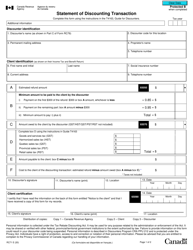

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC71

for the current year.

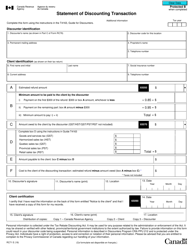

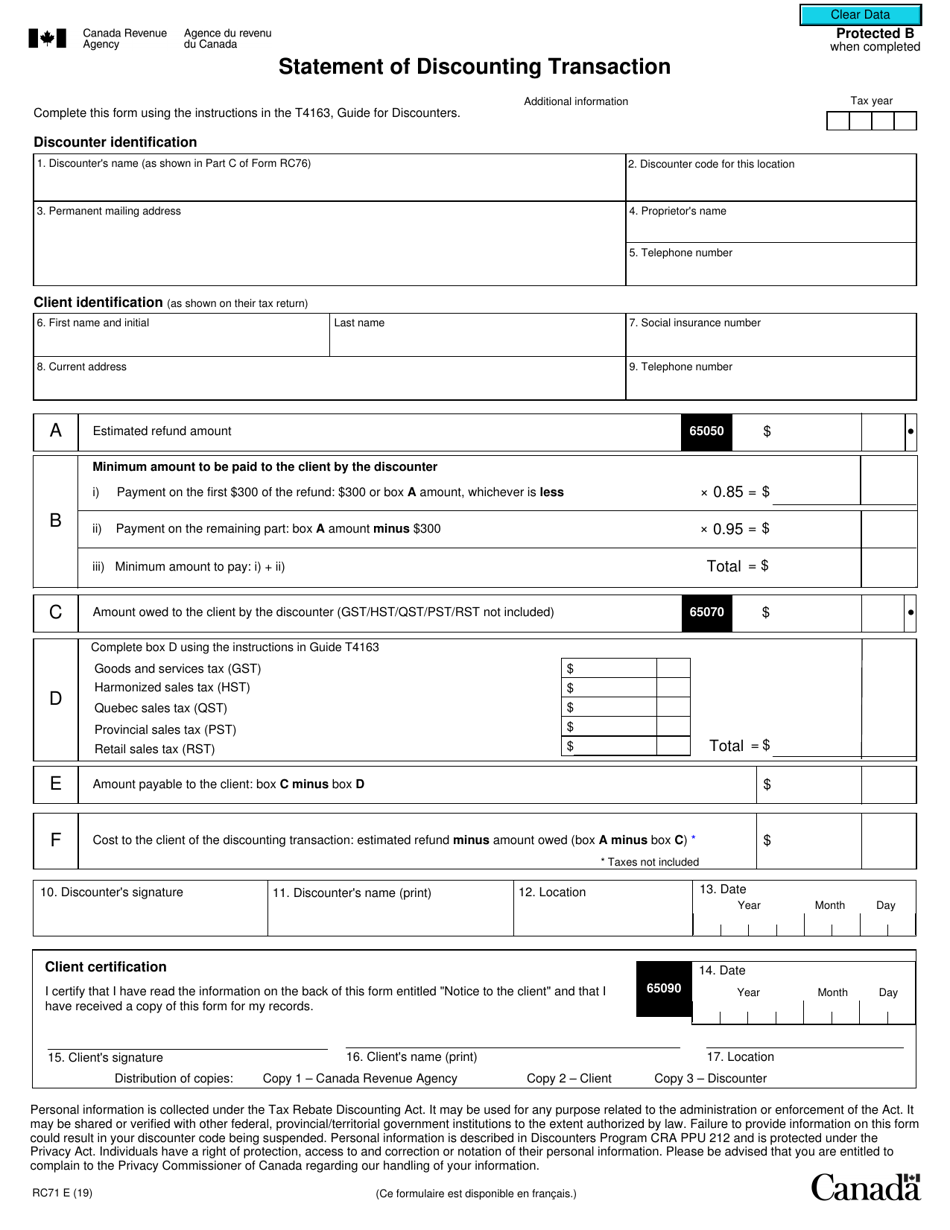

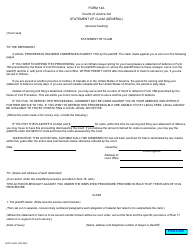

Form RC71 Statement of Discounting Transaction - Canada

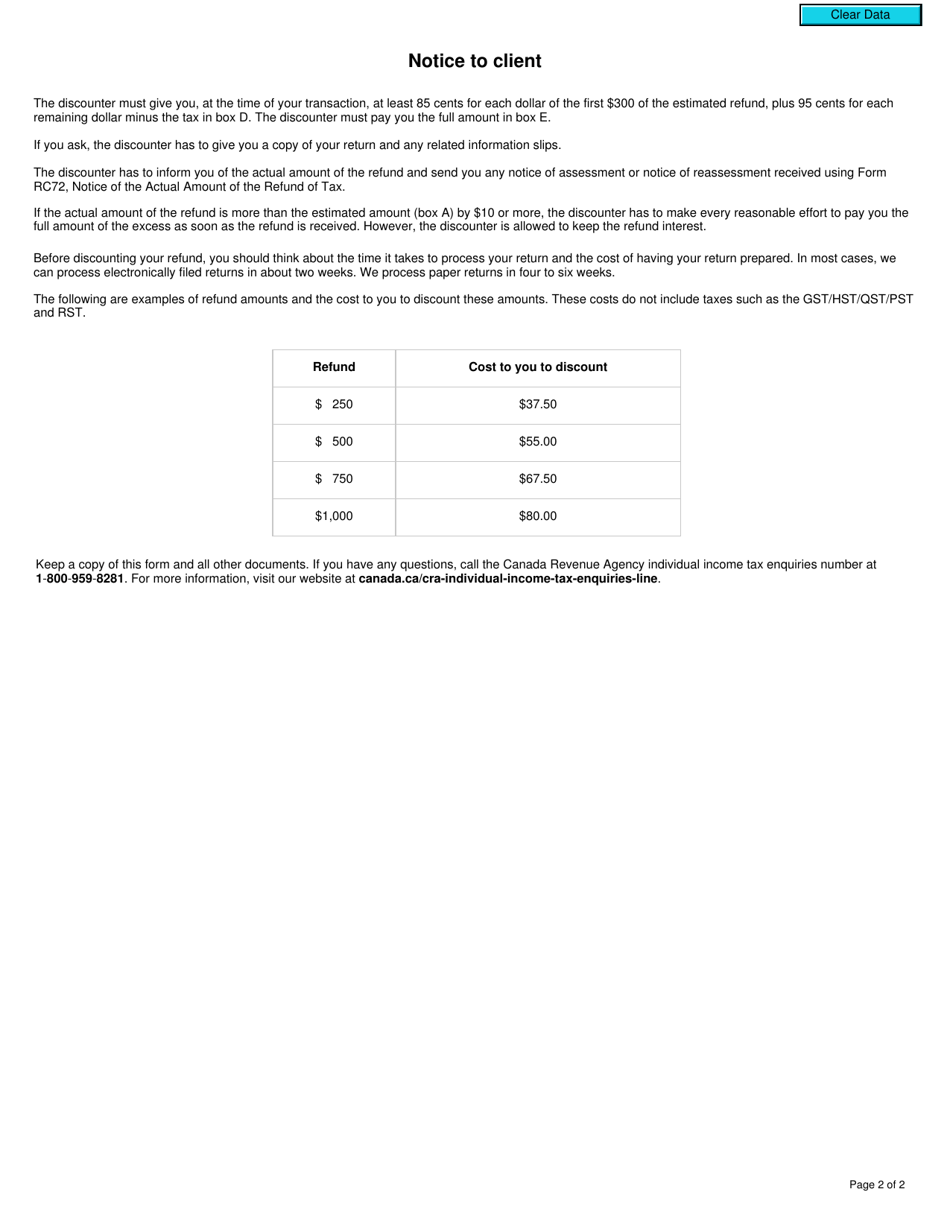

Form RC71 Statement of Discounting Transaction is used in Canada to report the details of a discounting transaction that occurred during the tax year. It is typically used by taxpayers who deal with the purchase and sale of accounts receivable or other forms of debt instruments.

The financial institution that carries out the discounting transaction files the Form RC71 Statement of Discounting Transaction in Canada.

FAQ

Q: What is Form RC71?

A: Form RC71 is a statement of discounting transaction in Canada.

Q: Who needs to file Form RC71?

A: A person or corporation who has discounted a debt or other obligation can file Form RC71.

Q: What is a discounting transaction?

A: A discounting transaction is when a debt or other obligation is sold for less than its face value.

Q: When should Form RC71 be filed?

A: Form RC71 should be filed within 90 days after the end of the calendar year in which the discounting transaction occurred.

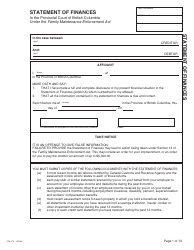

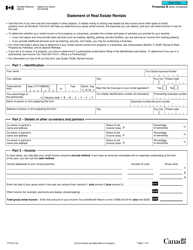

Q: What information is required on Form RC71?

A: Form RC71 requires information about the debt or obligation being discounted, the terms of the discounting transaction, and other related details.

Q: Are there any penalties for not filing Form RC71?

A: Yes, failure to file Form RC71 or providing false information can result in penalties imposed by the CRA.

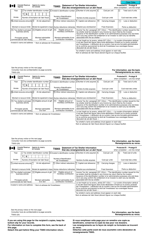

Q: Can I e-file Form RC71?

A: No, Form RC71 cannot be e-filed and must be submitted by mail or in person to the CRA.

Q: Do I need to keep a copy of Form RC71?

A: Yes, it is recommended to keep a copy of Form RC71 and any supporting documents for your records.

Q: Can I amend Form RC71 after filing?

A: Yes, if you need to make changes to Form RC71 after filing, you can submit an amended form to the CRA.