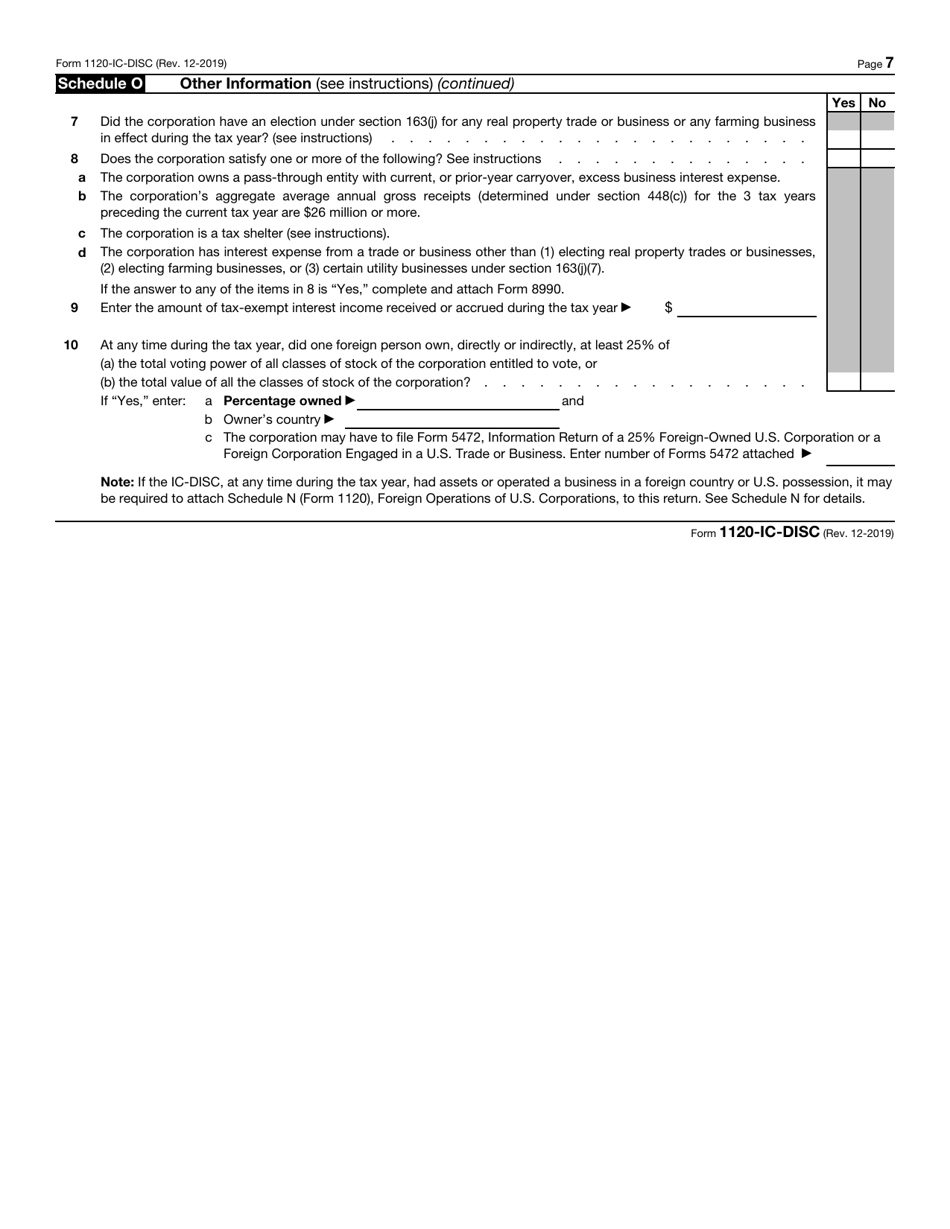

This version of the form is not currently in use and is provided for reference only. Download this version of

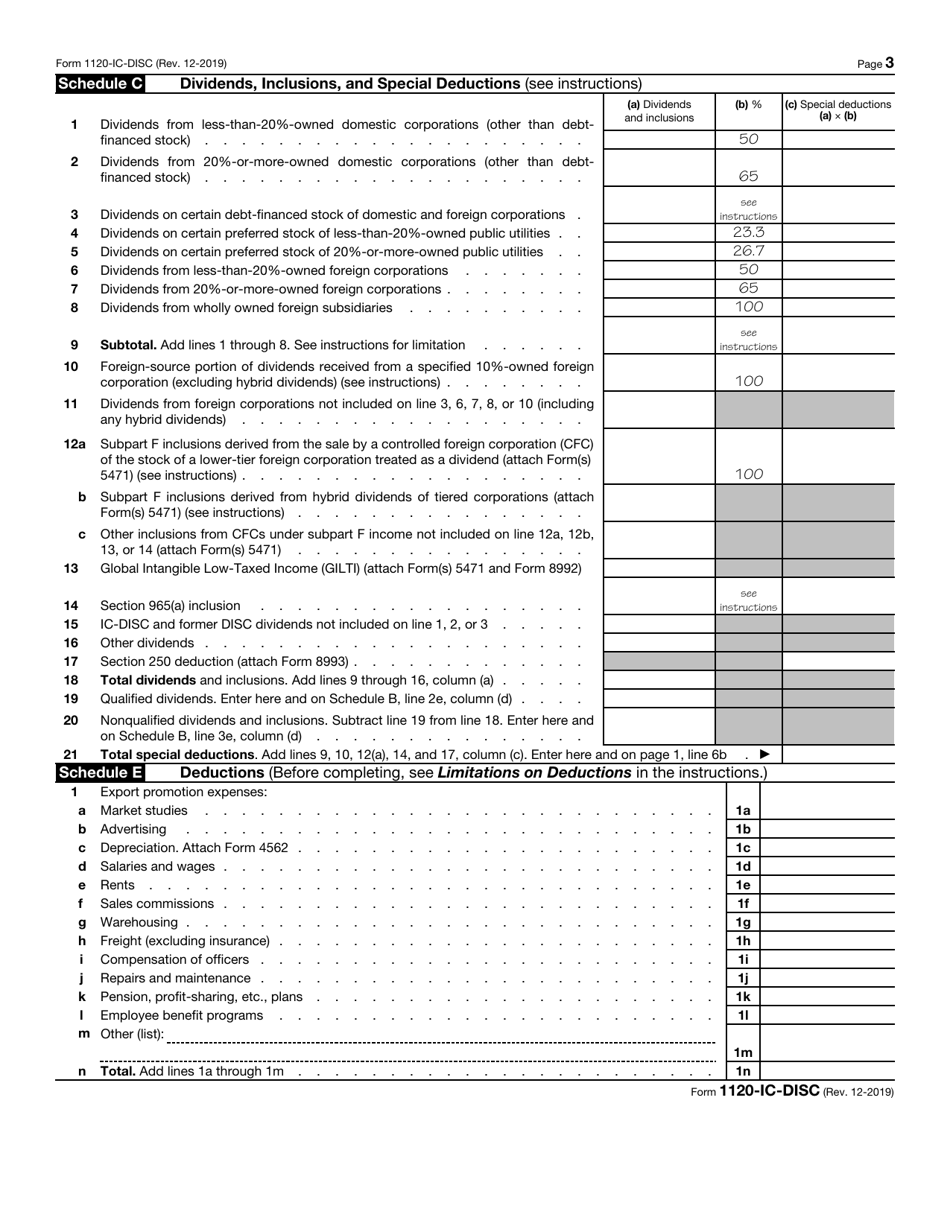

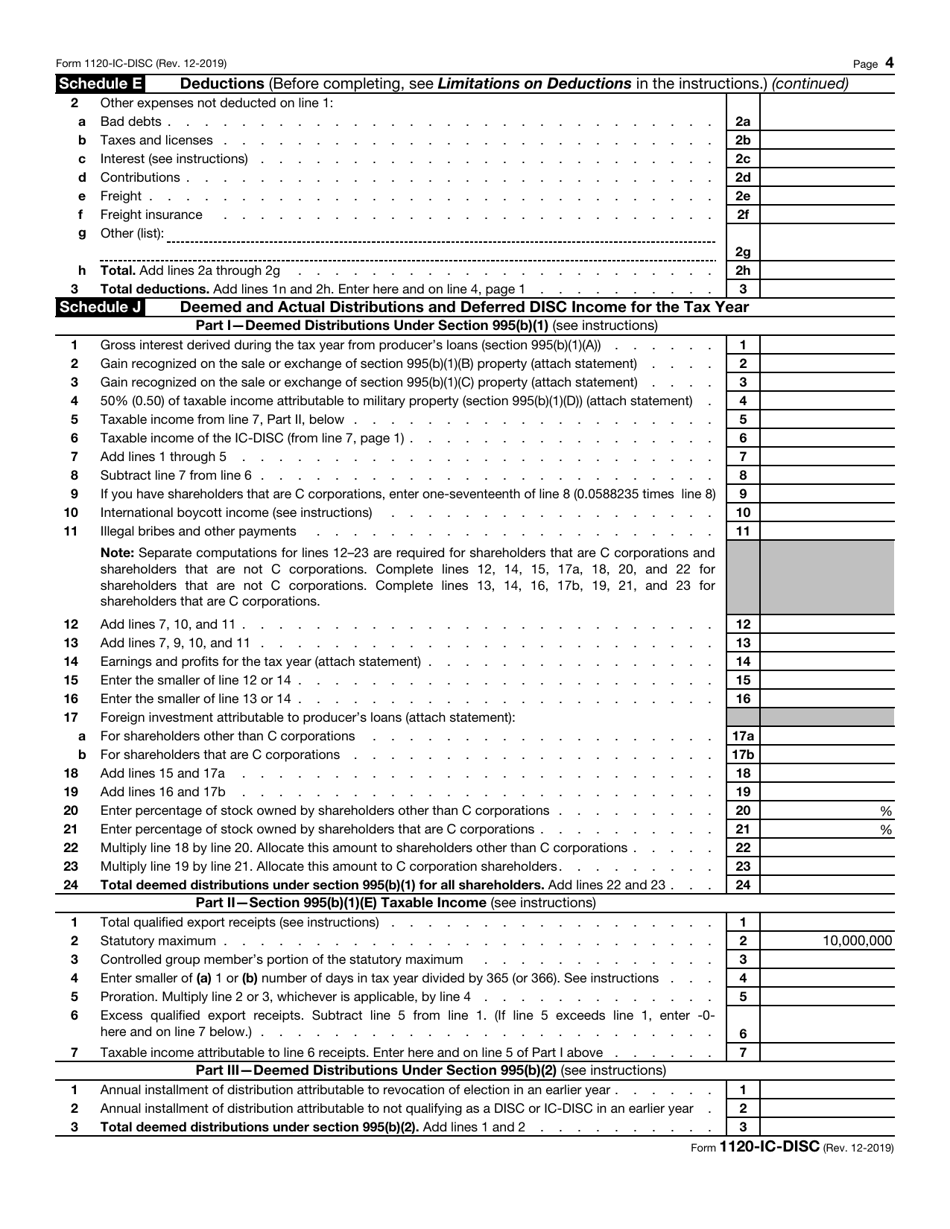

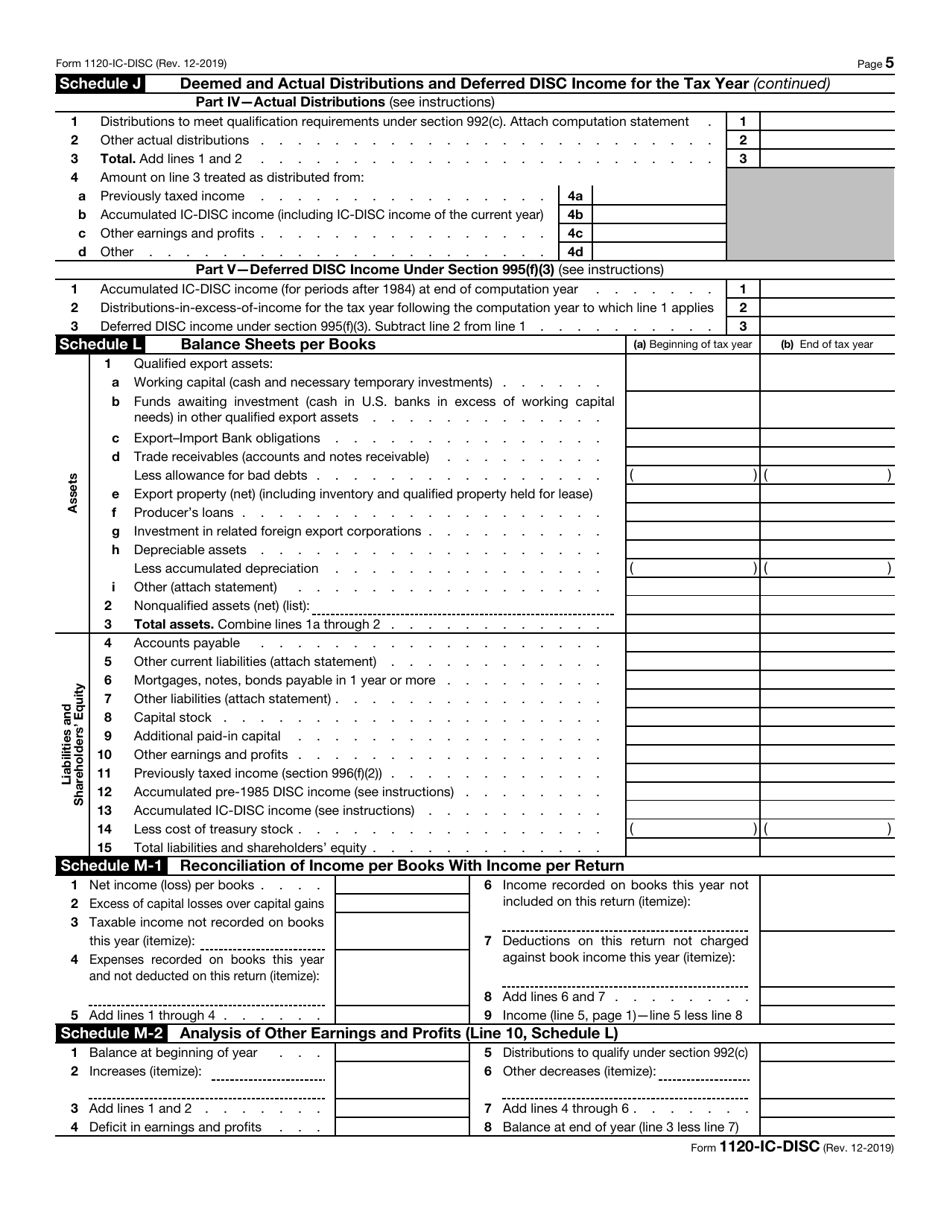

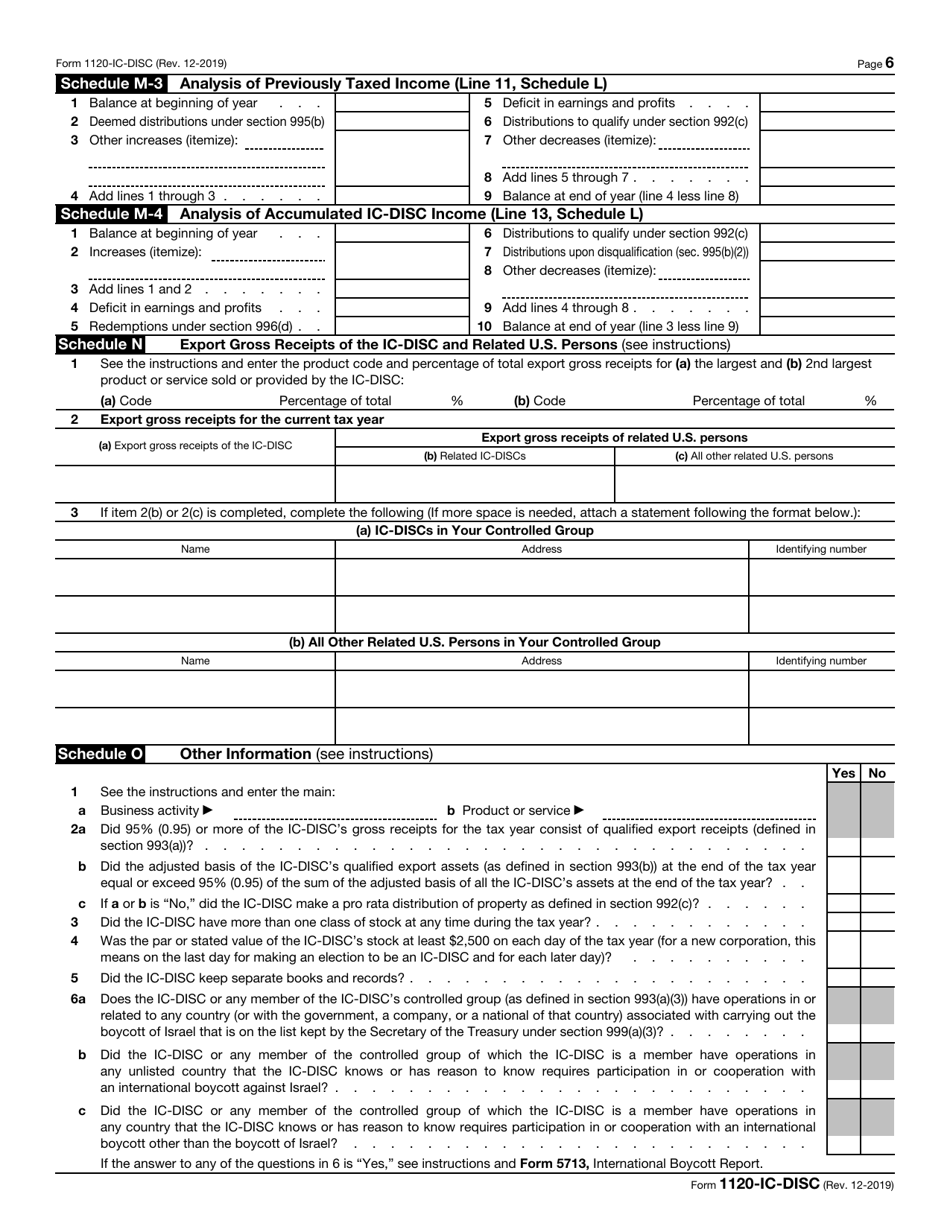

IRS Form 1120-IC-DISC

for the current year.

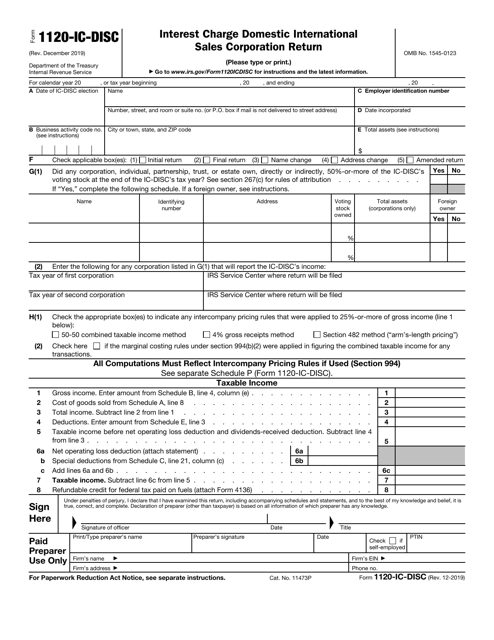

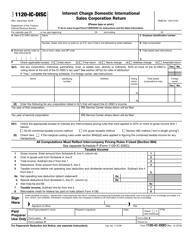

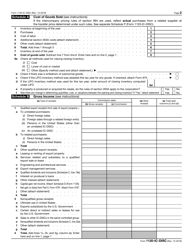

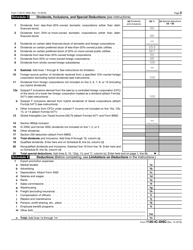

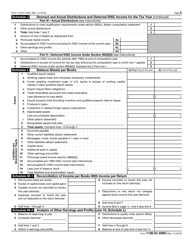

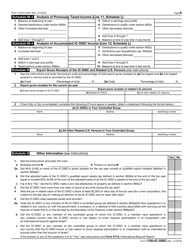

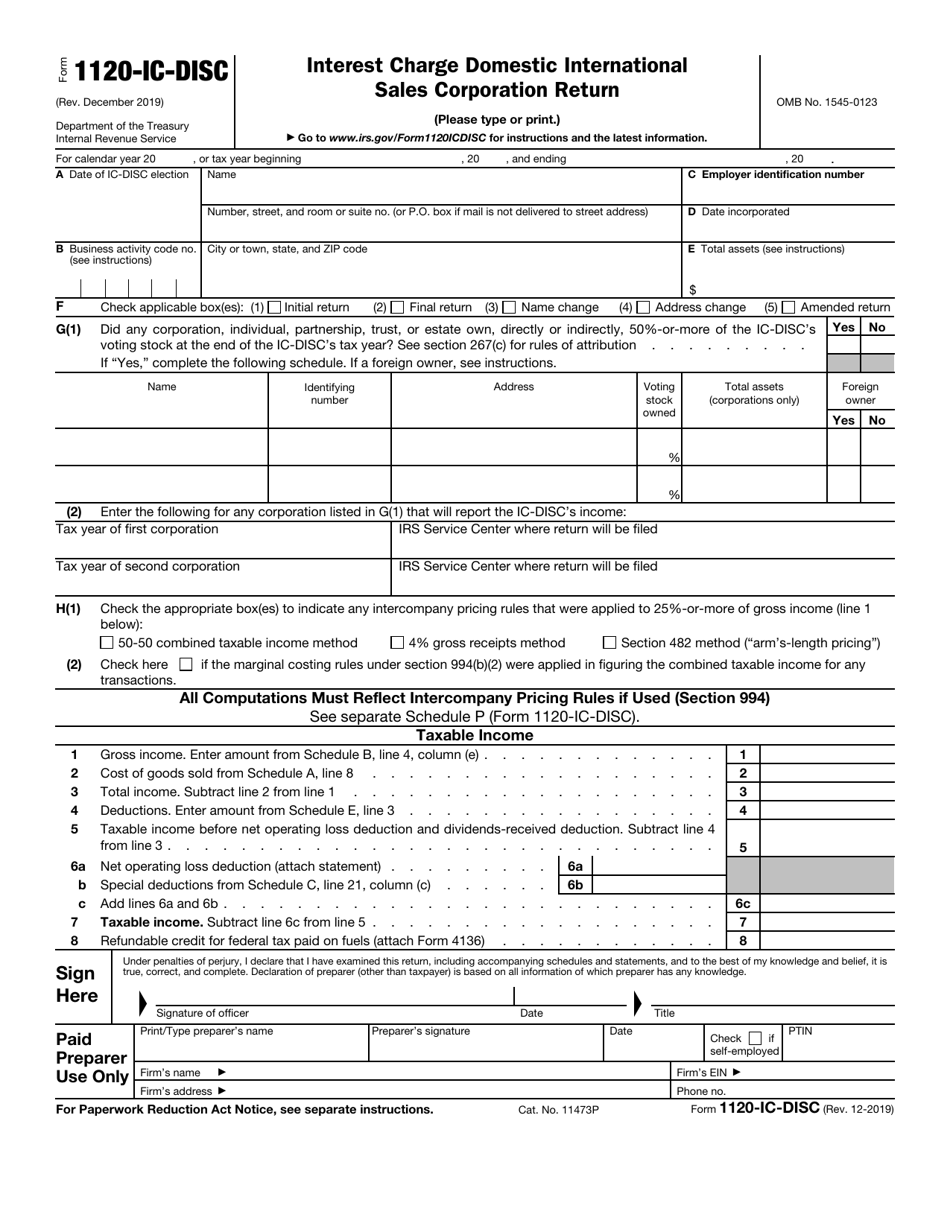

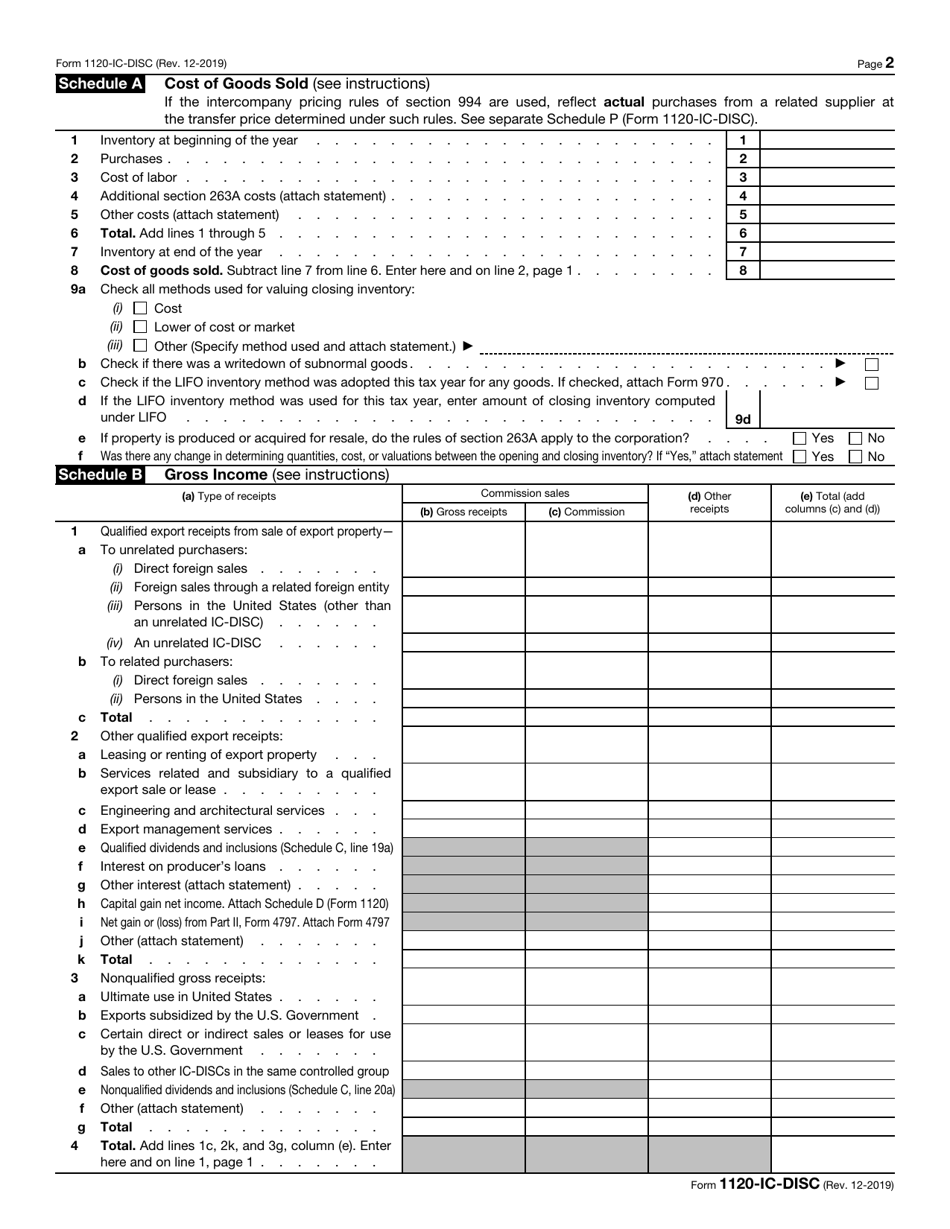

IRS Form 1120-IC-DISC Interest Charge Domestic International Sales Corporation Return

What Is IRS Form 1120-IC-DISC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-IC-DISC?

A: IRS Form 1120-IC-DISC is a tax return form specifically for Domestic International Sales Corporations (DISCs).

Q: What does DISC stand for?

A: DISC stands for Domestic International Sales Corporation.

Q: Who needs to file IRS Form 1120-IC-DISC?

A: Any company that qualifies as a Domestic International Sales Corporation (DISC) needs to file IRS Form 1120-IC-DISC.

Q: What is the purpose of IRS Form 1120-IC-DISC?

A: The purpose of IRS Form 1120-IC-DISC is to report the taxable income of a Domestic International Sales Corporation (DISC) and calculate the interest charge on deferred tax liabilities.

Q: How often do you need to file IRS Form 1120-IC-DISC?

A: IRS Form 1120-IC-DISC is generally filed annually.

Q: Are there any penalties for not filing IRS Form 1120-IC-DISC?

A: Yes, there can be penalties for not filing IRS Form 1120-IC-DISC or for filing it late. It's important to comply with the tax filing requirements.

Q: What if I need help filling out IRS Form 1120-IC-DISC?

A: If you need help filling out IRS Form 1120-IC-DISC, you can consult a tax professional or refer to the instructions provided by the IRS.

Q: Can I e-file IRS Form 1120-IC-DISC?

A: Yes, you can e-file IRS Form 1120-IC-DISC if you meet the requirements for electronic filing.

Q: Is IRS Form 1120-IC-DISC applicable in Canada?

A: No, IRS Form 1120-IC-DISC is specific to the United States and not applicable in Canada.

Form Details:

- A 7-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-IC-DISC through the link below or browse more documents in our library of IRS Forms.