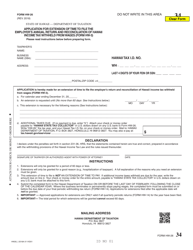

This version of the form is not currently in use and is provided for reference only. Download this version of

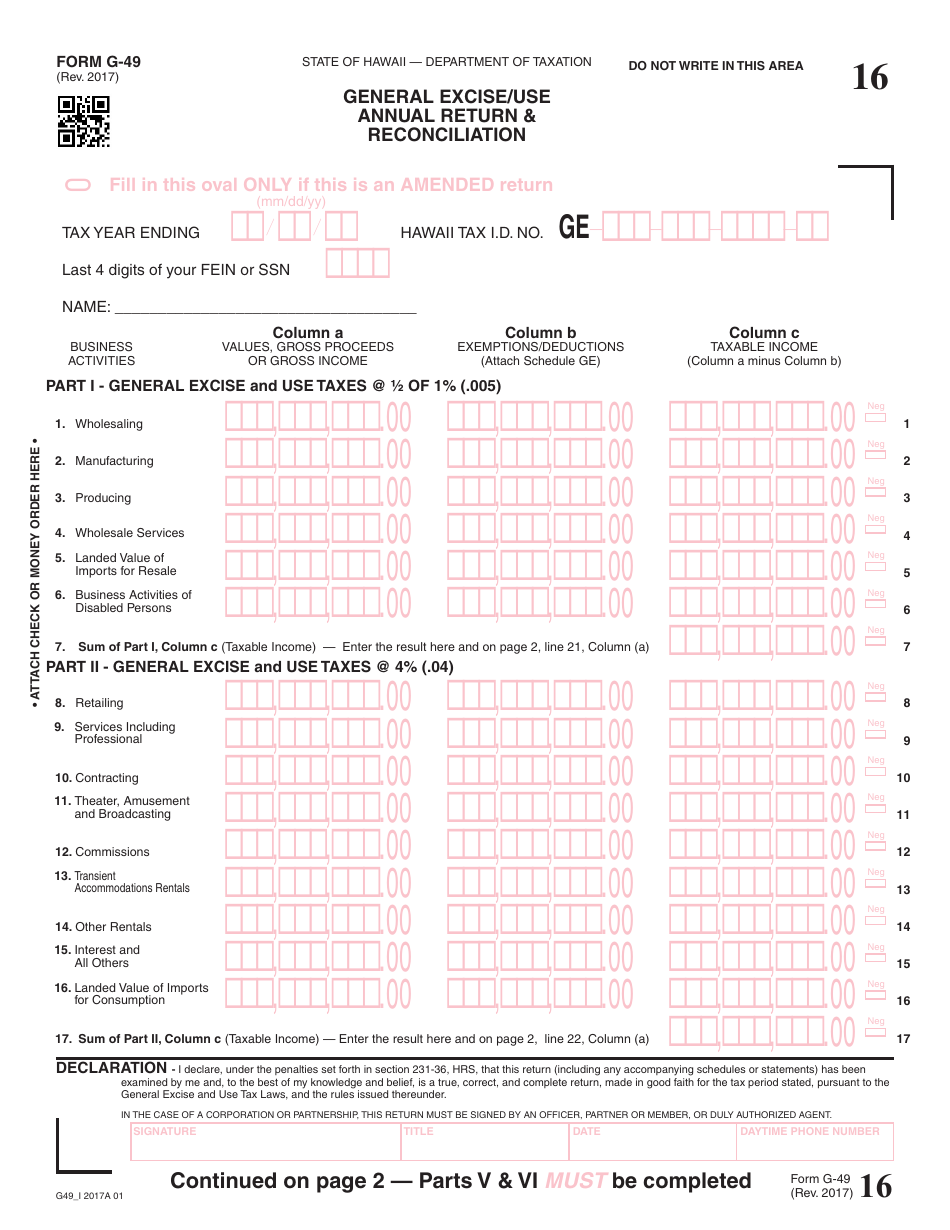

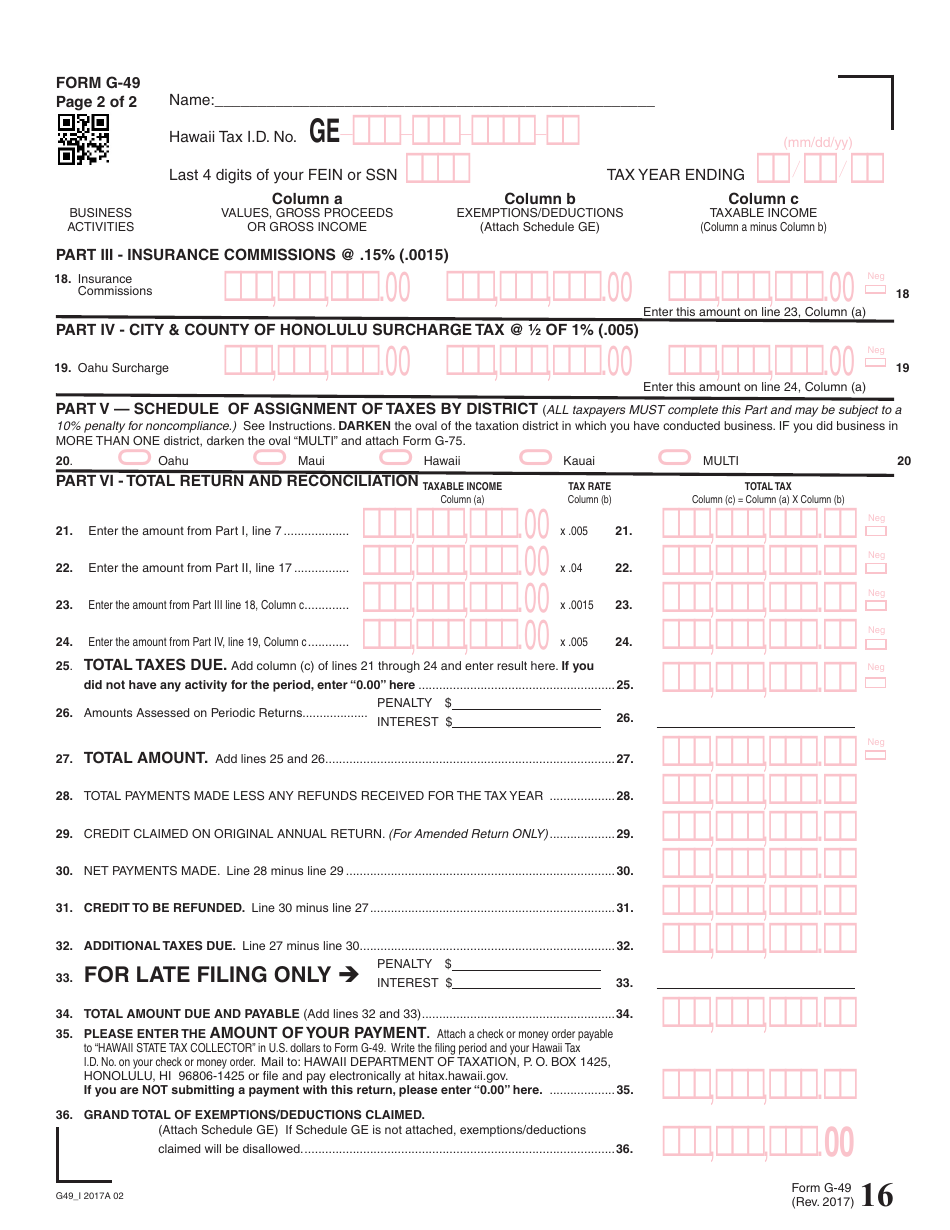

Form G-49

for the current year.

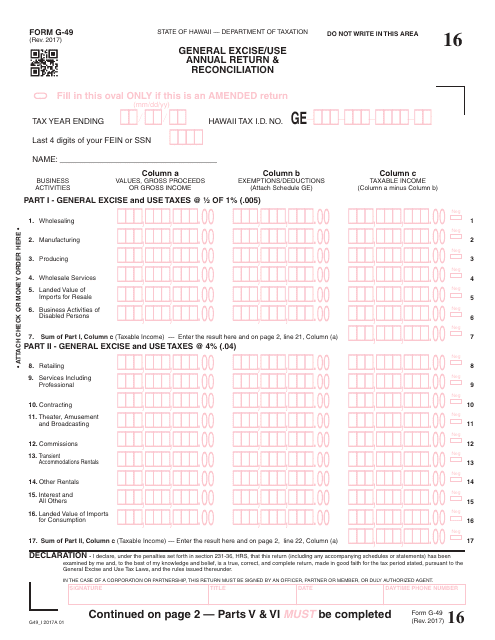

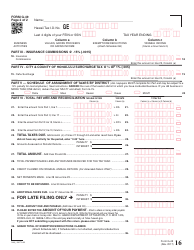

Form G-49 General Excise / Use Annual Return & Reconciliation - Hawaii

What Is Form G-49?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

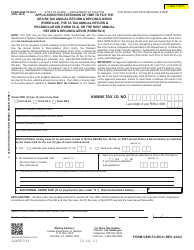

Q: What is Form G-49 General Excise/Use Annual Return & Reconciliation?

A: Form G-49 is a tax return form used in Hawaii to report general excise and use taxes.

Q: Who needs to file Form G-49?

A: Businesses and individuals engaged in activities subject to general excise or use taxes in Hawaii need to file Form G-49.

Q: What is the purpose of Form G-49?

A: The purpose of Form G-49 is to report and reconcile the general excise and use taxes paid or owed.

Q: When is Form G-49 due?

A: Form G-49 is due on the last day of the fourth month following the end of the tax year.

Q: What information is required on Form G-49?

A: Form G-49 requires detailed information about the taxpayer, business activities, and tax liability.

Q: Are there any penalties for late filing of Form G-49?

A: Yes, there are penalties for late filing of Form G-49, including interest charges and possible additional penalties.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form G-49 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.