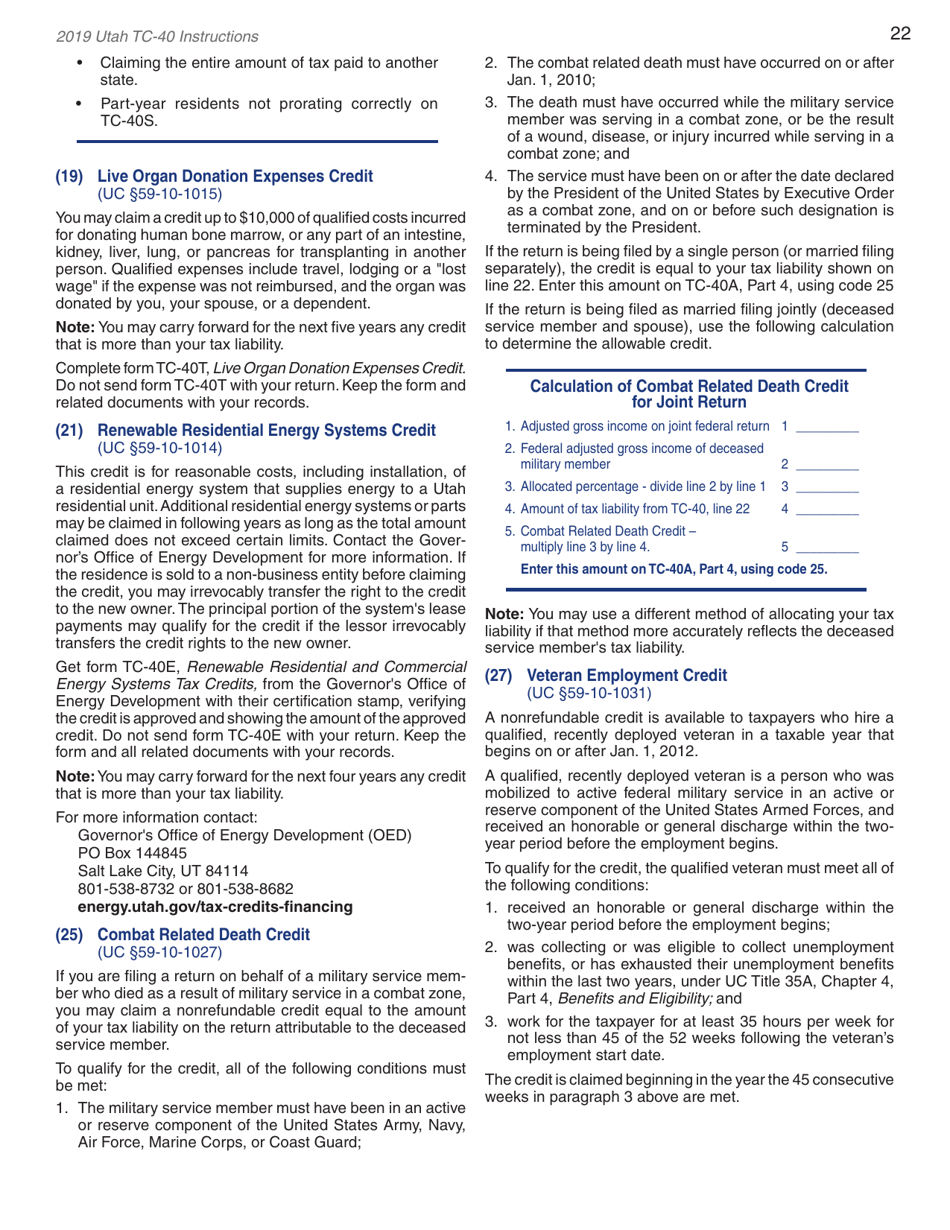

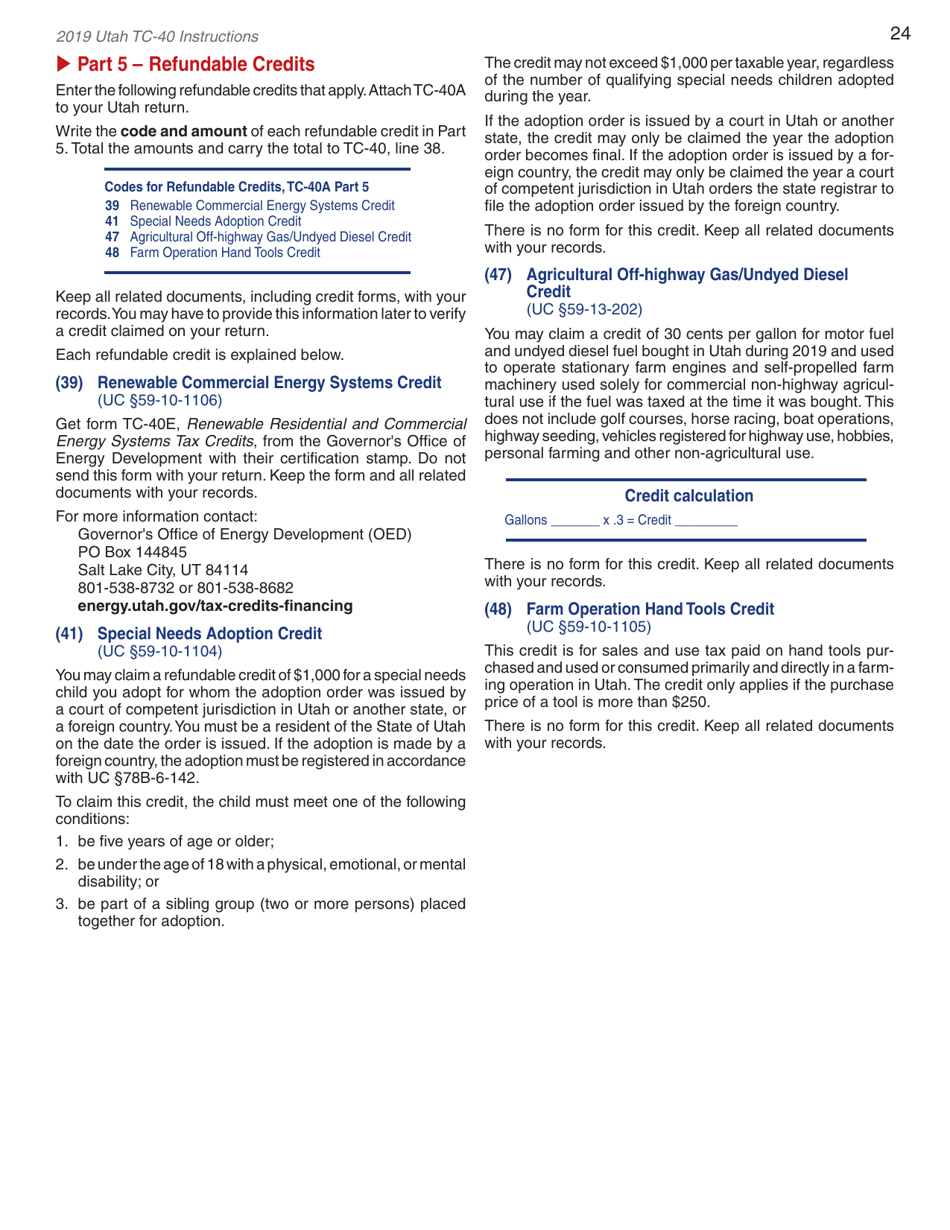

Q: Are there any deductions or credits available on Form TC-40?

A: Yes, there are various deductions and credits available on Form TC-40, including the standard deduction, dependent exemption, and various tax credits.

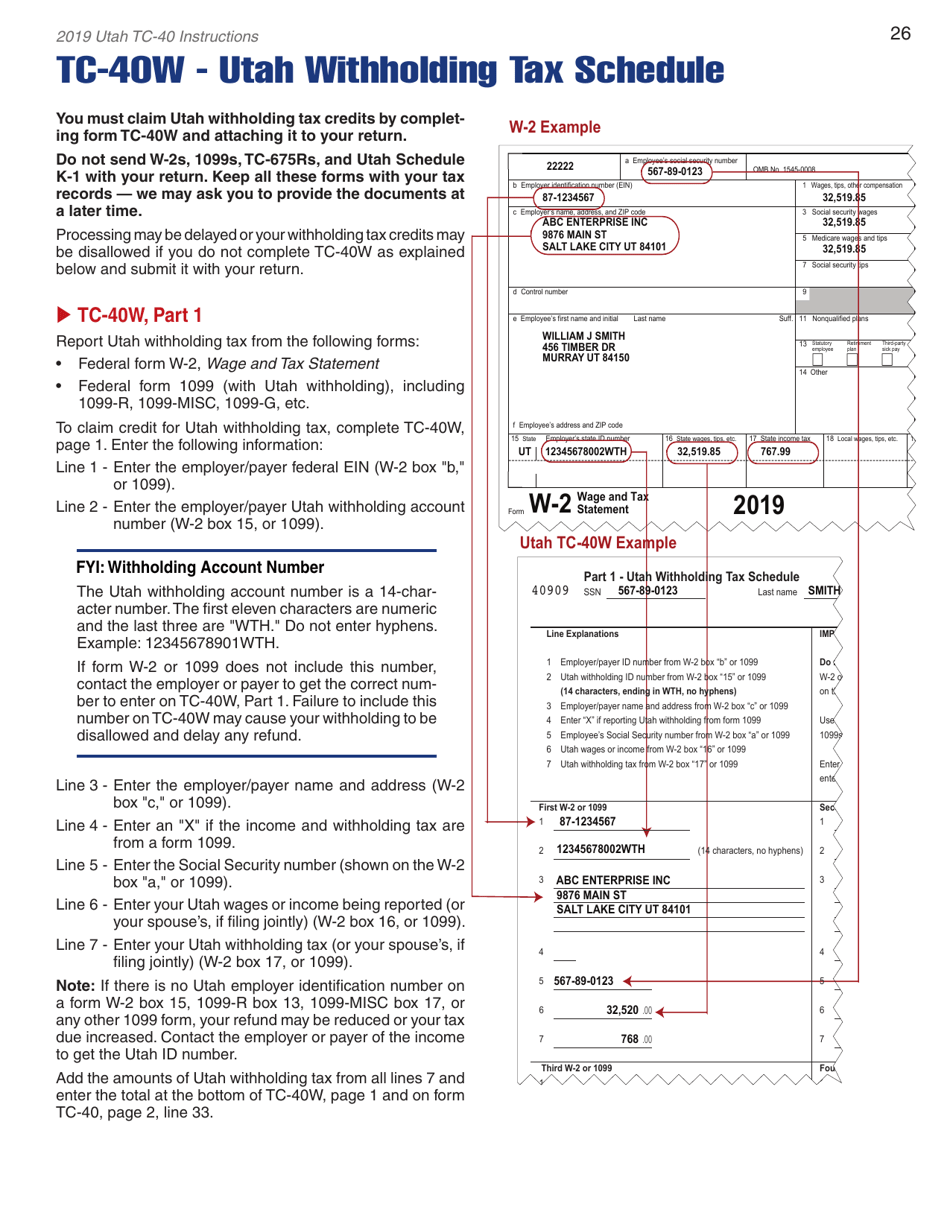

Q: Do I need to include any supporting documents with Form TC-40?

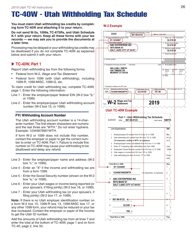

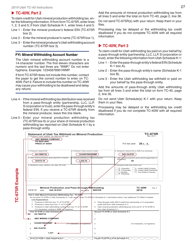

A: You may need to attach certain supporting documents, such as W-2 forms, 1099 forms, or schedules, depending on your specific tax situation.

Q: What if I need more time to file Form TC-40?

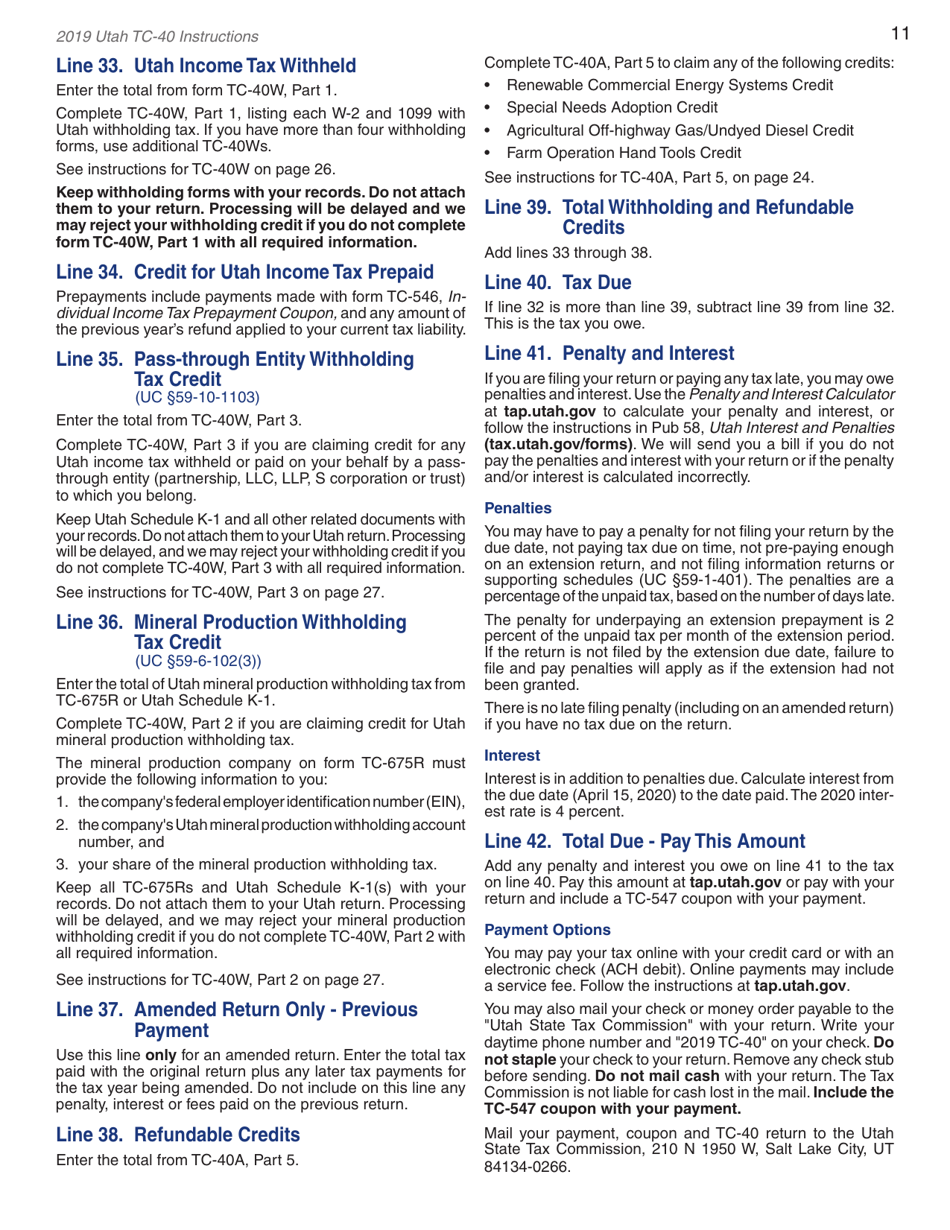

A: You can request an extension of time to file by submitting Form TC-546, but remember that an extension of time to file does not extend the deadline to pay any taxes due.

Instruction Details:

- This 30-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Utah State Tax Commission.