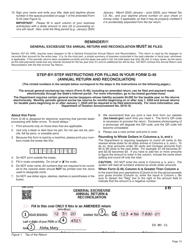

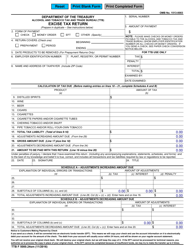

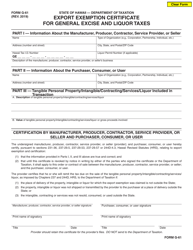

This version of the form is not currently in use and is provided for reference only. Download this version of

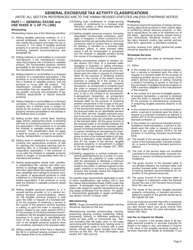

Instructions for Form G-45, G-49

for the current year.

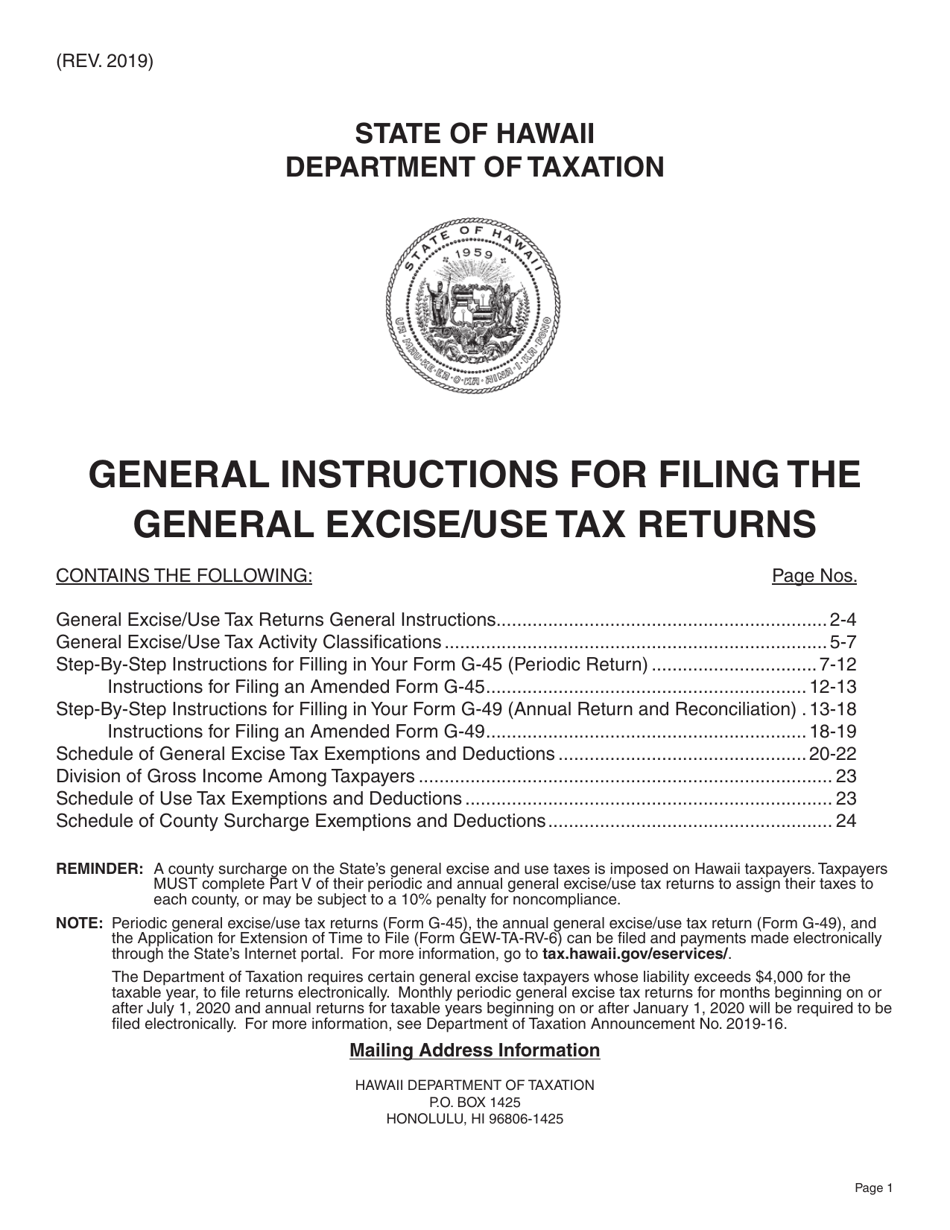

Instructions for Form G-45, G-49 - Hawaii

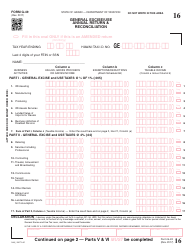

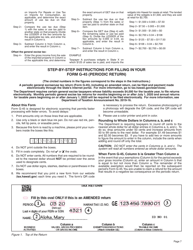

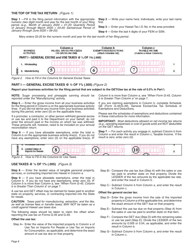

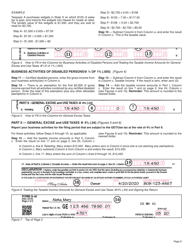

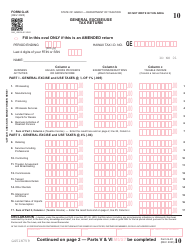

This document contains official instructions for Form G-45 , and Form G-49 . Both forms are released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form G-45 is available for download through this link. The latest available Form G-49 can be downloaded through this link.

FAQ

Q: What is Form G-45?

A: Form G-45 is the Employer's Annual Return & Reconciliation of Hawaii Income Tax Withheld from Wages.

Q: What is Form G-49?

A: Form G-49 is the Hawaii Tax Deposit Coupon for Employers.

Q: Who needs to file Form G-45?

A: Employers in Hawaii who have withheld income tax from their employees' wages need to file Form G-45.

Q: Who needs to file Form G-49?

A: Employers in Hawaii who are required to remit tax payments need to file Form G-49.

Q: How often do I need to file Form G-45?

A: Form G-45 needs to be filed annually by the 31st day of the first month following the close of the taxable year.

Q: How often do I need to file Form G-49?

A: Form G-49 needs to be filed quarterly, along with the tax payment, by the last day of the month following the end of each calendar quarter.

Q: What information do I need to complete Form G-45?

A: You will need information regarding the total wages paid and the amount of income tax withheld from employees' wages.

Q: What information do I need to complete Form G-49?

A: You will need information regarding the tax liability for the quarter and the amount of tax being remitted.

Q: Are there any penalties for late filing of Form G-45 or Form G-49?

A: Yes, there are penalties for late filing. It is important to file both forms on time to avoid penalties.

Instruction Details:

- This 24-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.