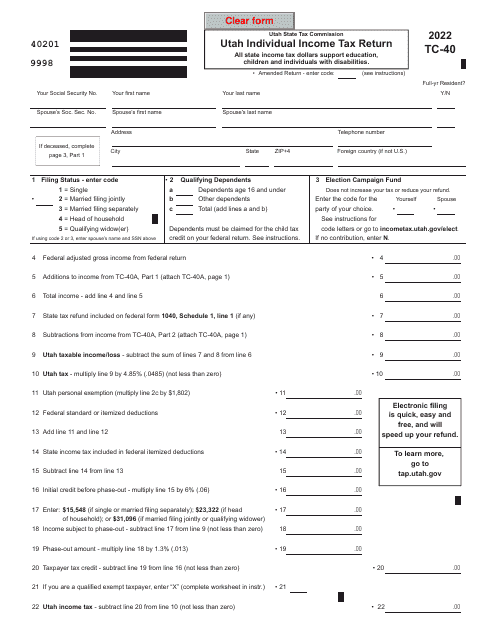

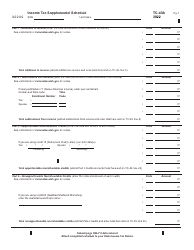

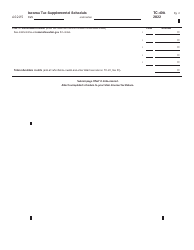

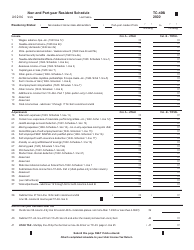

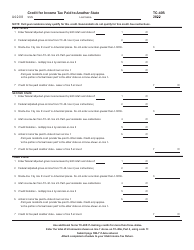

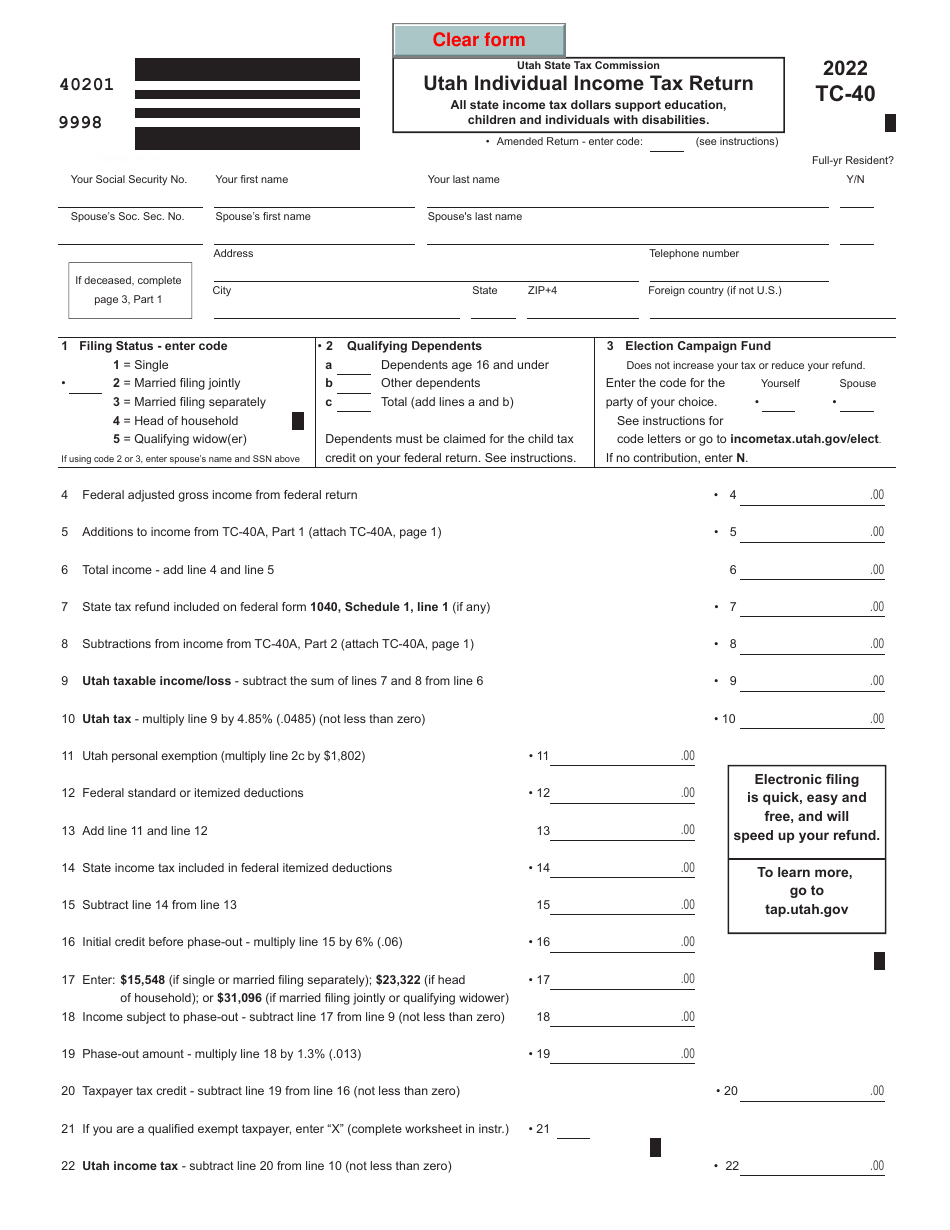

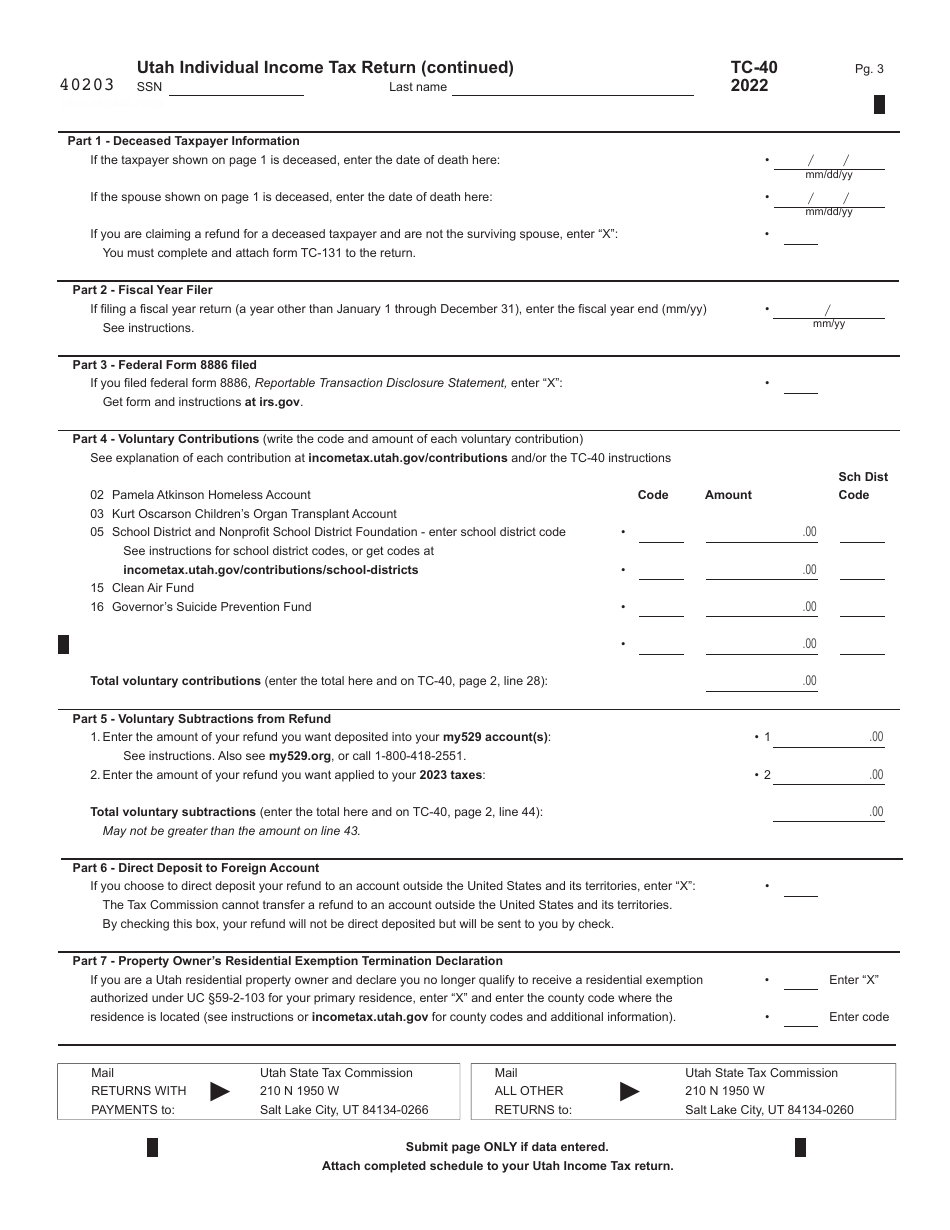

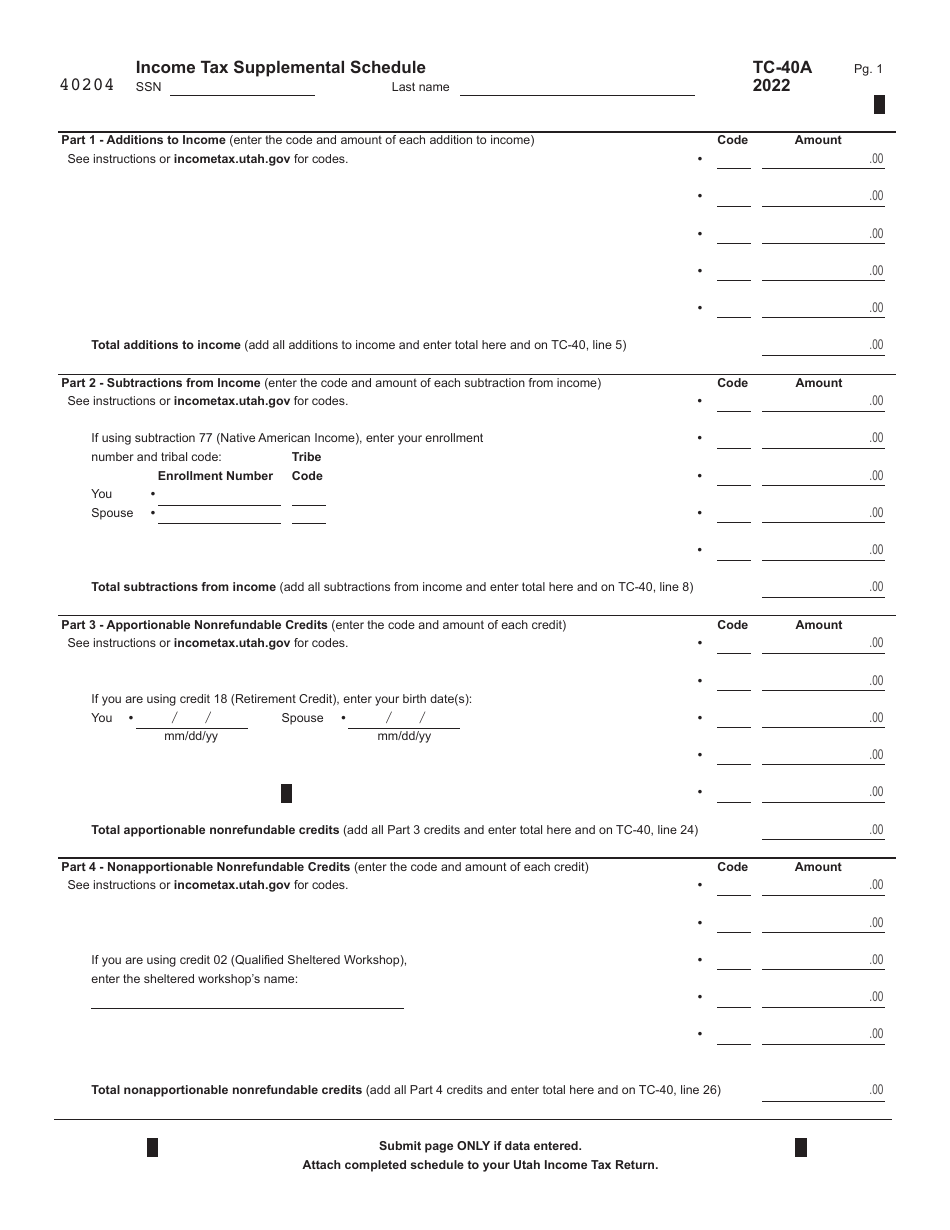

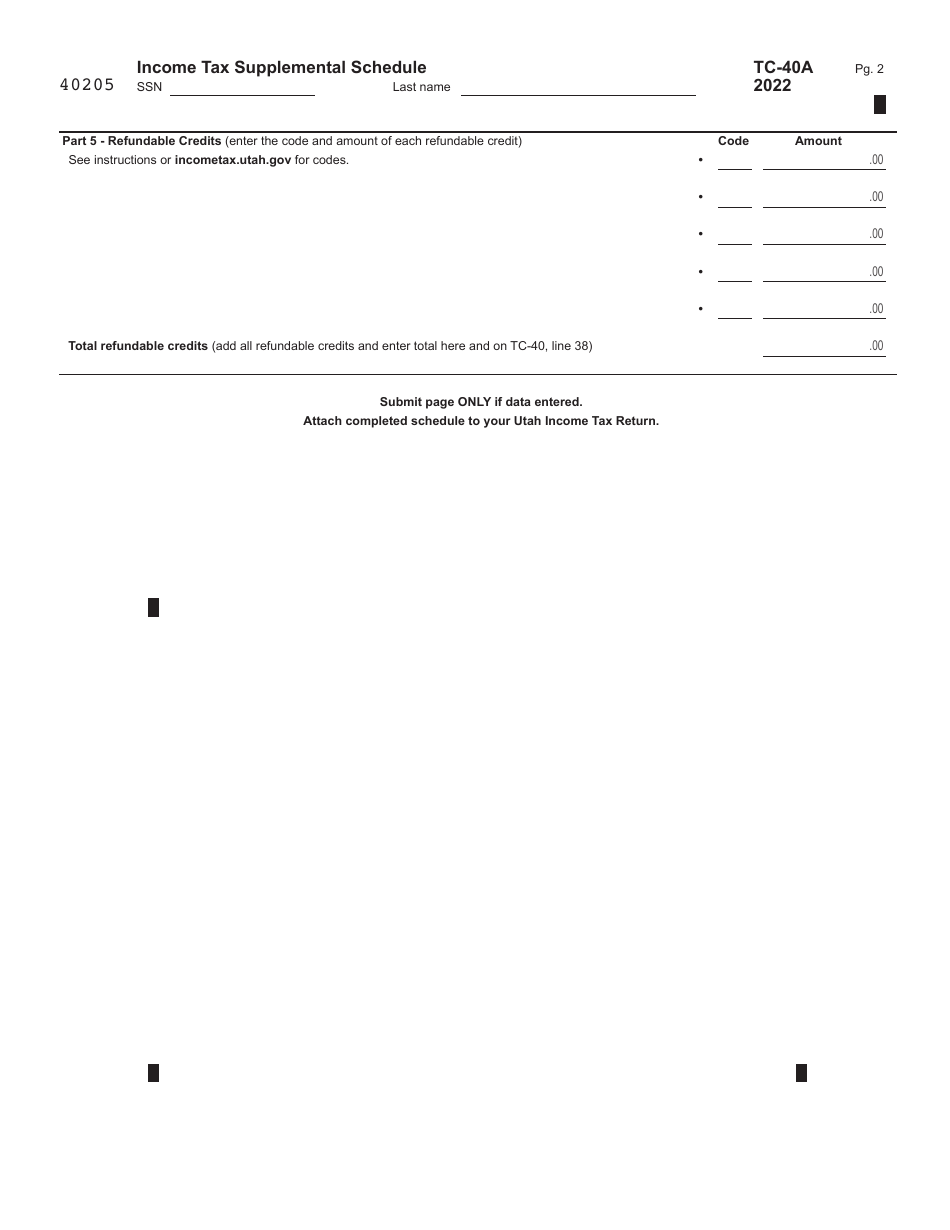

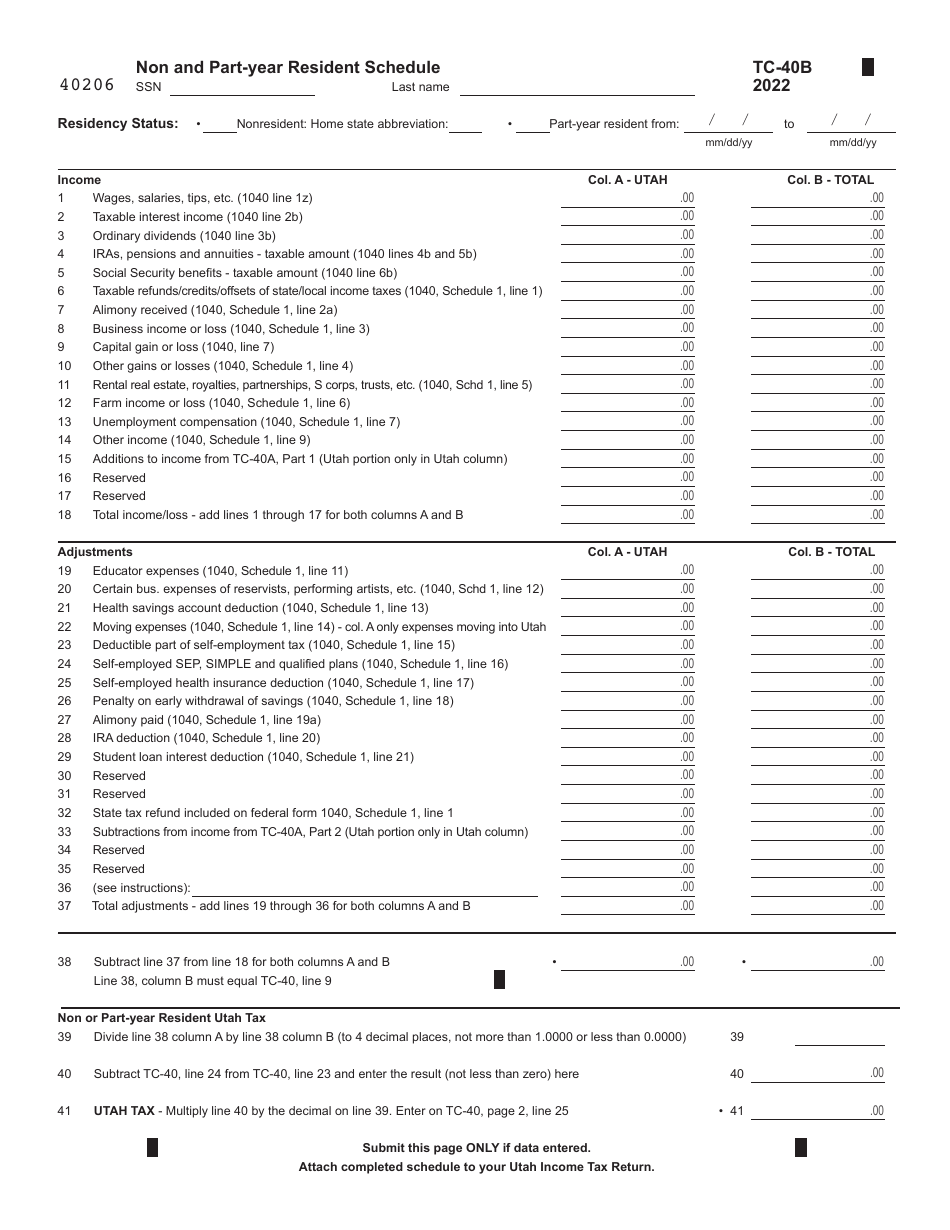

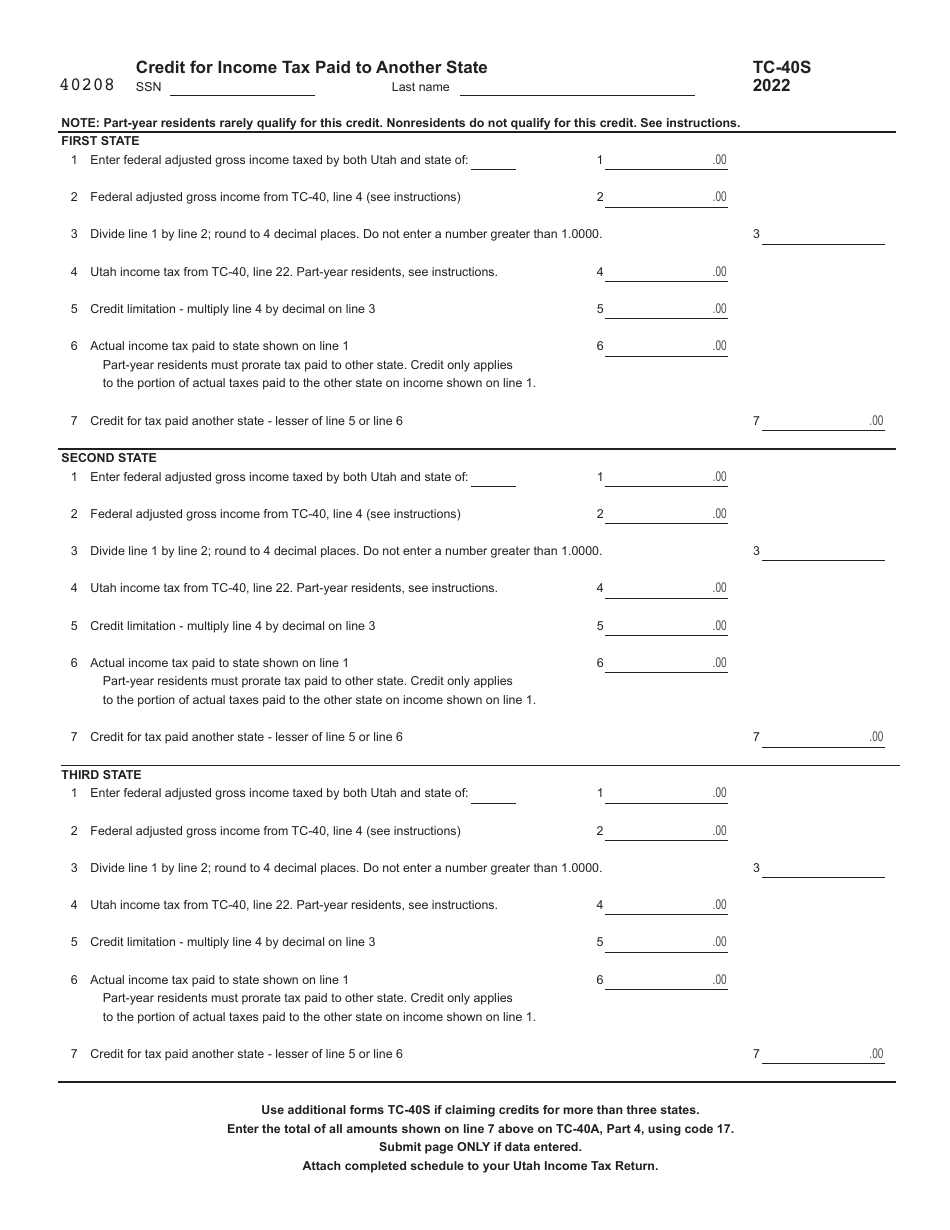

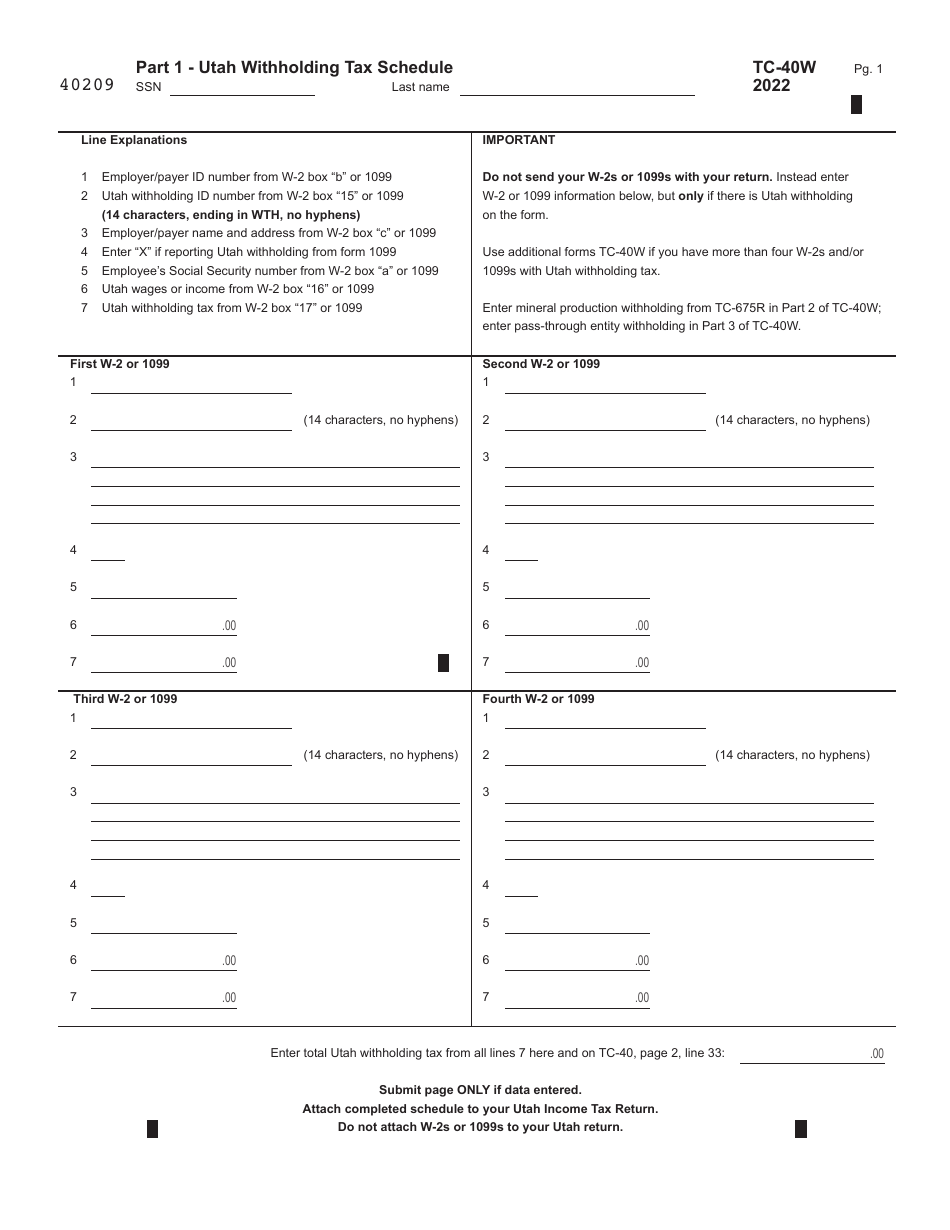

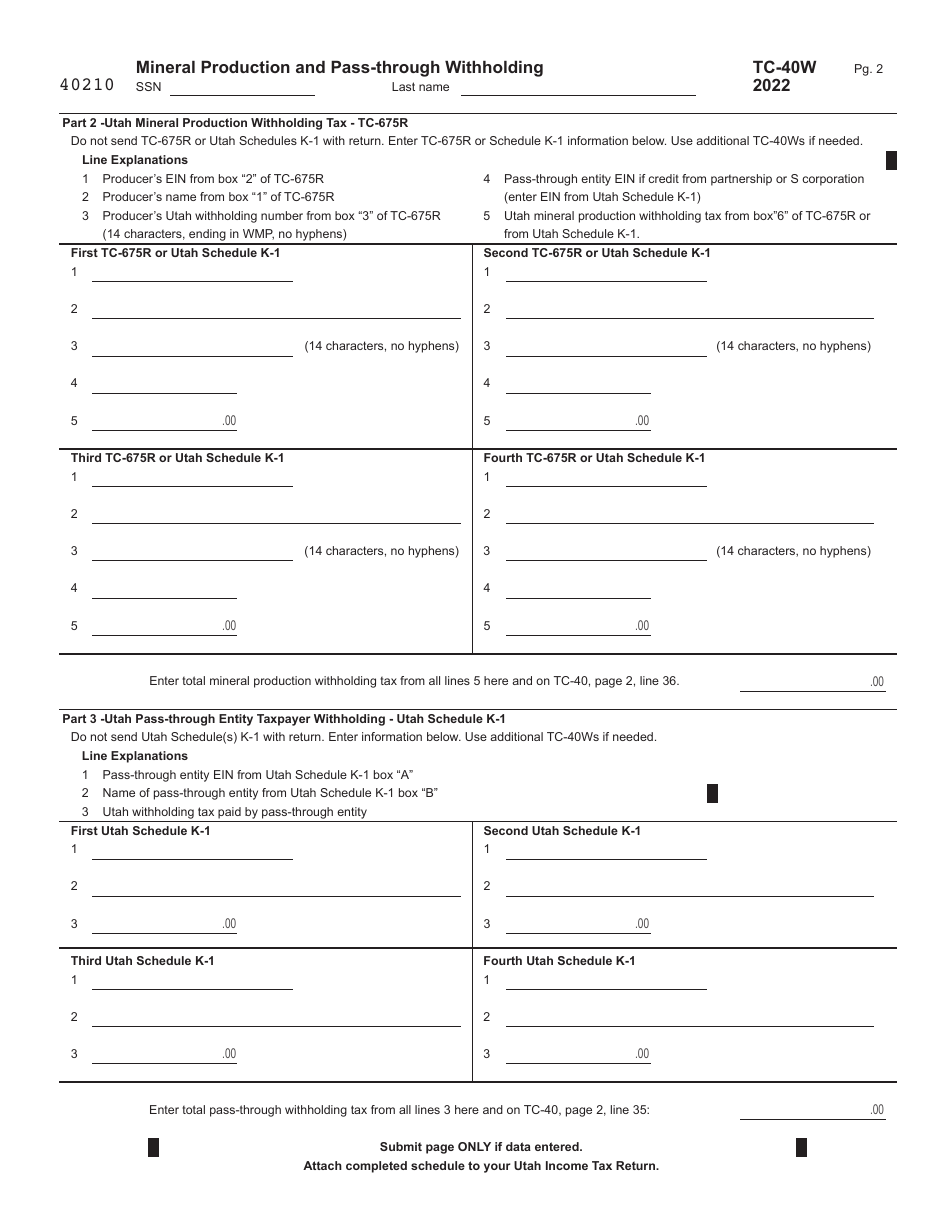

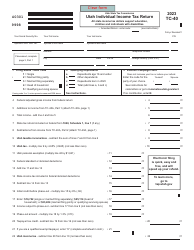

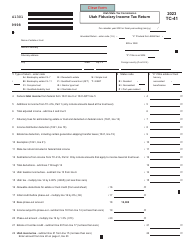

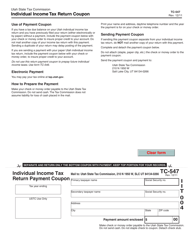

Form TC-40 Utah Individual Income Tax Return - Utah

What Is Form TC-40?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form TC-40?

A: Form TC-40 is used for filing your individual income tax return in the state of Utah.

Q: Who needs to file Form TC-40?

A: Residents of Utah who meet the income threshold or have income from Utah sources need to file Form TC-40.

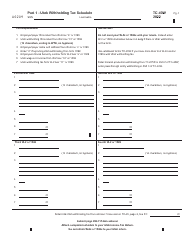

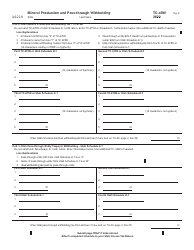

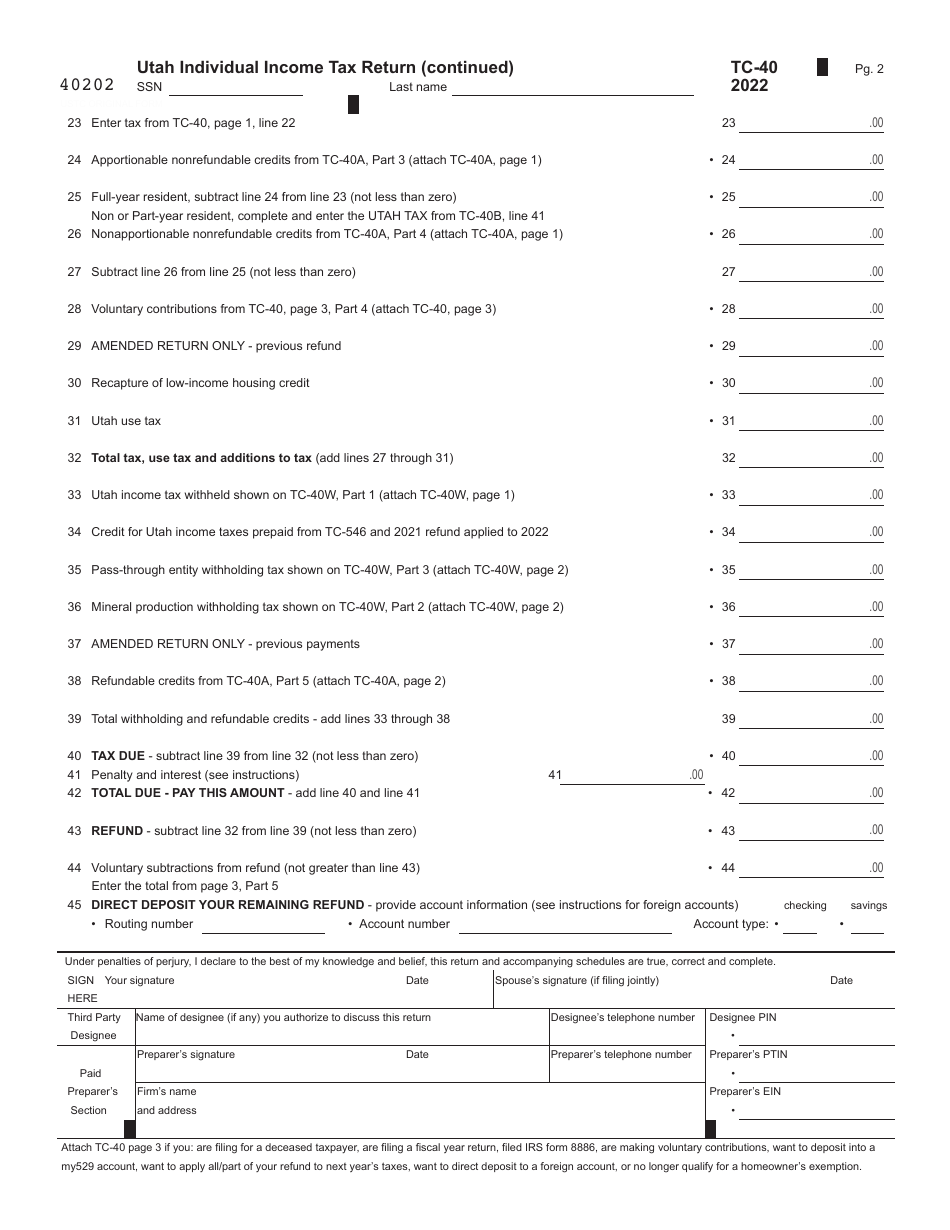

Q: What information do I need to complete Form TC-40?

A: You will need your personal information, income details, deductions, and credits to complete Form TC-40.

Q: When is the deadline for filing Form TC-40?

A: Generally, the deadline for filing Form TC-40 is April 15th, the same as the federal income tax deadline.

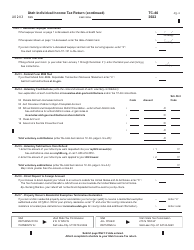

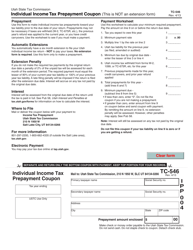

Q: Are there any extensions available for filing Form TC-40?

A: Yes, you can request an extension until October 15th by filing Form TC-546.

Q: Is there a separate form for Utah non-residents?

A: Yes, non-residents of Utah need to file Form TC-40B, the Utah Nonresident and Part-year Resident Income Tax Return.

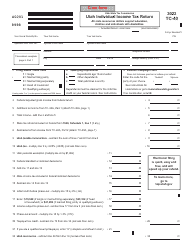

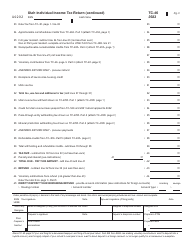

Q: Are there any specific deductions or credits available on Form TC-40?

A: Yes, Utah offers various deductions and credits, such as the Utah dependent exemption and the Utah child care credit.

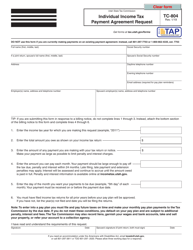

Q: What do I do if I have questions or need help with Form TC-40?

A: If you have questions or need assistance, you can contact the Utah State Tax Commission directly or consult a tax professional.

Form Details:

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-40 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.